Serengeti Expands Kwanika Central Zone Mineral Resource - Project Confidence Substantially Increased

VANCOUVER, British Columbia, March 03, 2019 (GLOBE NEWSWIRE) -- Serengeti Resources Inc. (SIR: TSX-V) is pleased to report the results of a recently completed independent mineral resource estimate on the Central Zone at the Kwanika Cu-Au Project in north-central BC. The Measured and Indicated (M&I) Mineral Resource at the Central Zone is now estimated to contain 1.32 billion pounds of copper and 1.83 million ounces of gold in addition to a significant Inferred Resource at the grades and tonnes noted in Table 1 below. Importantly, the new resource estimate has identified coherent higher-grade domains within the open pit and underground M&I Mineral Resources that will be the target for PFS-stage mine planning currently underway and scheduled for completion in mid-2019. The Kwanika Project is controlled by Kwanika Copper Corporation (“KCC”), a private company jointly owned by SERENGETI RESOURCES Inc. (65%) and POSCO DAEWOO Corporation (35%).

|

|||||

Combined open pit and underground constrained Central Zone resource highlights include:

- Combined Measured and Indicated (M+I) Resource of 223.6 million tonnes grading 0.27% copper, 0.25 g/t gold and 0.87 g/t silver containing 1.32 billion pounds of copper, 1.83 million ounces of gold and 6.27 million ounces of silver as summarized in Table 1;

- A substantial increase in resource tonnes in all categories compared to the 2016 resource;

- An overall increase in contained metal from the 2016 Indicated Resource estimate, including increases of 44% for copper, 32% for gold, and 52% for silver in the M+I categories;

- Conversion of 42.9 million tonnes of Indicated Resources to Measured category, representing approximately 20% of the combined open pit and underground M+I Resource;

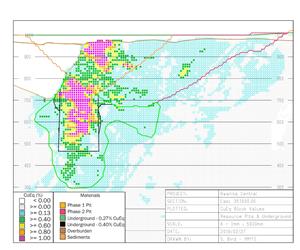

- Identification of higher-grade domains within both the open pit and underground resource (as shown in Figure 1) which will form the basis for PFS mine planning, as outlined in the sensitivity Table 2 below.

David Moore, Serengeti President and CEO stated: “We are very pleased with the new Kwanika Central Zone Mineral Resource. Not only has the overall contained metal inventory expanded significantly, but the current model is now based on more realistic open-pit and underground mining shapes that improve our overall confidence in the project. The new Mineral Resource also shows that at higher cut off grades for the open pit and at a higher-grade confining shell for underground mineral resources, higher-grade domains remain coherent, which suggests that we should be able to target these areas as the Kwanika mine plan is developed. We will be incorporating the new figures into the on-going PFS engineering work and anticipate the potential for an expanded Central Zone open pit and bulk underground mine life”.

Reasonable Prospects of Eventual Economic Extraction and Reporting Methods:

- Total Resources are reported within combined open pit and underground shapes to define “reasonable prospects of eventual economic extraction”.

- Open-pit constrained mineral resources are confined to a Lerchs-Grossman shell above the potential block cave and created using Net Smelter Prices (NSPs) and an NSR cut-off grade of CAD$11.30. The confining shape for the ultimate pit uses 120% of base case prices.

- Open pit planning for the PFS will consider mining a higher grade starter pit while underground development is in progress and will use a selective cutoff grade strategy to increase mill feed grades at the start of the project and stockpile lower grades to supplement underground production to ensure processing rates at mill capacity. Grade bin distribution for the open pit resource is provided in Table 2 below.

- Underground resources reported in Table 1 contain all material confined within a potentially minable shape defined by a 0.27% CuEq, or above and NSR of CAD$20.12. This total underground resource contains the material for the PFS study plus additional areas which are the exploration targets at depth, to the north and northwest of the current shape.

- Underground resources reported in Table 2 contain all material confined within a potentially mineable shape defined by the 0.40% CuEq (or NSR=CAD$29.80), which will be considered for the ongoing PFS study.

- The CuEq block grades and potentially mineable confining shapes described above are illustrated in the section below at 351500E (Figure 1).

| Table 1: Summary of Total Pit and Underground Resource - Kwanika Central (effective date: December 14, 2018) | |||||||||

| Pit-Constrained | |||||||||

| Classification | Quantity (Mt) | Cut-off (CuEq%) | Grade | Contained metal | |||||

| CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Cu (Mlbs) | Au (koz) | Ag (koz) | |||

| Measured | 24.2 | 0.13 | 0.51 | 0.34 | 0.33 | 1.07 | 179 | 254 | 833 |

| Indicated | 80.4 | 0.30 | 0.20 | 0.18 | 0.69 | 360 | 454 | 1,784 | |

| Total M+I | 104.6 | 0.35 | 0.23 | 0.21 | 0.78 | 540 | 708 | 2,617 | |

| Inferred | 5.7 | 0.23 | 0.16 | 0.13 | 0.65 | 20 | 25 | 119 | |

| Underground | |||||||||

| Classification | Quantity (Mt) | Confining Shape Basis (CuEq%) | Grade | Contained metal | |||||

| CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Cu (Mlbs) | Au (koz) | Ag (koz) | |||

| Measured | 18.7 | 0.27 confining shape - | 0.58 | 0.36 | 0.40 | 1.15 | 151 | 239 | 692 |

| Indicated | 100.2 | 0.44 | 0.29 | 0.27 | 0.92 | 634 | 884 | 2,964 | |

| Total M+I | 118.9 | 0.46 | 0.30 | 0.29 | 0.96 | 784 | 1,123 | 3,656 | |

| Inferred | 84.7 | 0.27 | 0.17 | 0.18 | 0.60 | 319 | 480 | 1,634 | |

| Combined Pit and Underground | |||||||||

| Classification | Quantity (Mt) | Cut-off (CuEq%) | Grade | Contained metal | |||||

| CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Cu (Mlbs) | Au (koz) | Ag (koz) | |||

| Measured | 42.9 | As applicable for pit and ug from above | 0.54 | 0.35 | 0.36 | 1.10 | 330 | 493 | 1,525 |

| Indicated | 180.6 | 0.38 | 0.25 | 0.23 | 0.82 | 994 | 1,338 | 4,748 | |

| Total M+I | 223.6 | 0.41 | 0.27 | 0.25 | 0.87 | 1,324 | 1,831 | 6,273 | |

| Inferred | 90.4 | 0.26 | 0.17 | 0.17 | 0.60 | 339 | 504 | 1,753 | |

| Table 2: Measured+Indicated Pit Resource Sensitivity and Underground Material within PFS Confining shapes | |||||||||

| Pit-Constrained Sensitivity Analysis at Various Cut-Off Grades | |||||||||

| Classification | Quantity (Mt) | Cut-off (CuEq%) | Grade | Contained Metal | |||||

| CuEq% | Cu % | Au (g/t) | Ag (g/t) | Cu (Mlbs) | Au (koz) | Ag (koz) | |||

| Total M+I | 104.6 | 0.13 | 0.35 | 0.23 | 0.21 | 0.78 | 540 | 708 | 2,617 |

| 63.2 | 0.25 | 0.45 | 0.30 | 0.27 | 0.89 | 424 | 546 | 1808 | |

| 24.4 | 0.40 | 0.67 | 0.45 | 0.41 | 1.26 | 244 | 318 | 991 | |

| Underground Sensitivity Analysis within 0.40% CuEq Confining Shape | |||||||||

| Total M+I | 64.0 | **0.4 confining shape | 0.62 | 0.39 | 0.43 | 1.23 | 550 | 884 | 2,520 |

Central Zone Resource Notes

- The cut-offs are based on prices of US$3.25/lb of copper, US$1,350/oz of gold, US$17/oz of silver and assumed recoveries of 91% for copper, 75% for gold, 75% for silver.

- Copper equivalents (CuEq) values are calculated using the formula below based on the above metal prices and recoveries. They are also calculated to include smelter terms and a $US:$CAD exchange rate of 0.77 which results in the following equation.

- CuEq = Cu% + ((Auoz*CAD$1620.77*75%) + (Agoz*CAD$18.79 *75%)) / (CAD$3.71*91%*22.0462)

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. All values are rounded to reflect the relative accuracy of the estimate.

The current Central Zone resource is based on 143 holes totaling 65,695 metres drilled at the Central Zone by Serengeti Resources since 2006 and incorporated drilling results from the 2018 program at Kwanika. Capping of assays for all metals has been done prior to compositing where applicable. Revised domains for copper and gold separately and updated grade trends reflect the presence of multiple mineralizing events and enrichment of gold and copper as overprinting events. The updated model results in a wider mineralized envelope extending deeper within the Central Zone compared to the 2016 resource estimate. A revised structural model created in 2018 provided a key input for the new resource model. Furthermore, the current resource is based on more reasonable underground and open pit confining shapes with the underground including all material within the shape (i.e. no cutoff has been applied) and the open pit allowing for reasonable cave heights. Final Cu, Au and Ag grades have been interpolated by Ordinary Kriging (OK). The model has been validated by comparison with volume-variance corrected nearest-neighbour (NN) grades to ensure no global bias and further validated with comparison to inverse-distance-cubed (ID3) interpolations for each metal to ensure consistency, precision and accuracy.

Serengeti also includes the 2016 South Zone resource (see table 3) which reported 33.3 million tonnes grading 0.26% copper and 0.08 g/t gold at 0.13% copper equivalent cut-off (Serengeti press release dated November 14th, 2016). The 2016 South Zone resource was based on 58 holes, totaling 17,958 meters drilled at the South Zone by Serengeti, between 2008-2010.

| Table 3: Restated 2016 Kwanika South Zone Mineral Resource Statement (SRK Consulting, October 14, 2016) | ||||||||||

| Pit-Constrained | ||||||||||

| Classification | Quantity (Mt) | Grade | Contained metal | |||||||

| CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) | Cu (Mlbs) | Au (koz) | Ag (koz) | Mo (Mlbs) | ||

| Inferred | 33.3 | 0.31 | 0.26 | 0.08 | 1.64 | 0.01 | 191 | 80 | 1,760 | 8 |

South Zone Resource Notes

*Open-pit constrained mineral resources are reported in relation to a conceptual Whittle pit shell. Mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

** Open-pit constrained mineral resources are reported at a copper equivalent cut-off of 0.13%. The cut-offs are based on prices of US$3.00/lb of copper, US$1,300/oz of gold, US$20/oz of silver, US$9.00/lb of molybdenum and assumed recoveries of 89% for copper, 70% for gold, 75% for silver, and 60% for molybdenum.

*** Copper equivalent values are calculated using the formula:

CuEq = Cu% + ((Augpt/31.1034*AuPrice*AuRecovery) + (Aggpt/31.1034*AgPrice*AgRecovery) + (Mo%*MoPrice*MoRecovery*22.0462)) / (CuPrice*CuRecovery*22.0462)

Independent Consultants

The current updated Central Zone resource estimate was completed by Moose Mountain Technical Services (MMTS) of Cranbrook, British Columbia under the direction of Sue Bird, P. Eng., an independent Qualified Person as defined by NI 43-101. Sue Bird, P. Eng. completed a site visit to the Kwanika property from July 13 – 16, 2018 and reviewed and advised the geological modeling input to the current study.

The South Zone resource estimate was completed in 2016 by SRK Consulting (Canada) Inc., of Vancouver, British Columbia under the direction of Marek Nowak P. Eng., an independent Qualified Person as defined by NI 43-101. Chad Yuhaz, P. Geo., also of SRK and also a QP, completed the site visit to the Kwanika property in 2016 and was involved with the geological modeling input for the 2016 South Zone resource estimate.

CIM (2014) definitions and guidelines were followed for the Mineral Resource estimation based on the parameters provided above. Mineral Resources do not have demonstrated economic viability and Measured Resources have a higher degree of confidence than do Indicated Resources, which have a higher degree of confidence than Inferred Resources. A technical report providing details of the estimate will be filed on SEDAR (www.sedar.com) within 45 days.

Readers are reminded that prior resource estimates published by Serengeti, and filed on SEDAR, are now superseded and should no longer be relied upon.

About Serengeti Resources Inc.

Serengeti is a mineral exploration company managed by an experienced team of professionals with a solid track record of exploration success. The Company is currently advancing its Kwanika copper-gold project in partnership with POSCO DAEWOO Corporation and exploring its extensive portfolio of properties in north-central British Columbia. A number of these other projects are available for option or joint venture and additional information can be found on the Company’s website at www.serengetiresources.com.

Quality Assurance/Quality Control

Sample analysis for the 2018 Kwanika drilling program was completed at Bureau Veritas Minerals Laboratory in Vancouver, BC, which is ISO 9001:2015 and 17025 accredited. A robust quality assurance/quality control program was completed by KCC which included inserting field blanks, standards and duplicates into the sample stream before being shipped to the laboratory. QAQC samples accounted for a minimum of 20% of the samples which were analyzed in addition to the laboratory’s own quality assurance program. Copper and silver analyses were determined by AQ 270 which is a combined ICP-ES/MS method following Aqua-Regia digestion and is capable of determining up to 100,000 ppm Cu and 1,000 ppm Ag; Au was determined by FA430, a lead collection, Fire Assay/AAS method using a 30-gram sub-sample and has an upper detection limit of 10 ppm Au. MMTS and SRK have concluded that the QAQC verifies the assay grades used in both the Kwanika Central and the Kwanika South models.

The field program was supervised by Serengeti Resources Inc. staff and the technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101, and reviewed by the Company’s qualified person, David W. Moore, P. Geo., President and CEO of Serengeti Resources Inc who has supervised the preparation of and approved the scientific and technical information in this news release.

ON BEHALF OF THE BOARD

David W. Moore, P. Geo.

President, CEO and Director

Cautionary Statement

This document contains “forward-looking statements” within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration plans and other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations as well as a comprehensive list of risk factors are disclosed in the Company’s documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates change, other than as required by law and readers are further advised not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Serengeti Resources Inc. Suite 520 – 800 West Pender St., Vancouver, BC, V6C 2V6

Tel: 604-605-1300 / Email: info@serengetiresources.com / Website: www.serengetiresources.com

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/3901d7c4-3612-4979-8108-131da1406c7f