2 Gold Stocks With High Discretionary Cash And Greater Debt Capacity

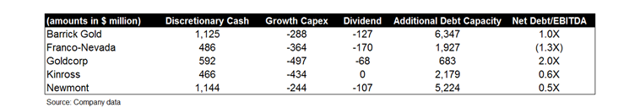

Discretionary cash is critical to Barrick Gold and Kinross Gold to sustain their growth capex and debt capacity.

Barrick Gold wins out in deleveraging using discretionary cash and its strong liquidity.

Kinross Gold has adequate discretionary cash thanks to organic growth strategy.

Image source: The Balance

Investment Thesis:

Releveraging of balance sheets is one of the important concerns of most gold mining companies. Shares of gold mining companies are presently lagging behind physical gold due to cash costs and growing capital expenditures.

It is through this concern that "discretionary cash" and debt capacity have become critical metrics. Discretionary cash is defined as cash available to fund dividends and growth capex.

In this investment research, we were able to filter out two gold stocks from our gold universe that have the highest level of discretionary cash. These mining companies are Barrick Gold and Kinross Gold. We will likewise determine if these companies will still have sufficient debt capacity if discretionary cash is the basis.

Barrick Gold (NYSE: ABX)

Company Overview: Barrick Gold is engaged in gold and copper production as well as mine development. It has gold mines in Peru, United States, Dominican Republic and Argentina. The company maintains a copper mine in Zambia. ABX is headquartered in Toronto, Canada. Barrick operates through the following units: Goldstrike, Pueblo Viejo, Cortez, Lagunas Norte and Veladero.

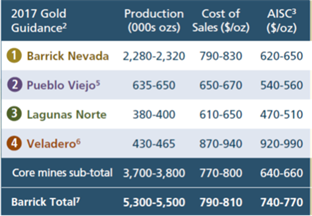

Image source: Company data.

2. Leverage: Barrick reiterated that it plans to reduce total debt to $5.0 billion by the end of 2018. They are targeting "at least half" of the debt reduction expected to be done during 2017 or approximately $1 billion remaining in 2017. They expect cash flow to improve before 2018. Ratio of Debt to Earnings before Interest, Taxes, Depreciation, and Amortization ((EBITDA)) slipped from 1.8X in the first quarter of 2017 (2.6X in the second quarter of 2016) to 1.7X in the third quarter.

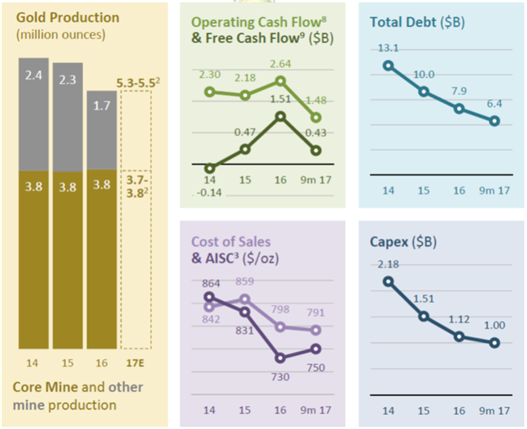

3. Liquidity & Financial Flexibility: ABX has a current ratio of 2.70:1. Debt to equity ratio is 0.67X. Long term debt to equity ratio was 0.66X.

ABX has maintained its high liquidity profile throughout 2017. ABX liquidity position strategy is to use its cash to facilitate its deleveraging program. Liquidity for deleveraging will come from operating cash flows, non-core asset sales and joint ventures formed.

Balance sheets proved to be sound. Total debt decreased from $7,633 million to $7,328 million. ABX repaid the 2019 maturities using cash on hand. Revolving credit facility of $ 4.0 billion was undrawn. In 2017, cash and equivalent rose from $2,277 million in the first quarter to $2,926 million in the third quarter.

ABX generated a positive free cash flow of $11 million. The third quarter free cash is below from the $63 million in the first quarter and from the $253 million generated in the prior-year period. The company experienced an increase in working capital needs that resulted in a $180 million use of cash. Cash usage is largely related to leach pad inventories at its Veladero mine.

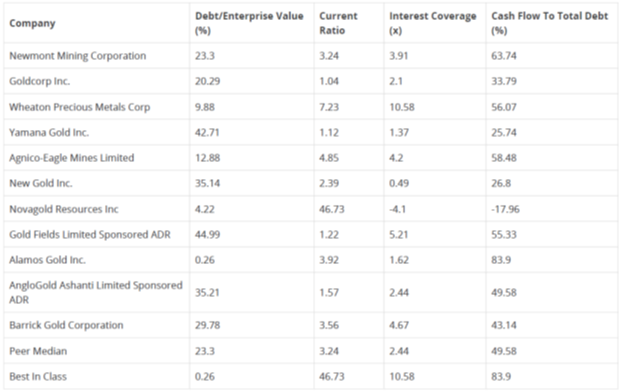

4. Additional Debt Capacity: Total debt is around 29.78% of enterprise value which is well above peer industry benchmark of 25%. The interest coverage ratio is well supported at 4.7X. Interest coverage is upward trending and is now at par with its five-year average interest coverage of 4.32X. Hence, ABX has more room to accommodate additional debt of approximately $6,347 million.

5. Discretionary Cash: As per Deutsche Bank analyst estimates, ABX has a total discretionary cash of $1,125 million.

Image source: Company data.

6. Share Price Catalyst: Last April, ABX inked an agreement with Shandong Gold of China for the sale of 50% stake in its Veladero mine for $960 million. The two collaborated for the development of Pascua Lama Project and other potential project situated near the border of Chile and Argentina. Proceeds from the share sale will be applied to reduce debt and for reinvestment.

Veladero was expected to produce 770,000 to 830,000 ounces of gold in 2017. Cash costs reached $500 to $540 per ounce, while all-in sustaining costs (AISC) add up to $840 to $940 per ounce of gold.

Source: CapitalCube.

Kinross Gold (ASX: K.TO)

1.Company Overview: This Toronto-based mining company is one of the largest gold mining companies in the world. It has a gold reserve of approximately 31 million ounces of gold. Operations are divided into three regional units: Americas (60% of 2016 output), Russia/Asia (27%) and West Africa (13%). The company's main listing is on the NYSE under the symbol (KGC.N). It is also listed on the Toronto Stock Exchange, trading under the symbol (K.TO).

2. Organic Growth: Ongoing development of its projects is doing well. Tasiast Phase One is on track to commence its commercial production towards the end of the second quarter of 2018. Engineering at Tasiast Phase Two is now 25% complete. The company is sure to deliver and have a strong operational momentum as it heads into 2018.

K.TO is tracking towards the high end of its 2017 guidance for gold production at 2.5 million to 2.7 million ounces of gold. Cost of sales is at the low end of its guidance at $660 to $720 per ounce of gold while all-in sustaining cost was estimated at $925 to $1,025 ounces of gold.

3. Balance Sheet & Capex: Tasiast gold mine was acquired from Red Back Mining Inc. last 2010. Kinross has since completed large write-downs after overpaying. The company repaired its balance sheet with improved Net Debt to EBITDA of 0.6X. It is constantly de-risking its Tasiast project via a two-phased risk strategy.

Capital expenditures for phase one were $370 million while phase two capital spending is estimated at $590 million. It expects to be within its capital expenditures guidance of $900 million.

4. Leverage: Total debt is equivalent to 27.77% of its enterprise value compared to an overall industry peer benchmark of 25%.

5. Discretionary Cash & Debt Capacity: As per Deutsche Bank analyst estimates, K.TO has sufficient discretionary cash of $466 million and additional debt capacity of $2,179 million.

As of the third quarter of 2017, cash and equivalent is $922.1 million while unused credit facility is $1,512 million, bringing total liquidity at $2.5 billion. K.TO has no maturing debt requiring repayments until 2021.

Our Takeaway:

Of the two companies, Barrick Gold is more stellar. The company is on track on its debt-reduction program. The firm is considered to have one of the lowest cost structures in the industry. It is the biggest gold producer in Canada and one of the top 10 gold producers globally. ABX could expect substantial gains and grow its discretionary cash if gold prices sustained its high price.

The company boasts of strong operating results in 2017 thanks to lower costs, higher gold production at Barrick Nevada, lower sales from higher cost operations at Turquoise Ridge and Acacia and lower costs at Pueblo Viejo.

Both Barrick and Kinross are on target to meet their annual earnings. They are tracking towards the high end of their gold production and the low end of their cost of sales and all-in sustaining cost guidance. These companies generated solid levels of discretionary cash and maintained one of the best balance sheets amongst their industry peers.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.