SRG Announces Positive Economic Results of Updated Feasibility Study for Lola Graphite Project

(TheNewswire)

| |||||||||

|  | ||||||||

-

SRG Announces Positive Economic Results of Updated Feasibility Study for Lola Graphite Project

-

Annual Production Doubled to 94,000 tpa Graphite in Concentrate

-

Modest Increase in Capital Costs of US$185 Million Compares Favourably to Industry Average Capital Intensity

-

After-Tax NPV8% of US$218 Million and IRR of 25% over 17 years

-

Financing, Offtake and Strategic Partnership Discussions Progressing

PRESS RELEASE FOR IMMEDIATE RELEASE

Montreal, QC - February 27, 2023 - SRG Mining Inc. (TSXV:SRG) (“SRG” or the “Company”) today welcomes the positive results of an independent Updated Feasibility Study (“UFS”) for the high-quality Lola Graphite Project in the Republic of Guinea. The Lola Graphite Project 2023 UFS evaluates a doubling in annual production capacity from the previous 2019 Lola Graphite Project Feasibility Study to an average of 94,000 tonnes of graphite flakes in concentrate per annum (“ktpa”) over its 17-year life of mine. The UFS was prepared by DRA Global Limited (“DRA”).

Highlights of the Updated Feasibility Study for the Lola Graphite Project include:

-

After-tax net present value (“NPV”) at a real 8% discount rate of US$218 million.

-

After-tax internal rate of return (IRR) of 25%.

-

After-tax project payback period of 3.2 years.

-

Pre-production capital costs, including contingency, estimated at US$185 million compare favourably to industry standards.

-

Life-of-mine average cash operating costs of US$585 per tonne of concentrate.

-

Life-of-mine average concentrate production doubled to 94ktpa, with an average concentrate grade of 95.4% graphite.

The UFS was prepared in compliance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101).

The UFS is the first phase of the Company’s integrated business model aimed at the creation of a mine-to-market active anode material producer, hosting a large high-purity graphite production mine and concentrator in Africa and a value-added, coated spherical purified graphite (“CSPG”) conversion facility in Europe, North America, Middle East or Africa. The Company anticipates publishing the fully integrated business model in Q2 2023 upon completion of the independent preliminary economic assessment (“PEA”). Dorfner Anzaplan GmbH, a leading consultancy and engineering company for industrial, specialty mineral and metal projects, based in Hirschau, Germany, is in final phases of completing the PEA.

The UFS focuses on an open pit mine which targets the oxide and fresh rock reserves of the Lola Graphite Project, which have an estimated 6.4 Mt of Proven Reserves grading 4.38% Cg and 34.5 Mt of Probable Reserves grading 4.09% Cg. The processing plant will consist of a conventional crusher, concentrator, floatation, dewatering and screening circuit. The Company anticipates exporting the final product by road through the port of Monrovia in the Republic of Liberia.

“The Updated Feasibility Study is the latest validation that Lola Graphite Project has the resources to become one of the world’s largest graphite producers at attractive capital and operating costs,” said Mr. Matthieu Bos, President and Chief Executive Officer of SRG. “Discussions are continuing with potential strategic partners and lenders to support our advance towards the development of the first graphite mine in the Republic in Guinea.”

“These results are the culmination of many months of studies to de-risk the project and add to its robustness using reasonable estimates and assumptions,” Mr Patrick Moryoussef, Chief Operating Officer of SRG added. “The cost estimates of the project reflect Q4 2022 market prices of equipment and raw materials which are likely at the peak of the current inflationary cycle. Basic engineering will focus on improvements in the front-end of the plant, tailings management, connection to the national electricity grid and reducing the mining footprint.”

Economic Sensitivities

Over the life of the mine, the Lola Graphite Project is expected to produce an average of 94 ktpa of saleable graphite flakes in concentrate. At an average sale price of US$1,400 per tonne, this represents US$131M annual revenue incurring average operating costs of US$585/t representing US$54M operating cash flow annually. Given the volatility of graphite prices in recent years and the bilateral nature of the sales contracts, a sensitivity analysis of the project’s economics is presented below.

Table 1: Updated Feasibility Study Sensitivity Analysis

|

LoM Average Sales Price (US$/t) |

$1,120 |

$1,260 |

$1,400(1) |

$1,540 |

$1,681 |

|

Post-Tax Results |

|||||

|

Avg. Revenue (US$M p.a.)(2) |

$105 |

$118 |

$131 |

$144 |

$157 |

|

Avg. Operational Cash Flow (US$M p.a.)(2) |

$36 |

$45 |

$53 |

$62 |

$71 |

|

NPV8% (US$M) |

$78 |

$148 |

$218 |

$287 |

$357 |

|

IRR (%) |

15% |

20% |

25% |

29% |

33% |

|

Payback (Years) |

4.8 |

3.7 |

3.2 |

2.8 |

2.5 |

-

Base Case, based on consensus pricing

-

Excluding Year 1 and 17 which don’t represent steady-state production

Mineral Resource and Reserve Update

The resource estimate was established using data from boreholes drilled and sampled up to December 1, 2018. The total resource estimate of the Lola Project includes Measured and Indicated Resources of 54.0 Mt grading 3.98% Cg, and Inferred Resources of 12.3 Mt grading 3.6% Cg. The resource estimate has been prepared using a cut-off grade of 1.0% Cg for oxides and 1.4% Cg for fresh rock.

Table 2: Lola Graphite Project Resource Statement

|

Category |

Tonnage (Mt) |

Grade (% Cg) |

Contained Cg (kt) |

|

Oxide |

7.78 |

4.04 |

314.6 |

|

Fresh Rock |

0.47 |

4.01 |

19.0 |

|

Measured Resources |

8.26 |

4.04 |

333.6 |

|

Oxide |

25.40 |

3.83 |

972.6 |

|

Fresh Rock |

20.29 |

4.14 |

839.3 |

|

Indicated Resources |

45.70 |

3.97 |

1,812.0 |

|

Total M&I Resources |

53.96 |

3.98 |

2,145.6 |

|

Oxide |

10.97 |

3.52 |

386.4 |

|

Fresh Rock |

1.33 |

4.23 |

56.1 |

|

Inferred Resources |

12.30 |

3.60 |

442.5 |

|

Notes:

|

|||

The Lola Graphite Project is characterised by its oxide surface mineralization, which continues along strike and at depth into the fresh rock bed. For the UFS, mining operations considered the mineralized material contained in the oxide weathered lateritic and saprolitic zones, as well as the mineralized material contained in the fresh rock formation. The total reserve estimate includes Proven and Probable Mineral Reserves of approximately 40.9 Mt grading 4.14% Cg. To access these Mineral Reserves, 35.9 Mt of overburden and waste rock must be mined, resulting in a low life-of-mine strip ratio of 0.88:1.

Table 3: Lola Graphite Project Reserve Statement

|

Category |

Tonnage (Mt) |

Grade (% Cg) |

Contained Cg (kt) |

|

Oxide |

6.15 |

4.38 |

269.5 |

|

Fresh Rock |

0.28 |

4.34 |

12.2 |

|

Proven Reserves |

6.43 |

4.38 |

281.8 |

|

Oxide |

20.38 |

4.10 |

835.5 |

|

Fresh Rock |

14.12 |

4.08 |

576.2 |

|

Probable Reserves |

34.50 |

4.09 |

1,411.1 |

|

Total Reserves |

40.93 |

4.14 |

1,694.7 |

|

Notes:

|

|||

Mining and Processing

The Company anticipates using a contract-mining operation to mine approximately 2.6Mtpa of ore and 2.3Mtpa of waste in a conventional drill-and-blast mining operation. The resulting average head-grade to the processing facility is 4.14% Cg.

The mineral processing plant consists of a crushing area and a concentrator where material beneficiation and concentrate dewatering, screening, and packaging takes place. The process flowsheet includes crushing, grinding, rougher flotation, polishing, and cleaner flotation. The back end of the concentrator includes tailings thickening, concentrate filtration and drying, dry screening and bagging of graphite products, and material handling. All the tailings from the concentrator will be thickened and pumped to the lined tailings ponds. Reclaiming water from the tailings ponds has been considered in the process design to minimize freshwater makeup to the concentrator.

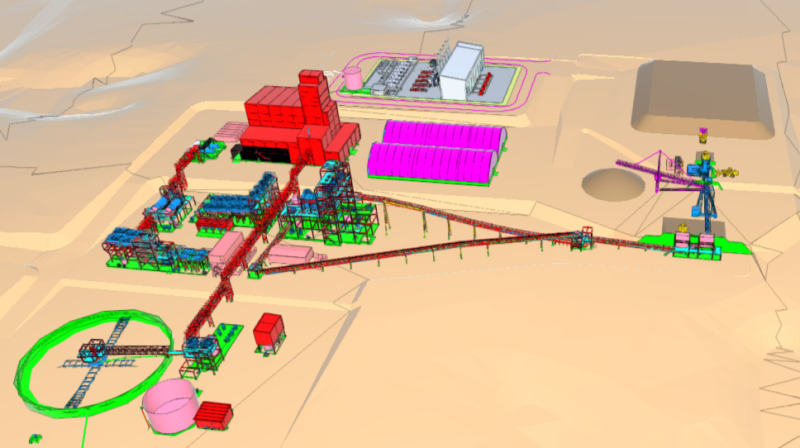

Figure 1: Processing Plant Lay-Out

The graphite concentrate will be recovered by a conventional flotation process at an overall recovery over the life of mine of 83.6%. Saprolite ore beneficiation process has an overall graphite recovery of 73.1%, producing a graphite concentrate grade of 95.4 % Cg. The addition of up to 45% of fresh rock in the feed blend improves the average graphite recovery over the life of mine to 83.6%. Over the life of the mine, the processing plant is expected to produce graphite concentrate divided into four standard-size fractions: +48 mesh, -48+80 mesh, -80+100 mesh and -100 mesh.

Table 4: Life-of-Mine Size Fraction Distribution

|

Size Fraction (Mesh) |

Life-of-Mine Distribution |

Concentrate Grade (% Cg) |

|

+48 |

13.4% |

97.0% |

|

-48 to +80 |

26% |

96.0% |

|

-80 to +100 |

9% |

94.5% |

|

-100 |

51.6% |

94.9% |

|

Total |

100% |

95.4% |

Note: Based on oxide Reserves. Numbers may not add due to rounding (Year 17 not included)

The Company expects a 14-month construction period followed by a 3-month commissioning phase and a 3-month ramp-up phase to reach steady state production.

Table 5: Summary Technical Assumptions

|

Life-of-Mine Average |

||

|

Strip Ratio |

(ratio) |

0.88 |

|

Total Ore Milled |

(Mtpa) |

2.6 |

|

Head Grade |

(% Cg) |

4.14 |

|

Metallurgical Recovery |

(%) |

83.6 |

|

Concentrate Production |

(ktpa) |

94 |

|

Construction Period |

(months) |

14 |

|

Commissioning & Ramp-Up |

(months) |

3 + 3 |

Note: 2. Excluding Year 1 and 17 which don’t represent steady-state production

Capital and Operating Costs

The projected capital and operating costs for the project are presented below in Table 6 and 7 and have an accuracy of +/-15%. The costs include the Company’s contract mining operations, an owner operated processing facility using its own power generators (5 generators for a total installed capacity of 13 MW) as well as a logistics operation to the port of Monrovia. There is further scope to reduce these costs as the Company explores the viability of third-party contractors working in close collaboration with the Company on certain elements of the operating cost. A key focus area for the Company will be to investigate to possibility to connect the Lola Graphite Project to the national electricity grid, which would yield significant savings on the pre-production capital costs. The average annual sustaining capital expenditure over a 17-year period is US$6M.

Table 6: Pre-production Capital Costs

|

Category |

US$M |

|

Mining |

$8M |

|

Process Plant |

$62M |

|

Tailings & Water Management |

$4M |

|

Site Infrastructure |

$11M |

|

Power Plant & Distribution |

$36M |

|

Preliminary & General |

$16M |

|

Total Direct Costs |

$136M |

|

Indirect |

$25M |

|

Owners |

$6M |

|

Contingency |

$17M |

|

Total Costs |

$185M |

Note: Numbers may not add due to rounding

Table 7: Operating Costs

|

Category |

US$ / tonne concentrate |

|

Mining(1) |

$171 |

|

Process |

$323 |

|

Site General & Administrative |

$51 |

|

Concentrate Transport to Port |

$40 |

|

Total Direct Costs (FOB Monrovia) |

$585 |

|

Sustaining Capital Costs |

$63 |

|

All-In Sustaining Costs |

$648 |

1. Contract mining

Note: Numbers may not add due to rounding

Financing, Offtake and Strategic Partnership Discussions Progressing

The Company is advancing discussions with multiple parties who have expressed interest in providing financing to advance SRG towards first production. The Company is very encouraged by the level of interest it has received from several high-quality investors to provide both debt and equity financing to fund the construction of the first phase of the Lola Graphite Project. In addition to the existing offtake agreements, several Western and Asian parties have also expressed interest in a significant and long-term offtake agreement for the Lola Graphite Project concentrate production. The Company has made available, large one-tonne samples from its bulk sample pilot plant to prospective offtakers to complete the necessary quality assessments ahead of progressing the discussions on commercial terms. As the Company is developing its downstream beneficiation strategy several parties have expressed interest in joining forces with SRG to become a Tier One supplier to the Western end markets.

SRG will provide further comment only if a specific transaction or process is concluded, or if further disclosure is required or deemed appropriate. There can be no assurance that the Company will pursue any transaction or that a transaction, if pursued, will be completed.

Quality Assurance and Control

For readers to fully understand the information in this press release, they should read the Technical Report in its entirety when it is available on SEDAR, including all qualifications, assumptions, and exclusions that relate to the information to be set out in the Technical Report, which qualifies the technical information contained in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical information contained in this news release has been reviewed and approved by DRA QPs listed below and Marc-Antoine Audet, Ph.D. P. Geo, Geological Consultant, all Qualified Persons as defined by NI 43-101.

The complete NI 43-101 Technical Report pertaining to the UFS will be filed within 45 days and will be available on SRG's website and on www.sedar.com.

The QPs who will prepare the Technical Report are:

-

Mineral Resources: Dr. Marc-Antoine Audet, Ph.D. Geology, P.Geo.

-

Mineral Reserves and Mining: DRA Global Limited, Ghislain Prevost, P.Eng. M.A.Sc.

-

Mineral Processing: DRA Global Limited, Volodymyr Liskovych, P. Eng., PhD.

-

Capital Cost Estimation: DRA Global Limited, Alex Duggan, M.Sc, P.Eng.

-

Hydrogeology: DRA Global Limited Schadrac Ibrango, P.Geo., PhD.

-

All Other Sections: DRA Global Limited, Elie Accad, P.Eng., MBA

By virtue of education and relevant experience, the aforementioned are independent “Qualified Persons” for the purpose of NI 43 – 101, except for Dr. Marc-Antoine Audet, Ph.D., who was previously a Director of the Company.

About DRA Global

DRA Global Limited (ASX: DRA | JSE: DRA) is a diversified global engineering, project delivery and operations management group, headquartered in Perth, Australia. It has more than 4,500 professionals and a proven track record in undertaking independent assessments of Mineral Resources and Mineral Reserves, project evaluations and audits, technical reports and independent evaluations on behalf of exploration and mining companies, and financial institutions worldwide

About SRG Mining

SRG Mining is a Canadian-based mining company focused on developing the Lola Graphite Project located in the Republic of Guinea, West Africa. The Lola Graphite Project has Proven and Probable Reserves of 41Mt at a grade of 4.14% Cg. SRG aims to develop a fully integrated source of battery anode material to supply the European lithium-ion and fuel cell markets. With attractive operating costs, proximity to European end-markets and strong ESG credentials, the Company is poised to become a reliable supplier while promoting sustainability and supply chain transparency. SRG is committed to generating sustainable, long-term benefits that are shared with the host countries and communities where it operates.

For additional information, please visit SRG’s website at www.srgmining.com.

Contact :

Matthieu Bos Matt Johnston

President & CEO Corporate Development Advisor

Email: m.bos@srgmining.com Email: m.johnston@srgmining.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains "forward-looking information" within the meaning of Canadian securities legislation. All information contained herein that is not clearly historical in nature may constitute forward-looking information. Generally, such forward-looking information can be identified by the use of forward-looking terminology such as “double”, “highlight”, “favourable”, “include”, “aimed”, anticipates”, “estimate”, “will”, “become”, “assume”, “expect”, “continue”, “result”, “project”, “advance”, “progress”, “result”, “confirm”, “increase”, “potential”, “demonstrate”, “deliver”, “believe”, or variations of such words and phrases or state that certain actions, events or results "may", "could", "would" or "might". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: (i) volatile stock price; (ii) the general global markets and economic conditions; (iii) the possibility of write-downs and impairments; (iv) the risk associated with exploration, development and operations of mineral deposits and mine plans for the Company’s mining operations; (v) the risk associated with establishing title to mineral properties and assets including permitting, development, operations and production from the Company’s operations being consistent with expectations and projections; (vi) fluctuations in commodity prices, finding offtake takers and potential clients or enforcing such agreements against same, (vii) prices for diesel, process reagents, fuel oil, electricity and other key supplies being approximately consistent with current levels; (viii) production and cost of sales forecasts meeting expectations; (ix) the accuracy of the mineral reserve and mineral resource estimates of the Company; (x) labour and materials costs increasing on a basis consistent with the Company's current expectations; (xi) there being no significant disruptions affecting the operations of the Company whether due to COVID-19 restrictions, the war in Ukraine, artisanal miners, access to water, extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; and (xi) asset impairment (or reversal) potential, being consistent with the Company's current expectations. and other risks and factors described or referred to in the section entitled "Risk Factors" in the MD&A of the Company and which is available at www.sedar.com, all of which should be reviewed in conjunction with the information found in this news release.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Such forward-looking information has been provided for the purpose of assisting investors in understanding the Company's business, operations and exploration plans and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is given as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws.

Copyright (c) 2023 TheNewswire - All rights reserved.