Superior Gold Announces Positive Preliminary Economic Assessment for the Plutonic Main Pit Push-Back Project

After-Tax $120 Million NPV with 35% IRR at A$2,150/oz (US$1,505/oz) gold

(All dollar amounts referenced, unless otherwise indicated, are expressed in Australian Dollars)

TORONTO, Dec. 2, 2020 /CNW/ - Superior Gold Inc. ("Superior Gold" or the "Company") (TSXV: SGI) is pleased to announce positive results from the independent Preliminary Economic Assessment ("PEA") of a push-back of the previously producing main pit (the "Plutonic Main Pit") as well as an updated Mineral Resource estimate at its 100%-owned Plutonic gold operations, located in Western Australia (the "Plutonic Gold Operations"). The PEA demonstrates the potential of the Plutonic Main Pit to be a robust open pit gold mine with compelling project economics. Based on the results of the PEA, the Company expects to proceed to a Pre-Feasibility Study ("PFS") for the Plutonic Main Pit push-back project.

PEA Highlights:

- Robust economics with after-tax Net Present Value (5% discount rate) ("NPV5%") of $120 million and an after-tax Internal Rate of Return ("IRR") of 35% at $2,150 per ounce of gold (US$1,505 per ounce)

- Low capital intensity project with only $82 million pre-production capital cost net of $22 million of pre-production revenue

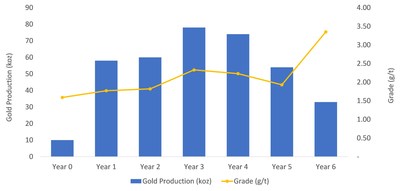

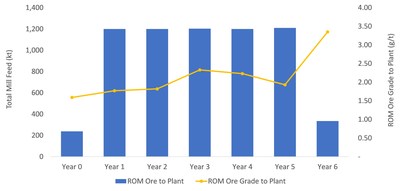

- Average production of 60,000 ounces gold per year over six years for 357,000 ounces of total production

- Low life-of-mine ("LOM") All-In Sustaining Cost ("AISC") of US$863 per ounce gold

- Technically simple project based on a push-back of the existing Plutonic Main Pit utilising existing processing and other existing infrastructure

- Significant leverage to gold price: $265 million NPV5% at recent spot price of $2,850 per ounce of gold (US$2,000 per ounce)

- Value enhancement potential available through removing open pit constraints, resource expansion and exploration drilling

- Proceeding to a PFS expected to be completed in the first half of 2022

Updated Mineral Resource Highlights:

- Updated Measured and Indicated Mineral Resources of 1.89 million ounces of gold (16.26 million tonnes at a 3.6 g/t Au grade)

- Updated Inferred Mineral Resources of 3.07 million ounces of gold (30.55 million tonnes at a 3.1 g/t Au grade)

Tamara Brown, Interim CEO of Superior Gold stated: "The Plutonic Main Pit push-back project starts to unlock the significant value sitting within the Plutonic Gold Operations. It is a technically simple, high-return, brownfield gold project in one of the most favourable mining jurisdictions in the world, with all necessary infrastructure already in place. The PEA defines robust project economics based on reasonable capital expenditures. This low capital intensity derives from leveraging the existing Plutonic infrastructure and the simplicity of the project which will utilize conventional open pit mining techniques and proven existing processing operations.

We are extremely pleased to present the results of a PEA on the Plutonic Main Pit project which in management's view clearly demonstrates the potential of significantly increasing production at the Plutonic Gold Operations. The project shows robust economics with an after-tax IRR of 35%, a payback of 2.6 years and an NPV5% of $120 million at a $2,150 per ounce gold price. The PEA supports a 3,300 tonnes per day open pit operation with production spanning six years, with very attractive cash costs, AISC and low capital intensity as we are able to leverage off our existing infrastructure. The production from the open pit operations of an average of 60,000 ounces per year for six years, peaking at 78,000 ounces in year three, will supplement our existing production from the Plutonic underground operations, potentially significantly boosting our annual production levels. Importantly, the project provides a steady base load of feed supply for our primary mill, repositioning the Plutonic Gold Operations for long-term success."

Cautionary Statement: The reader is advised that the PEA summarized in this news release is preliminary in nature and is intended to provide an initial, high-level review of the Plutonic Main Pit's economic potential and design options. The PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There are no Mineral Reserves contained in the PEA.

PEA Summary

The PEA was prepared by RPM Advisory Services Pty Limited ("RPM Global"), based on an updated Mineral Resource estimate prepared by the Company, all in accordance with National Instrument 43-101 ("NI 43-101"). The updated Mineral Resource estimate and PEA were completed under the supervision of Stephen Hyland, FAusIMM who is a "qualified person" as defined by NI 43-101 and is independent of the Company.

This news release contains information from a preliminary economic assessment, which is a conceptual study, and other forward-looking information about potential future results and events. Please refer to the cautionary statements in the footnotes below and the cautionary statements located at the end of this news release, which include associated assumptions, risks, uncertainties and other factors.

Table 1: Plutonic Main Pit Project PEA Economics(1)

Economics | Pre-Tax | Post-Tax | |

Net present value (NPV5%) | $ millions | 177 | 120 |

Net present value (NPV5%) | US$ millions | 124 | 84 |

Internal rate of return (IRR) | % | 45 | 35 |

Payback (undiscounted) | years | 2.5 | 2.6 |

LOM avg. annual cash flow after capital | $ millions | 55.1 | 43.0 |

Total cash flow (undiscounted) | $ millions | 242 | 169 |

Forecasts | |||

Gold price assumption | US$/oz | 1,505 | |

A$ to US$ assumption | A$/US$ | 0.70 | |

Production | |||

Average annual gold production | ounces/yr | 60,000 | |

Total LOM recovered gold (excl. pre-production) | ounces | 357,000 | |

Mine life(2) | years | 6 | |

Average annual mining rate | million tonnes/yr | 11.6 | |

LOM strip ratio | waste:ore | 10.3 | |

Average mill grade | g/t gold | 2.1 | |

Average recoveries | % | 86.4 | |

Capital Expenditures | |||

Initial capital costs (net of pre-production revenue) | $ millions | 82.5 | |

LOM sustaining capital costs | $ millions | 5.6 | |

Costs | |||

Mining cost | $/tonne mined | 3.89 | |

Processing cost | $/tonne milled | 19.38 | |

G&A cost | $/tonne milled | 4.15 | |

Royalty | % | 2.5% | |

Total cash cost(3) | US$/oz | 852 | |

AISC(3) | US$/oz | 863 | |

NOTES: | |

1. | The PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There are no Mineral Reserves contained in the PEA. |

2. | LOM calculation and "Mine Life" is defined as the duration of mining operations of six years after the first year of pre-stripping and capital spend. |

3. | This is a non-IFRS financial measure. Please refer to "Non-IFRS Performance Measures" at the end of this news release for a description of these non-IFRS performance measures and to the Non-IFRS Performance Measures disclosure included in the Company's MD&A for a description and calculation of these measures. |

The Plutonic Main Pit push-back project is part of the Plutonic Gold Operations located 800 kilometres north-east of Perth in Western Australia. The Plutonic Main Pit was first put into production in 1990 and produced 2.1 million ounces of gold, along with other satellite pits, between 1990 and 2005 when production in respect of the Plutonic Main Pit ceased. The Plutonic Main Pit is situated directly above the existing underground operations and located directly adjacent to the Company's milling facilities which consist of a 1.8 million tonne per annum ("Mtpa") primary processing plant ("PP1") and a 1.2 Mtpa secondary processing plant ("PP2") which is currently on care and maintenance. Existing tonnage from the underground mine supplies approximately 800,000 tonnes per annum to PP1. Therefore, PP1 has capacity for open pit sources of feed.

The PEA considers a push-back of the past producing Plutonic Main Pit utilizing contractor operated conventional open pit mining methods. Drill and blasting of rock will be followed by conventional truck and shovel operations within the open pit for the movement of plant feed and waste with on-site treatment of mine material by conventional milling and gravity recovery through PP1. The PEA also contemplates the expansion of PP1 from 1.8 Mtpa to 2.0 Mtpa with only minor modifications to the existing processing flowsheet. Tailings from the Carbon in Leach ("CIL") circuit will be deposited in the existing on-site paddock style tailings storage facility ("TSF") and the already permitted TSF paddocks 4 and 5 to be constructed starting in late 2021.

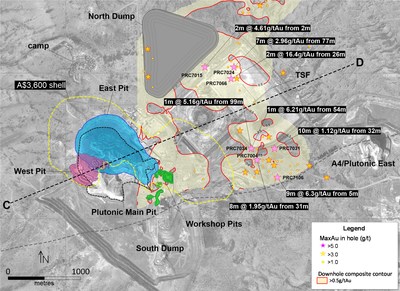

The push-back of the Plutonic Main Pit encounters a number of potential surface constraints impacting the pit size, including the location of processing plant infrastructure and heritage sites. The PEA base case has been completed conservatively assuming no relocation of any of these open pit constraints. Future work will need to be completed to assess the viability of removing one or more of these pit size constraints.

Gold Price Sensitivities

The following table demonstrates the after-tax sensitivities of NPV and IRR to gold price per ounce. The base case, highlighted in the table below, assumes $2,150 per ounce of gold (US$1,505 per ounce):

Table 2: Sensitivity Table

Economic Sensitivities to Gold Prices (post-tax) | ||

Per ounce of gold | (NPV5%) $ millions | IRR% |

US$1,300 | 59 M | 20% |

US$1,350 | 74 M | 24% |

US$1,505 ($2,150) | 120 M | 35% |

US$1,800 | 206 M | 57% |

US$1,900 | 236 M | 64% |

US$2,000 | 265 M | 72% |

Opportunities

Several opportunities to potentially improve the economics of the Plutonic Main Pit project contemplated under the PEA have been identified. Examples include, but are not limited to:

- Investigate the potential removal of one or more surface constraints currently limiting the size of the open pit;

- Complete infill drilling to convert Inferred Mineral Resources to Measured and Indicated Resources;

- Complete on-strike step-out drilling to potentially expand Inferred Mineral Resources (Figure 5);

- Investigate existing targets south east of the Plutonic Main Pit (Figure 5);

- Geotechnical drilling to confirm opportunities to steepen current pit walls;

- Further optimize mining strategy resulting in operating cost savings;

- Further optimize mine designs and scheduling resulting in fully-utilized contractor fleet;

- Investigate interaction with the underground operations to identify optimization opportunities at the overall operation; and

- Utilize Australian tax losses of approximately $36 million (as of December 31, 2019).

Mineral Resources Estimate

As part of the PEA, the Company completed an updated Mineral Resource estimate for the Plutonic Gold Operations as at December 31, 2019. The updated Mineral Resource is estimated from a drill hole database containing 35,784 drill holes consisting of 2.9 million metres of drilling.

Mineral Reserves for the Plutonic Gold Operations as at December 31, 2019 did not change and there are no Mineral Reserves contained in the PEA. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resources as at December 31, 2019 were estimated using a long-term gold price of $2,150 per ounce (US$1,505 per ounce). Cut off grades for the Mineral Resource estimates were 1.50 g/t Au for underground and 0.40 g/t Au for open pit.

Table 3: Updated Measured and Indicated Mineral Resources

December 31, 2019 | December 31, 2019 (Updated) | |||||

Tonnes | Grade (g/t Au) | Oz Au (000's) | Tonnes | Grade (g/t Au) | Oz Au (000's) | |

Underground | ||||||

Measured | 3.69 | 5.50 | 650 | 3.45 | 5.5 | 590 |

Indicated | 5.54 | 4.60 | 820 | 5.15 | 4.6 | 750 |

Total | 9.23 | 5.00 | 1,470 | 8.61 | 5.0 | 1,330 |

Open Pit | ||||||

Measured | – | – | – | 1.64 | 3.9 | 210 |

Indicated | 2.69 | 1.40 | 120 | 6.02 | 1.8 | 350 |

Total | 2.69 | 1.40 | 120 | 7.66 | 2.3 | 560 |

Stockpiles | ||||||

Measured | – | – | – | – | – | – |

Grand Total | 11.92 | 4.20 | 1,590 | 16.26 | 3.6 | 1,890 |

NOTES: | |

1. | Mineral Resources are quoted inclusive and not additional to those Mineral Resources converted to Mineral Reserves. |

2. | The reporting standard adopted for the reporting of the Mineral Resource estimate uses the terminology, definitions and guidelines given in the CIM Standards on Mineral Resources and Mineral Reserves as required by NI 43-101. |

3. | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate and have been used to derive subtotals, totals and weighted averages. |

4. | Mineral Resources are estimated at a cut-off grade of 1.50 g/t Au for the Plutonic underground gold mine. |

5. | Plutonic Underground Resources based on Deswik Mining Stope Optimizations using generalized Reserve MSO input parameters and/ or restricted 'grade shell' reported Resources. Plutonic Main Pit Resources based on pit optimization parameters derived by the PEA. |

6. | Plutonic Open Pit Mineral Resources are estimated at a cut-off grade of 0.40 g/t Au. |

7. | Mineral Resources are estimated using an average gold price of $2,150 per troy ounce (~US$1,505 per ounce). |

8. | Rounding errors exist in this table and numbers may not add correctly. |

Table 4: Updated Inferred Mineral Resources

December 31, 2019 | December 31, 2019 (Updated) | |||||

Tonnes | Grade (g/t Au) | Oz Au (000's) | Tonnes | Grade (g/t Au) | Oz Au (000's) | |

Underground | ||||||

Inferred | 19.45 | 4.20 | 2,640 | 18.15 | 4.2 | 2,400 |

Open Pit | ||||||

Inferred | 4.73 | 1.20 | 180 | 12.40 | 1.7 | 670 |

Grand Total | 24.19 | 3.60 | 2,820 | 30.55 | 3.1 | 3,070 |

NOTES: | |

1. | Mineral Resources are quoted inclusive and not additional to those Mineral Resources converted to Mineral Reserves. |

2. | The reporting standard adopted for the reporting of the Mineral Resource estimate uses the terminology, definitions and guidelines given in the CIM Standards on Mineral Resources and Mineral Reserves as required by NI 43-101. |

3. | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate and have been used to derive subtotals, totals and weighted averages. |

4. | Mineral Resources are estimated at a cut-off grade of 1.50 g/t Au for the Plutonic underground gold mine. |

5. | Plutonic Underground Resources based on Deswik Mining Stope Optimizations using generalized Reserve MSO input parameters and/ or restricted 'grade shell' reported Resources. Plutonic Main Pit Resources based on pit optimization parameters derived by the PEA. |

6. | Plutonic Open Pit Mineral Resources are estimated at a cut-off grade of 0.40 g/t Au. |

7. | Mineral Resources are estimated using an average gold price of $2,150 per troy ounce (~US$1,505 per ounce). |

8. | Rounding errors exist in this table and numbers may not add correctly. |

Next Steps

The results of the PEA indicate that the proposed Plutonic Main Pit push-back project has technical and financial merit using the base case assumptions. It has also identified additional upside opportunities to remove pit constraints with trade-off studies and analysis required.

In 2021, the Company expects to move forward with enhancing the project through exploration and further drilling. Superior Gold will drill resource expansion targets, high-priority Caspian and Carribean exploration targets and several infill holes to improve confidence in geo-tech, metallurgy and resource estimation data. The Company will also continue to generate additional drill targets.

The Company expects to commence permitting activities which will include the commencement of heritage surveys for the project The results of the surveys and the engineering work completed for the PEA will be used to initiate the permitting process for the Plutonic Main Pit push-back project in the second half of 2021.

Conference Call

Management will host a conference call and webcast on Wednesday December 2, 2020 at 8:30AM ET to discuss the results of the PEA.

Conference Call and Webcast | |

Date: | Wednesday December 2, 2020 8:30AM ET |

Toll-free North America: | (888) 231-8191 |

Local or International: | (647) 427-7450 |

Webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1410025&tp_key=c5b5ab31d1 | |

Conference Call Replay | |

Toll-free North America: | (855) 859-2056 |

Local or International: | (416) 849-0833 |

Passcode: | 3448578 |

The conference call replay will be available from 1:00PM ET on December 2, 2020 until 23:59PM ET on December 16, 2020.

The presentation will be available on the Company's website at www.superior-gold.com.

Filing of Technical Report

A technical report prepared in accordance with NI 43-101 will include the results of the PEA discussed in this news release together with an updated Mineral Resource estimate for the Plutonic Gold Operations will be filed on SEDAR at www.sedar.com under the Company's profile within 45 days in accordance with NI 43-101.

Qualified Persons

The updated Mineral Resource estimate and PEA were completed under the supervision of Stephen Hyland, FAusIMM who is a "qualified person" as defined by NI 43-101 and is independent of the Company. Mr. Hyland is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and a member of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) and a "qualified person" within the meaning of NI 43-101. Mr. Hyland is employed by Hyland Geological and Mining Consultants (HGMC) and has been engaged on the basis of professional association between client and independent consultant.

The PEA was prepared under the supervision of the Qualified Person, Mr. Hyland by the following individuals at RPM Global, all of whom are Qualified Persons under the terms of NI 43-101:

- Mining: Mr Igor Bojanic, FAusIMM

- Processing and Infrastructure: Dr Andrew Newell, MAusIMM (CP), MIE(CP)

Though the RPM Global team were not designated Qualified Persons for the purposes of this PEA, they do meet the requirements for Qualified Persons under the terms of NI 43-101.

Scientific and technical information in this news release has been reviewed and approved by Keith Boyle, P.Eng., Chief Operating Officer of the Company, who is a "qualified person" as defined by NI 43-101. Mr. Boyle is not independent of the Company within the meaning of NI 43-101.

About Superior Gold

Superior Gold is a Canadian based gold producer that owns 100% of the Plutonic Gold Operations located in Western Australia. The Plutonic Gold Operations include the Plutonic underground gold mine and central mill, numerous open pit projects including the Plutonic Main Pit push-back project, the Hermes open pit projects and an interest in the Bryah Basin joint venture. Superior Gold is focused on expanding production at the Plutonic Gold Operations and building an intermediate gold producer with superior returns for shareholders.

Non-IFRS Performance Measures

Total cash costs per gold ounce and all-in sustaining costs per gold ounce are non-IFRS performance measures, they do not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other companies.

"Total cash costs per gold ounce" is a common financial performance measure in the gold mining industry but with no standard meaning under IFRS. Superior Gold reports total cash costs on a sales basis. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate liquidity through operating cash flow to fund future capital expenditures and working capital needs. Superior Gold believes that this measure, along with sales, is a key indicator of the Company's ability to generate operating earnings and cash flow from its mining operations.

Total cash costs are calculated in accordance with a standard developed by The Gold Institute, a worldwide association of suppliers of gold and gold products that ceased operations in 2002. Adoption of the standard is voluntary and the cost measures presented may not be comparable to other similarly titled measures of other companies. Total cash costs include mine site operating costs such as mining, processing and administration costs, royalties, production taxes and realized gains and losses on fuel contracts, but are exclusive of amortization, reclamation, capital and exploration costs and net of by-product sales. Total cash costs are then divided by gold ounces sold to arrive at the total cash costs per ounce sold.

Total cash costs are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

"All-in sustaining costs per gold ounce" is a non-IFRS measure based on guidance announced by the World Gold Council ("WGC") in June 2013. The WGC is a non-profit association of the world's leading gold mining companies established in 1987 to promote the use of gold to industry, consumers and investors. The WGC is not a regulatory body and does not have the authority to develop accounting standards or disclosure requirements. The WGC has worked with its member companies to develop a measure that expands on IFRS measures such as operating expenses to provide visibility into the economics of a gold mining company. Current IFRS measures used in the gold industry, such as operating expenses, do not capture all of the expenditures incurred to discover, develop and sustain gold production. Superior Gold believes the all-in sustaining costs measure provides further transparency into costs associated with producing gold and will assist analysts, investors and other stakeholders of the Company in assessing its operating performance and its overall value.

All-in sustaining costs per gold ounce is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws that is intended to be covered by the safe harbours created by those laws. "Forward-looking information" includes statements that use forward-looking terminology such as "may", "will", "expect", "anticipate", "believe", "continue", "potential" or the negative thereof or other variations thereof or comparable terminology. The forward-looking information contained herein includes, without limitation, information related to: the Plutonic Main Pit having the potential to be a robust open pit gold mine with compelling project economics; the results of the PEA, including, but not limited to, the NPV5%, IRR, estimated costs, average production, production rate, LOM and AISC; the expectation that the Plutonic Main Pit will be a robust operation and profitable at a variety of prices and assumptions; the expected high quality of the Plutonic Main Pit concentrates; the potential impact of the Plutonic Main Pit in the Western Australia, including but not limited to the potential generation of tax revenue and contribution of jobs; value enhancement of the Plutonic Main Pit having the potential through removing open pit constraints, resource expansion and exploration drilling; and the expectation of proceeding to a PFS in respect of the Plutonic Main Pit. These statements are subject to risks and uncertainties, including, but not limited to: the reasonability of the economic assumptions at the basis of the results of the PEA and technical report; changes in interpretations of geological, geostatistical, metallurgical, mining or processing information and interpretations of the information resulting from future exploration, analysis or mining and processing experience; declines in general economic conditions; fluctuations in exchange rates and changes in political conditions, in tax, royalty, environmental and other laws in Western Australia and financial market conditions; new information from drilling programs or other exploration or analysis; unexpected variations in mineral grades, types and metallurgy; fluctuations in silver and gold prices; and failure of mined material to meet expectations. By identifying such information in this manner, the Company is alerting the reader that such information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made. Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. Readers are encouraged to refer to the Annual Information Form filed on SEDAR (www.sedar.com) for a discussion of other risks including risks related to outbreaks or threats of outbreaks of viruses, other infectious diseases or other similar health threats, such as the novel coronavirus outbreak, which could have a material adverse effect on the Company by causing operational and supply chain delays and disruptions, labour shortages, shutdowns, the inability to sell gold, capital markets volatility or other unknown but potentially significant impacts. The Company cannot accurately predict what effects these conditions will have on the Plutonic Gold Operations or the financial results of the Company, including uncertainties relating to travel restrictions to the Plutonic Gold Operations or otherwise and business closures that have been or may be imposed by governments. If an outbreak or threat of an outbreak of a virus or other infectious disease or other public health emergency occurs, it could have a material adverse effect on the Company's business, financial condition and results of operations.

The Company cautions that there can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information as no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, and if any of them do so, what benefits the Company will derive therefrom. Except as required by law, the Company does not assume any obligation to release publicly any revisions to forward-looking information contained in this news release to reflect events or circumstances after the date hereof.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/superior-gold-announces-positive-preliminary-economic-assessment-for-the-plutonic-main-pit-push-back-project-301183277.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/superior-gold-announces-positive-preliminary-economic-assessment-for-the-plutonic-main-pit-push-back-project-301183277.html

SOURCE Superior Gold

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/02/c2076.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2020/02/c2076.html