Stornoway Reports First Quarter 2019 Production and Sales Results

LONGUEUIL, Québec, April 09, 2019 (GLOBE NEWSWIRE) -- Stornoway Diamond Corporation (TSX-SWY; the “Corporation” or “Stornoway”) announces production and sales results at the Renard Diamond Mine for the quarter ended March 31, 2019. Highlights are as follows:

|

|||||

(All quoted figures in CAD$ unless otherwise noted)

- 429,506 total carats sold in two tender sales for gross proceeds1 of $47 million2 at an average price of US$83 per carat ($110 per carat2). In terms of total carats sold, pricing and gross proceeds, this represents increases of 38%, 8% and 47% over the fourth quarter of 2018, respectively. First quarter diamond sales represent diamonds recovered during the fourth quarter of 2018.

- First quarter diamond production was 444,562 carats recovered from the processing of 582,613 tonnes of ore at an average grade of 76 cpht. Carats recoveries decreased by 8% compared to the fourth quarter of 2018, principally due to mechanical issues at the front end of the process plant related to very cold weather in January and February. In March, the process plant surpassed its budgeted daily rate with an average of 7,209 tonnes processed per day.

- Stornoway has made the decision to suspend open pit mining operations starting in April, as the current stockpile of Renard 65 open pit ore is sufficient to meet planned process plant feed requirements into the second quarter of 2020.

Patrick Godin, President and CEO of Stornoway, commented “Sales in the first quarter were significantly higher than the previous quarter on the good production results of the last three months of 2018, which was the first full quarter with fully ramped-up underground operations. The average pricing obtained increased as well, primarily due to improvements in the quality of the goods and the mix sold. The rough diamond market, however, did not show notable improvement from the fourth quarter. Processing results were down sequentially on mechanical issues at the plant experienced in January and February, but March showed modest outperformance versus budgeted daily rate, and we are confident that this rate can be maintained looking forward and believe that the small underperformance relative to budget in the first two months will be caught up over the balance of 2019. We have taken the decision to temporarily halt production from the Renard 65 open pit, as current Renard 65 ore stockpiles are sufficient to maintain its planned contribution to the process plant’s feed into the second quarter of 2020. As such, no effect on revenue in 2019 is to be expected. Surface equipment operators were trained and have begun transitioning to our underground operations.”

FIRST QUARTER SALES RESULTS

Two tender sales were completed during the first quarter from diamonds that were recovered between October 6 and December 27, 2018. Table 1 summarizes first quarter sales results, and compares these results to those of the first and fourth quarters of 2018. Table 2 provides a breakdown between run-of-mine and supplemental diamonds sold.

| 3 months ended March 31, 2019 | 3 months ended December 31, 2018 | 3 months ended March 31, 2018 | |

| Number of tender sales | 2 | 2 | 3 |

| Total Carats Sold (ct) | 429,506 | 312,242 | 441,798 |

| Total Gross Proceeds1 ($M) | 47 | 32 | 58 |

| Total Average Price per Carat ($/ct) | 110 | 103 | 130 |

| Total Average Price per Carat (US$/ct) | 83 | 77 | 103 |

| Average Exchange Rate ($ : US$) | 1.33 | 1.33 | 1.27 |

Table 1. Summary of first quarter sales results3.

| 3 months ended March 31, 2019 | 3 months ended December 31, 2018 | 3 months ended March 31, 2018 | |

| Run-of-mine Carats Sold (ct) | 361,404 | 253,929 | 399,135 |

| Run-of-mine Average Price per Carat ($/ct) | 127 | 122 | 142 |

| Run-of-mine Average Price per Carat (US$/ct) | 95 | 92 | 112 |

| Supplemental Carats Sold (ct) | 68,102 | 58,313 | 42,663 |

| Supplemental Achieved Price ($/ct) | 20 | 19 | 24 |

| Supplemental Achieved Price ($US/ct) | 15 | 14 | 19 |

Table 2. Summary of first quarter sales results, broken down between run-of-mine4 and supplemental carats.

The achieved pricing of US$83 per carat for all goods sold during the quarter represents an increase of 8% compared to the fourth quarter of 2018, attributed to the quality of goods and mix sold. The sales for the first quarter continue to reflect a challenging rough diamond market. While the pricing of higher quality goods and specials continues to remain strong, smaller and lower quality goods have remained stable at the lower prices experienced in the fourth quarter of 2018.

FIRST QUARTER PRODUCTION RESULTS

First quarter production was 444,562 carats recovered from the processing of 582,613 tonnes of ore at an attributable grade of 76 cpht. Tonnes processed, grade and carats recoveries decreased by 4%, 5% and 8% respectively compared to the fourth quarter of 2018 as a results of lower plant availability. Tonnes processed, grade and carats recovered increased by 4%, 50% and 55% year over year, due to an improved mix of ore sent to the process plant.

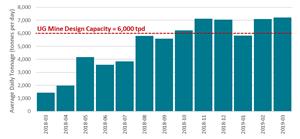

During the quarter, mill feed was derived from the Renard 2 underground mine (89%), the Renard 65 open pit (6%), and Renard 3 underground development (5%). Processing rates in January (5,520 tonnes per day) and February (6,715 tonnes per day) were lower than budgeted due to mechanical issues reducing plant availability. Most of these issues were at the front end of the process plant and related to the very cold weather experienced on site at the beginning of the year. In March (7,209 tonnes per day), the average processing rate was above the budgeted rate of 7,000 tonnes per day, demonstrating improvements in plant reliability. Stornoway is confident it will be able to continue surpassing the processing rate over the balance of the year to be able to catch up on the shortfall of the first two months. The average ore tonnage hauled to surface from the underground mine was 6,707 tonnes per day during the first quarter, significantly above the design capacity of 6,000 tonnes per day. Figure 1 summarizes underground ore tonnages hauled to surface, showing the outperformance compared to design capacity for the majority of the months since the completion of the underground ramp-up was announced in August 2018.

To view Figure 1. Underground ore tonnes hauled to surface, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/2ae46657-842a-4c76-b69b-8527fac37992

SUSPENSION OF OPEN PIT MINING OPERATIONS

The Corporation has made the decision to suspend open pit mining operations in the Renard 65 open pit. This decision comes as the current stockpile of Renard 65 open pit ore is sufficient to sustain planned processing requirements into the second quarter of 2020. The suspension will enable the idling of part of the surface mobile equipment fleet, thus realizing operating cost savings and pushing forward capital maintenance costs.

AMENDMENTS TO CERTAIN AGREEMENTS

By March 29, 2019, the Corporation had entered into amendments to (i) the restated Purchase and Sale Agreement with Osisko Gold Royalties Ltd, Caisse de dépôt et placement du Québec, Triple Flag Mining Finance Bermuda Ltd., Albion Exploration Fund LLC and Washington State Investment Board, as buyers, to (ii) the Master Lease Agreement executed on July 25, 2014, as amended with Caterpillar Financial Services Limited, and to (iii) the Credit Agreement dated July 8, 2014, as amended, with Diaquem inc., an affiliate of Investissement Québec, pursuant to which the definition of “Tangible Net Worth” in each agreement was amended to discount the non-cash impact of IFRS 15 from the calculation of Tangible Net Worth and the Corporation’s covenant, under each agreement, to maintain a tangible net worth on a consolidated basis of no less than $250 million, was reduced to $225 million until December 31, 2019, inclusively.

QUALIFIED PERSON

Disclosure of a scientific or technical nature in this press release was prepared under the supervision of Mr. Patrick Sévigny, P.Eng. (Québec), Vice President, Operations, a “qualified person” under National Instrument (“NI”) 43-101.

ABOUT THE RENARD DIAMOND MINE

The Renard Diamond Mine is Québec’s first producing diamond mine and Canada’s sixth. It is located approximately 250 km north of the Cree community of Mistissini and 350 km north of Chibougamau in the James Bay region of north-central Québec. Construction on the project commenced on July 10, 2014, and commercial production was declared on January 1, 2017. Average annual diamond production is forecast at 1.8 million carats per annum over the first 10 years of mining. Readers are referred to the technical report dated January 11, 2016, in respect of the September 2015 Mineral Resource estimate, and the technical report dated March 30, 2016, in respect of the March 2016 Updated Mine Plan and Mineral Reserve Estimate for further details and assumptions relating to the project.

ABOUT STORNOWAY DIAMOND CORPORATION

Stornoway is a Canadian diamond exploration and production company listed on the Toronto Stock Exchange under the symbol SWY and headquartered in Montreal. A growth-oriented company, Stornoway owns a 100% interest in the world-class Renard Mine, Québec’s first diamond mine. The head office of Stornoway is located at 1111 St. Charles Ouest, Bureau 400, Tour Ouest, Longueuil, Québec, J4K 5G4.

On behalf of the Board

STORNOWAY DIAMOND CORPORATION

/s/ “Patrick Godin”

Patrick Godin

President and Chief Executive Officer

| For more information, please contact Patrick Godin (President and CEO) at 450-616-5555 x2201 or Orin Baranowsky (CFO) at 416-304-1026 x2103 or Alexandre Burelle (Manager, Investor Relations and Business Development) at 450-616-5555 x2264 or toll free at 1-877-331-2232 Pour plus d’information, veuillez contacter Alexandre Burelle (Directeur, Relations avec les investisseurs et développement des affaires) au 450-616-5555 x2264, aburelle@stornowaydiamonds.com ** Website: www.stornowaydiamonds.com Email: info@stornowaydiamonds.com ** |

FORWARD-LOOKING STATEMENTS

This document contains forward-looking information (as defined in National Instrument 51‑102 – Continuous Disclosure Obligations) and forward-looking statements within the meaning of Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward-looking information” or “forward-looking statements”). These forward-looking statements are made as of the date of this document and, the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law.

These forward-looking statements relate to future events or future performance and include, among others, statements with respect to Stornoway’s objectives for the ensuing year, our medium and long-term goals, and strategies to achieve those objectives and goals, as well as statements with respect to our management’s beliefs, plans, objectives, expectations, estimates, intentions and future outlook and anticipated events or results. Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking statements reflect current expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the amount of Mineral Reserves, Mineral Resources and exploration targets; (ii) the estimated amount of future production over any period; (iii) net present value and internal rates of return of the mining operation; (iv) expectations and targets relating to recovered grade, size distribution and quality of diamonds, average ore recovery, carats recovered, carats sold, internal dilution, mining dilution and other mining parameters set out in the 2016 Technical Report as well as levels of diamond breakage; (v) expectations, targets and forecasts relating to gross revenues, operating cash flows and other revenue metrics set out in the 2016 Technical Report, growth in diamond sales, cost of goods sold, cash cost of production, gross margins estimates, planned and projected diamond sales, mix of diamonds sold, and capital expenditures, liquidity and working capital requirements; (vi) mine and resource expansion potential, expected mine life, and estimated incremental ore recovery, revenue and other mining parameters from potential additional mine life extension; (vii) expected time frames for completion of permitting and regulatory approvals related to ongoing construction activities at the Renard Diamond Mine; (viii) the expected time frames for the completion of the open pit and underground mine at the Renard Diamond Mine; (ix) the expected financial obligations or costs incurred by Stornoway in connection with the ongoing development of the Renard Diamond Mine; (x) mining, development, production, processing and exploration rates, progress and plans, as compared to schedule and budget, and planned optimization, expansion opportunities, timing thereof and anticipated benefits therefrom; (xi) future exploration plans and potential upside from targets identified for further exploration; (xii) expectations concerning outlook and trends in the diamond industry, rough diamond production, rough diamond market demand and supply, and future market prices for rough diamonds and the potential impact of the foregoing on various Renard financial metrics and diamond production; (xiii) the economic benefits of using liquefied natural gas rather than diesel for power generation; (xiv) requirements for and sources of, and access to, financing and uses of funds; (xv) the ability to meet Subject Diamonds Interest delivery obligations under the Purchase and Sale Agreement; (xvi) the foreign exchange rate between the US dollar and the Canadian dollar; and (xvii) the anticipated benefits from recently approved plant modification measures and the anticipated timeframe and expected capital cost thereof. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “schedule” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions by Stornoway or its consultants and other important factors that, if untrue, could cause the actual results, performances or achievements of Stornoway to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business prospects and strategies and the environment in which Stornoway will operate in the future, including the recovered grade, size distribution and quality of diamonds, average ore recovery, internal dilution, and levels of diamond breakage, the price of diamonds, anticipated costs and Stornoway’s ability to achieve its goals, anticipated financial performance, regulatory developments, development plans, exploration, development and mining activities and commitments, access to financing, and the foreign exchange rate between the US and Canadian dollars. Although management considers its assumptions on such matters to be reasonable based on information currently available to it, they may prove to be incorrect. Certain important assumptions by Stornoway or its consultants in making forward-looking statements include, but are not limited to: (i) the accuracy of our estimates regarding capital and estimated workforce requirements; (ii) estimates of net present value and internal rates of return; (iii) recovered grade, size distribution and quality of diamonds, average ore recovery, carats recovered, carats sold, internal dilution, mining dilution and other mining parameters set out in the 2016 Technical Report as well as levels of diamond breakage; (iv) the expected mix of diamonds sold, and successful mitigation of ongoing issues of diamond breakage in the Renard Diamond Mine process plant and realization of the anticipated benefits from plant modification measures within the anticipated timeframe and expected capital cost; (v) the stabilization of the Indian currency market and full recovery of prices; (vi) receipt of regulatory approvals on acceptable terms within commonly experienced time frames and absence of adverse regulatory developments; (vii) anticipated timelines for the development of an open pit and underground mine at the Renard Diamond Mine; (viii) anticipated geological formations; (ix) continued market acceptance of the Renard diamond production, conservative forecasting of future market prices for rough diamonds and impact of the foregoing on various Renard financial metrics and diamond production; (x) the timeline, progress and costs of future exploration, development, production and mining activities, plans, commitments and objectives; (xi) the availability of existing credit facilities and any required future financing on favourable terms and the satisfaction of all covenants and conditions precedent relating to future funding commitments; (xii) the ability to meet Subject Diamonds Interest delivery obligations under the Purchase and Sale Agreement; (xiii) Stornoway’s interpretation of the geological drill data collected and its potential impact on stated Mineral Resources and mine life; (xiv) the continued strength of the US dollar against the Canadian dollar and absence of significant variability in interest rates; (xv) improvement of long-term diamond industry fundamentals and absence of material deterioration in general business and economic conditions; and absence of significant variability in interest rates; (xvi) increasing carat recoveries with progressively increasing grade in LOM plan; (xvii) estimated incremental ore recovery, revenue and other mining parameters from potential additional mine life extension with minimal capital expenditures; (xviii) availability of skilled employees and maintenance of key relationships with financing partners, local communities and other stakeholders; (xix) long-term positive demand trends and rough diamond demand meaningfully exceeding supply; (xx) high depletion rates from existing diamond mines; (xxi) global rough diamond production remaining stable; (xxii) modest capital requirements post-2018 with significant resource expansion available at marginal cost; (xxiii) substantial resource upside within scope of mine plan; (xxiv) opportunities for high grade ore acceleration and processing expansion and realization of anticipated benefits therefrom; (xxv) significant potential upside from targets identified for further exploration; and (xxvi) limited cash income taxes payable over the medium term.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward- looking statements as a number of important risk factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. These risk factors may be generally stated as the risk that the assumptions and estimates expressed above do not occur, including the assumption in many forward-looking statements that other forward-looking statements will not be correct, but specifically include, without limitation: (i) risks relating to variations in the grade, size distribution and quality of diamonds, kimberlite lithologies and country rock content within the material identified as Mineral Resources from that predicted; (ii) variations in rates of recovery and levels of diamond breakage; (iii) the uncertainty as to whether further exploration of exploration targets will result in the targets being delineated as Mineral Resources; (iv) risks associated with our dependence on the Renard Diamond Mine and the limited operating history thereof; (v) unfavourable developments in general economic conditions and in world diamond markets; (vi) variations in diamond valuations and fluctuations in diamond prices from those assumed; (vii) insufficient demand and market acceptance of our diamonds; (viii) risks associated with the production and increased consumer demand for synthetic gem-quality diamonds; (ix) risks relating to fluctuations in the Canadian dollar and other currencies relative to the US dollar and variability in interest rates; (x) inaccuracy of our estimates regarding future financing and capital requirements and expenditures, significant additional future capital needs and unavailability of additional financing and capital, on reasonable terms, or at all; (xi) uncertainties related to forecasts, costs and timing of the Corporation’s future development plans, exploration, processing, production and mining activities; (xii) increases in the costs of proposed capital, operating and sustainable capital expenditures; (xiii) increases in financing costs or adverse changes to the terms of available financing, if any; (xiv) tax rates or royalties being greater than assumed; (xv) uncertainty of mine life extension potential and results of exploration in areas of potential expansion of resources; (xvi) changes in development or mining plans due to changes in other factors or exploration results; (xvii) risks relating to the receipt of regulatory approvals or the implementation of the existing Impact and Benefits Agreement with aboriginal communities; (xviii) the failure to secure and maintain skilled employees and maintain key relationships with financing partners, local communities and other stakeholders; (xix) risks associated with ongoing issues of diamond breakage in the Renard Diamond Mine process plant and the failure to realize the anticipated benefits from plant modification measures within the anticipated timeframe and expected capital cost, or at all; (xx) the negative market effects of recent Indian demonetization and continued impact on pricing and demand; (xxi) the effects of competition in the markets in which Stornoway operates; (xxii) operational and infrastructure risks; (xxiii) execution risk relating to the development of an operating mine at the Renard Diamond Mine; (xxiv) the Corporation being unable to meet its Subject Diamonds Interest delivery obligations under the Purchase and Sale Agreement; (xxv) future sales or issuances of Common Shares lowering the Common Share price and diluting the interest of existing shareholders; (xxvi) the risk of failure of information systems; (xxvii) the risk that our insurance does not cover all potential risks; (xxviii) the risks associated with our substantial indebtedness and the failure to meet our debt service obligations; and (xxix) the additional risk factors described herein and in Stornoway’s annual and interim MD&A, its other disclosure documents and Stornoway’s anticipation of and success in managing the foregoing risks. Stornoway cautions that the foregoing list of factors that may affect future results is not exhaustive and new, unforeseeable risks may arise from time to time.

__________________________________

1 Before stream and royalty

2 Based on an average $: US$ conversion rate of 1.33

3 The first quarter of fiscal year 2018 includes 127,616 carats that were sold in the first quarter for which revenue was realized in the second quarter.

4 Run-of-Mine (ROM) carats represent the proportion of total diamonds recovered above the mineral resource bottom cut-off (+1 DTC) and normalized to a proportion of small diamonds (-7 DTC) that is consistent with the mineral resource. The excess carats recovered above the normalized, run-of-mine production is defined as supplemental carats. The supplemental goods are segregated from the run-of-mine production during the sale tender process.