Troilus Announces Sale of Select Properties to Emerging Lithium Producer Sayona Mining Ltd. for C$40 Million, Retains 2% NSR Royalty; Additional C$4.8 Million Private Placement Investment

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

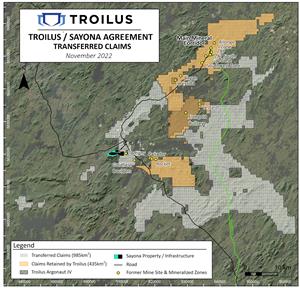

MONTREAL, Nov. 16, 2022 (GLOBE NEWSWIRE) -- Troilus Gold Corp. (“Troilus” or the “Company”, TSX: TLG; OTCQX: CHXMF) is pleased to announce that the Company has entered into a definitive agreement (the “Agreement”), pursuant to which Troilus has agreed to sell a package of 1,824 claims which represents an area of approximately 985 square kilometres (the “Transferred Claims”) to a subsidiary of Sayona Mining Limited (“Sayona”) by way of an asset sale (the “Sale”). The Transferred Claims do not include any of the claims on which Troilus has a current National Instrument 43-101 (“NI 43-101”) gold and copper resource estimate on which its Preliminary Economic Assessment (“PEA”) from August 2020 was based (the “Main Mineral Corridor”), nor do the Transferred Claims include ground where the majority of recent exploration activities were undertaken by Troilus (see Figure 1). The Transferred Claims do include land that currently hosts the Tortigny deposit, which is located adjacent to existing Sayona properties and infrastructure, including its Moblan Project (see Figure 1).

As consideration for the Sale, Troilus shall receive 184,331,797 ordinary Shares of Sayona to be issued at closing (the “Consideration Shares”), at a price of C$0.217 per Consideration Share, representing an aggregate value of C$40 million. As additional consideration, Troilus shall be granted a 2% net smelter returns royalty (“NSR”) on all mineral products from the Transferred Claims. Concurrently with entering into the Agreement for the foregoing transaction, Sayona has agreed to subscribe for approximately C$4.8 million worth of common shares of Troilus (“Common Shares”) on a non-brokered private placement basis (the “Private Placement”), bringing Sayona’s investment in Troilus to approximately 9.26%.

Justin Reid, CEO of Troilus, commented, “We are pleased to welcome Sayona as a major shareholder, joining Investissement Quebec, their partner in the Moblan Lithium Project. The Sale is for claims considered at present to be non-core assets of the Company as our current focuses are on the development and exploration of well-defined targets over the 400 square kilometres that we have retained all while advancing the development of the Troilus Project. Nevertheless, given the opportunity for continued discovery and the prospective nature of the ground being transferred, we are excited to maintain exposure through a 2% NSR. We look forward to working with Sayona in the spirit of collaboration and cooperation as future developers and producers in this exciting region. Upon closing of the Private Placement and the issuance of the Consideration Shares, Troilus will have cash and marketable securities that will provide strong financial flexibility over the coming years as we move through continued exploration, engineering and permitting.”

Sayona Mining Managing Director and CEO Brett Lynch commented, “Sayona is pleased to become a large and long-term shareholder of Troilus. Troilus and Sayona each hold development assets and significant infrastructure in the area, which will provide the opportunity for great synergy to benefit both companies moving forward. We look forward to working closely with the Troilus team and see the value opportunity in our investment and land acquisition as we develop and expand the Moblan Project.”

Benefits to Troilus Shareholders

- Significantly accretive to Troilus shareholders – unlocking substantial value in exchange for a non-core land package;

- Allows the Company to continue to advance its engineering focused on the Main Mineral Corridor which is not part of the Transferred Claims;

- Maintains growth potential – Transferred Claims are not subject to the majority of recent exploration activities undertaken by Troilus; and

- Provides for collaboration and technical/infrastructure synergies to be recognized by both Troilus and Sayona as the predominant development projects within the Frotêt Evans Greenstone Belt.

Figure 1: Transferred Claims & Excluded Claims

Terms of the Agreement

Under the terms of the Agreement, Sayona will issue 184,331,797 Consideration Shares to Troilus with a value of C$40 million at an issue price equivalent to C$0.217 per Consideration Share (the “Issue Price”). The Consideration Shares will be unrestricted and free trading in Australia and subject only to any trading restrictions imposed by applicable regulatory and/or securities laws for trading in Canada.

In addition, Troilus has been granted a 2% NSR on all mineral products from the Transferred Claims. Sayona will have the right to repurchase 100% of the NSR for C$20 million in cash at any time from the date that is 30 days prior to the first occurring commencement of commercial production on any of the Transferred Claims. The royalty payor shall be the holder of the Transferred Claims.

Private Placement

In addition to the foregoing consideration, pursuant to the Private Placement, Sayona has agreed to subscribe, on a non-brokered private placement basis, for 9,883,163 Common Shares at a price of C$0.49 per share for aggregate gross proceeds to Troilus of C$4,842,749.87. Upon completion of the Private Placement, Sayona is expected to hold approximately 9.26% of the issued and outstanding Common Shares, including the Common Shares it already owns. In connection with the Private Placement, Sayona will be granted certain participation rights to maintain its equity interest so long as it maintains said interest at or above 5%.

The Private Placement remains subject to applicable regulatory approvals, including the final approval of the Toronto Stock Exchange and the availability of a private placement exemption under Australian securities law.

The Company intends to use the net proceeds of the Sale and Private Placement for working capital and general corporate purposes.

Conditions Precedent and Closing Date

The Sale and the Private Placement are subject to certain closing conditions, including the receipt of any necessary final approvals by the TSX in respect of the Private Placement. Closing of the Sale and the Private Placement is expected to occur shortly after this announcement.

Advisors and Counsel

Cormark Securities Inc. is acting as financial advisor and Cassels Brock & Blackwell LLP is acting as legal counsel to Troilus.

Qualified Person

The technical and scientific information in this press release has been reviewed and approved by Kyle Frank, P.Geo., Manager of Exploration, who is a Qualified Person as defined by NI 43-101. Mr. Frank is an employee of Troilus and is not independent of the Company under NI 43-101.

About Troilus Gold Corp.

Troilus Gold Corp. is a Canadian-based junior mining company focused on the systematic advancement and de-risking of the former gold and copper Troilus Mine towards production. From 1996 to 2010, the Troilus Mine produced +2 million ounces of gold and nearly 70,000 tonnes of copper. Troilus is located in the top-rated mining jurisdiction of Quebec, Canada, where, assuming completion of the Sale, it will hold a land position of 435 km² in the Frotêt-Evans Greenstone Belt. Since acquiring the project in 2017, ongoing exploration success has demonstrated the tremendous scale potential of the gold system on the property with significant mineral resource growth. The Company is advancing engineering studies following the completion of a robust PEA in 2020, which demonstrated the potential for the Troilus project to become a top-ranked gold and copper producing asset in Canada. Led by an experienced team with a track-record of successful mine development, Troilus is positioned to become a cornerstone project in North America.

For more information:

Justin Reid

Chief Executive Officer, Troilus Gold Corp.

+1 (647) 276-0050 x 1305

justin.reid@troilusgold.com

Caroline Arsenault

VP Corporate Communications

+1 (647) 407-7123

info@troilusgold.com

The Common Shares issued in relation to the Private Placement have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor will there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Cautionary Note Regarding Forward-Looking Statements and Information

This press release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding the expected closing of the Sale and Private Placement and the timing thereof, the anticipated benefits of the Sale and Private Placement for the parties thereto and their shareholders, timing of the completion of the transactions, expected regulatory approvals, future results of operations, performance and achievements of the parties to the transaction, the intended use of proceeds, Troilus’ growth potential and the ability of Troilus to continue engineering and other activities. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “continue”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are made based upon certain assumptions and other important facts that, if untrue, could cause the actual results, performances or achievements of Troilus to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Troilus will operate in the future. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, currency fluctuations, the global economic climate, dilution, share price volatility and competition. Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Troilus to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: uncertainties with respect to obtaining all regulatory approvals; risks of the benefits of the transactions not being realized; there being no assurance that the exploration program will result in expanded mineral resources; risks and uncertainties inherent to mineral resource estimates; the impact the COVID 19 pandemic may have on the Company’s activities (including without limitation on its employees and suppliers) and the economy in general; the impact of the recovery post COVID 19 pandemic and its impact on gold and other metals; the receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future prices of mineral prices; accidents, labour disputes and shortages; environmental and other risks of the mining industry, including without limitation, risks and uncertainties discussed in the most recent Technical Report and in other continuous disclosure documents of the Company available under the Company’s profile at www.sedar.com. Although Troilus has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Troilus does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/62644bc5-a1fa-49f7-8988-19e8080809a2