Stellar AfricaGold Increases Private Placement to $1,750,000 and Closes Final Tranche

(TheNewswire)

Vancouver – TheNewswire - March 22, 2021 - John Cumming, President and CEO of Stellar AfricaGold Inc., (TSXV:SPX) ("Stellar" or the "Company") is pleased to announce that Stellar has increased its non-brokered private placement to $1,750,000 and closed on the final tranche.

Private Placement

The private placement financing is comprised of 29,166,667 units at $0.06 per unit for gross proceeds of C$1,750,000. Each unit is comprised of one common share and one share purchase warrant exercisable at $0.15 for 24 months. The net proceeds of the private placement will be used to advance exploration on the Company’s Tichka Est gold property in Morocco and on its Prikro gold property in Côte d’Ivoire, and for general corporate purposes including potential new property acquisitions in Morocco, Mali and Côte d’Ivoire.

Tranche I of the private placement closed on February 26, 2021 with Stellar issuing 11,391,667 units for gross proceeds of $683,500. The Units issued pursuant to Tranche I are subject to an investment hold period until June 26, 2021. The share purchase warrants issued pursuant to Tranche I may be exercised until February 26, 2023.

Tranche 2 of the private placement closed on March 19, 2021 with Stellar issuing 17,775,000 units for gross proceeds of $1,066,500. The Units issued pursuant to Tranche 2 are subject to an investment hold period until July 20, 2021. The share purchase warrants issued pursuant to Tranche 2 may be exercised until March 16, 2023.

Finder’s fees will be paid to ten arm’s length parties in respect of this private placement as follows: $46,267 cash, 1,356,999 shares and 2,178,108 warrants. The shares and warrants issued to finders are subject to an investment hold period until July 20, 2021. The share purchase warrants issued to finders are exercisable at $0.15 per share until March 16, 2023.

One Director of the Company subscribed for a total of 400,000 units of the private placement. Participation of the Director of Stellar in the private placement is considered a “related party transaction” as defined under Multilateral Instrument 61-101 (“MI 61-101”). The transactions are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the securities to be distributed in the private placement nor the consideration to be received for those securities, in so far as the private placement involves the Insiders, exceeds 25% of the Company’s market capitalization.

Options

The Company also announces that it has granted 4,000,000 incentive stock option to directors, officers and consultants. The options are exercisable for up to five years until March 22, 2026 and will entitle the holder to acquire on common share of the Company at $0.07 per share.

Tichka Est Project, Morocco

The Tichka Est property is comprised of three contiguous prospecting permits covering an area of 44.6 km2. It is located in the Atlas Mountain about 160 km SSW of the city of Marrakech. The area is accessible year-round via a national road to the village of Analghi located near the mineralized gold zone.

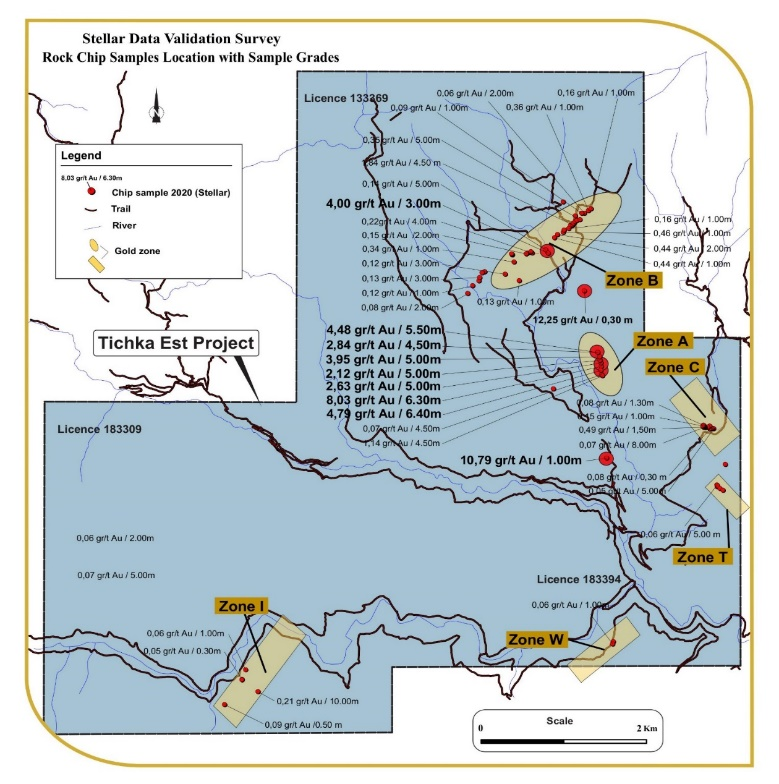

On August 19, 2020, Stellar AfricaGold Inc. announced the signature of the final agreement for the acquisition of 90% interest in the Tichka Est Gold Project where anomalous gold concentrations were first discovered during a 2009 regional stream sediments sampling program conducted by Office National des Hydrocarbures et des Mines of Morocco (“ONHYM”). Follow-up geological prospecting and trench sampling indicated that gold mineralization developed along a regional shear zone with high grade samples over significant width including 8.03 g/t Au over 6.30 m and 5.14 g/t Au over 4.9 m.

An independent summary compilation report* (see news release January 5, 2020) commissioned by Stellar reviewed available historical data and the results of a June 2020 due diligence validation program completed by Stellar identified 6 anomalous gold zones with two zone, Zones A and B, warranting priority attention. The Zone A and Zone B prospects are host to multiple high-grade gold intercepts with grades (chip samples in trenches) above 2.0 g/t Au, across widths exceeding 2.0 m and extending along strike for a minimum of 300 meters. Although the property remains at an early stage of development, these two prospects have, individually, the potential to develop a significant gold resource base if mineralization extends vertically and laterally with similar characteristics. A 3-phase exploration program totaling US$ 2,080.000 was recommended.

The Zone A prospect was outlined by a cluster of 85 anomalous gold-in-stream sediment samples over an area of 27.15km2 with assay values ranging from 21 ppb to 17.06 g/t Au. It was prospected with 9 trenches distributed at regular intervals along a strike length of 400 m.

The gold mineralization was found along a steeply dipping ENE-WSW striking regional shear zone that was traced on surface for about 400 m along strike. The shear zone is injected with narrow quartz veins (0.4 to 1.2 m wide) and swarms of veinlets running near and parallel to the intrusive contact with a micro-granitic porphyry dyke. They are, strongly brecciated and mineralized with disseminated and locally semi-massive pockets of pyrite and arseno-pyrite. In outcrops, the sulfide minerals are strongly altered to hematite, goethite, limonite and other alteration products.

The Zone B gold prospect is located about 3.0 km north of the village of Analghi. It was outlined by 27 anomalous stream sediment samples with grades ranging from 33 ppb to 22.33 g/t Au over an area of 6.38 km2. The area was prospected and 10 trenches excavated across the structure over a strike length of 300 m. The trenches exposed a wide brecciated fault zone running ENE-WSW in a highly deformed, altered and fractured sedimentary sequence. Anomalous grades of 0.1 to 4.0 g/t Au over 1.0 m are reported. Within the brecciated sections of the shear zone, the best gold assays are in gossans.

Summary Map of Stellar Validation Survey

Prikro Permit, Côte d’Ivoire

The Prikro permit comprises a 369.5 km2 exploration licence located in the Prikro and Koun-Fao Departments in eastern Côte d’Ivoire, approximately 240 km northeast of Abidjan. Originally, the licence was selected due to the presence of historical reported gold occurrences, prospective geology, and the existence of artisanal workings in the surrounding areas including along strike of a major NE-SW trending shear zone which is interpreted to traverse the licence area across its southern half. Birimian-age greenstone rocks reportedly crop out extensively across the Prikro licence which are the dominant host setting for gold deposits across West Africa.

ABOUT STELLAR AFRICAGOLD INC.

*The Report titled “Preliminary Technical Evaluation Report of the Gold Potential of the Tichka Est Gold Project, High Atlas Mountains Region, Kingdom of Morocco” by Benoit M. Violette, P.Geo., is effective November 15, 2020. Mr. Violette is an independent consulting geologist to Stellar.

Stellar AfricaGold Inc. is a Canadian gold company with offices in Vancouver, BC and Montreal, QC. Stellar President John Cumming can be contacted at 604-618-4262 or by email at cumming@stellarafricagold.com.

The technical content of this press release has been reviewed and approved by Yassine Belkabir, MScDIC, CEng, MIMMM, a Stellar director and a Qualified Person as defined in NI 43-101.

On Behalf of the Board

John Cumming, LLM,

President & CEO

This release contains certain "forward-looking information" under applicable Canadian securities laws concerning the Arrangement. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases forward-looking information can be identified by terminology such as "may", "will", "should", "expect", "intend", "plan", "anticipate", "believe", "estimate", "projects", "potential", "scheduled", "forecast", "budget" or the negative of those terms or other comparable terminology. Assumptions upon which such forward-looking information is based includes, among others, that the conditions to closing of the Arrangement will be satisfied and that the Arrangement will be completed on the terms set out in the definitive agreement. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: that the remaining conditions to the Arrangement will not be satisfied; that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2021 TheNewswire - All rights reserved.