Teranga Gold Announces Early-Stage Initial Resource for Golden Hill Including Indicated Resources of 415,000 Ounces at 2.02 g/t Au and Inferred Resources of 644,000 Ounces at 1.68 g/t Au

(All amounts are in U.S. dollars unless otherwise stated)

|

|||||

TORONTO, Feb. 21, 2019 (GLOBE NEWSWIRE) -- Teranga Gold Corporation ("Teranga" or the "Company") (TSX: TGZ, OTCQX:TGCDF) is pleased to announce an initial mineral resource estimate for its Golden Hill advanced exploration project, located within the central part of the highly mineralized Houndé Greenstone Belt in southwest Burkina Faso, West Africa. Teranga owns 100% of Golden Hill.

GOLDEN HILL RESOURCE ESTIMATE HIGHLIGHTS

- Indicated mineral resources of 6.40Mt averaging 2.02 g/t gold for 415,000 ounces

- Inferred mineral resources of 11.95Mt averaging 1.68 g/t gold for 644,000 ounces

- Excellent along trend and to-depth continuity of gold mineralization at all prospects drilled

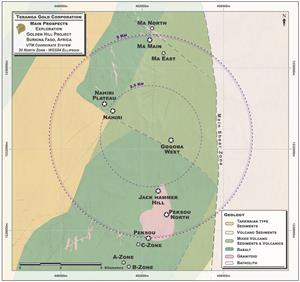

This initial mineral resource estimate was prepared by Teranga in accordance with CIM Standards and disclosed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. Please see Table 1 in Appendix 1 for the Golden Hill mineral resource estimation summary table. This initial resource estimation includes the following prospects: Ma Main, Ma North, Jackhammer Hill, Peksou/C-Zone, Nahiri, A-Zone and B-Zone (Figure 1 in Appendix 2).

“It is still very early in our exploration program. However, after only 18 months of drilling, Golden Hill has advanced rapidly and we are increasingly confident that Golden Hill will ultimately represent Teranga’s third gold mine,” said Richard Young, President and Chief Executive Officer. “With an early-stage initial resource estimate in hand, the focus now is on advancing the metallurgical test work required to produce the initial technical and economic assessments. The completion of these assessments is a prerequisite to drawing down on the debt facility in place to take Golden Hill into the feasibility stage of development.”

"Our initial resource estimate provides a solid base from which to grow Golden Hill and reaffirms our interpretations that most of the prospects offer substantial upside,” said Paul Chawrun, Chief Operating Officer. “We are pleased with the grades, strong continuity and widespread mineralization at Golden Hill. Given the encouraging results of this early-stage initial resource estimate, our confidence in – and understanding of – the project geology, recent discoveries and the proven mineral potential of the region, our priority is to increase the number of resource ounces and advance the project through a PEA and into the feasibility stage of development.”

Drilling at Golden Hill has identified and partially outlined numerous at-surface, oxide-hosted mineralized gold zones demonstrating excellent along trend and to-depth continuity. These gold zones extend to considerable depths below the oxide-hosted mineralization transitioning into fresh brecciated and altered shear zones that remain open to further depth expansion.

“We recognize the paramount importance of structural controls on the gold zones and will focus ongoing exploration efforts on identifying additional favorable structural trends that should add resources through drilling evaluations,” said David Mallo, Vice President, Exploration.

In line with that goal, Teranga has had prospecting success at its newest Golden Hill discovery, Gogoba West, which is now drill ready. Teranga is also set to initiate an exploration program that will include auger and core drilling at a number of similar structurally controlled mineralized zones located on the adjacent Dossi permit area, which was recently optioned from ACC Resources through a joint venture agreement.

Golden Hill’s initial resource estimate is based on the results from nearly 650 drill holes totaling more than 70,000 metres distributed among nine prospects. More than 500 of these holes were drilled with oriented diamond core to enhance confidence in lithologic, structural and mineralization interpretations. Historic drill holes, completed prior to Teranga’s acquisition of Golden Hill, were excluded from this initial resource due to missing QA/QC data.

Cumulative drill results from all prospects within the Golden Hill project are included on the Company’s website www.terangagold.com under Exploration.

NEXT STEPS

In addition to further drilling evaluations, Teranga is continuing with metallurgical test work as well as base line environmental and social studies programs at Golden Hill. The project currently includes nine prospects all within a 7.5-kilometre radius. This configuration is conducive to a multi-pit operation feeding into a centralized processing facility, very similar to the Company’s Sabodala and Wahgnion gold operations.

The next steps for drilling at Golden Hill are as follows:

- Ma Structural Complex: The various components of the Ma structural complex offer many opportunities for additional resource-focused exploration. The latest drilling phase expanded Ma North considerably to the east where multiple brecciated shear zones were intersected. It is now a high-priority drill target area. Ma Main, the most extensively drilled prospect to-date, has considerable potential remaining down plunge of the wider and higher-grade portions of Ma Main targeting pit depth extension. This initial resource estimation does not include historic drilling at Ma East due to some missing QA/QC data.

- Peksou/C-Zone: The resource at Peksou/C-Zone demonstrates very good grade and remains open along trend and to depth along defined plunge orientations. Additional upside exists in the area in and around the intersection of the Peksou and C-Zone mineralized trends as well as further along trend beyond this intersection. Additional resource evaluation drilling at these potential Peksou/C-Zone expansion opportunities remains a high priority during the next drilling phase at Golden Hill. This initial resource estimation does not include historic drilling at Peksou/C-Zone due to missing QA/QC data.

- Jackhammer Hill: While this prospect has produced encouraging results since its discovery in late 2017, the resource estimation pit was smaller than anticipated. Geological re-interpretation has been initiated towards re-assessing the potential for further drilling evaluation.

- A-Zone and B-Zone: While B-Zone has limited expansion opportunities, A-Zone demonstrates further upside potential requiring additional drilling evaluation along trend and both up-dip and down-dip of the historic drilling results here. Similar to Ma East and Peksou/C-Zone, the historic drilling at A and B-Zones was not included in this initial resource estimation due to incomplete QA/QC data.

- Additional Targets: A number of other priority exploration targets have been identified which are worthy of more detailed evaluation. One of these, the Gogoba West discovery (Figure 1 in Appendix 2), is a series of northwest trending, favorably altered, mineralized, veined and brecciated structures observed over a minimum 500-metre strike extent. The undrilled Gogoba West prospect is a high priority target justifying further evaluation during the next drilling campaign.

- Regional Exploration: The 2019 exploration program will include an outward expansion of our evaluation program beyond the area of our currently known prospects. We recognize that the entirety of the Golden Hill ground is highly prospective as it contains identical geology and favorable structural controls.

- Dossi Permit Area: As an extension of the regional exploration program, the Company plans to initiate prospecting, geologic/structural mapping, systematic auger drilling and core drilling evaluations at a number of prospects lying to the north of Golden Hill within the immediately adjacent Dossi permit area, which is covered by a joint venture agreement with ACC Resources Limited. Historical data accumulated and reviewed suggests that at least a half dozen mineralized Dossi targets are very similar to those already identified at Golden Hill.

INITIAL PEA WORK UNDERWAY

The Company has also commenced initial studies and test work in support of a forthcoming preliminary economic analysis (“PEA”) at Golden Hill. Metallurgical test work has been underway at ALS (Perth) using a number of composites from the Ma suite, as well as separate composites for the Jackhammer, A, B and C-Zones and Peksou deposits. Upon completion of this test work to determine the basis for an optimized flowsheet for all of these deposits, PEA level engineering in concert with ESIA baseline work will commence to determine an estimate of capital and operating costs that support an initial mine plan concept. This work will provide the basis for the initial technical and economic assessment of the project.

Golden Hill also has a funding commitment in place. Subject to satisfaction of conditions precedent relating to the project’s initial technical and economic assessment, Teranga has secured $25 million in debt financing to advance the Golden Hill project through to feasibility stage development, which will include the next steps for drilling mentioned above, as well as feasibility stage engineering work.

QUALIFIED PERSONS STATEMENT

The scientific and technical information contained in this document relating to Golden Hill’s mineral resource estimates is based on, and fairly represents, information compiled by Ms. Patti Nakai-Lajoie. Ms. Nakai-Lajoie, P. Geo., is a Member of the Association of Professional Geoscientists of Ontario. Ms. Nakai-Lajoie is a full-time employee of Teranga and is not "independent" within the meaning of NI 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Ms. Nakai-Lajoie has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which she is undertaking to qualify as a "Qualified Person" under NI 43-101. Ms. Nakai-Lajoie has consented to and approved the inclusion in this document of the matters based on her compiled information in the form and context in which it appears in this document.

Teranga's disclosure of mineral reserve and mineral resource information is governed by NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM ("CIM Standards"). There can be no assurance that those portions of mineral resources that are not mineral reserves will ultimately be converted into mineral reserves.

FORWARD-LOOKING STATEMENTS

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding Teranga's future growth and business prospects and opportunities. Forward-looking statements include, without limitation, all disclosure regarding possible events, conditions or results of operations, future economic conditions expectations and anticipated courses of action. Although the forward-looking statements contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements are based upon assumptions, opinions and analysis that management believes to be reasonable and relevant but that may prove to be incorrect. Teranga cautions you not to place undue reliance upon any such forward-looking statements.

The risks and uncertainties that may affect forward-looking statements are more fully described in Teranga's Annual Information Form dated March 29, 2018, and in other filings of Teranga with securities and regulatory authorities, which are available at www.sedar.com. Teranga does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

This document also contains references to estimates of mineral resources. The estimation of mineral resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that ultimately may prove to be inaccurate. Mineral resource estimates may have to be re-estimated based on: (i) fluctuations in price of gold or other mineral prices; (ii) results of drilling; (iii) metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates and/or changes in mine plans; (vi) the possible failure to receive required permits, approvals and licences; and (vii) changes in law or regulation.

ABOUT TERANGA

Teranga is a multi-jurisdictional West African gold company focused on production and development as well as the exploration of approximately 6,400 km2 of land located on prospective gold belts. Since its initial public offering in 2010, Teranga has produced more than 1.6 million ounces of gold at its Sabodala operation in Senegal. Focused on diversification and growth, the Company is advancing construction of its second producing gold mine, Wahgnion, which is located in Burkina Faso, as well as carrying out exploration programs in three West African countries: Burkina Faso, Côte d’Ivoire and Senegal. The Company had more than 4.0 million ounces of gold reserves as of June 30, 2018. Teranga applies a rigorous capital allocation framework for its investment decisions and is focused on funding future organic growth plans responsibly.

Steadfast in its commitment to set the benchmark for responsible mining, Teranga operates in accordance with the highest international standards and aims to act as a catalyst for sustainable economic, environmental, and community development as it strives to create value for all of its stakeholders. Teranga is a member of the United Nations Global Compact and a leading member of the multi-stakeholder group responsible for the submission of the first Senegalese Extractive Industries Transparency Initiative revenue report.

| CONTACT INFORMATION | ||

| Richard Young | Trish Moran | |

| President & CEO | Head of Investor Relations | |

| T: +1 416 594 0000 | E: ryoung@terangagold.com | T: +1 416 607 4507 | E: tmoran@terangagold.com | |

APPENDIX 1

TABLE 1: MINERAL RESOURCE SUMMARY

| Measured Resources | Indicated Resources | Measured + Indicated Resources | Inferred Resources | |||||||||

| Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | |

| Ma | 0 | 0.00 | 0 | 5,789 | 2.03 | 378 | 5,789 | 2.03 | 378 | 4,082 | 1.71 | 225 |

| Jackhammer Hill | 0 | 0.00 | 0 | 610 | 1.87 | 37 | 610 | 1.87 | 37 | 692 | 1.50 | 33 |

| Peksou/C-Zone | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 3,839 | 2.13 | 263 |

| Nahiri | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 1,659 | 0.85 | 45 |

| A and B-Zones | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 0 | 0.00 | 0 | 1,675 | 1.45 | 78 |

| Total Golden Hill | 0 | 0.00 | 0 | 6,399 | 2.02 | 415 | 6,399 | 2.02 | 415 | 11,947 | 1.68 | 644 |

Notes for Mineral Resource Estimate (effective November 30, 2018)

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported at cut-off grades ranging from 0.333 g/t Au to 0.437 g/t Au in oxide, 0.381 g/t Au to 0.497 g/t Au in transition, and 0.425 g/t Au to 0.553 g/t Au in primary rock.

- The effective date for all deposits is November 30, 2018.

- High grade assays were capped at grades ranging from 15 g/t Au to 25 g/t Au.

- Mineral Resources are estimated using a long-term gold price of US$1,450 per ounce.

- A minimum thickness of two metres was applied.

- Mineral Resources are constrained by preliminary pit shells.

- Totals may not add due to rounding.

APPENDIX 2

FIGURE 1: GOLDEN HILL PROPERTY – PROSPECT LOCATION MAP

http://www.globenewswire.com/NewsRoom/AttachmentNg/b27e3175-a25f-49a6-9405-86cc12b3f83b