White Gold Corp. Increases Mineral Resource Estimate by 25% to 1,039,600 Indicated and 508,700 Inferred Ounces of Gold with 2018 Exploration on the White Gold Property, Yukon, Canada

TORONTO, June 10, 2019 (GLOBE NEWSWIRE) -- White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF, FRA: 29W) (the "Company") is pleased to announce an update to its Mineral Resource Estimate on the White Gold property located in Yukon, Canada. The update was performed based on the results of the Company’s 2018 exploration program exploration plan backed by our partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corp (TSX: K, NYSE: KGC).

Highlights Include:

- Indicated Mineral Resource of 1,039,600 gold ounces within 14,330,000 tonnes at 2.26 g/t gold, and Inferred Mineral Resource of 508,700 gold ounces within 10,696,000 tonnes at 1.48 g/t gold, from the Golden Saddle (“GS”) and Arc deposits representing a 25% increase based on 2018 activities.

- 8% increase in Indicated Resources and 80% in Inferred Resources.

- Increases in the Golden Saddle driven by the 2018 GS West Zone discovery, expansion of the GS Main and Footwall Zones and expansion of potential underground ounces.

- Increases in the Arc driven by 2018 drilling and updated geologic modelling.

- GS & Arc mineralization remains open along strike and down dip/plunge. Significant ounces added with only 12,368m of drilling in 2018 on these zones.

- GS Main contains a consistent high-grade core of 832,000 gold ounces at a grade of 2.96 g/t gold in the Indicated category and 107,000 gold ounces at a grade of 3.18 g/t gold Inferred using a >1 g/t cut-off. Included in this high-grade core is 525,600 gold ounces at a grade of 4.68 g/t gold in the Indicated category and 81,900 gold ounces at a grade of 4.74 g/t gold Inferred using a >3 g/t cut-off.

Detailed images of the resource model and additional information can be found at http://whitegoldcorp.ca/investors/exploration-highlights/.

“This expansion of the mineral resource estimate further demonstrates the continued success of our systematic data driven exploration methodologies and the value we are generating across our unique portfolio of assets. We are very pleased with the significant increase in the Golden Saddle & Arc in 2018 with the relatively limited amount of drilling performed. The growth in the Golden Saddle was primarily driven by the 2018 GS West Zone discovery and continued drilling of the GS Main Zone. The newly discovered GS West is part of the same mineralized system as the Golden Saddle, all of which we believe can be expanded with additional drilling,” stated David D’Onofrio, Chief Executive Officer. “Continuing to grow the Golden Saddle & Arc resource will be one element of our fully funded $13 million 2019 exploration program which also includes plans to expand our 230,000 ounce Inferred Resource on the recently acquired VG Zone, diamond drilling on the high-grade 2018 Vertigo discovery and the generation of additional grass root discoveries across our 1 million acre land package in Yukon’s prolific White Gold District. The exploration season is just getting underway and we are extremely excited for what lies ahead.”

Resource Estimate Details

The resource estimate was conducted by Arseneau Consulting Services (“ACS”) and is reported within the guidelines of the Canadian Securities Administration National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). ACS carried out database verification, grade shell geometry, variography, and ordinary kriging exercises. A database with a total of 4,386 samples from 188 drill holes was used for the Golden Saddle and Arc areas. The Indicated and Inferred mineral resources were classified according to the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definition Standards for Mineral Resources and Mineral Reserves by Dr. Gilles Arseneau, P.Geo., of ACS, a “qualified person” as defined by NI 43-101. The Company intends to publish an updated technical report within 45 days of this news release which will include the updated resource estimate. The report will be available at that time on the Company's issuer profile on SEDAR and the Company’s website.

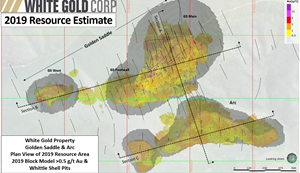

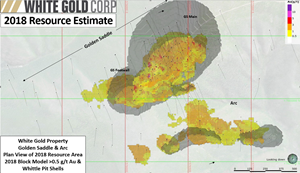

Indicated and Inferred resources were categorized as potentially open pit or underground minable utilizing 10m x 10m x 10m blocks at 0.5 g/t Au and 3.0 g/t Au cut-off grades, respectively, and utilizing a Whittle shell model. The Grade Tonnage Report using an Ordinary Kriging Estimate is as follows (1-5):

2019 Golden Saddle and Arc Mineral Resource Statement

| 2019 Resource | ||||||||

| Area | Type | Classification | Cut-off (g/t) | Tonnes (000's) | Grade (g/t) | Contained Gold (oz) | ||

| GS | Open Pit | Indicated | 0.5 | 13,681 | 2.30 | 1,009,700 | ||

| Inferred | 5,120 | 1.58 | 259,600 | |||||

| Underground | Indicated | 3.0 | 86 | 4.40 | 12,200 | |||

| Inferred | 3.0 | 390 | 4.36 | 54,700 | ||||

| Arc | Open Pit | Indicated | 0.5 | 562 | 0.98 | 17,700 | ||

| Inferred | 5,186 | 1.17 | 194,500 | |||||

Comparison of 2018 to 2019 Mineral Resource Estimates

| 2018 Resource | 2019 Resource | ||||||||

| Area | Type | Classification | Cut-off (g/t) | Tonnes (000's) | Grade (g/t) | Contained Gold (oz) | Tonnes (000's) | Grade (g/t) | Contained Gold (oz) |

| GS | Open Pit | Indicated | 0.5 | 12,294 | 2.43 | 959,800 | 13,681 | 2.30 | 1,009,700 |

| Inferred | 4,041 | 1.67 | 216,400 | 5,120 | 1.58 | 259,600 | |||

| Underground | Indicated | 3.0 | 0 | 0 | 0 | 86 | 4.40 | 12,200 | |

| Inferred | 3.0 | 235 | 3.53 | 26,700 | 390 | 4.36 | 54,700 | ||

| Arc | Open Pit | Indicated | 0.5 | 30 | 1.19 | 1,100 | 562 | 0.98 | 17,700 |

| Inferred | 881 | 1.39 | 39,400 | 5,186 | 1.17 | 194,500 | |||

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this report were estimated using the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Indicated and Inferred ounces were determined using the following assumptions: gold price of US$1,400/oz, average gold recovery of 94% on the Golden Saddle and 85% on the Arc (based on preliminary metallurgical test work), pit slope of 50 degrees, mining cost of CAN$2.50/tonne mined, processing costs of CAN$15.00/tonne milled, G&A costs of CAN$5.00/tonne milled, transportation and royalty costs of CAN$46.15/oz, and a US:CAN exchange rate of 0.77. These assumptions are subject to the completion of a detailed economic analysis and are not to be interpreted as such.

Wireframes for the Golden Saddle and Arc were constructed to enclose mineralized zones with composited assays greater than 0.3 g/t Au over 1.5m length. The Golden Saddle, including the GS West, was split into 8 domains (GS Main: 101, 102, 103, 104, & 110, GS Footwall/GS West: 201, 202, 203) with the 110 domain consisting of a “high-grade” core within the 101 domain that was modelled on 1.5m composites greater than 3 g/t Au. Arc and Arc Footwall were modelled as distinct domains.

Capping was performed on the assays using the 97th or 98th percentile values based on assays within each zone. Within the GS Main, domains 101 – 104 were capped at 10 g/t Au and the 110 domain was capped at 18 g/t Au. All domains within the GS Footwall were capped at 7 g/t Au and the Arc was capped at 5 g/t Au.

A block model encompassing all zones was constructed by ordinary kriging using Dassault Systems GEMS software. The model was estimated using 10m x 10m x 10m blocks and grades were estimated in three passes. Pass 1 and 2 were based on variography and had expanding ranges from 50-60m for pass 1 and 110 – 130m for pass 2. Pass 3 estimated blocks that had not been estimated during pass 1 or 2 but were pierced by drill holes. Any blocks estimated during pass 1 by at least three drill holes within a 50m radius were classified as Indicated and all other estimated blocked were classified as Inferred.

Mineral Resources on both the Golden Saddle and Arc are potentially amenable to open pit mining methods. Any mineralized blocks that were not within the pit shells but at a >3g/t cut-off were considered potentially amenable to underground mining methods. All tonnage, grade, and contained metal content estimates have been rounded. Rounding may result in apparent summation difference between tonnage, grade, and contained metal content.

Mineralization on portions of both the Golden Saddle and Arc is known to extend beyond the limits of the current resource estimate, however, the mineralization in these areas does not currently meet the criteria to be classified as Mineral Resources. Based on drilling in these areas and current geologic models this includes an estimated 10 – 12 million tonnes grading between 1 – 2 g/t Au. The reader should be cautioned that the potential quantity and grade is conceptual in nature; there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Golden Saddle Deposit

Within the Golden Saddle, the resource estimate includes the GS Main, GS Footwall and GS West zones. All zones trend NE-SW and dip to the NW at approximately 55 degrees with mineralization occurring along faults, fractures, and breccia zones in an overall normal to strike-slip structural regime. Together, the zones define mineralization over 1,500m strike length and up to 725m down dip. This includes a continuous high-grade core of mineralization >3 g/t Au on the GS Main that is up to 50m true-thickness and traceable over 500m of strike length and from surface up to 530m down-dip.

The current expansion of the Golden Saddle resource was driven by four primary factors:

- Inclusion of the 2018 GS West discovery; located approximately 750m west of the GS Main and accounting for an estimated 62,500 oz Au (1,339,000 tonnes at 1.45 g/t Au). The GS West is located approximately 750m west of the GS Main and is interpreted as a western continuation of the Golden Saddle structural system. Limited historic drilling has occurred between the GS West and the GS Main and one of the Company’s key objectives for the 2019 season will be to expand this zone and explore the potential continuity between the two zones.

- Infill drilling on the GS Main and GS Footwall; upgrading estimated blocks in these areas.

- Down dip/plunge drilling on the GS Main; expanding the footprint of the deposit by up to 325m down dip and increasing potential underground resources by an estimated 12,200oz Au Indicated and 39,900oz Au Inferred.

- Increase in GS Footwall mineralization captured in the Whittle shell model based on updated geologic modelling.

It should also be noted that there was a significant conversion of Inferred to Indicated resources on the Golden Saddle with an estimated 6% (62,100 oz Au) increase in Indicated Resources on the deposit.

Mineralization on the Golden Saddle is open along strike and down dip/plunge, and the 2019 exploration will focus on expanding the GW West zone; infill drilling on Golden Saddle to infill gaps within the current model; and step-out drilling between the GS Main/GS Footwall and GS West zones to asses for continuity of mineralization between the areas.

Currently, the GS Main is the most significant zone in terms of estimated ounces and overall grade; containing approximately 95% of the Indicated ounces within the overall resource. Furthermore, the 101-110 domain is specifically important as it encompasses the core of mineralization within the GS Main; can be consistently be traced from surface to over 400m depth; defines an overall northly plunging ore body. This is highlighted by the grade sensitivity on the GS Main, where over 90% of the contained Indicated ounces are within a cut-off grade of >1 g/t and approximately 51% are within a cut-off grade of >3g/t Au.

| GS Main - Open Pit – 2019 Mineral Resource Estimate Grade Sensitivity | ||||||

| Classification | Cut-off (g/t) | Tonnes (000's) | Grade g/t | Contained Gold (oz) | ||

| Indicated | >3.0 | 3,405 | 4.69 | 513,600.00 | ||

| >2.0 | 5,799 | 3.77 | 703,000.00 | |||

| >1.5 | 7,731 | 3.26 | 810,600.00 | |||

| >1.0 | 10,076 | 2.79 | 904,000.00 | |||

| >0.9 | 10,537 | 2.71 | 918,100.00 | |||

| >0.8 | 10,917 | 2.65 | 928,500.00 | |||

| >0.7 | 11,341 | 2.57 | 938,700.00 | |||

| >0.6 | 11,704 | 2.51 | 946,300.00 | |||

| >0.5 | 12,163 | 2.44 | 954,400.00 | |||

| >0.4 | 12,574 | 2.38 | 960,300.00 | |||

| >0.3 | 12,954 | 2.32 | 964,700.00 | |||

| Inferred | >3.0 | 454 | 4.55 | 66,400.00 | ||

| >2.0 | 773 | 3.69 | 91,700.00 | |||

| >1.5 | 984 | 3.27 | 103,600.00 | |||

| >1.0 | 1,351 | 2.71 | 117,800.00 | |||

| >0.9 | 1,452 | 2.59 | 120,900.00 | |||

| >0.8 | 1,587 | 2.44 | 124,600.00 | |||

| >0.7 | 1,698 | 2.33 | 127,200.00 | |||

| >0.6 | 1,812 | 2.22 | 129,600.00 | |||

| >0.5 | 1,919 | 2.13 | 131,500.00 | |||

| >0.4 | 2,004 | 2.06 | 132,700.00 | |||

| >0.3 | 2,094 | 1.99 | 133,700.00 | |||

Arc Deposit

The Arc is located approximately 400m south of the Golden Saddle and consists of two zones, the Arc Main and Arc Footwall zones. Both zones trend E-NE and dip to the north at approximately 50 degrees. Mineralization at the Arc has been defined over 1,200m in strike length and up to 450m down dip with mineralization open along strike and down dip.

The current expansion of the Arc resource was driven by 2018 drilling on the deposit and subsequent revision of the geologic model, which increased total estimated blocks in the Arc by 10% and, of these, there was a 20% increase in blocks >0.5 g/t Au. This resulted in significant expansion of the Whittle shell model on the deposit and increasing the reportable resource by an estimated 16,600oz Au Indicated and 155,000 oz Au Inferred.

The 2019 exploration program on the Arc will consist of step-out drilling along strike of the current resource area and infill drilling on higher grade (2 g/t Au) portions of the deposit.

QA/QC

The analytical work for the 2018 program was performed by Bureau Veritas Commodities Canada Ltd., an internationally recognized analytical services provider, at its Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All RC chip and diamond core samples were prepared using procedure PRP70-250 (crush, split and pulverize 250 g to 200 mesh) and analyzed by method FA430 (30g fire assay with AAS finish) and AQ200 (0.5g, aqua regia digestion and ICP-MS analysis). Samples containing >10g/t Au were reanalyzed using method FA530 (30g Fire Assay with gravimetric finish).

The reported work was completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standards and blanks into the sample stream. Additionally, historic QA/QC data and methodology on the White Gold property were reviewed and are summarized in the “Independent Mineral Resource Estimate for the White Gold Project, Dawson Range, Yukon, Canada”, dated April 15, 2018, filed under the Company’s profile on SEDAR. The qualified persons detected no significant QA/QC issues during review of the data.

About White Gold Corp.

The Company owns a portfolio of 22,040 quartz claims across 35 properties covering over 439,000 hectares representing over 40% of the Yukon’s White Gold District. The Company’s flagship White Gold property has a mineral resource of 1,039,600 ounces Indicated at 2.26 g/t Au and 508,700 ounces Inferred at 1.48 g/t Au. Mineralization on the Golden Saddle and Arc is also known to extend beyond the limits of the current resource estimate. Regional exploration work has also produced several other prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Goldcorp Inc. with a M&I gold resource(6) of 3.4M oz and Western Copper and Gold Corporation’s Casino project which has P&P gold reserves(6) of 8.9M oz Au and 4.5B lb Cu. For more information visit www.whitegoldcorp.ca.

6. Noted mineralization is as disclosed by the owner of each property respectively and is not necessarily indicative of the mineralization hosted on the Company’s property.

Qualified Person

Jodie Gibson, P.Geo., Vice President of Exploration for the Company is a “qualified person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, and has reviewed and approved the content of this news release.

Cautionary Note Regarding Forward Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", “proposed”, "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include:; expected benefits to the Company relating to exploration conducted and proposed to be conducted at the Company’s properties; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described in the most recently filed management’s discussion and analysis of the Company. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSX Venture Exchange (the “Exchange”) nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Information:

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

Images accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca5bcfa8-b035-4fb8-9103-3b55eb3b944f

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed4279f5-4e72-4f63-9bf7-ebbf9b17f59b