Vanadium One Closes First Tranche of Non-Brokered Private Placement of Common Share Units and Flow Through Share Units

- Proceeds to be used to drill 3,500 meters to expand resources at its Mont Sorcier project in Quebec

- RAB Capital to become a reporting insider of the Company

TORONTO, ON / ACCESSWIRE / August 17,2020 / Vanadium One Iron Corp. ("Vanadium One" or the "Company") (TSXV:VONE), ) is pleased to announce that it has closed the first tranche of the hard dollar unit segment of the previously announced non-brokered private placement (the "Offering") of common share units (the "Units")in the amount of C$459,000 subject to final approval from the TSX Venture Exchange (‘TSXV'). In addition, the Company is pleased to announced it has commitments for 6,000,000 Units of its offering of Flow Through Share Units for anticipated gross proceeds of C$1,080,000, which is planned to close on or around August 21, 2020 in conjunction with the Flow Through segment of the Offering.

In connection with the closing of the first tranche of the Offering the Company has issued 4,590,000 Units at a price of $0.10 per Unit for gross proceeds of C$459,000. Each Unit consists of one common share of the Company ("Share") plus one common share purchase warrant of the Company. Each Warrant shall entitle the holder to purchase one Share at a price of $0.15 for a period of 2 years following the Closing Date of the Offering.

Upon closing of the second tranche of the private placement, Vanadium One Iron is pleased to announce that RAB Capital will become a reporting insider of the Company and hold approximately 11 % of the basic shares outstanding. Philip Richards, Founder and President of RAB Capital stated "RAB Capital is investing because it believes Vanadium One's Mont Sorcier project is a world class asset and will generate strong strategic interest following the resource expansion expected from the current drill program. In addition to its premium product offering, the project is ideally situated with all major infrastructure in place and located in a world class mining and operating jurisdiction that will encourage future development."

Mark Brennan, Executive Chairman commented, "We are extremely delighted to have Philip and RAB Capital join Vanadium One Iron as a significant shareholder to support our efforts to make the Mont Sorcier project a reality. We view RAB Capital's strong support as highlighting the significant value potential we aim to unlock at Mont Sorcier."

The securities issued pursuant to the Offering will be subject to a four (4) month plus one (1) day statutory hold period. No finders fee was paid in connection with the Offering.

Approximately 39% of the total Offering under the Hard Dollar segment was taken up by Directors and Officers of the Company. As certain insiders of Vanadium One participated in the Offering, it is deemed to be a "related party transaction" as defined under Multilateral Instrument 61-101-Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is exempt from the formal valuation requirement of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(b) of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101 pursuant to Subsection 5.7(a) of MI 61-101.

The Company intends to use the gross proceeds of the Offering to fund costs to continue exploration and further definition of the Company's Mont Sorcier Iron and Vanadium Property and for general administration purposes.

Project Update

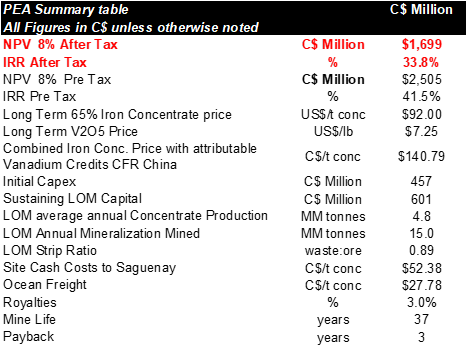

With robust iron ore market conditions continuing as global economies begin to lift recent restrictions related to COVID 19, Vanadium One is excited to get back into the field and continue to enhance the robust results published for the Mont Sorcier Project through its Preliminary Economic Assessment ("PEA") released early this year (February 27, 2020). The Company notes current 65% grade iron concentrates are trading at over US$125/t, well in excess of the US$92/t assumption that underpins the PEA. Going forward Vanadium One anticipates strong demand to continue as governments look to increase infrastructure funding to increase employment.

With funds in place, the Company plans to undertake a drill program of approximately 3,500 metres focusing on expanding the current resource at Mont Sorcier and deliver a new Mineral Resource Estimate by year end. The aim of the drill program is to increase the current resources to between 900 million to 1.1 billion tonnes at grades of between 24-34% magnetite. This is similar to the grade profile of the current resource. Investors are cautioned that this resource target is conceptual in nature at this time and there has been insufficient exploration to define a new mineral resource. In addition, the company plans to continue its ongoing discussions with various potential strategic partners to move the project forward.

The drill results are expected to enhance the value presented in the PEA as outlined in the Technical Report entitled "NI 43-101 Technical Report - Preliminary Economic Assessment (PEA) of the Mont Sorcier Project, Province of Quebec, Canada". The report was completed by CSA Global Consultants Canada Ltd, an ERM Company (CSA Global) and has an effective date of February 27, 2020. The report was prepared in accordance with Canadian Securities Administrators' National Instrument 43-101 ("NI 43-101") Standards of Disclosure for Mineral Projects. A summary of the results is highlighted below:

PEA Summary Results

The PEA was prepared by CSA Global incorporating contributions from Vulcan Technologies for the Iron and Vanadium Market Pricing Study. The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

The Technical Report is available for review under the Company's profile on SEDAR and on the Company's website.

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Qualified Persons Statements

The PEA and other scientific and technical information contained in this news release were prepared by CSA Global, in accordance with the Canadian regulatory requirements set out in National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has been reviewed and approved by, as it relates to geology, sampling, drilling, exploration, and QAQC : Dr. Luke Longridge, Ph.D., P.Geo, Senior Geologist (CSA Global); as it relates to mineral resources: Dr. Adrian Martinez Vargas, Ph.D., P.Geo, Senior Resource Geologist (CSA Global); as it relates to metallurgy, processing and related infrastructure: Georgi Doundarov, M.Sc., P. Eng., PMP, CCP, (Magemi Mining Inc.) and Associate Metallurgical Engineer (CSA Global); as it relates to mining, related infrastructure, and mining costs: Karol Bartsch, BSc Mining (Hons), MAusIMM, Principal Mining Engineer (CSA Global); and as it relates to financial modelling and economic analysis: Bruce Pilcher, B.E. (Mining), Eur Ing, CEng, FIMMM, FAusIMM CP, Principal Mining Engineer (CSA Global) and Alex Veresezan, M.Sc., P.Eng., Manager - Mining (Americas). Dr. Luke Longridge, Dr. Adrian Martinez Vargas, Georgi Doundarov, Karol Bartsch, Bruce Pilcher and Alex Veresezan are all independent Qualified Persons ("QP"), as defined under NI 43-101.

The technical information contained in this news release has been reviewed and approved by Pierre-Jean Lafleur, P.Eng. (OIQ), who is a Qualified Person with respect to the Company's Mont Sorcier Project as defined under National Instrument 43-101.

About Vanadium One Iron Corp.:

Vanadium One Iron Corp. is a mineral exploration company headquartered in Toronto, Canada. The Company is focused on advancing its Mont Sorcier, Vanadium-rich, Magnetite Iron Ore Project, in Chibougamau, Quebec.

NOT FOR DISTRUBITION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

ON BEHALF OF THE BOARD OF DIRECTORS OF VANADIUM ONE IRON CORP.

Cliff Hale-Sanders, President & CEO

Tel: 416-819-8558

csanders@vanadiumone.com

www.vanadiumone.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" including statements with respect to the future exploration performance of the Company. This forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements of the Company, expressed or implied by such forward-looking statements. These risks, as well as others, are disclosed within the Company's filing on SEDAR, which investors are encouraged to review prior to any transaction involving the securities of the Company. Forward-looking information contained herein is provided as of the date of this news release and the Company disclaims any obligation, other than as required by law, to update any forward-looking information for any reason. There can be no assurance that forward-looking information will prove to be accurate and the reader is cautioned not to place undue reliance on such forward-looking information.

SOURCE: Vanadium One Iron Corp.

View source version on accesswire.com:

https://www.accesswire.com/601841/Vanadium-One-Closes-First-Tranche-of-Non-Brokered-Private-Placement-of-Common-Share-Units-and-Flow-Through-Share-Units