3 Small Cap Gold Stocks Scoring Good On FCF Yields

Gold companies have free cash flow yields at par with global average of 6.2% but not greater than a minus 20% lower limit.

Free cash flows of these companies reflect strong performance in production and gearing.

Gold prices can influence returns on marginal ounces in the mine plan.

Source: Gainesville News

Source: Gainesville News

Investment Thesis:

In our gold universe, we were able to screen for gold stocks. We filtered out stocks whose free cash flow (FCF) yields are approximately close to the global average of 6.2%, but not greater than the lower limit of negative -20%.

A gold mining company is usually generating ample cash that is used to run and help it to grow. Free cash flows must always come in positive. However, there are some gold companies that are not able to generate sufficient cash to support their businesses. This results in negative free cash flows. These companies are investing heavily to immediately grow their mining businesses.

Through the analysis presented below, we will try to validate the market speculation that these three companies under review possess strong cash capabilities and sound FCF yield ratios.

Oceanagold Corp. (OTCPK:OCANF) (ASX: OGC):OGC is an Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX) listed gold mining company. It owns mining operations in Philippines and New Zealand. OGC also owns exploration projects in the USA, Philippines and New Zealand. Its regional headquarters is based in Melbourne, Australia.

OGC is fast becoming an established gold mining company. Issues in its Haile gold mine have already been identified during the first stages of commissioning. The ramp-up in commissioning will result in a speedy recovery from operational issues by the end of 2017.

OGC will widen its footprint to gain five to seven more mine pits. Existing mining operations are found in four locations acquired through joint venture agreements inked in Laos and Argentina.

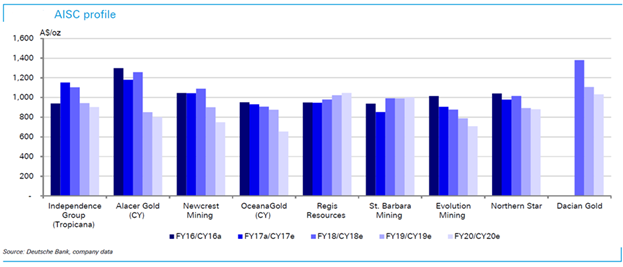

Image source: Deutsche Bank, Company data.

Gold exploration activities will ramp up to more than 270,000 ounces of gold. All-In Sustaining Costs (AISC) are estimated to be below $500 per ounce in the next three years.

The open pit in Didipio is expected to deliver its first gold ore by the end of the year. The New Zealand operation is on track to boost gold production. OGC is also active in Brownfield and Greenfield explorations in New Zealand.

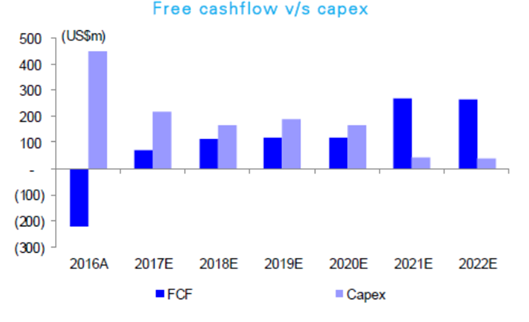

Image source: Deutsche Bank forecast.

Five-year average free cash flow yield is -0.003377%. However, the FCF yield for 2017 is positive at 3%. Higher gold production and lower sustaining capital expenditures support cash flows. The Didipio mine expects to produce 150,000 to 160,000 ounces of gold in 2017.

Annual earnings growth is less than its five-year annual average (7.9% versus 24.7%, respectively). The total debt is satisfactorily covered by annual operating cash flows (81.8% which is greater than 20% of the total debt). Interest on the debt is sufficiently covered by earnings (EBIT is 9.6X coverage).

The company has a Price to Cash Flow ratio of 6.13X, and a current P/E ratio of 12.60X.

2. St. Barbara Ltd. (OTCPK:STBMY) (ASX: SBM):

SBM is a junior gold exploration company. Key mine assets include the Gwalia mine in Western Australia and Simberi in Papua New Guinea.

The company continues to progress with its Gwalia extension project. In doing so, the company will cooperate with raise bore contractors and suppliers.

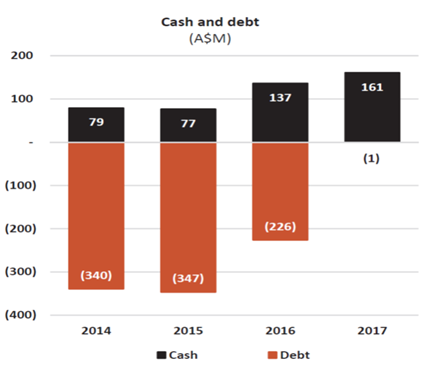

SBM reduced its total debt by $228 million in 2017 and repaid senior secured notes in full. It settled its debt twelve months ahead of schedule.

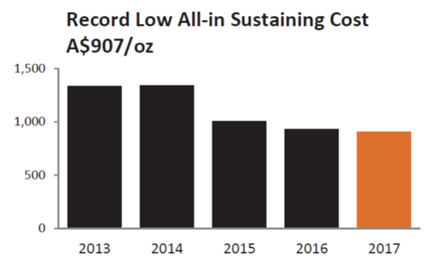

Image source: Company data

Total revenues rose from $610 million in 2016 to $642 million in 2017. SBM benefitted from significantly higher average gold prices. However, it suffered a decrease in gold ounces sold mainly due to the King of the Hills mine. It contributed 9,112 ounces in the previous year prior to its divestment of the mine in 2015.

Image source: Company data.

Available cash balance was $161 million, with no amounts held on deposit as restricted cash. Trade receivables reported a zero amount. Total net cash contribution from operations was higher at $301 million in 2017, up from $269 million in 2016. It was due to the record performance from Gwalia and Simberi.

Total debt is sufficiently covered by annual operating cash flows (55,434.4%, greater than 20% of the total debt). Interest on the debt is well covered by earnings (EBIT is 40.5X coverage).

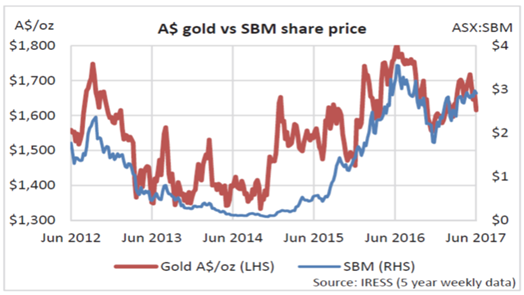

The share price is sitting near its lowest in 10 years. SBM stock plummeted 62% during the previous 12 months and 96% since its peak in November 2010. It was trading at just 11 cents and recorded a market value of $54 million.

SBM became the second best-performing stock in the ASX index last 2015. Shares gained a staggering 1,157%. Trading price hovered at $1.32. The price is down from its 52-week high of $1.47, while the company added $600 million to its market value.

Image source: IRESS

3. Dacian Gold (OTC:DCCNF) (ASX: DCN):

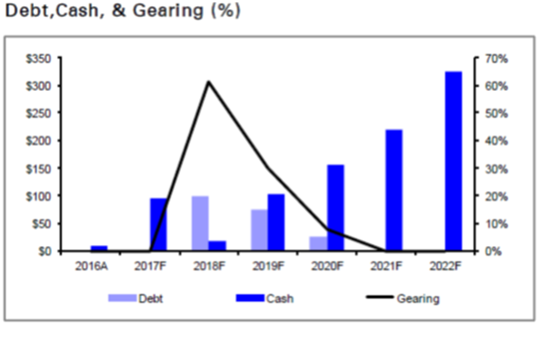

DCN owns 100% of the Mt. Morgans Gold Project, which is expected to come into production in 2018.

Gold production is critical to the company's negative free cash flow yield of -14%. DCN has $90 million cash in banks with negative cash flows from operations of -$16.6 million. It only shows that the company is "burning" cash to run its operations, since it is spending more working capital funds than it makes.

Share price catalysts would drive back the free cash flow yield to a positive print and the contributing factors would be:

Successful gold production plans of an economic nature.

Delivery of the Mount Morgan project.

Australian dollar that can influence returns on marginal ounces targeted in the mine plan.

However, DCN is still exposed to prevailing risks which include:

Delays in project delivery.

Lower Australian dollar gold price.

Project cost overruns.

Other financial related factors that will support the FCF yield turnaround are:

Based on consensus analyst expectations, DCN's earnings are expected to jump at over 20% annually.

Revenues are expected to increase significantly at more than 20% annually as well.

Total debt, however, is not well covered by annual operating cash flows (-1,094.5% which is less than 20% of the total debt). Despite this, interest on the total debt is amply covered by earnings with EBIT is 56,383.2X coverage.

Creditors may be less hesitant to lend out more funding as DCN's high interest coverage is seen as sound and safe.

Image source: Deutsche Bank

Our Takeaway:

Free cash flow yields generated by the companies indicate they could improve the operating efficiency of these companies in order to meet the demands for repayments and capital spending.

Though, it became visible that these companies are still able to pay all of their upcoming debt from the current or short-term assets.

The contributing factor of gold prices in this analysis remains sustained by the market's persistent tug-of-war between the US Fed's rate path guidance, inflation and general market expectations.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.