Rugby Mining to Acquire Proximo Resources

VANCOUVER, British Columbia, July 26, 2021 (GLOBE NEWSWIRE) -- Rugby Mining Limited (“Rugby” or the “Company”) (TSX-V: RUG) is pleased to report that it has entered into a purchase agreement (the “Purchase Agreement”) pursuant to which it has agreed, subject to TSX Venture Exchange acceptance, to acquire private Australian company Proximo Resources Pty Ltd (“Proximo”). Proximo owns silver and gold projects in Chile and Argentina, including the drill ready Salvadora silver-copper-gold project. The Proximo management is considered exceptional and will form a key part of the Rugby team going forward. Upon closing of the Purchase Agreement, the new CEO and President of Rugby will be Mr. Peter Love, the current CEO of Proximo.

Highlights

- Rugby will acquire 100% of the outstanding ordinary shares and options of Proximo from the holders thereof in consideration for 50 million common shares (the “Rugby Shares”) and 3,500,000 Rugby options (the “Rugby Options”).

- Proximo’s key project is the Salvadora silver-copper-gold property in Chile (the “Salvadora Project”). It is situated south of, and on trend from the high grade El Indio gold mine. Salvadora represents one of the best undrilled epithermal silver-gold systems known in Chile. A secondary gold project located in the prolific gold-silver Santa Cruz province of Argentina (the “Deseado Project”) will also be acquired.

- The Salvadora area is known for the El Indio, Alturas, Veladero and Pascua Lama deposits. The famous El Indio mine (23 Mt at 6.6 g/t gold, 121 g/t silver, 4% copper) shipped 0.54 Mt of ore at 121 g/t gold containing 2.1 Moz of gold, from a zone only 500 metres (“m”) long (Porter, 2001).

- The new CEO and President of Rugby will be current Proximo CEO Mr. Peter Love, an industry professional with strong experience in capital markets, minerals, and energy.

- Messrs. Bryce Roxburgh and Yale Simpson will share the role of Non-Executive Chairman of Rugby.

- Paul Joyce, Glen Van Kerkvoort and Arturo Correa will lead Rugby’s exploration team.

- Proximo management has decades of experience in South America, experience that will be applied to pursuing a drilling permit on Rugby’s Cobrasco copper project in Colombia and advancing the El Zanjon gold project in Argentina.

CEO Bryce Roxburgh and Chairman Yale Simpson state “Salvadora represents an outstanding opportunity for Rugby to acquire a project with scale in the famous El Indio gold belt. Rarely does one have the opportunity to be the first company to test a consolidated land package such as Proximo has accomplished. The project is permitted for immediate drilling but targeting can be enhanced through more sampling and geophysical surveys over the 70% of the property covered by scree.

As a group we are very comfortable continuing to expand our holdings in Chile and Argentina where we were so successful in our previous companies, Exeter and Extorre. Both companies made world class discoveries and were sold to majors. We also remain confident that we will be able to realize substantial shareholder value from our Colombian asset base going forward.

Our strong involvement in Rugby will most definitely continue, particularly as we have such significant shareholdings in the Company.”

Mr. Peter Love states, “I believe Salvadora has all the necessary ingredients to be a flagship project for Rugby. It is a large mineralized system in a superb location.

We intend to drive shareholder value by rapidly advancing Salvadora to drilling later this year. We plan to finalize drill locations following an exploration program to commence after snow melt in October.

I recognize the potential of Rugby’s Cobrasco porphyry copper project in Colombia. I believe the project could be a world class discovery once drilling is permitted. We will work with the Rugby team to further demonstrate to both the environmental and technical authorities the merits of copper development and Rugby as an ideal partner for Colombia.”

Acquisition Terms

Pursuant to the Purchase Agreement between Rugby, Proximo, and the shareholders and option holders of Proximo, Rugby will issue 46,000,000 Rugby Shares to acquire 20,387,500 Proximo ordinary shares representing all of the issued shares of Proximo. In addition, Rugby will acquire 8,000,000 Proximo stock options in consideration for 4,000,000 Rugby Shares and 3,500,000 Rugby Options. The Rugby Options will be issued under Rugby’s stock option plan. Each Rugby Option will be exercisable to acquire one Rugby common share at a price of $0.10 per share expiring January 13, 2026. The transaction is at arms length and no new control persons will be created. The Rugby Shares issued in consideration for the Proximo shares and options will, in addition to the 4 month statutory hold period imposed under applicable securities law, be subject to contractual voluntary escrow, with such Rugby Shares being released from escrow as follows: 25% six months following closing, 25% twelve months following closing, 25% eighteen months following closing and 25% twenty-four months following closing.

Mr. Paul Joyce will step down as a director, while maintaining his position as COO, and Rugby will increase the number of directors to seven to facilitate the appointment of Peter Love, CEO of Proximo, as a director and President and CEO of Rugby and Glen Van Kerkvoort as a director and Chief Technical Officer of Rugby.

The transaction is conditional on, among other matters, TSX Venture Exchange acceptance, Rugby raising a minimum of $2,500,000, the appointment of 2 Proximo directors to the Board of Directors of Rugby, and the continued accuracy of the representations and warranties contained in the Purchase Agreement.

The transaction is expected to close by August 31, 2021.

The Proximo Projects

Rugby has completed a comprehensive legal and technical due diligence review of the Proximo projects (Figure 1). An independent technical report on the Salvadora Project prepared by Dr. Gustavo Delendatti, Ph.D., B.Sc-Geol, MAIG, is currently being prepared in accordance with National Instrument 43-101 (Standards for Disclosure of Mineral Projects) (the “Salvadora Technical Report”).

Proximo’s flagship property is the silver-copper-gold Salvadora Project located at the southern end of the El Indio belt, 40 kilometres (“km”) south of Barrick’s El Indio mine which was one of the highest grade gold mines in Chile. In the Deseado Massif of Santa Cruz Province, Argentina is Proximo’s 100% owned Deseado Project, comprised of the Venidero and Altiro-Futuro properties. The Venidero property is approximately 60 km south of Newmont Goldcorp’s Cerro Negro gold mine. The early stage Altiro-Futuro silver-gold property is located on the western margin of the Deseado Massif in Patagonia, Southern Chile.

Figure 1. Location map of Proximo’s projects.

The Salvadora Project

The undrilled Salvadora Project is located 2.5 hours’ drive by sealed all weather road from the Coquimbo deep water port and La Serena capital airport with 8 daily flights connecting to Santiago (Figure 2).

Figure 2. Salvadora project location.

The Salvadora Project is located in the El Indio gold belt that hosts in excess of 44 Moz of gold and 880 Moz of silver (Barrick, 2004; Barrick, 2019; Porter, 2001). It is 40 km south of the famous El Indio mine owned by Barrick Gold which produced +5 million ounces of gold, including 2.1 Moz of gold in direct shipping ore grade at 121 g/t Au (3.89 ozt/t) (Jannas et al., 1999; Porter, 2001).

The target is a high grade silver analogue of the El Indio gold mine to the north. The property hosts a 7 km long vein system with high silver grades. Most of the system is covered by scree such that artisanal mining focused only on the limited sites of vein outcrop. The hydrothermal alteration halo is large, suggesting excellent ore potential (Figure 3).

Figure 3. Salvadora view looking east.

The Silverado prospect at the southern end of the Salvadora vein system has silver grades from mineralized veins that range between 0.25 g/t to 1,060 g/t silver, 0.12% to 2.47% copper, 0.0025 g/t to 0.7 g/t gold and 0.003% to 5.8% lead.

The Cumbres prospect at the northern end of the Salvadora vein system has grades from samples of mineralized quartz veins and sheeted veins that range 0.25% to 2.37% copper, 26.2 g/t to 1,160 g/t silver, 0.01 g/t to 0.7 g/t gold; and 0.07% to 3.18% lead.

The project is permitted for drilling from 39 drill platforms. Drilling is expected to commence late this year, or Q1, 2022, following more detailed geological mapping, scree geochemical sampling, and geophysical surveying including magnetics and electrical surveys.

Geology & Mineralization

Mineralization on the Salvadora Project conforms to a structurally controlled intermediate sulfidation epithermal silver-copper-gold style deposit. It is hosted by steeply dipping acid to intermediate tuffs and ignimbrites. The hydrothermal alteration zone is 7 km long and up to 500 m wide. It strikes north-south. The vertical extent of mineralization exposed at Salvadora is 400 m extending from 3,800 m to 4,200 m elevation.

The Salvadora Project is divided into two main prospects within the alteration corridor. The Silverado prospect is in the south and the Cumbres prospect in the north (Figure 4). The southern Silverado zone exhibits discrete sectors of silver-copper-gold bearing subvertical veins, vein breccias and sheeted sub-horizontal veins. Composites of individual veins up to one metre wide form outcrops 5 to 20 m wide.

The northern Cumbres zone is characterized by steeply dipping silver-copper-gold bearing structures 0.2 to 5.0 m wide. These structures host fine quartz to opaline silica intermixed with abundant illite, haloysite and kaolin.

Alteration is best observed in band ratio enhanced satellite imagery (Figure 5). It is also visible from the paved international highway that passes through the valley to the east of the project. Alteration is seen as a north-south trending color anomaly exposed on a steep, east-facing, deeply incised slope that forms the western wall to the valley.

In the field, hydrothermal alteration is observed as a core of pervasive quartz–sericite assemblages and breccia fragments of quartz-sericite-calcite-barite affecting a dacite wall rock that grades outwards to an illite dominated argillic assemblage with subordinate chlorite. Mineralization is characterized by silver and copper with lesser gold, lead and zinc. It is associated with primary sulfides and sulfosalts that are partially to totally leached to oxide mineralization.

Proximo Exploration

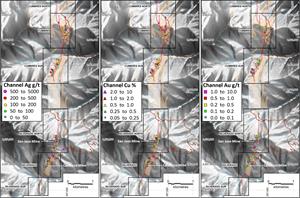

During 2020-2021, Proximo exploration work comprised road rehabilitation, geological mapping, geochemistry, alteration analysis and remote sensing satellite studies. Two hundred and eighteen surface rockchip and continuous channel samples were collected from veins and mineralized exposures within the two main areas of the project (Figure 6).

At the Silverado prospect grades range between 0.12% to 2.47% copper; 0.25 g/t to 1,060 g/t silver; up to 0.7 g/t gold; and up to 5.8% lead. At the Cumbres prospect, samples range between 0.25% to 2.37% copper; 26.2 g/t to 1,160 g/t silver; up to 0.7 g/t gold; and up to 3.18% lead (Figure 7).

Figure 7. Proximo’s channel sampling geochemistry.

The Salvadora Option Agreements

The Salvadora Project is comprised of 35 individual exploration and mining concessions covering an aggregate area of 6,924 hectares (“ha”). The concessions are currently held by Proximo (holding the peripheral areas) and two additional entities. Proximo successfully negotiated the consolidation of artisanal miners landholdings by way of option agreements to purchase 100% of their interest. The terms negotiated by Proximo are attractive.

The first option agreement provides for escalating annual payments totalling US$900,000 and in-ground expenditures of US$8,100,000 contingent on success over 4 years. A final payment, less the US$900,000 paid, is payable based on resources established ranging from US$3.27 per gold equivalent ounce for inferred resources to US$79.00 per gold equivalent ounce for proven reserves.

The second option agreement requires Proximo to make escalating annual payments totalling US$555,000 over 4 years. There are no expenditure commitments and the vendor will retain a 1% NSR which can be purchased by Proximo for US$5,000,000.

The Deseado Project, Argentina

The 100% owned Deseado Project comprises the Venidero and Altiro-Futuro properties located within the prolific epithermal precious metal vein district of the Deseado Massif located in Santa Cruz Province, Argentina and Patagonia, Southern Chile (Figure 8).

Figure 8. Deseado Project location map.

Venidero Property

The Venidero property application is located in the west of the Deseado Massif, Santa Cruz Province, Argentina, 60 km south of Newmont Goldcorp’s Cerro Negro mine. A drilling permit application was submitted in June 2020, and is expected to receive final approval by authorities in Argentina in Q4 2021.

The undrilled vein (“Gorgonzola Vein”) displays high level hydrothermal breccia and chalcedonic to opaline colloform banded veins in a major regional fault structure (Figure 9 and Figure 10). The north-south trending vein has a number of selected higher grade gold results to 4.5 g/t (Figure 11). The vein outcrops 12 km north of an advanced argillic silica cap zone and peripheral argillic (illite) alteration.

Figure 9. Outcropping hydrothermal breccia and veins - Venidero.

Figure 10. High level banded silica (assay 4.5 g/t gold).

Figure 11. Gorgonzola Vein Gold Geochemistry.

Textures are comparable with those observed at the Eureka vein at Cerro Negro where the discovery was below similar vein textures.

Prior to drilling, detailed mapping, sampling and geophysical surveys are essential to identify non-outcropping sulphide-rich veins similar in style to those at the Cerro Moro and Cerro Negro gold-silver mines.

Altiro-Futuro Property

The Altiro-Futuro silver-gold property comprises 21 concessions totalling 6,300 ha, located in the western extension of the Deseado Massif, Chile (Figure 12). Exploration has identified potential for high grade silver-gold epithermal deposits.

Figure 12. Altiro-Futuro property location.

At Futuro, Red Hill (Chile) previously reported drilling 18 drill holes (1,824 m) with significant intersections of 2.6 m grading 48.18 g/t gold from drill hole IDH06 which includes 1.13 m grading 109.21 g/t gold (Figure 13), 1.55 m grading 3.09 g/t Au from IDH04 and 4 m grading 1.43 g/t Au from drill hole IDH1.

Drill hole IDH03 intersected a diatreme breccia averaging 0.16 g/t Au over 38 m. Similar breccias are observed in numerous epithermal precious metal vein deposits in the region forming the uppermost levels of the hydrothermal systems.

Figure 13. Felsic dyke with sphalerite, galena and fine visible gold (IDH006 at 78.0m).

At the early stage Altiro property, rock sampling returned several zones of anomalous silver-gold results including 3,560 g/t silver (114 ozt/t) at Cerro Colorado (Figure 14) and 8.06 g/t gold at Crazy King.

Figure 14. Cerro Colorado prospect (left) and Proximo’s selected rock sample assay results (right).

References Cited

Barrick 2004, Barrick Gold Corporation, Annual Report, 2004; SEDAR.com

Barrick 2004, Barrick Gold Corporation, Annual Report, 2004; SEDAR.com

Barrick 2019, Barrick Annual Information Form for the year ended December 31, 2019; SEDAR.com

Jannas, R.R., Bowers, T.S., Petersen, U., and Beane, R.E., 1999, High-sulfidation deposit types in the El Indio district, Chile, in Skinner, B.J., ed., Geology and Ore Deposits of the Central Andes: Society of Economic Geologists, Special Publication 7, p. 219–266.

Porter 2001, El Indio Belt - El Indio, Tambo, Pascua Lama; Porter GeoConsultancy Pty Ltd, 2001; portergeo.com.au

Qualified Person

Paul Joyce, Rugby’s Chief Operating Officer, Director and a “qualified person” (“QP”) within the definition of that term in National Instrument 43-101, Standards of Disclosure for Mineral Projects, has verified the technical information that forms the basis for this news release, however some of the information is historical in nature and the Company will be required to do further assessment of this data. The technical due diligence conducted for the Company also comprised an independent technical report on the Salvadora project by Dr Gustavo Delendatti (PhD, B.Sc-Geol, MAIG), in accordance with NI 43-101.

About Rugby

Rugby is an exploration company conducting “discovery stage” exploration on targets in Colombia, Argentina, the Philippines and Australia. The Company controls a portfolio of gold project applications in Colombia that do not require the Department of Forestry approval that stalled the Company’s Cobrasco copper project in the Chocó Department. These gold project applications have considerable potential for gold, silver and copper discoveries. The Company is optimistic that the Department of Mines could move to grant titles later this year as Covid restrictions ease in Colombia.

The Company benefits from the experience of its directors and management, a team that has either been directly responsible for world-class mineral discoveries or have been part of the management teams responsible for such discoveries. Two successful companies under their management were Exeter Resource Corporation and Extorre Gold Mines Limited, which discovered significant deposits in South America. These companies were purchased by Goldcorp (Newmont) and Yamana Gold respectively.

For additional information you are invited to visit the Rugby Mining Limited website at www.rugbymining.com

| Robert Grey, VP, Corporate Communications Tel: 604.688.4941 Fax: 604.688.9532 Toll-free: 1.855.688.4941 | Suite 810, 789 West Pender St. Vancouver, BC Canada V6C 1H2 info@rugbymining.com |

CAUTIONARY STATEMENT

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of Canadian securities legislation. This includes statements concerning the Company’s proposed acquisition of Proximo Resources Pty Ltd (“Proximo”), plans at its projects including exploration plans for the Salvadora Project in Chile, progress on obtaining approval for its exploration concession applications in Colombia, the expected timing of drilling and/or geophysics programs, budgeted costs to conduct exploration programs including drilling, high grade potential and potential for mineral discoveries at its projects and the style or occurrence of the mineralization which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. In addition, the proposed acquisition of Proximo is subject to regulatory approval and certain conditions precedent including completion of a capital raise of a minimum of $2,500,000. There can be no certainty that the proposed acquisition will proceed as planned or at all. The Company holds certain of its projects under option agreements, which require annual cash payments, expenditure and/ or drilling requirements in order to maintain its interest. Should the Company not be able to meet its obligations or renegotiate the agreements it will lose its rights under the option agreement. Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the effect on prices of major mineral commodities such as copper and gold by factors beyond the control of the Company; events which cannot be accurately predicted such as political and economic instability, terrorism, environmental factors and changes in government regulations and taxes; the shortage of personnel with the requisite knowledge and skills to design and execute exploration programs; difficulties in arranging contracts for drilling and other exploration services; the Company’s dependency on equity market financings to fund its exploration programs and maintain its mineral exploration properties in good standing; political risk that a government will change, interpret or enforce mineral tenure, environmental regulations, taxes or mineral royalties in a manner that could have an adverse effect on the Company’s assets or financial condition and impair its ability to advance its mineral exploration projects or raise further funds for exploration; risks associated with title to resource properties due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the interpretation of laws regarding ownership or exploration of mineral properties in the Philippines, Argentina, Chile and Colombia and in the sometimes ambiguous conveyancing characteristic of many resource properties, currency risks associated with foreign operations, the timing of obtaining permits to conduct exploration activities, the ability to conclude agreements with local communities and other risks and uncertainties, the ongoing effects of the COVID 19 virus and including those described in each of the Company’s management discussion and analysis and those contained in its financial statements for the year ended February 28, 2021 filed with the Canadian Securities Administrators and available at www.sedar.com. In addition, forward-looking information is based on various assumptions including, without limitation, assumptions associated with exploration results and costs and the availability of materials and skilled labour. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE