Vanadium One and Glencore Enjoin to Support Development of the Mont Sorcier Iron and Vanadium Project

- Glencore to assist in arranging funding to deliver Bankable Feasibility study for the Mont Sorcier project

- Eight Year Offtake Agreement securing market access for 100% of

Mont Sorcier production

TORONTO, ON / ACCESSWIRE / May 12, 2021 / Vanadium One Iron Corp. ("Vanadium One" or the "Company") (TSXV:VONE), is very pleased to announce that it has entered into a long-term arrangement with a wholly owned subsidiary of Glencore plc ("Glencore") to support the development of the Mont Sorcier Iron and Vanadium project located in Chibougamau, Quebec. The parties have entered into a Finance Raising Assistance Agreement ("FR Agreement") and a separate Concentrate Offtake Agreement "Offtake Agreement") to support the ongoing development and the eventual construction and production of the Mont Sorcier iron and vanadium project.

Cliff Hale-Sanders, President and CEO stated "We are extremely pleased to be entering into this long-term relationship with Glencore; one of the world's largest commodity traders in both the iron ore and vanadium markets. We believe this partnership offers shareholders, not only a way to expedite development, but also the best opportunity to maximize the value of future production utilizing Glencore's worldwide reach, thus unlocking the robust potential we see at Mont Sorcier as outlined in our Preliminary Economic Assessment. With Glencore's support, we plan to deliver a Bankable Feasibility Study at Mont Sorcier." He continued, "Our preference would be to find a strong technical and financial partner who can help us maximize the value chain as we bring Mont Sorcier to production, that said, we have the very capable technical nucleus to commence our journey."

Under the terms of the FR Agreement, Glencore will undertake to assist Vanadium One in raising not less than US$10 million, either directly or indirectly, in project financing to support the completion of a Bankable Feasibility study on the Mont Sorcier project. Such funding is to be secured no later than year end 2021. Glencore is expected to facilitate the arrangement of at least US$8MM of this funding requirement. The structure of such financing remains to be determined through negotiations and on terms acceptable to Vanadium One. The use of proceeds will be used to deliver the feasibility study, upgrading the classification of the resource, enhanced metallurgical test work and project engineering. In addition, a portion of the proceeds will be dedicated for community agreements, related environmental studies and the initiation of the permitting process.

Upon the successful fulfillment of the FR Agreement, Vanadium One will grant to Glencore an eight (8) year Offtake Agreement for 100% of the annual production from the Mont Sorcier iron and vanadium project. The key terms of the Offtake Agreement are as follows:

- Initial term of eight (8) years, extendable by mutual agreement, for 100% of annual vanadium rich iron concentrate produced;

- Glencore will be granted a life of mine offtake agreement if it provides equity or debt funding for project construction on terms acceptable to Vanadium One;

- Vanadium One retains the right to claw back 50% of the annual offtake, if needed, to secure project development funding; and

- In order to secure the best price possible for the vanadium contained within the iron concentrate, Glencore and Vanadium One have negotiated a price participation agreement in the offtake for any premium secured above the Metal Bulletin 65% iron index price for a given quotational period for the product sold. Glencore is obligated to use commercially reasonable endeavours to secure a value for the contained vanadium.

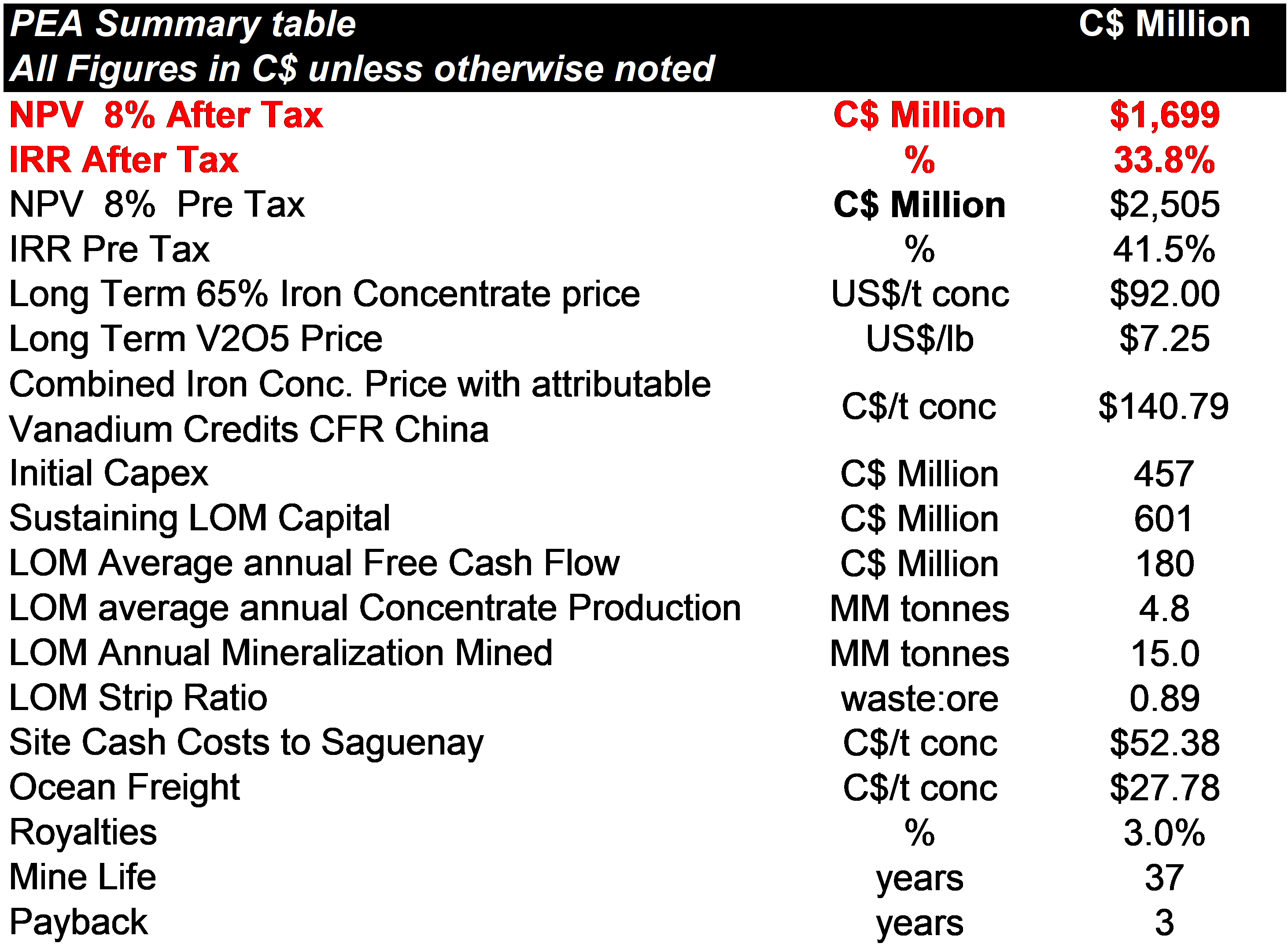

Funding arranged with the support of Glencore will be used to allow Vanadium One to move rapidly to further define the project as outlined in the Technical Report entitled NI 43-101 Technical Report - Preliminary Economic Assessment ("PEA") of the Mont Sorcier Project, Province of Quebec, Canada. The report was completed by CSA Global Consultants Canada Ltd, an ERM Group Company ("CSA Global") and has an effective date of February 27, 2020. The report was prepared in accordance with Canadian Securities Administrators' National Instrument 43-101 ("NI 43-101") Standards of Disclosure for Mineral Projects. A summary of the results is highlighted below:

The results of the PEA are based upon the current Mineral Resource Estimate ("MRE"), published in April 2019, as outlined below. Vanadium One is currently completing the work to increase the resource estimate based on its latest drill program undertaken in Q4/2020. Results are expected to be available shortly.

Mineral Resource Estimate1 at Mont Sorcier Using a Cut-off Grade2 of 14% Fe, effective 23 April 2019 (https://www.vanadiumone.com/news/2019/Indicated-Resource-of-113.5-Million-Tonnes.pdf).

Zone | Category4, 5 | Tonnage | Head grade | Grade in concentrate | |||||||

Rock (Mt) | Concentrate (Mt) | Fe (%) | Magnetite (%) | Fe (%) | V2O5 (%) | Al2O3 (%) | TiO2 (%) | MgO (%) | SiO2 (%) | ||

South | Indicated | 113.5 | 35.0 | 22.7 | 30.9 | 65.3 | 0.6 | 0.3 | 1.2 | 3.8 | 2.8 |

Inferred | 144.6 | 36.1 | 20.2 | 24.9 | 66.9 | 0.5 | 0.4 | 1.0 | 3.4 | 2.5 | |

North | Inferred | 376.0 | 142.2 | 27.4 | 37.8 | 63.7 | 0.6 | 1.0 | 1.8 | 3.5 | 4.2 |

Total | Indicated | 113.5 | 35.0 | 22.7 | 30.9 | 65.3 | 0.6 | 0.3 | 1.2 | 3.8 | 2.8 |

Inferred | 520.6 | 178.3 | 25.4 | 34.2 | 64.4 | 0.6 | 0.8 | 1.7 | 3.5 | 3.9 | |

- 1 Numbers have been rounded to reflect the precision of Inferred and Indicated Mineral Resource estimates.

- 2 The reporting cut-off was calculated for a magnetite concentrate containing 65% Fe with price of $US 90/t of dry concentrate, 50% of the price of V2O5 contained in the concentrate, a V2O5 price of $US 14/lb, a minimum of 0.2 % of V2O5 contained in the concentrate, an open pit mining operation, a cost of mining and milling feed mineralization of USD 13.80/t, a cost of transporting concentrate of USD 40/t; and a cost of tailing disposal of USD 1.5/t.

- 3 Vanadium One is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing or political factors that might materially affect these mineral resource estimates.

- 4 Resource classification, as defined by the Canadian Institute of Mining, Metallurgy and Petroleum in their document "CIM Definition Standards for Mineral Resources and Mineral Reserves" of May 10, 2014.

- 5 Mineral Resources are not Mineral Reserves and by definition do not demonstrate economic viability. This MRE includes inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

The PEA was prepared by CSA Global incorporating contributions from Vulcan Technologies for the Iron and Vanadium Market Pricing Study. The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

The Technical Report is available for review under the Company's profile on SEDAR and on the Company's website.

Technical Disclosure

The reader is advised that the PEA summarized in this news release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Qualified Persons Statements

The Mineral Resource Estimate and other scientific and technical information contained in this news release were prepared by CSA Global, in accordance with the Canadian regulatory requirements set out in National Instrument 43- 101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has been reviewed and approved by, as it relates to geology, sampling, drilling, exploration, QAQC and mineral resources: Dr. Luke Longridge, Ph.D., P.Geo, Senior Geologist (CSA Global); as it relates to metallurgy, processing and related infrastructure: Georgi Doundarov, M.Sc., P. Eng., PMP, CCP, Associate Metallurgical Engineer (CSA Global); as it relates to mining, related infrastructure, and mining costs: Karol Bartsch, BSc Mining (Hons), MAusIMM, Principal Mining Engineer (CSA Global); and as it relates to financial modelling and economic analysis: Bruce Pilcher, B.E. (Mining), Eur Ing, CEng, FIMMM, FAusIMM CP, Principal Mining Engineer (CSA Global). Dr. Luke Longridge, Georgi Doundarov, Karol Bartsch and Bruce Pilcher are all independent Qualified Persons ("QP"), as defined under NI 43-101.

The technical information contained in this news release has been reviewed and approved by Pierre-Jean Lafleur, P.Eng. (OIQ), who is a Qualified Person with respect to the Company's Mont Sorcier Project as defined under National Instrument 43-101.

About Glencore

Glencore is one of the world's largest global diversified natural resource companies and a major producer and marketer of more than 60 responsibly-sourced commodities that advance everyday life. The Group's operations comprise around 150 mining and metallurgical sites and oil production assets.

With a strong footprint in over 35 countries in both established and emerging regions for natural resources, Glencore's industrial activities are supported by a global network of more than 30 marketing offices. Glencore's customers are industrial consumers, such as those in the automotive, steel, power generation, battery manufacturing and oil sectors. We also provide financing, logistics and other services to producers and consumers of commodities. Following the completion of the sale, Glencore's companies employ around 135,000 people, including contractors.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. We are an active participant in the Extractive Industries Transparency Initiative. Our ambition is to be a net zero total emissions company by 2050.

About Vanadium One Iron Corp.:

Vanadium One Iron Corp. is a mineral exploration and development company headquartered in Toronto, Canada. The Company is focused on advancing its 100% held Mont Sorcier, Vanadium-rich, Magnetite Iron Ore Project, in Chibougamau, Quebec. The Mont Sorcier Iron ore property hosts a large high quality magnetite iron resource with significant and extractable vanadium in a top tier mining jurisdiction. The project is located just 18 km outside of Chibougamau close to existing road, rail, low-cost hydro power and with access to deep water ports for export to global markets. Based upon recent and historical metallurgical test work Mont Sorcier is expected to produce a premium iron ore premium product (65-67% Fe) containing approximately 0.6% vanadium. .

ON BEHALF OF THE BOARD OF DIRECTORS OF VANADIUM ONE IRON CORP.

Cliff Hale-Sanders, President & CEO

Tel: 416-819-8558

csanders@vanadiumone.com

www.vanadiumone.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" including statements with respect to the future exploration performance of the Company. This forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements of the Company, expressed or implied by such forward-looking statements. These risks, as well as others, are disclosed within the Company's filing on SEDAR, which investors are encouraged to review prior to any transaction involving the securities of the Company. Forward-looking information contained herein is provided as of the date of this news release and the Company disclaims any obligation, other than as required by law, to update any forward-looking information for any reason. There can be no assurance that forward-looking information will prove to be accurate and the reader is cautioned not to place undue reliance on such forward-looking information.

SOURCE: Vanadium One Iron Corp.

View source version on accesswire.com:

https://www.accesswire.com/646651/Vanadium-One-and-Glencore-Enjoin-to-Support-Development-of-the-Mont-Sorcier-Iron-and-Vanadium-Project