Wallbridge Commences 20,000-metre Regional Drill Program on its 910 km2 Detour-Fenelon Land Package starting at the Martini??re Gold Property

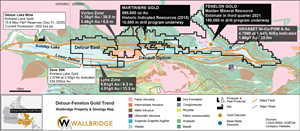

TORONTO, July 22, 2021 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX:WM) (“Wallbridge” or the “Company”) is pleased to announce that it is initiating a 20,000-metre regional drill program, part of the Company’s planned 170,000-metre 2021 drill program, starting at the Martinière Gold Project (“Martinière” or the “Property”), located 30 kilometres west of its flagship Fenelon Gold Property (“Fenelon”) and 45 kilometres east of Kirkland Lake Gold’s Detour Lake Gold mine (see Fig. 1).

Located in Québec’s northern Abitibi Greenstone Belt, the Detour-Fenelon Gold Trend has demonstrated potential for world-class gold deposits, yet it remains highly underexplored in comparison to the other prolific gold belts in the southern portion of the Abitibi, like the Timmins-Porcupine, Kirkland Lake and Val d’Or camps. Spanning 97 kilometres in east-west direction within this belt (roughly equivalent to the distance between Rouyn-Noranda and Val d’Or), Wallbridge’s extensive, 910 km2 regional Detour-Fenelon land package offers excellent potential for new gold discoveries and the Company has selected Martinière as its second priority area after Fenelon.

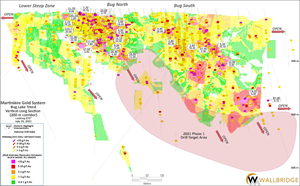

Martinière has a historic indicated resource of approximately 591,000 gold ounces, reported by the previous owner, Balmoral Resources (“Balmoral”) in March 2018 (see details in Table 2). The mineralization extends over a known area of approximately 2 by 1.8 kilometres and has been traced down to 700 metres vertical depth by sporadic drill holes (see Figs. 2, 3 and 4). Most of the drilling, however, is restricted to the top 300 metres from surface and the Company believes there is excellent potential to expand the known zones both along strike and down-plunge.

A review of the geology and the controls on gold deposition at Martinière, has identified a number of attractive exploration targets and opportunities for expansion of the historic resource.

“We are very excited to kick-off our regional exploration program on Martinière, our second most advanced gold project after Fenelon,” stated Marz Kord, President & CEO of Wallbridge. “The quality of the gold mineralization at Martinière, as highlighted by the historic intersections reported in Table 1, shows many similarities to our Fenelon gold system and gives us confidence that we can replicate the discovery success we have achieved at Fenelon. All the zones remain open along strike and at depth with very little drill testing below 300 metres vertical depth.”

“Our team has completed a detailed review of the historic data, as well as re-interpretation and 3D modelling of the geology at Martinière in preparation for this initial drill program and an updated Martinière mineral resource estimate that is to be reported along with the Fenelon maiden mineral resource estimate,” explained Attila Péntek, Vice President Exploration of Wallbridge. “Previous operators, especially Balmoral Resources, have demonstrated that Martinière hosts an extensive gold system over a footprint of several kilometres in diameter and we now have the opportunity to build on this past work to thoroughly evaluate this prospective property.”

Planned 2021 Regional Drill Program

A surface drill rig was mobilized to the Property this week with plans to complete an approximate 10,000-metre Phase 1 drill program focusing on the following:

- Near-surface targets to extend known mineralized zones along strike with the objective of increasing the open pit portion of the mineral resource (see Fig. 3);

- Targets at depth to follow known high-grade shoots to depth and thereby increasing the underground, high-grade resource potential (see Fig. 4);

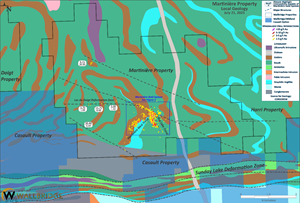

- High-priority geological-geophysical targets and isolated historical gold intersections property-wide to discover new mineralized gold zones (see Fig. 2).

The Phase 1 drill program is expected to be completed by the end of October, and the results will be used to prioritize drill targets for a Phase 2 drill program, which will commence right after Phase 1, or in early 2022.

In early August, a second regional drill rig will be mobilized to the Casault Project, which is under option from Midland Exploration Inc., to test drill targets within 5 kilometres west of Martinière and to carry out drilling on other regional exploration targets.

About the Martinière Gold Project

Martinière is located within Wallbridge’s 910 km2 Detour-Fenelon Gold Trend land package, which extends over 97 kilometres in an East-West direction along the Sunday Lake Deformation Zone (“SLDZ”), a major structure that controlled the emplacement of Kirkland Lake Gold’s Detour Lake deposit, 45 kilometres west of Martinière, and the Company’s Fenelon Gold System, located 30 kilometres to the east of Martinière (see Fig. 1).

Gold on the Martinière project was discovered in 1997 by Cyprus Canada Inc. and subsequently the property was explored by International Taurus Resources Inc. and American Bonanza. Balmoral acquired Martinière in November 2010 and, from 2011 to 2017, drilled over 130,000 metres and reported an initial mineral resource estimate in March 2018. Their work expanded the historical intercepts on the project into the Bug and Martinière West gold deposits and identified several additional zones and showings, including VMS mineralization.

The Martinière Gold System extends over a known area of approximately 2 by 1.8 kilometres and has been traced down by sporadic drill holes to 700 metres vertical depth, with most drilling, however, focusing only on the top 300 metres from surface. The gold system is divided into the Bug deposits (Bug Lake North and South), which were emplaced along the Bug Lake Porphyry; the Martinière West deposit, hosted by a gabbroic intrusion; and other less explored mineralized zones along strike or near these deposits (Horsefly Zone, Central Zone, NW Extension and others) (see Fig. 3).

The Martinière Gold System is most likely part of the orogenic class of gold deposits and high-grade, structurally controlled gold mineralization is generally surrounded by a broader, lower grade halo. Table 1 compiles highlight historic drill results (> 100 metal factor; metal factor = gold grade multiplied by core length) from Balmoral’s drill programs completed between 2011 and 2017.

Table 1. Martinière Highlight Drill Results (> 100 Metal Factor) from 2011-2017 Drilling by Balmoral Resources

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Metal Factor (1) | ||

| MDE-14-143 | 88.30 | 116.40 | 28.00 | 170.70 | 4785 | ||

| MDE-12-29 | 166.00 | 173.80 | 7.80 | 117.30 | 913 | ||

| MDE-15-166 | 118.80 | 163.20 | 44.50 | 18.10 | 806 | ||

| MDE-15-170 | 105.50 | 116.40 | 10.90 | 21.90 | 240 | ||

| MDW-13-88 | 97.30 | 123.30 | 26.00 | 9.10 | 237 | ||

| MDE-12-39 | 35.60 | 36.50 | 1.00 | 195.50 | 190 | ||

| MDW-11-04 | 80.30 | 100.70 | 20.40 | 8.80 | 180 | ||

| MDE-14-145 | 59.00 | 138.20 | 79.20 | 2.20 | 176 | ||

| MDW-11-17 | 52.50 | 74.00 | 21.50 | 7.80 | 167 | ||

| MDE-12-60 | 172.40 | 174.80 | 2.40 | 67.60 | 165 | ||

| MDE-13-122A | 186.60 | 192.80 | 6.20 | 26.40 | 164 | ||

| MDE-16-205 | 202.20 | 204.50 | 2.30 | 67.90 | 157 | ||

| MDW-11-01 | 106.00 | 118.00 | 12.00 | 12.90 | 155 | ||

| MDE-15-173 | 119.10 | 141.60 | 22.50 | 6.90 | 154 | ||

| MDE-12-72 | 25.70 | 32.50 | 6.70 | 22.60 | 152 | ||

| MDE-12-65 | 60.60 | 80.30 | 19.70 | 7.70 | 151 | ||

| MDE-15-175A | 172.00 | 187.70 | 15.80 | 9.00 | 142 | ||

| MDE-12-56 | 106.00 | 107.00 | 1.00 | 138.00 | 138 | ||

| MDE-16-242A | 162.20 | 240.40 | 78.20 | 1.60 | 127 | ||

| MDE-15-184 | 74.90 | 83.40 | 8.50 | 14.70 | 125 | ||

| MDW-11-19 | 135.50 | 164.10 | 28.60 | 4.20 | 121 | ||

| MDE-15-168 | 199.40 | 210.40 | 11.00 | 10.90 | 120 | ||

| MDE-16-221 | 110.90 | 137.80 | 26.90 | 4.40 | 118 | ||

| MDE-14-143 | 395.30 | 402.80 | 7.50 | 15.50 | 116 | ||

| MDE-16-218 | 148.70 | 189.00 | 40.30 | 2.80 | 112 | ||

| MDE-12-20 | 41.00 | 50.30 | 9.30 | 11.30 | 105 | ||

| MDE-12-83 | 18.10 | 27.00 | 8.90 | 11.70 | 105 | ||

| MDE-11-01 | 57.00 | 75.60 | 18.60 | 5.60 | 104 | ||

| MDW-11-24a | 120.70 | 124.40 | 3.70 | 27.50 | 103 | ||

| MDE-16-216 | 206.40 | 231.50 | 25.10 | 4.10 | 103 | ||

| MDW-11-22 | 67.50 | 68.90 | 1.40 | 74.50 | 101 | ||

| MDW-11-30 | 142.00 | 144.30 | 2.30 | 43.40 | 101 | ||

| MDE-14-147 | 288.30 | 296.30 | 8.00 | 12.50 | 100 |

1 gold grade multiplied by core length

2018 Historic Resource Estimate and Updated NI 43-101 Resource Estimate

Balmoral reported a mineral resource estimate for the Martinière project in March 2018, which was prepared by Ginto Consulting Inc. (Vancouver, BC) and included separate estimates for the Bug and Martinière West gold deposits (see Table 2).

These “Resources” are deemed historic and should not be relied upon. The qualified persons of the March 2021 Technical Report (see Technical Report filed on March 18, 2021 on SEDAR) have not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although they comply with current NI 43-101 requirements and follow CIM Definition Standards, they are included for illustrative purposes only and the Company is not treating the historical estimate as current mineral resources.

The Company has retained InnovExplo to complete an updated mineral resource estimate on the Property which is expected to be published along with the Fenelon maiden mineral resource estimate in the third quarter of 2021.

Table 2. Martinière 2018 Historic Mineral Resources

| INDICATED | INFERRED | ||||||||

| Au Cut-Off (g/t) | Tonnage (tonnes) | Au Grade (g/t) | Content (oz) | Tonnage (tonnes) | Au Grade (g/t) | Content (oz) | Strip Ratio | ||

| OPEN PIT MINERAL RESOURCES | |||||||||

| 0.5 | 6.827,183 | 1.96 | 431,225 | 132,147 | 2.50 | 10,622 | 11.6 | ||

| UNDERGROUND MINERAL RESOURCES | |||||||||

| 2.5 | 1,092,415 | 4.54 | 159,417 | 231,273 | 5.75 | 42,722 | |||

| TOTAL RESOURCES AT PREFERRED CUT-OFFS | |||||||||

| 0.5/2.5 | 7,919,598 | 2.32 | 590,642 | 363,420 | 4.57 | 53,344 | |||

The assumptions and notes which accompany this initial resource estimate are listed below:

- The Independent and Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101, is Mr. Marc Jutras, P.Eng., M.A..Sc., Principal of Ginto Consulting Inc. The effective date of the Estimate is March 27, 2018.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- While the results are presented undiluted, the reported mineral resources are considered to have reasonable prospects for eventual economic extraction. The near surface mineral resource is constrained within an optimized open pit shell, while the below pit portion of the mineral resource is reported at an elevated gold grade cut-off.

- The estimate includes several discrete zones/sub-zones of mineralization.

- Resources were compiled at gold cut-off grades of 0.5, 0.7 and 1.0 g/t gold for the evaluation of open pit estimates and at 2.0, 2.5 and 3.0 g/t gold for evaluation of underground estimates (see table below). The base case resource estimate is reported at a cut-off grade of 0.5g/t gold for resources constrained within the optimized pit shell and 2.5 g/t gold for resources outside the pit shell.

- Cut-off calculations for calculating the base case resource used: (all USD figures) $1.80/t for overburden removal, $2.00/t for open pit mining, $50.00/t for underground mining, $17.00/t for Processing (for both open pit and underground scenario’s), $2.50/t for G&A costs and mill recovery rates of 91%.

- Gold recovery rates of up to 91% have been achieved in limited testing for the Bug deposit. The Bug deposit comprises the majority of the estimated resource. Gold recoveries of.up to 97% to concentrate, and 72% overall, have been achieved in preliminary testing of theMartinière West Deposit.

- For the open pit scenario pit slopes of 50 degrees were assumed in bedrock and 25 degrees in overburden.

- Calculations used a USD/CAD exchange rate of 1.22 and a gold price of US$1,300 in keeping with current long-term consensus estimates.

- Cut-off grade calculations would have to be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, and mining costs).

- Density values were estimated for all lithological units from measured samples. Density values for the mineralized zones were calculated from a measured density database.

- The resource was estimated using Vulcan software. The estimate is based on results from 490 diamond drill holes (91,988 m). The cut-off date for the drill hole database is January 30, 2018.

- High grade capping was done on composited assay data and established on a per zone basis.

- Compositing was done on drill hole intercepts falling within the mineralized zones (composite length of 1.0 m).

- Resources were evaluated from composited and capped drill hole assays using3-pass ordinary kriging and inverse distance squared interpolation methods in a block model (block size = 2.5 x 2.5 x 2.5 m).

- The Mineral Resources presented herein are categorized as Indicated and Inferred based on drill spacing and geological and grade continuity. Based on the nature of the mineralization, a maximum average distance of composites of 40 m was used for Indicated resources in the Bug Deposit and 35 m in the Martinière West Deposit.

- Ounce (troy) = metric tonnes x grade / 31.10348. Calculations used metric units (metres, tonnes and g/t). Metal contents are presented in ounces.

- The number of metric tonnes and contained ounces were rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects

- The quantity and grade of reported Inferred resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred resources as Indicated or Measured, and it is uncertain if further exploration will result in upgrading them to these categories.

- CIM definitions and guidelines for mineral resources have been followed.

Figure 1. Overview Map of Wallbridge’s Detour-Fenelon land package

https://www.globenewswire.com/NewsRoom/AttachmentNg/5bbf2d3b-b8a1-409d-8234-e8a4694140c0

Figure 2. Geology Map of the Martinière Property

https://www.globenewswire.com/NewsRoom/AttachmentNg/7d4e3482-de30-41f6-b994-0c470a91b0b8

Figure 3. Plan view of the Martinière Gold System

https://www.globenewswire.com/NewsRoom/AttachmentNg/321ee558-068b-4b5a-98ed-1898e1389bcf

Figure 4. Vertical Long Section of the Bug Lake Trend

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bd895ff-1e75-4e7c-b79b-05a72aa7ccd9

Assay QA/QC and Qualified Persons

Drill core samples from Balmoral’s drill programs at Martinière were all submitted for analysis to ALS Canada Ltd. Balmoral’s QA/QC practices and ALS’s analytical methods were described in detail in the 2018 Technical Report on the Property (see Technical Report filed by Balmoral Resources on March 29, 2018 on SEDAR).

Drill core samples from Wallbridge’s 2021 drill program at Martinière are cut and bagged on site and transported to Bureau Veritas Commodities Canada Ltd. for analysis. Samples, along with standards and blanks that are included for quality assurance and quality control, were prepared and analyzed at the laboratories. Samples are crushed to 90% less than 2mm. A 1kg riffle split is pulverized to 85% passing 75 microns. 50g samples are analyzed by fire assay and AAS. Samples >10g/t Au are automatically analyzed by fire assay with gravimetric finish or screen metallic analysis. To test for coarse free gold and for additional quality assurance and quality control, Wallbridge requests screen metallic analysis for samples containing visible gold. These and future assay results may vary from time to time due to re‒analysis for quality assurance and quality control.

The Qualified Person responsible for the technical content of this press release is Peter Lauder, P.Geo, Exploration Manager of Wallbridge.

About Wallbridge Mining

Wallbridge is currently advancing the exploration and development of its 100%‒owned Fenelon Gold property which is located along the Detour‒Fenelon Gold Trend, an emerging gold belt in northwestern Québec. The Company completed approximately 102,000 metres of drilling in 2020 and has begun a fully‒funded 2021 program of approximately 170,000 metres of drilling (including a 20,000-metre regional drill program exclusive of Fenelon) and 2,500 metres of underground exploration development (Phase 1 of a 10,000-metre program). The Company intends to complete a maiden mineral resource estimate on the Fenelon Gold System in the third quarter of 2021.

Wallbridge now holds several kilometres surrounding its rapidly expanding Fenelon discovery providing room for growth, as well as future mine development flexibility. Wallbridge's land holdings in Québec along the Detour‒Fenelon Gold Trend are 910 km2, improving Wallbridge's potential for further discoveries for over 97-kilometre strike length in this underexplored belt.

Wallbridge is also the operator of, and a 17.8% shareholder in, Lonmin Canada Inc., a privately‒held company with a portfolio of nickel, copper, and platinum‒group metals (PGM) projects in Ontario's Sudbury Basin.

This news release has been authorized by the undersigned on behalf of Wallbridge Mining Company Limited.

For further information please visit the Company's website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited

Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682‒9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Investor Relations Advisor

Email: vvargas@wallbridgemining.com

This press release may contain certain “forward‒looking statements” within the meaning of applicable Canadian securities legislation relating to, among other things, the operations of Wallbridge Mining Company Limited (“Wallbridge” or “Company”) and the environment within which it operates. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding future plans and objectives of Wallbridge, future opportunities and anticipated goals, the Company’s portfolio, treasury, management team, timetable to mineral resource estimation, permitting and the prospective mineralization of the properties, are forward‒looking statements that involve various risks, assumptions, estimates and uncertainties. Generally, forward‒looking information can be identified by the use of forward‒looking terminology such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved”. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

By their nature, forward‒looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predicted outcomes could differ materially from those contained in such statements. These risks and uncertainties include, but are not limited to, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other required approval, the actual results of current exploration activities, fluctuations in prices of commodities, fluctuations in currency markets, actual results of additional exploration and development activities at the Company’s projects, capital expenditures, the availability of any additional capital required to advance projects, accidents, or pandemic interruptions.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward‒looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. These statements reflect the current internal projections, expectations or beliefs of the Company and are based on information currently available to the Company.

The Company does not undertake to update any forward‒looking information, except in accordance with applicable securities laws. The Company believes that the expectations reflected in those forward‒looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward‒looking statements included in this press release should not be unduly relied upon by investors as actual results may vary.

Risks and uncertainties about Wallbridge’s business are more fully discussed in the disclosure material filed with the securities regulatory authorities in Canada and available on SEDAR under the Company’s profile at www.sedar.com. Readers are urged to read these materials and should not place undue reliance on the forward‒looking statements contained in this press release.

Covid‒19 ‒ Given the rapidly evolving nature of the Coronavirus (COVID‒19) pandemic, Wallbridge is actively monitoring the situation in order to continue to maintain as best as possible the activities while striving to protect the health of its personnel. Wallbridge' activities will continue to align with the guidance provided by local, provincial and federal authorities in Canada. The Company has established measures to continue normal activities while protecting the health of its employees and stakeholders. Depending on the evolution of the virus, measures may affect the regular operations of Wallbridge and the participation of staff members in events inside or outside Canada.