Zijin and Xanadu Transaction Completed and Kharmagtai PFS Underway

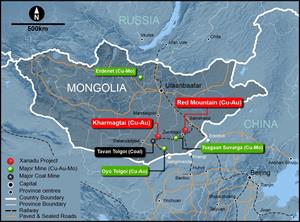

TORONTO, March 10, 2023 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (Xanadu or the Company) is pleased to announce the completion on 10 March 2023 of Phase 2 and Phase 3 of its Strategic Partnership with Zijin Mining Group Co., Ltd. (Zijin). This provides crucial funding for the Company’s flagship Kharmagtai Copper-Gold Project (Kharmagtai) through the next phase of project evaluation and exploration, leading to formal Decision to Mine. It will also provide funding to Xanadu for activities outside of Kharmagtai such as our second project at Red Mountain.

Xanadu also announces the appointment of Mr Shaoyang Shen as a non-executive director, having been nominated by Zijin in accordance with the Phase 2 Share Subscription Agreement.

Highlights

- Completed A$7.164,645.28 million placement for 179,116,132 Xanadu shares at $0.04 per share, a 33% premium on the latest market close price, increasing Zijin shareholding to 19.42% of Xanadu.

- US$35 million invested directly into the Kharmagtai project creating a 50/50 Joint Venture (JV) at the project level.

- Kharmagtai Pre-Feasibility Study (PFS) and Discovery Exploration have now commenced, with data acquisition drilling underway.

- PFS will evaluate growth-focussed opportunities in Mining & Processing Technologies and higher-grade focussed Discovery Exploration, aimed at materially upgrading the base case Scoping Study1.

- Xanadu is Operator of the JV with an 18-month plan to complete the PFS (upon which operatorship will pass to Zijin).

- Post PFS, Xanadu has options to a) independently fund its share of construction, b) sell its 50% share of the JV to Zijin for US$50M, or c) sell half its share of the JV (25%) to Zijin for US$25M plus a zero cash loan carry for the remaining 25% to commercial production1.

- New, highly experienced non-executive Director appointed to Xanadu’s Board

- Upcoming near term announcements will outline detailed Kharmagtai PFS program of work, targeting value enhancement, Resource Definition Drilling and Discovery Exploration.

Xanadu’s Executive Chairman & Managing Director, Colin Moorhead said, “We are pleased to have money in the bank and PFS activities underway. We have already started working successfully with our partners at Zijin and with Mr Shen our new Director, who are fully aligned with our goal for Kharmagtai to realise its potential as globally significant copper-gold project. We expect to provide regular updates and news-flow through the next 18-month PFS period.”

Strategic Partnership

The strategic partnership2 included three phases of investment. The first phase (Phase 1 Placement) was completed on 27 April 2022, raising A$5.56 million via a subscription by Zijin to 139 million fully paid ordinary shares in Xanadu at A$0.04 per share to provide Zijin with a 9.9% shareholding in the Company. The two subsequent phases were completed on 10 March 2023 and included a second placement of ordinary shares at A$0.04 per share to increase Zijin’s total shareholding in the Company to 19.42% (Phase 2 Placement) and the creation of a 50/50 Joint Venture in Khuiten Metals Pte. Ltd., the entity currently 100% owned by Xanadu that holds a 76.5% effective interest in Kharmagtai (Phase 3 JV), for a cash investment of US$35 million.

Following the 18 month PFS, Xanadu has the option to fund its share of construction, sell it’s 50% of the Phase 3 JV to Zijin for US$50 million or sell half of its share of the Phase 3 JV (25%) to Zijin for US$25 million plus a loan carry for Xanadu’s remaining share of costs until commercial production.

PFS to Evaluate Upside in Scoping Study

The 2022 Scoping Study3 confirmed Kharmagtai as a potential world class, low cost, long life mine with an estimated 20% IRR (range 16-25%), US$630 million NPV at 8% (range US$ 405-850 million) and 4-year payback (range 4-7 years) over 30 year mine life. This included first quartile all in sustaining costs and projected production ranges from 30-50ktpa copper and 50-110kozpa gold production during the first five years. It is based on a JORC Compliant Mineral Resource of 1.1 billion tonnes containing 3 million tonnes of copper, 8 million tonnes of gold and 100 million tonnes of higher grade zones at > 0.8% copper equivalent grade.

The Scoping Study outlined a conventional, low technical complexity open pit and process plant with low 0.9:1 strip ratio for the first five years. However, it also identified growth-focussed upside opportunities which could materially upgrade the economics of the project, all of which will be investigated during the PFS:

- Oxide Processing: Top 20-30 metres of partially oxidised mineralisation cannot be processed through flotation and is conservatively treated as waste in the Scoping Study. The PFS will evaluate the use of glycine-cyanide leach technology to convert this pre-strip waste into cash generating ore.

- Mining Technology: Use of electrified haulage and in-pit crush & convey technology could significantly reduce mining costs as well as Scope 1 emissions. This has the potential to deepen and extend current pit shells, incorporating additional, deep zones of high-grade ore, adding to the valuation and enhancing life of the mine.

- Processing Technology: PFS will evaluate coarse ore flotation and beneficiation technologies, targeted at reducing energy requirements and operating cost per tonne of ore processed.

- Exploration Drilling: Kharmagtai Mineral Resource remains open at depth and along strike. Deeper drilling at Stockwork Hill completed after the 2021 Mineral Resource has already confirmed continuation of the higher-grade bornite mineralisation at depth. There is also significant potential to grow White Hill Resource and new discoveries across the tenement. These will be investigated as a matter of priority and could prove transformational for Kharmagtai project economics.

During the PFS, Xanadu and its partner Zijin will complete all major project trade-off decisions and refine capital and operating cost estimates to +/-15-25%, leading to selection of a single go-forward option for final engineering and construction. With the study and inclusion of upside opportunities above, Xanadu and Zijin are targeting a real and sustained uplift relative to the Scoping Study economics.

Xanadu is operator of the joint venture during the PFS delivery period of 18 months, after which Zijin will become operator for final engineering, construction and operation stages of the project.

Appointment of Non-Executive Director

Mr Shaoyang Shen has been appointed as a non-executive director of Xanadu, having been nominated by Zijin in accordance with the Phase 2 Share Subscription Agreement. Mr Shaoyang Shen is the Deputy President for Corporate Development & Overseas Operations of Zijin Mining Group. He has more than a dozen years of operations management and investment (M&A) experience in the mining industry. Prior to joining Zijin in 2014, he held senior executive positions with Silvercorp Metals Inc., including as COO of the company and Vice President for China Operations. He also served as a board member of Pretium Resources Inc. from 2015 to 2018, and as a Managing Director of Barrick New Niugini Limited from 2015 to 2019. Mr. Shen graduated from Xiamen University with a bachelor’s degree in economy. He obtained an MBA from the National University of Singapore and a Master of Management & Professional Accounting (MMPA) from the University of Toronto.

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration company operating in Mongolia. We give investors exposure to globally significant, large-scale copper-gold discoveries and low-cost inventory growth. Xanadu maintains a portfolio of exploration projects and is operator of the globally significant Kharmagtai copper-gold project.

For further information on Xanadu, please visit: www.xanadumines.com or contact:

| Colin Moorhead Executive Chairman & Managing Director E: colin.moorhead@xanadumines.com P: +61 2 8280 7497 | Spencer Cole Chief Financial Officer E: spencer.cole@xanadumines.com P: +61 2 8280 7497 |

This Announcement was authorised for release by Xanadu’s Board of Directors.

1 ASX/TSX Announcement 6 April 2022 – Scoping Study – Kharmagtai Copper-Gold Project

2 ASX/TSX Announcement 21 December 2022 - Investment Deal Signed with Zijin - Pathway to Production

3 ASX/TSX Announcement 6 April 2022 – Scoping Study – Kharmagtai Copper-Gold Project. The material assumptions underpinning production target and the forecast financial information derived from the production target continue to apply and have not materially changed.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2e3bf58b-9acb-4c4b-97f3-fa464d4e011f