Silver Spruce Signs Definitive Agreement to Acquire Interest in Diamante 1 and 2 Au-Ag Concessions, Sonora, Mexico

BEDFORD, NS / ACCESSWIRE / April 29, 2021 / Silver Spruce Resources, Inc. ("Silver Spruce" or the "Company") (TSXV:SSE) (FRA:S6Q1) is pleased to announce the signing of a Definitive Agreement ("DA"), effective April 27, 2021, on the Diamante 1 and Diamante 2 concessions. Silver Spruce recently secured a Letter of Intent with Colibri Resource Corp. (TSXV:CBI) ("Colibri"), and its wholly-owned Mexican subsidiary, Yaque Minerales SA de CV ("Yaque"), to acquire up to 50% interest in four concessions comprising 1,057 hectares (see Press Releases - April 12 and April 26, 2021).

"We expedited our due diligence, validated our high level of interest and now have signed the DA to acquire an interest in Diamante," said Greg Davison, Silver Spruce VP Exploration and Director. "With execution of the DA, Silver Spruce and our project partner, Yaque and Colibri, shall commence geological, spectral and LiDAR mapping, rock sampling and an environmental report for SEMARNAT approval and the permit necessary to engage the maiden 2,000 metre drilling program at Diamante."

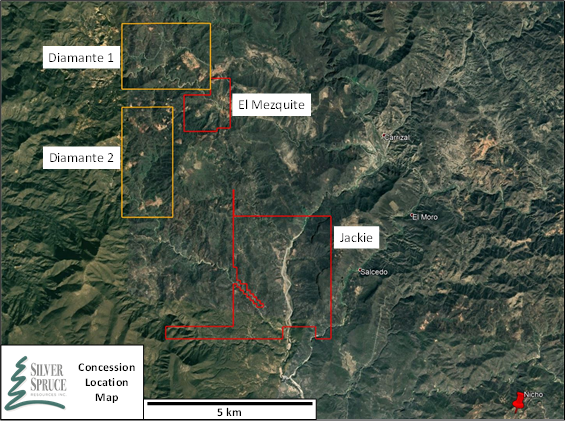

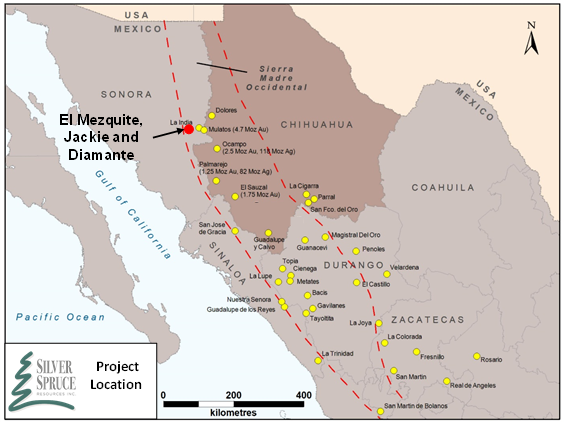

Figure 1. Diamante 1 and 2 Concession Location Map. Note adjacent El Mezquite and Jackie Concessions. Nicho mine development by Minera Alamos located 12 km SE of Diamante.

The Diamante gold-silver (Au-Ag) project ("Diamante" or the Property") is a drill-ready precious metal project located 5 km northwest of the town of Tepoca, and 165 km southeast of the capital city of Hermosillo, eastern Sonora, Mexico.

Diamante 1 is situated adjacent to the west boundary of Silver Spruce's 180-ha El Mezquite project. Diamante 2, 700 metres south of Diamante 1, is located 1.6 kilometres northwest of the Company's 1,130-ha Jackie project (Figure 1). The acquisition nearly doubles the Company's land holdings to 2,367 hectares.

Silver Spruce engaged a geological team to Diamante to verify the location of known mineralization, collect a photographic record of the geology, topography and vegetation, and carry out preliminary rock sampling.

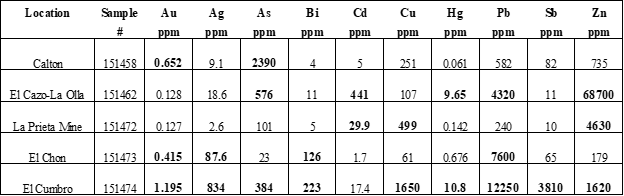

The assays of specific interest from rock samples collected at five of the targets (Calton, El Cumbro, El Cazo-La Olla, La Prieta and El Chon) are reported below in Table 1, and includes channel and grab samples from the artisanal workings.

Table 1. Selected precious metal, base metal and pathfinder element assays from due diligence samples

"The pathfinder elements associated with precious and base metals create an opportunity to evaluate geochemical zoning on a property scale prior to drilling, and the artisanal workings provides the Company with early targets for discovery," stated Greg Davison, Silver Spruce VP Exploration and Director.

Project Geology

Diamante covers ten known occurrences at La Prieta-El Aguaje, El Chon-El Pillado, La Olla, La Cruz and El Caso, Mezquite Raizudo, El Puerto, El Cumbro, Calton and the Southern Anomaly.

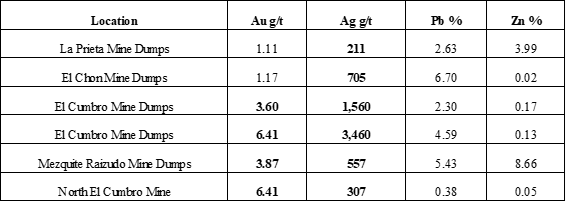

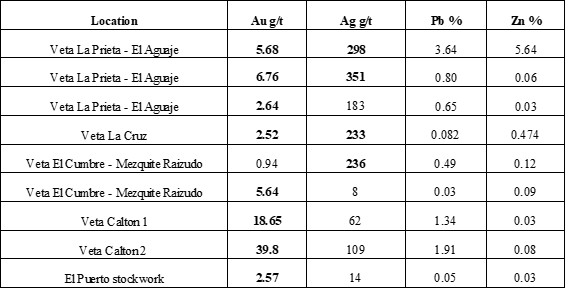

Historical exploration sampling on Diamante (Tables 2 and 3) has reported outstanding values of Au, Ag, Pb and Zn collected from mine dumps, slag, and vein and stockwork mineralization (see Press Release - April 12, 2021).

The Property exhibits geological features of epithermal low to intermediate sulphidation Ag-Au (Pb-Zn), high sulphidation Au-Cu, and potential transition to porphyry style Au-Cu. Polymetallic mineralization occurs as disseminated, stockwork and vein styles accompanied by silicification (with veining), and phyllic, argillic, advanced argillic and propylitic zones, with near-surface overprinting by weathering, iron oxide and oxyhydroxide staining, jarosite and vuggy silica.

Table 2. Selected precious metal, base metal and pathfinder element assays from mine dumps

Table 3. Selected precious metal, base metal and pathfinder element assays from veins and stockworks

Structural lineaments with ENE, NE and NW orientations identified in the historical exploration correspond to six known vein systems.

Mineralization is reported as pyrite, chalcopyrite and galena, and probable secondary base metal oxides, carbonates and sulphates, including copper carbonate (malachite) and copper sulphates.

Project Background

The Property is located within the west-central portion of the Sierra Madre Occidental Volcanic Complex within the prominent northwest-trending "Sonora Gold Belt" of northern Mexico and parallel to the well-known, precious metals-rich Mojave-Sonora Megashear (Figure 2).

The adjacent El Mezquite and Jackie projects are currently subject to option agreements with Colibri wherein SSE can earn 50% of the gold and silver projects by meeting certain criteria over four years and two years, respectively. El Mezquite and Jackie currently have assays pending from Phase 1 mapping and prospecting while the Company recently received our SEMARNAT approval for El Mezquite's maiden drilling program to begin next month.

Figure 2. Location Map of Diamante Property and Mines of the Sierra Madre Occidental

Terms of Agreement

Silver Spruce has completed the execution of the Definitive Agreement and upon acceptance by the TSX Venture Exchange (TSXV), to earn its initial 25% interest in the Property, the Company agrees to pay Colibri an initial cash amount of $75,000 USD directed to the Vendor's $100,000 USD initial property payment whereupon Silver Spruce and Yaque each will hold a 25% interest in the Property and manage the Property as equal partners ("Partners").

Silver Spruce will be the designated operator of the Property during the earn-in period with the Vendor. The Partners will direct the exploration program via a Project Oversight Committee.

To earn its initial 50% of the Diamante project, Silver Spruce and Yaque also agree to design, permit and drill a minimum of 2,000 metres on the Property within 24 months from the Execution Date of Yaque's final agreement with the Vendor; including any requisite exploration leading to the drill program, submit a final drilling report to meet NI 43-101 reporting guidelines and pay approved exploration costs at a ratio of Silver Spruce (75%) and Yaque (25%).

The Partners will pay to the Vendor 50% of the bi-annual property taxes and surface rights payments.

Upon completion of the initial earn-in, Silver Spruce and Yaque will become equal joint venture partners with the Vendor in BIMCOL, a private Mexico company holding the concessions, pay to the Vendor 50% of the bi-annual property taxes and surface rights payments and pay approved prorata exploration costs at a ratio of Silver Spruce (50%) and Yaque (50%).

Yaque will have an exclusive period of six months to purchase the remaining 50% of BIMCOL by paying the Vendor either of: i) US$2.1 million or ii) US$1.45 million and the grant of a 2% net smelter royalty (NSR) on the project.

Should Yaque elect to exercise its right to purchase the remaining 50% of BIMCOL, Yaque will also grant Silver Spruce the option to purchase one-half of its additional ownership for one-half of the cost for a period not to exceed six (6) months from the date Yaque elects to exercise its right and Yaque will provide three (3) months notice to Silver Spruce for the purchase due date within the first three (3) months of the option period.

Geochemical Analysis, Quality Assurance and Quality Control

Due diligence samples were delivered to the ALS sample preparation facility in Hermosillo, Sonora, Mexico. ALS Global in North Vancouver, British Columbia, Canada, is a facility certified as ISO 9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards Council of Canada. Analytical protocols are described previously (see Press Release - April 12 and April 26, 2021).

Given the small number of samples collected, in-house quality control samples (blanks, standards, preparation duplicates) were not inserted into the due diligence sample set. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results were provided with the Company sample certificates. The results of the ALS control samples were reviewed by the Company's QP and evaluated for acceptable tolerances. All sample and pulp rejects will be stored at ALS Global pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, as requisite.

All of the metal values disclosed herein by past operators and Silver Spruce are reported from grab and channel samples which may not be representative of the metal grades, and those from previous exploration efforts must be considered as historical in nature. The Company has reviewed the certificates and believes the analytical protocols and data will withstand scrutiny for inclusion.

Qualified Person

Greg Davison, PGeo, Silver Spruce VP Exploration and Director, is the Company's internal Qualified Person for the Diamante Project and is responsible for approval of the technical content of this press release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"), under TSX guidelines.

About Silver Spruce Resources Inc.

Silver Spruce Resources Inc. is a Canadian junior exploration company which has signed Definitive Agreements to acquire 100% of the Melchett Lake Zn-Au-Ag project in northern Ontario, and with Colibri Resource Corp. in Sonora, Mexico, to acquire 50% interest in Yaque Minerales S.A de C.V. holding the El Mezquite Au project, a drill-ready precious metal project, and up to 50% interest in each of Colibri's early stage Jackie Au and Diamante Au-Ag projects, with the three properties located from 5 kilometres to 15 kilometres northwest from Minera Alamos's Nicho deposit, respectively. The Company also is pursuing exploration of the drill-ready and fully permitted Pino de Plata Ag project, located 15 kilometres west of Coeur Mining's Palmarejo Mine, in western Chihuahua, Mexico. Silver Spruce Resources Inc. continues to investigate opportunities that Management has identified or that have been presented to the Company for consideration.

Contact:

Silver Spruce Resources Inc.

Greg Davison, PGeo, Vice-President Exploration and Director

(250) 521-0444

gdavison@silverspruceresources.com

Michael Kinley, CEO

(902) 826-1579

mkinley@silverspruceresources.com

info@silverspruceresources.com www.silverspruceresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements

This news release contains "forward-looking statements," Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future, including but not limited to, statements regarding the private placement.

Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with mineral exploration and difficulties associated with obtaining financing on acceptable terms. We are not in control of metals prices and these could vary to make development uneconomic. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that the beliefs, plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that such beliefs, plans, expectations or intentions will prove to be accurate.

SOURCE: Silver Spruce Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/643256/Silver-Spruce-Signs-Definitive-Agreement-to-Acquire-Interest-in-Diamante-1-and-2-Au-Ag-Concessions-Sonora-Mexico