Roxgold Reports First Quarter 2020 Results; Operations Continue to Generate Substantial Cash Flows

Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) today reported its first quarter financial results for the period ended March 31, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200512005910/en/

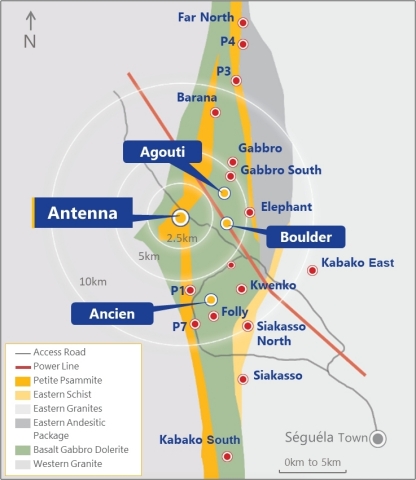

Seguela Location Plan (Graphic: Business Wire)

For complete details of the unaudited Condensed Interim Consolidated Financial Statements and associated Interim Management’s Discussion and Analysis please refer to the Company’s filings on SEDAR (www.sedar.com) or the Company’s website (www.roxgold.com). All amounts are in U.S. dollars unless otherwise indicated.

Q1 2020 Highlights:

During the quarter ended March 31, 2020, the Company:

Safety

- Continued a strong safety record with no lost time injuries over the last twelve months

- Management of the current global COVID-19 crisis is ongoing. Operations at Yaramoko were not materially impacted with heightened preventative measures and response plans in place to mitigate and minimize any potential impacts from the virus. Initial confirmed cases have recovered and no other employees in isolation.

Operations

- Production of 32,380 ounces compared to 33,652 ounces in Q1 2019

- Increased plant throughput by 18% to 125,879 tonnes compared to 106,816 in Q1 2019

- Cash operating cost2 of $566 per ounce produced and all-in sustaining cost2 of $1,058 per ounce sold

- Maintained cash operating costs2 of $146 per tonne processed

Financial

- Sold 30,126 ounces of gold for a total of $48.0 million in gold sales (32,798 ounces and $42.8 million respectively in Q1 20191)

- Achieved an adjusted EBITDA2 and adjusted EBITDA margin2 of $19.8 million and 41% respectively in 2020 compared to $18.3 million and 46% in Q1 2019

- Generated improved cash flow from mining operations2 totalling $25.4 million for cash flow from mining operations per share2 of $0.07 (C$0.09/share)

- Adjusted net income2 of $4.2 million ($0.01 per share) compared to $4.0 million ($0.01 per share) in Q1 2019

- Produced a mine operating margin2 of $938 per ounce and a return on equity2 of 11%

Growth

- Delivered a PEA for Séguéla Gold Project with after-tax NPV of $268 million and 66% IRR at a gold price of $1,450 per ounce and an NPV of $379 million and 88% IRR at a gold price of $1,730 per ounce

- Reported an updated Mineral Resource Estimate for the Séguéla Gold Project in January 2020 with Total Indicated Mineral Resources increasing 7% to 529,000 ounces and Inferred Mineral Resources increasing 1,286% to 471,000 ounces

- Announced multiple high grade results in Ancien deposit at Séguéla

- New high grade discovery at Boussoura, Burkina Faso

“The start of 2020 has been an unprecedented time in the market and in our lives,” commented John Dorward, President and CEO of Roxgold. “While the world continues to adapt and manage the current pandemic, Roxgold has faced this adversity with characteristic attentiveness and rigour. Our regional teams have done an impressive job – employing foresight and initiative to introduce comprehensive protocols at all our sites and offices to manage and mitigate the impacts of COVID-19 on our employees and contractors. As a result, Yaramoko continues to operate well with a strong quarter to start the year as the mine reported tonnages and grades ahead of expectations. Based on the quarterly results, we have maintained our production and cost guidance, while acknowledging that should a prolonged COVID-19 related interruption occur there could be an impact on current guidance.”

Looking ahead, we recently announced the results of the PEA for our Séguéla Gold Project in Côte d’Ivoire, which returned exceptional prospective project economics. Séguéla has been a substantially value accretive acquisition for Roxgold, as the project has the potential to double our production within a short timeframe without undue dilution to our shareholders. Further, the PEA is just a snapshot in time of the potential value of Séguéla. It is our belief that, with continued drilling success, there is the potential to add significant production ounces and value to the project. We have identified several opportunities to expand and optimize the PEA, which we intend to evaluate as we proceed towards a Feasibility Study, which is well underway and with an anticipated completion in early 2021.”

2020 Operating Outlook

- Gold production between 120,000 and 130,000 ounces

- Cash operating cost2 between $520 and $580/ounce

- All-in sustaining cost2 between $930 and $990/ounce

- Non-sustaining capital spend of $5-$10 million

- Growth spend (includes Exploration and Séguéla study spend) of $15-$20 million

Based upon Q1 production results, Roxgold is slightly ahead of expectations and remains on track to deliver between 120,000 and 130,000 ounces of production from Yaramoko. As noted earlier this year, the increase in AISC is expected to be relatively higher compared to prior years due to increased projected capital spend as the Bagassi South decline development is completed in 2020 along with enhanced security infrastructure investment. Growth spend is forecast to increase this year to $15-$20 million due to accelerating the drilling program at Séguéla and Boussoura following recent exploration successes at these projects. Although the COVID-19 pandemic did not materially impact Roxgold’s operations during the first quarter of 2020, a prolonged COVID-19 related interruption may have an impact on production and cost guidance.

Response to the COVID-19 Pandemic

As previously announced on April 8, 2020, management of the current global COVID-19 crisis is ongoing. Operations at Yaramoko were not materially impacted by COVID-19 with heightened preventative measures and response plans in place to mitigate and minimize any potential impacts from the virus. The Company is continually assessing the health and safety risks to the Company’s personnel and contractors at its operations and offices. On the 22 March 2020, the Company announced that two contractors at the Yaramoko mine in Burkina Faso tested positive for COVID-19. Both of these cases experienced only mild symptoms and have now recovered. Additionally, all of the previously isolated workers who were identified via contact-tracing have returned to the workforce after completing their prescribed isolation periods and testing. The Company has continued to enhance its testing and on-site medical support as well as reducing all non-essential mine site personnel. It has also increased the supply chain thresholds for consumables. Whilst production guidance has been maintained, a prolonged COVID-19 related interruption may have an impact on the Company’s operations, financial position and liquidity.

Roxgold finished the quarter with approximately $50 million of cash and gold doré on hand. The Company strengthened its liquidity position in the quarter following the drawdown of the remaining $15 million of its revolving credit facility to maximise cash reserves and reduce liquidity risk given the volatile and uncertain financial market conditions. In addition, the Company continues to make regularly scheduled gold shipments from the Yaramoko Gold Mine.

Mine Operating Activities

|

Three months ended March 31 2020 |

Three months ended March 31 2019 |

||

|

|

|

||

Operating Data |

|

|

||

Ore mined (tonnes) |

134,472 |

98,140 |

||

Ore processed (tonnes) |

125,879 |

106,816 |

||

Head grade (g/t) |

8.7 |

10.0 |

||

Recovery (%) |

97.9 |

98.3 |

||

Gold ounces produced |

32,380 |

33,652 |

||

Gold ounces sold1 |

30,126 |

32,798 |

||

|

|

|

||

Financial Data (in thousands of dollars) |

|

|

||

Revenues – Gold sales1 |

48,045 |

42,840 |

||

Mining operating expenses |

(16,912) |

(15,437) |

||

Government royalties |

(2,883) |

(1,976) |

||

Depreciation and depletion |

(13,350) |

(11,942) |

||

|

|

|

||

Statistics (in dollars) |

|

|

||

Average realized selling price (per ounce) |

1,595 |

1,307 |

||

Cash operating cost (per tonne processed)2 |

146 |

147 |

||

Cash operating cost (per ounce produced)2 |

566 |

468 |

||

Total cash cost (per ounce sold)2 |

657 |

527 |

||

Sustaining capital cost (per ounce sold)2 |

345 |

180 |

||

Site all-in sustaining cost (per ounce sold)2 |

1,003 |

711 |

||

All-in sustaining cost (per ounce sold)2 |

1,058 |

775 |

Health and safety performance

There were no Lost Time Injury (“LTI”) incidents in the first quarter of 2020.

Operational performance

The Company’s gold production in Q1 2020 was 32,380 ounces at a head grade of 8.7 g/t compared to 33,652 ounces at 10.0 g/t in Q1 2019.

Mining activities continued to see strong ore production with a total of 134,472 tonnes of ore mined at a grade of 7.93 g/t (includes marginal ore mined totalling 17,594 tonnes at a grade of 2.9 g/t) and 1,453 metres of waste development. This compares with 98,140 tonnes of ore at 10.4 g/t and 1,547 metres of waste development in Q1 2019. The 55 Zone mine produced 88,131 tonnes at 8.3 g/t and the Bagassi South mine contributed 46,292 tonnes at a grade of 7.3g/t.

The mining tonnage increase was attributable to the commencement of stoping activities at the Bagassi South mine in July 2019, with stoping operations expanding as more development levels are completed. During Q1 2020, approximately 64% of ore produced came from stoping activities and 36% from development.

Decline development at the 55 Zone mine reached the 4754 level, approximately 560 metres below surface, with increased ore drive development. Ore development continued down to 4774 level allowing for the eastern extension of the 4811, 4828 and 4845 levels. The development of the Bagassi South decline reached the 5078 level and ore development commenced on the 5095 level, which is approximately 220 metres below surface. Good progress on ore development has seen the Bagassi South mine largely developed, providing additional stoping access for the remainder of the year.

Mine reconciliation performance between the Mineral Reserve and Grade Control model was 94% for tonnes and 97% for grade in the first quarter of 2020.

The plant processed 125,879 tonnes at an average head grade of 8.7 g/t in Q1 2020 compared to 106,816 tonnes of ore at 10.0 g/t in Q1 2019. The processing plant availability was 96.4% in the quarter compared to 95.4% in Q1 2019 and reported an average throughput rate of 1,383 tonnes per day exceeding nameplate capacity by approximately 26%. The average throughput was impacted by a planned mill shutdown for relining in February. Plant recovery was 97.9% in Q1 2020 compared to 98.3% for the comparative quarter.

The Yaramoko Gold Mine continued to maintain a low cash operating cost2 of $146 per tonne processed driven by increased throughput and strong cost control.

Financial Performance

Gold sales in Q1 2020 totalled $48.0 million from 30,126 ounces of gold. The Company’s average realized gold price was $1,595 per ounce sold, 22% higher than the average realized gold price in Q1 2019.

The Company continued to maintain a low cash operating cost2 per tonne processed of $146 per tonne. The cash operating cost2 per ounce produced totalled $566 per ounce for the period compared to $468 per ounce in the prior year mainly driven by the lower head grade.

The total cash cost2 per ounce sold of $657 in Q1 2020 was higher compared to $527 per ounce sold in Q1 2019. This was primarily impacted by the lower head grade, higher gold price in Q1 2020 which increased royalty payments by $14 per ounce sold and the commencement of the 1% contribution to the Mining Fund for local development increasing royalties by $16 per ounce sold.

As a result, the Company achieved a site all-in sustaining cost of $1,003 per ounce sold and an all-in sustaining cost2 of $1,058 per ounce sold in the three-month period in 2020 compared to $711 per ounce and $775 per ounce sold, respectively in the comparable 2019 period. The higher all-in sustaining cost in the quarter is attributed to the ongoing decline development at Bagassi South which is weighted towards the first half of the year. Gold ounces sold of 30,126 ounces were lower than production due to the timing of gold shipments at the end of the quarter. This had an unfavourable impact on AISC of approximately $40 per ounce sold.

The Company generated a mine operating margin2 of $938 per ounce in 2020 which was 20% higher than in 2019 mainly due to the higher average gold sales price.

The Company invested $6.1 million in underground mine development at the 55 Zone and $4.3 million at Bagassi South in the first quarter of 2020.

The Company generated strong cash flow from mining operations2 of $25.4 million in Q1 2020, for cash flow from mining operations per share2 of $0.07 (C$0.09/share). Comparatively, the Company generated cash flow from mining operations2 of $24.3 million and $0.07 cash flow from mining operations per share2 in Q1 2019.

Exploration activities

Séguéla Gold Project

Exploration activities have continued to progress with the objective of delineating additional mineral resources within close proximity to Antenna. The current targets, including Agouti, Boulder and Ancien, are within 10 kilometres of the Antenna deposit (Figure 1).

Figure 1: Séguéla Location Plan

Significant progress was made on defining and extending mineralization at Boulder, Agouti and Ancien with 4 RC/diamond core rigs active throughout the first quarter of 2020, culminating in the release of the PEA on April 14th (refer to Company press release dated April 14, 2020).

Ancien

An additional 63 infill and extension RC/DD holes has been completed at Ancien since the drillhole data cutoff date (February 12 2020) used to support the Inferred Mineral Resource estimate in the PEA of 261,000 ounces (refer to Company press release dated April 14, 2020). Results from 59 of the drill holes were received during April (refer to Company press releases dated April 20 and 29, 2020), with the balance expected in late May (Figure 2). Infill drilling of the high-grade core within the PEA conceptual shell has continued to return excellent grades as well as expanding the shoot to the south with results such as 7m at 10.4g/t from SGRD709 and 11m at 5.9g/t from SGRD545.

Extension drilling testing the down plunge projections was also very successful with SGRD705 intersecting 10m at 59.4g/t, including 2m at 175.0g/t, approximately 35m below the conceptual pit base and further confirming the central high grade shoot. In addition, results from SGRD715 (3m at 26.1g/t) and SGRD541 (4m at 17.4g/t) are suggestive of a second shoot below the central high grade shoot, and which remains open at depth and along strike to the north.

Highlights from the most recent drilling at Ancien include:

-

10 metres (“m”) at 59.4 grams per tonne gold (“g/t Au”) in drill hole SGRD705 from 207m including:

- 2m at 175.0g/t Au from 209m

- 3m at 26.1g/t Au in drill hole SGRD715 from 193m

-

7m at 10.4g/t Au in drill hole SGRD709 from 124m including:

- 2m at 32.1g/t Au from 124m

-

4m at 17.4g/t Au in drill hole SGRD541 from 99m including:

- 1m at 58.6g/t Au from 101m

-

11m at 5.9g/t Au in drill hole SGRD545 from 113m including:

- 1m at 13.8g/t Au from 117m

- 1m at 29.2g/t Au from 122m

-

5m at 8.0g/t Au in drill hole SGRD530 from 79m including:

- 2m at 15.1g/t Au from 83m and

- 7.6m at 2.8g/t Au in drill hole SGRD713 from 62.6m

Figure 2: Ancien Longsection highlights

Boulder

A short infill and extension drilling program at Boulder was completed during the quarter with encouraging results received from several holes testing potential depth extensions below the southern section of the Boulder conceptual pit shell (refer to Company press release dated April 20, 2020).

Highlights from the most recent drilling at Boulder include:

-

6m at 5.8 g/t Au in drill hole SGRC672 from 182m including:

- 1m at 31.3 g/t Au from 183m

-

6m at 8.8 g/t Au in drill hole SGRC673 from 169m including:

- 2m at 19.5 g/t Au from 170m

- 13m at 1.3 g/t Au in drill hole SGRC676 from 134m and

- 19m at 1.2 g/t Au in drill hole SGRC661 from 28m

Agouti

The first stage of an infill and extension drilling program at Agouti to upgrade and extend the resource confidence to Indicated status was completed. Agouti currently has an Inferred Mineral Resource estimate of 110,000 oz at 2.6 g/t Au (refer to Company press release dated April 14, 2020). Infill results support the higher grades and continuity between sections (Figure 3). In addition, results from several drill holes testing down plunge continuity beyond the conceptual pit shells, show the deposit remains open at depth.

Highlights from the most recent drilling at Agouti include:

-

11 m at 8.2g/t Au in drill hole SGRD627 from 27m including:

- 1m at 10.3g/t Au from 30m;

- 1m at 63.4 g/t Au from 33m;

-

13m at 5.1g/t Au in drill hole SGRC588 from 1m including:

- 1m at 38.3g/t Au from 7m;

- 5m at 7.8g/t Au in drill hole SGRC601 from 27m;

-

7m at 5.0g/t Au in drill hole SGRC659 from 63m including:

- 1m at 15.1g/t Au from 63m;

-

5m at 6.9g/t Au in drill hole SGRD555 from 70m;

- 1m at 15.7g/t Au from 70m;

-

6m at 5.5g/t Au in drill hole SGRD604 from 59m; and

- 2m at 12.8g/t Au from 61m

Figure 3: Agouti highlights

Boussoura Project

Located approximately 190km south of Yaramoko, RC and core drilling at the Boussoura project has led to a new high grade discovery at Galgouli, and excellent results following up historic drilling at Fofora (refer to Company press release February 3 and 20, 2020). The Boussoura project is located in the southern portion of the Houndé Greenstone Belt in southern Burkina Faso.

Galgouli

Exploration activities at Galgouli during the quarter focussed on Reverse Circulation and Diamond core drilling, testing the extent of high grade mineralization along a >1km trend with drilling to a vertical depth of approximately 250m. High grade mineralization is associated with a series of steeply dipping quartz-chlorite-carbonate-pyrite veins with coarse gold (1-3mm) commonly identified on vein margins and selvedges. Veining is hosted by variably altered and sheared porphyritic andesites with 5-10m wide alteration zones hosting low grade.

Auger drilling and soil geochemistry sampling also commenced on nearby areas at Galgouli during the quarter, testing and refining target identification in areas where artisanal workings are indicative of further high grade extensions.

Fofora

Drilling continued at Fofora during the quarter with the results extending the down plunge footprint of the mineralized envelope to over 450m (greater than 175m below surface) and where it remains open. Drilling also identified a separate, high grade, footwall structure parallel to the main lode. Highlights of the drilling during the quarter include:

- 14.9m at 9.8g/t Au in drill hole BSR-20-DD-FFR-016 from 67m including:

- 3.9m at 29.2g/t Au from 75.8m;

- 8.0m at 8.5g/t Au in drill hole BSR-20-DD-FFR-019 from 25m including:

- 4.5m at 14.8g/t Au from 25.5m;

- 0.5m at 59.4g/t Au in drill hole BSR-20-DD-FFR-015 from 70.9m (Footwall structure)

Before activities were temporarily suspended at the end of the quarter as part of the Company’s COVID-19 precautions, several additional targets have been identified at the Boussoura permit. Historically, work before 2012 focussed around the Fofora area with shallow drilling and trenching, and pre-dated much of the current artisanal workings, with very little work carried out on the remainder of the permit. Outcrop mapping and the extensive artisanal workings coupled with historic geophysical surveys, has helped develop a good understanding of the key structural controls, assisting with targeting of the host high grade quartz veins. Active artisanal workings in at least 15 localities within the Boussoura permit and which commonly extend for 300-400m, highlight the potential for additional high grade gold mineralization.

2020 Exploration Program

At Yaramoko, a 14,000 metre infill resource drilling program from the 4700m RL in the 55 Zone is scheduled to commence in H2 2020, with the results to form the basis of an updated Yaramoko mineral resource estimate planned for Q1 2021.

Exploration activities at Séguéla will focus on potential resource growth at Ancien, Agouti and Boulder to support the upcoming feasibility study, while also advancing other satellite opportunities. Additional target generation activities will also continue at Séguéla.

The Boussoura program, once resumed, will focus on Galgouli and Fofora, as well as testing other high priority targets associated with artisanal mining activities and targets generated from soil geochemistry programs.

Regional work on the remaining properties in Côte d’Ivoire will involve interpretation of the airborne magnetic surveys, BLEG, auger, soil geochemistry and termite mound sampling the results of which will be ranked for further work.

Events subsequent to March 31, 2020

On April 14, 2020, Roxgold announced the results of a PEA for the Séguéla Gold Project in Côte d’Ivoire. The PEA provides a base case assessment of developing the Antenna, Ancien, Agouti and Boulder deposits as open pit mines feeding a central gold processing facility. Roxgold expects to continue its evaluation of Séguéla with the intent of growing the resource base and advancing to the feasibility stage.

Financial highlights from the PEA include:

- LOM after-tax net cash flow of $354 million at a gold price of $1,450 per ounce

- Project payback of 1.2 years

- Robust economics with net present value (“NPV”) and internal rate of return (“IRR”) of:

Metric |

Base Case @

|

Spot Price @

|

||

NPV5% after-tax – attributable to Roxgold’s 90% interest |

$268 million |

$379 million |

||

After tax IRR |

66% |

88% |

The PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Review of Q1 2020 financial results

Mine operating profit

During the quarter ended March 31, 2020, revenues totalled $48.0 million (2019 - $39.8 million) while mine operating expenses and royalties totalled $16.9 million (2019 - $13.6 million) and $2.9 million (2019 - $1.8 million), respectively. The increase in sales is primarily due to the 22% increase in the average realized gold price. During the quarter, the Company achieved total cash cost2 per ounce sold of $657 and a mine operating margin2 of $938 per ounce sold.

For more information on the cash operating costs2 see the financial performance of the Mine Operating Activities section of this MD&A.

During the three-month period ended March 31, 2020, depreciation totalled $13.4 million compared to $11.8 million in 2019. The increase in depreciation is a result of the Company’s continued investment in the underground development of 55 Zone and Bagassi South combined with higher throughput.

General and administrative expenses

General and administrative expenses were 11% lower at $1.3 million for Q1 2020 compared to $1.5 million in Q1 2019 primarily as a result of lower travel expenses.

Sustainability and other in-country costs

Sustainability and in-country costs totalled $0.4 million for Q1 2020 compared to $0.6 million for the comparative period. The decrease in expenditures primarily relates to timing of community investments in 2019. These expenditures are incurred as part of Roxgold’s commitment to responsible operations in Burkina Faso including several sustainability and community projects.

Exploration and evaluation expenses (“E&E”)

Exploration and evaluation expenses totalled $7.8 million in Q1 2020 compared to $3.2 million in Q1 2019. The significant increase in exploration and evaluation activities was primarily due to advancing the PEA at the Séguéla Gold Project which was released in a press release on April 14, 2020. There was also drilling at the Boussoura project in Burkina Faso.

E&E expenses totalled $5.8 million at the Séguéla Gold Project and $2.0 million for Boussoura and Yaramoko. Expenditures at the Séguéla Gold Project included $4.8 million in drilling costs with $2.8 million of exploration drilling primarily at Ancien and $2.0 million relating to infill drilling at Boulder and Agouti. The Company spent an additional $0.2 million on PEA study costs.

Drilling expenses totalled $1.3 million at the Boussoura permit and $0.3 million spent related to regional drilling at Yaramoko.

Share-based payments

Share-based payments totalled $0.2 million in Q1 2020 compared to $0.4 million in the comparative period.

Financial expenses

Financial expenses totalled $1.6 million in Q1 2020 compared to $3.5 million in Q1 2019. The decrease is mainly attributed to the favourable movement in foreign exchange gain (loss) of $1.7 million along with a reduction of interest expense. The decrease in financial expense were partially offset by an unfavourable change period over period in the fair value of the Company’s gold forward sales contracts of $0.5 million.

Current and deferred income tax expense

The current income tax expense for Q1 2020 is consistent with the comparable period in 2019. The higher effective tax rate is also due to the significant increase in exploration expenditures in Q1 2020 incurred in Burkina Faso and Cote d’Ivoire not being tax effected due to the Company’s status under the mining regulations.

Net income & EBITDA

The Company’s net income and EBITDA2 in Q1 2020 was $1.9 million and $17.5 million, respectively compared to $1.9 million and $16.2 million, respectively in the comparative 2019 period. Net income was consistent with prior period primarily as a result of higher average realized gold sales price, offset by its focus on growth with significant investments in exploration and evaluation at Séguéla, higher depreciation due to increased capital investment and higher tonnes processed.

Income Attributable to Non-Controlling Interest

For the three-month period ended March 31, 2020, the income attributable to the non-controlling (“NCI”) interest was $1.0 million. The Government of Burkina Faso holds a 10% carried interest in Roxgold SANU SA and as such is considered Roxgold’s NCI. The NCI attributable income is based on IFRS accounting principles and does not reflect dividend payable to the minority shareholder of the operating legal entity in Burkina Faso.

Conference Call and Webcast Information

A webcast and conference call to discuss these results will be held on Wednesday, May 13, 2020, at 8:00AM Eastern time. Listeners may access a live webcast of the conference call from the events section of the Company’s website at www.roxgold.com or by dialing toll free 1-844-483-3764 within North America or 1-647-689-6800 from international locations and entering passcode: 522 84 99.

An online archive of the webcast will be available by accessing the Company’s website at www.roxgold.com. A telephone replay will be available for two weeks after the call by dialing toll free 1-800-585-8367 and entering passcode: 522 84 99.

Notes:

- For the three-month period ended March 31, 2019, gold ounces sold, and gold sales included pre-commercial production ounces sold of 2,305 ounces and revenues of $3.0 million. The pre-commercial production gold sales and mining operating expenses were accounted against Property, Plant and Equipment.

- The Company provides some non-IFRS measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results. Please refer to note 15 “Non-IFRS financial performance measures” of the Company’s MD&A dated May 12, 2020, available on the Company’s website at www.roxgold.com or on SEDAR at www.sedar.com for reconciliation of these measures.

Qualified Persons

Paul Criddle, FAusIMM, Chief Operating Officer for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed, verified and approved the technical disclosure contained in this news release.

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has verified and approved the technical disclosure contained in this news release. This includes the QA/QC, sampling, analytical and test data underlying this information. For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form dated December 31, 2018, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

For further information regarding the Yaramoko Gold Mine, please refer to the technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Worodougou Region, Cote d’Ivoire” dated July 23, 2019 (the “Séguéla Technical Report”) and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: economic statements with respect to Mineral Reserves and Mineral Resource estimates (including proposals for the potential growth, extension and/or upgrade thereof and any future economic benefits which may be derived therefrom), future production and life of mine estimates, production and cost guidance, anticipated recovery grades, and potential increases in throughput, the anticipated increased proportion of mill feed coming from stoping ore, future capital and operating costs and expansion and development plans including with respect to the 55 zone and Bagassi South, and the expected timing thereof (including with respect to the delivery of ore and future stoping operations), proposed exploration plans and the timing and costs thereof, the anticipated operations, costs, proposed funding, timing and other factors set forth in the Technical Report, and sufficiency of future funding. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. In certain cases, forward-looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Yaramoko Gold Project and other properties including the Séguéla Gold Project in the short and long-term, the progress of exploration and development activities as currently proposed and anticipated, the receipt of necessary regulatory approvals and permits, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters, as well as assumptions set forth in the Company’s technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Worodougou Region, Cote d’Ivoire” dated July 23, 2019 (the “Séguéla Technical Report” and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and SEDAR at www.sedar.com. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: delays resulting from the COVID-19 pandemic, changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel, failure to obtain permits as anticipated or at all, failure of exploration and/or development activities to progress as currently anticipated or at all, and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200512005910/en/