Xander Resources Announces Accelerated Buyout of Senneville Properties

(TheNewswire)

Vancouver, British Columbia – TheNewswire - October 27, 2021 - Xander Resources Inc. (TSXV:XND) (FSE:1XI) (OTC:XNDRF) (the “Company”) announces that it has completed the accelerated buyout of the three options comprising the Senneville Claim Group:

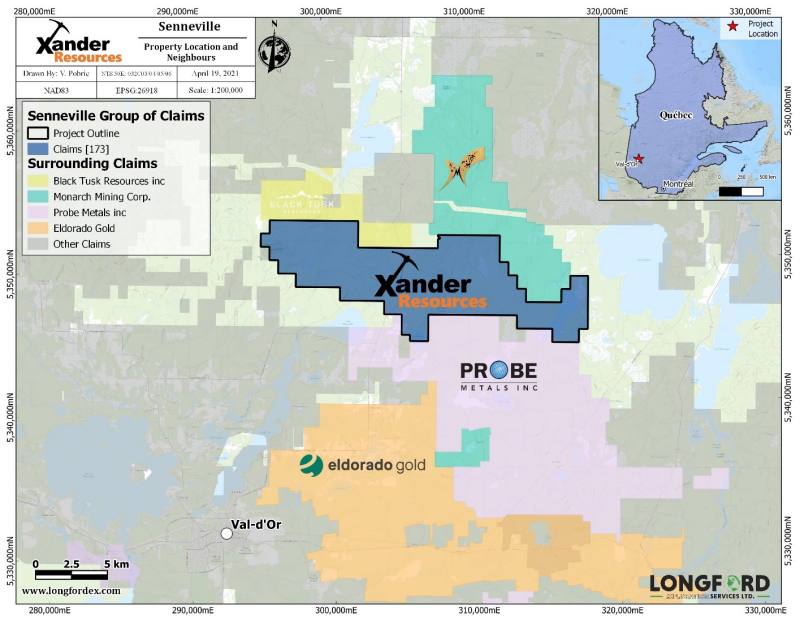

The Company’s Senneville Claim Group that covers over 100 sq km and is contiguous in the South to Probe Metals’ new discovery, and contiguous in the north to Monarch Mining and in close proximity to Eldorado Gold’s (formerly QMX Gold) projects in the Val-d’Or Gold Camp. The Senneville Claim Group is located in the eastern part of the Abitibi Greenstone Belt, about 25 km northeast of the gold mining center of Val-d’Or, Quebec. The claims extend from the Lacorne Batholith in the west to the contact area of the Pascalis Batholith in the east. The Senneville West Property geology is east of the North American Lithium Deposit with proven and probable reserves of 17.06 Mt grading 0.94% Li2O, and measured and indicated resources of 33.24 Mt grading 1.19% Li2O; Great Thunder Gold‘s Chubb Lithium property and East of the Sayona Mining Authier Lithium Deposit.

Val-d’Or Senneville South Property

Further to the news release dated September 11, 2020, announcing the property option agreement dated May 27, 2020 with Optionor1, the Company has completed the accelerated buyout of the exclusive option to purchase a 100% interest in and to the Company’s Senneville South Property is comprised of three complete cells, five partial cells and one old-style lot, totalling an area of 370 hectares. The Company paid the cash balance of $35,000 and issued 140,000 common shares (the “Shares”) of the Company to Optionor1 at a deemed price of $0.16 per Share. The Shares are subject to the applicable hold periods in accordance with securities laws in Canada and the Exchange policies.

The Company fulfilled the option exploration requirements with a preliminary three-hole drill program, including an intersection 18.15 gpt Au over 0.85 meters, as reported in the Company’s news release dated July 14, 2021, and with the accelerated payment of cash and Shares has now met all the option requirements on the claims, which remain subject to a 2% net smelter return royalty (“NSR”).

Val-d’Or Senneville West Property

Further to the news release dated June 2, 2020 announcing the expansion of the Company’s Val-d’Or Gold Camp properties and the property option agreement dated May 18, 2020 with Optionor2, the Company has entered into an amendment agreement with Optionor2 whereby the Company may exercise the option to a date before 2½ years of the closing of the agreement by satisfying the share issuances and cash payments thereunder. The Company has now completed the accelerated buyout of the exclusive option to purchase a 100% interest in 80 mineral claims in the Company’s Senneville West Property and extends from the eastern arbitrary boundary of Hwy 397, to the northwest for 10 km. The Company paid the cash balance of $72,000 and will issue 1,000,000 Shares of the Company at a deemed price of $0.155 per Share to Optionor2. The Shares will be subject to the applicable hold periods in accordance with securities laws in Canada and the Exchange policies.

Optionor2 has agreed to relieve the Company of the obligation to spend $625,000 in exploration in exchange for the above cash and shares. The Company has further agreed that in the event of abandonment of any of the claims, the Company will provide Optionor2 six months notice of the intended abandonment, and in the event of a third party sale of the claims that Optionor2 will be entitled to receive 20% of the sale proceeds, such percentage reducing to 15% if the Company spends $250,000 in qualified exploration expenditures on the property, and to 10% by the Company spending $500,000 in qualified exploration expenditures on the property. The claims remain subject to a 2% NSR.

Val-d’Or Senneville East Property

Further to the news release dated June 12, 2020 announcing the expansion of the Company’s Val-d’Or properties and the property option agreement dated May 18, 2020 with Optionor3, the Company has entered into an amendment agreement with Optionor3 whereby the Company may exercise the option to a date before 2½ years of the closing of the agreement by satisfying the share issuances and cash payments thereunder. The Company has now completed the accelerated buyout of the exclusive option to purchase a 100% interest in 62 mineral claims in the Company’s Senneville East Property. The Senneville East Property is located in the eastern part of the Abitibi Greenstone Belt, about 30 km north of Val-d’Or and is comprised of 62 claims which extend from just east of Highway 397, where it adjoins the Senneville West and South Group properties, to the contact area of the Pascalis Batholith. The Company paid the cash balance of $36,000 and will issue the 640,000 Shares of the Company at a deemed price of $0.155 per Share to Optionor3. The Shares are subject to the applicable hold periods in accordance with securities laws in Canada and the Exchange policies.

Optionor3 has agreed to relieve the Company of the obligation to spend $625,000 in exploration in exchange for the above cash and shares. The Company has further agreed that in the event of abandonment of any of the claims, the Company will provide Optionor2 six months notice of the intended abandonment, and in the event of a third party sale of the claims that Optionor2 will be entitled to receive 20% of the sale proceeds, such percentage reducing to 15% if the Company spends $250,000 in qualified exploration expenditures on the property, and to 10% by the Company spending $500,000 in qualified exploration expenditures on the property. The claims remain subject to a 2% NSR.

Deepak Varshney, PGeo, CEO of the Company states “The aggregation of all the Senneville Claim Group through the buyout of the options will enable the Company to better allocate it’s exploration expenditures and ensure a more efficient utilization of financial and other resources to thoroughly and systematically explore for gold and lithium on our extremely well positioned properties in the historic Val-d’Or Mining Camp.”

About Xander Resources:

Xander Resources is a junior exploration firm focused on developing accretive gold and lithium properties within Canada. The company currently has a focus on projects located within the Provinces of Ontario and Quebec.

ON BEHALF OF THE BOARD OF DIRECTORS

Deepak Varshney, P.Geo., President

and CEO

For more information please visit our website: www.xanderresources.ca

Email: Investor Relations: ir@xanderresources.ca Dan Samartino or

info@xanderresources.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement: Investors are cautioned that the above information and the information on the adjacent properties is taken from the publicly available sources. The Company has not been able to independently verify the information contained. The information is not necessarily indicative of the mineralization on the Property, which is the subject of this news release. The Company will need to conduct exploration to confirm historical mineralization reported on the property and there is no guarantee that significant discovery will be made as a result of its exploration efforts. The Company is in the process of compiling exploration and geological data available on the property and surrounding area to develop an exploration work plan.

Copyright (c) 2021 TheNewswire - All rights reserved.