Rupert Resources Reports Results for 3 and 9 Months Ending November 30, 2021

Rupert Resources Ltd (“Rupert” or the “Company”) announces that it has published its unaudited, condensed consolidated interim financial statements for the three and nine months ending November 30, 2021 and accompanying Management’s Discussion and Analysis for the same period. Both of the above have been posted on the Company’s website www.rupertresources.com and on Sedar at www.sedar.com.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220121005174/en/

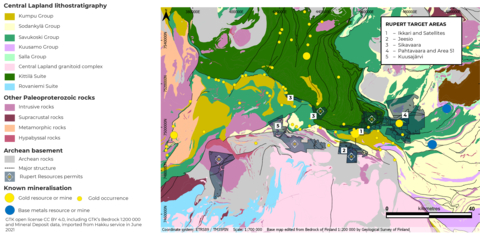

Figure 1 – Location of Rupert Resources' exploration properties in Central Lapland (Photo: Business Wire)

Highlights

- Cash at end of period of $49,324,781

- Drill programme for calendar 2022 increased from 62,000 to 80,000 with six rigs now active on Rupert Lapland properties in key winter drilling season

- Tetra Tech has been appointed to lead preliminary economic assessment (“PEA”) scheduled for completion in third calendar quarter of 2022.

- PEA will evaluate the economic potential of the Ikkari and Pahtavaara mineral resources as well as satellite deposits that will continue to be drilled during the current winter exploration program.

- New 138km2 Kuusäjarvi property now under reservation (20km west of Ikkari)

- Exploration activities planned at five target areas in 2022: Ikkari and Satellites; Jeesiö; Sikavaara; Pahtavaara and Area 51; and Kuusäjarvi (figure 1)

James Withall, CEO of Rupert Resources commented “The most intensive drilling campaign since Rupert commenced exploration in Central Lapland is now underway with our drill program designed to extend the Ikkari resource and to make further discoveries of scale on an enlarged 735km2 land package as we work towards a PEA during the 3rd calendar quarter of 2022. We plan to apply our systematic exploration approach across the region on five prospective target areas the first of which yielded six new gold discoveries, including the multi-million ounce Ikkari gold deposit”

Operating performance

The work programs at the Rupert Lapland Project are designed to identify and evaluate the mineral potential contained in Rupert’s expanded 735km2 land package on five target areas: Ikkari and Satellites; Jeesiö; Sikavaara; Pahtavaara and Area 51; and Kuusäjarvi. In July 2020 Rupert commenced a 60,000m diamond drill program to further evaluate six new discoveries made in an area within the licence package known as the Rupert Lapland Project Area, as well as continuing to generate new targets. At the end of December 2021, 77,168m had been drilled since May 2020 including 50,381m at the Ikkari discovery. This program is being increased over the 2021/22 winter season with the aim of expanding areas of known mineralisation and it is noted that Ikkari remains open at depth and along strike. Drill rigs from local contractors have been secured to execute Rupert work programs for the next two years, with circa 80,000m of diamond drilling now budgeted for calendar 2022. Sixty percent of drilling is budgeted for infill and extension drilling at Ikkari with the balance allocated to regional exploration.

Base of till (“BoT”) sampling continues across the Rupert Lapland Project over geophysical anomalies of interest and programs will begin on recently granted permits in the coming months.

Following publication in September 2021 of the Ikkari Technical Report, and the on-going regional diamond and BoT drilling and sampling programs, further work to optimize potential extraction methods and cut-off grades is being undertaken as part of the PEA, expected to be completed along with an update to the MRE during the third calendar quarter of 2022.

The PEA project has been awarded to Tetra Tech, with initial meetings held in mid-December 2021. The PEA will encompass an evaluation of the economic potential of the Ikkari and Pahtavaara mineral resources as well as satellite deposits that will continue to be drilled during the current winter exploration program.

The aim of the PEA is to better define the optimum parameters that will be used in a Pre-feasibility Study (“PFS”) that is expected to be initiated subsequent to completion of the PEA.

Work continues on updating the Mineral Resource Estimate for the Pahtavaara Mine. Trade-off studies to be completed as part of the PEA will define the most suitable mining methods and cut-off grades that will be used to complete an updated National Instrument 43-101 Technical Report. The PEA will also review the opportunity to develop Pahtavaara as a satellite mine to a new central processing facility at Ikkari, which may allow Pahtavaara to benefit from cost synergies and shared infrastructure.

During the reporting period the Company published a maiden National Instrument (“NI”) 43-101-compliant mineral resource estimate (“MRE”) for Ikkari - see the technical report entitled “NI 43-101 Technical Report: Ikkari Project, Finland” with an effective date of September 13, 2021 prepared by Brian Wolfe, Principal Consultant, International Resource Solutions Pty Ltd., an independent qualified person under NI 43-101 (the “Ikkari Technical Report”).

The MRE as disclosed in the Ikkari Technical Report comprises 49 million tonnes (“Mt”) at 2.5 grams per tonne gold (“g/t Au”) in the Inferred category, which was reported using cut-offs of 0.6g/t Au for mineralisation potentially mineable by open pit methods and 1.2g/t Au for that portion that is potentially extractable by underground methods, for 3.95 million ounces Au in total.

Ikkari Inferred Mineral Resource |

||||||||||

|

Cutoff Grade

|

Tonnes

|

Average Grade

|

Gold Metal

|

Gold Metal

|

|||||

Open Pit |

0.4 |

34.44 |

2.3 |

2.58 |

80,200 |

|||||

0.6 |

30.53 |

2.6 |

2.51 |

78,200 |

||||||

0.8 |

27.14 |

2.8 |

2.44 |

75,900 |

||||||

1.0 |

24.47 |

3.0 |

2.36 |

66,500 |

||||||

Underground |

1.0 |

23.56 |

2.1 |

1.60 |

49,800 |

|||||

1.2 |

18.80 |

2.4 |

1.44 |

44,600 |

||||||

1.3 |

17.34 |

2.5 |

1.38 |

42,800 |

||||||

1.5 |

13.65 |

2.8 |

1.21 |

37,700 |

||||||

Open Pit |

0.6 |

30.53 |

2.6 |

2.51 |

78,200 |

|||||

Underground |

1.2 |

18.80 |

2.4 |

1.44 |

44,600 |

|||||

Total |

|

49.33 |

2.5 |

3.95 |

122,800 |

|||||

The MRE has been estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines”. It was calculated using the multiple indicator kriging method (MIK) and is classified as an inferred mineral resource as defined by the CIM. Numbers are affected by rounding. The MRE was reported using cut-offs of 0.6g/t Au for mineralisation potentially mineable by open pit methods and 1.2g/t Au for that portion that is potentially extractable by underground methods. The cut-offs were based on a gold price of US$1430/oz Au, with a 92% overall recovery and costs derived from benchmarks and first principles (see: the Ikkari Technical Report). Mineral Resources do not include Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources will be converted to Mineral Reserves.

The MRE was modelled utilising an initial geological interpretation of the deposit, following a review of all available data that has been collected since discovery in April 2020 and based on over 36,000m of drilling completed by Rupert up to the end of June 2021.

Financial performance

During the nine months ended November 30, 2021, the Company spent $16,513,835 (9 months ended November 30, 2020 – $10,540,853) on its exploration projects. During the period the Company raised $48,654,000 (before expenses) through concurrent equity financings and as of November 30, 2021, Rupert held cash or cash equivalents of $49,324,781. The Company recorded a net loss and comprehensive loss for the three and nine months ended November 30, 2021 of $(3,462,153) and $(8,435,622) respectively (three and nine months ended November 30, 2020 – $(4,535,505) and $(4,683,061) respectively) and a net loss per share for the three and nine months ended November 30, 2021 of $(0.01) and $(0.03) respectively (three and nine months ended November 30, 2020 – $(0.03) and $(0.04) respectively).

About the Rupert Lapland Project

The Rupert Lapland Project is located in the epicentre of the Central Lapland Greenstone Belt, Northern Finland, where the company has made six new discoveries including the high quality Ikkari Project with an inferred mineral resource estimate of 49Mt at 2.5 g/t gold for 3.95 million ounces1. The Rupert Lapland Project also holds the permitted Pahtavaara mine and mill (on active care & maintenance) within a regional land package of some 735km2. The Company acquired the project for USD2.5m in 2016 and is undertaking exploration both at the existing mine and across the region to demonstrate the potential for significant economic mineralisation. The Ikkari deposit and five other discoveries are located in a structural corridor that lies between the Kittilä Group allochthon to the north and the younger Kumpu Group basin to the south. The mineralised area is dominated by large E-W to ENE trending faults which have controlled broad to isoclinal folding within the sediment-dominated (Savukoski Group) rock package. A complex network of cross cutting structures has focused multi-stage fluid flow, with gold mineralisation associated with massive to fine-grained disseminated sulphides and concentrated at favourable structural intersections.

Review by Qualified Person, Quality Control and Reports

Dr Charlotte Seabrook, MAIG, RPGeo., Exploration Manager of Rupert, is the Qualified Person as defined by National Instrument 43-101 responsible for the accuracy of scientific and technical information in this news release.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Venture Exchange under the symbol “RUP.” The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high quality gold discovery in Northern Finland. Ikkari is part of the Company’s “Rupert Lapland Project,” which also includes the Pahtavaara gold mine, mill, and exploration permits and concessions located in the Central Lapland Greenstone Belt of Northern Finland (“Pahtavaara”). The Company also holds a 100% interest in the Surf Inlet Property in British Columbia, a 100% interest in properties in Central Finland and a 20% carried participating interest in the Gold Centre property located adjacent to the Red Lake mine in Ontario.

For further information, please contact:

Rupert Resources Ltd

82 Richmond Street East, Suite 203, Toronto, Ontario M5C 1P1

Tel: +1 416-304-9004

Web: http://rupertresources.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking statements” within the meaning of applicable securities laws, including statements with respect to: results of exploration activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended February 28, 2021 available at www.sedar.com. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

1 National Instrument 43-101 inferred mineral resource estimate (“MRE”) for Ikkari of 49 million tonnes (“Mt”) at 2.5 grams per tonne gold (“g/t Au”), for 3.95 million ounces (“oz”) in total (see the technical report entitled “NI 43-101 Technical Report: Ikkari Project, Finland” with an effective date of September 13, 2021 prepared by Brian Wolfe, Principal Consultant, International Resource Solutions Pty Ltd., an independent qualified person under NI 43-101: the “Ikkari Technical Report”).

The MRE has been estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines”. It was calculated using the multiple indicator kriging method (MIK) and is classified as an inferred mineral resource as defined by the CIM. Numbers are affected by rounding. The MRE was reported using cut-offs of 0.6g/t Au for mineralisation potentially mineable by open pit methods and 1.2g/t Au for that portion that is potentially extractable by underground methods. The cut-offs were based on a gold price of US$1430/oz Au, with a 92% overall recovery and costs derived from benchmarks and first principles (see: the Ikkari Technical Report). Mineral Resources do not include Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources will be converted to Mineral Reserves.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220121005174/en/