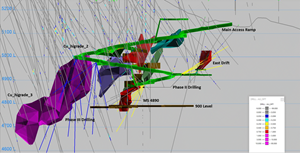

Vulcan 3-D Modelling Defines Significant Zones at Madison, Underground Phase II & III Drilling Planned

NOT FOR DISTRIBUTION IN THE UNITED STATES OR FOR DISSEMINATION TO US NEWSWIRE SERVICES

OAKVILLE, Ontario, Jan. 31, 2019 (GLOBE NEWSWIRE) -- Broadway Gold Mining Ltd. (“Broadway” or the “Company”) (TSX-V:BRD) (OTCQB:BDWYF) is pleased to announce that it has completed a Vulcan 3-D model of its Madison Project in the Butte-Anaconda region of Montana. Based on the positive results generated, Broadway is planning a new multi-phased underground diamond drilling program. The Phase II and III programs will target the expansion of known high-grade gold and copper massive sulphide and skarn zones of mineralization. Previous Madison mine test stope production grades between 2005 – 2011, based on mill settlement statements of 13,242 tonnes, average 25% copper and 17.8 grams per tonne gold, which included a mill settlement of a bulk sample of 2,429 tonnes of 35% copper and 1,372 tonnes of 23.0 grams per tonne gold.

Development of the Vulcan 3-D model utilized all available underground 2-D mine working plans as well as underground and surface diamond-core drill results from 150 holes, incorporating 62,329 feet (18,998 m) of drilling. Phil Mulholland, Broadway’s chief geologist, supervised the modelling work.

The follow-up multi-phase drill program is supported by the 3-D model as shown in Figure 1. A Phase II drill program will evaluate two high grade gold zones: the “MS 4890,” a massive sulphide gold skarn; and, the “East Drift,” a zone of mixed massive sulfide and skarn. The Phase III drill program will target a third zone between the “Cu_higrade_2” and “Cu_higrade_3” zones, a copper-rich skarn.

The MS 4890 is a block of 2,177 tonnes averaging 24.96 grams per tonne gold and 1.10 % copper. The East Drift zone is defined by three holes: 86-6, 25.71 grams per tonne Au over 7.3 meters; 88-C9, 11.3 grams per tonne Au over 8.8 meters; and C06-13, 10.6 grams per tonne Au over 12.2 meters. Cu_higrade_2 is a zone of 86,767 tonnes of 3.46% Cu; and, Cu_higrade_3 is a zone of 86,736 tonnes of 2.61% Cu.

The Company is currently budgeting a 2,200-foot (670 meters) Phase II program consisting of twelve diamond drill holes from two underground stations. Seven core holes, representing 1,200 feet (366 meters), will be dedicated to the MS 4890 zone. Five core holes, approximately 1,000 feet (305 meters), will be dedicated to the East Drift. It is anticipated the MS 4890 drill results will extend that zone 100 vertical feet down dip, connecting mineralization of the Madison mine to the adjacent Broadway mine’s 900 level. The Broadway Mine has produced 144,000 ounces of gold at 0.32 oz/ton (11 grams per tonne).

Upon completion of the Phase II program, a Mise-a-La–Masse geophysical survey will be used to map the geometry of the conductive massive sulphide body at depth. This approach was successful at Madison in 2017 when it was used to delineate the massive sulphide ore body at depth from surface. Mise-a-la-Masse is a geophysical method developed by Boliden AB to measure the conductivity and, thereby, the shape of a massive sulphide mineralized body. With improved understanding of the geometry and orientation of the known massive sulphide mineralization, the Company expects to improve targeting of future drilling.

“Mise-a-la-Masse is to drilling massive sulphide ore bodies as leapfrogging is to startup businesses,” said Thomas Smeenk, CEO. “Each underground massive sulphide zone can be shaped by its conductivity. That geometry and orientation enables the team to drill more statistically significant results.”

The Company intends to raise $490,000 in a non-brokered private placement of seven million units. Each unit consists of a common share at $0.07 and one half share purchase warrant. Each whole Warrant may be exercised at $0.15 to acquire a common share of the Company within 12 months from date of closing. A Commission of 8% of proceeds raised may be paid to brokers and qualified finders.

About Broadway Gold Mining Ltd.

Through its wholly owned Montana-based subsidiary, Broadway Gold Corp., the Company is focused on the exploration and development of its two mines, the Broadway and Madison mines, and the discovery of the porphyry source of their mineralization. The Company owns a 100% interest in the two mines and has staked an area of four-square-miles in the Butte-Anaconda region of Montana, a porphyry-based mining district. The Company is permitted for mining and exploration. Approximately $20 million has been invested in the exploration, development and bulk sampling of the Madison mine since 2005. Whereas the Broadway mine produced 144,000 ounces of gold at an average grade of 0.32 Oz/ton (11 grams per tonne) Au from 1880 – 1950, the Madison produced bulk samples of 13,242 tonnes at an average grade of 25% Cu and 11 grams per tonne gold from 2005-2011. The Company is expanding known copper and gold zones that are open to depth with a 2,200 foot (670 meter) infill drill program; working a surface exploration program that has identified new anomalies along the two-mile contact zone; seeking a senior mining company to drill porphyry targets identified by its soil geochemistry, its geophysics, and its discovery of Latite porphyry in holes C17-24 and C17-C27 (see news release dated January 22, 2018) that appear to be of significant size with intercepts to-date measuring up to 234 meters, open in all directions.

For more information:

Thomas Smeenk, BA

President and CEO

Broadway Gold Mining Ltd.

1-800-680-0661

IR@broadwaymining.com

www.broadwaymining.com

Media:

Adam Bello

Primoris Group Inc.

+1 416.489.0092

media@primorisgroup.com

Forward-Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release or other future plans, objectives or expectations of Broadway are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Broadway's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating commodity prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by Broadway with securities regulators. Broadway expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Neither the TSX Venture Exchange Inc. nor its regulation services provider (as that term is defined in the policies of The TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/6e5a3cbc-4fc3-4bba-8c7e-f1483a760b45