5 Reasons Never To Buy Gold

If the markets fall, some investors tend to flee to gold as a hedge in their portfolio.

In this article I present five reasons why I will never invest in gold.

I invite the readers to convince me of the worth of a gold investment.

Introduction

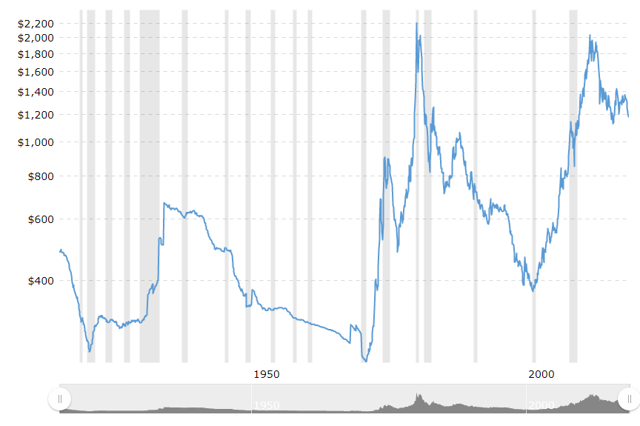

The markets are down considerably over the last few days. The typical reaction for some investors is to buy gold (GLD). I have had some comments from people around me in the last few days about the fact that it would be better to buy gold now. And yes, gold was up on Wednesday and Thursday last week, days on which the S&P 500 (SPY) fell considerably:

SPY data by YCharts

SPY data by YCharts

A lot of investors see it as a hedge and a safety in their portfolio. But in this article I will argue that if you are a long-term investor, as I am, you really shouldn't have gold in your portfolio.

1. What's the worth of gold?

As I know that a lot of gold lovers will read this, I know that they might be mad at me after this article. But I am going to start with the door-in-your-face approach: questioning the value of gold. What is the worth of that yellow metal? It is only worth what people are willing to give for it, but has little real value as in 'things you can do with it'.

As Warren Buffett once famously said about gold:

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

(Source)

Although some very tiny parts of your smartphone may be gold and there are some industrial uses, the prime use of gold, 78% of its production, is used for jewelry, that other thing that only has worth if you attach worth to it. Don't get me wrong: my wedding ring is from gold, but that is it. My wife likes silver better for her jewelry and I have no other jewelry myself, attaching no value to it, except for the sentimental value of my wedding ring. But even for its most used purpose, gold is not good enough. It needs other metals such as silver or copper to be strong enough as jewelry.

(Source)

Silver is a lot more useful: it is used on medical devices as a bacteria-free coating, for antimicrobial effect in wound dressings, creams, breathing tubes, catheters, etc. In electronics, silver is used because of its great electrical and thermal conductivity. It is used widely in computers, smartphones, etc.

2. Gold is not a hedge against inflation

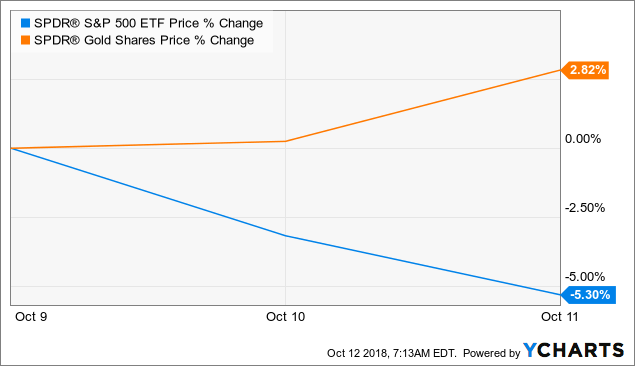

Some gold investors try to convince me that gold is a hedge against inflation. That always sounds good, right? But is it true? This is the 100-year evolution of the gold price:

(Source)

You could have bought gold in 1934 for $670 per ounce. In November 1970 it would have been worth $233. You would have had to wait until 1974 before you would be back at your cost price. 40 years of losing money. Because if you calculate inflation, your $670 would actually be worth $2,467 in 1974. And the inflation of your original money of 1934 would even bring it to $12,607 today. Your ounce of gold would only be worth $1,217. That is a loss of $11,390 versus inflation. And you tell me it is an inflation hedge?

3. Gold is gambling

Since there is no logical worth in gold, you are not investing in gold, but actually just gambling if the price goes up or down. Even over very long periods you don't know if the gold market will go up or down, unlike the long-term price of the stock market. And as a hedge against a bear market: good luck with that timing. No one can predict a crisis unless you are either lucky or keep repeating the same thing.

(Source)

Of course, you can keep gold in your portfolio at every moment. But that means that you will underperform the stock market over the long term. As I have written in my article 'Wanna Win? Forget About Your Stocks!' one of the main reasons individual investors underperform versus the market is that they hold too much cash in their portfolio, while ETFs and funds are (almost) fully invested. If you keep a percentage of your portfolio in gold, this is the same: over the long term, you lose versus stocks. And that is my next point.

4. Gold is worthless versus stocks

I know what some gold bugs will say now: 'From Growth To Value, you have been cherry picking! The gold price of 1934 was extremely high and I wouldn't have bought then.'

Ok, let's do the exercise: let's take the very lowest price point in the last 100 years: $233 in 1970. Congratulations! You have gone up to $1,217, an increase of 522%. That is a compound annual growth rate (or CAGR) of 3.5%. But the average inflation over the period was 2.70%. That means that your CAGR would be only 0.80%. That means that the buying value of your $233 would have gone up from $233 to $342. I don't know about you, but to me that is not to get excited after 48 years of investing.

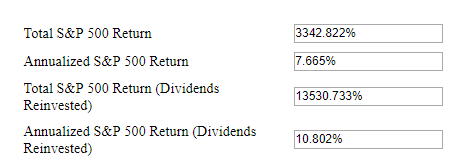

But suppose you would have invested $233 in the stock market index in 1970.

This would be your total return:

(Source: dqydj.com)

Suppose you reinvested your dividends, which after all will not have been much in the beginning, having invested only $233. Then with a yearly inflation of 2.70%, your CAGR would be 8.102%. In real money, so including inflation, your $233 investment would have grown to $9,803 of pure buying power.

(Source)

Again Warren Buffett has a great quote about this:

I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side...Now for that same cube of gold, it would be worth at today's market prices about $7 trillion dollars - that's probably about a third of the value of all the stocks in the United States...For $7 trillion dollars...you could have all the farmland in the United States, you could have about seven Exxon Mobils, and you could have a trillion dollars of walking-around money...And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally...Call me crazy, but I'll take the farmland and the Exxon Mobils.

(Source)

5. Gold is not an apocalypse-safe paying means

I know that a small but not tiny fraction of investors invests in gold because it makes them feel safe in case of an apocalypse. But suppose there is one coming, will you be dragging around with tons of gold?

(Source)

Or maybe you have taken precautions and you already have a safe room somewhere with the gold stack there. If there really would be an apocalypse, I wouldn't want gold above money if I were a survivor. I would probably favor utilities that I could use in the apocalyptic world or food or anything useful, but not gold.

Conclusion

I know that a lot of gold lovers might hate me for this article. And I won't deny there is something attractive to that warm yellow metal. But as an investment, I cannot see any rational reason to invest in it. I gave five rational reasons not to invest in gold in this article. But I am always open to learning experiences, so I would invite readers to convince me why I should buy gold. I look forward to your comments!

If you have enjoyed this article and would like to read more articles from me, please hit the "Follow" button next to my name.

In the meantime: keep growing!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow From Growth to Value and get email alerts