All That Glitters Is Not Gold

Reduction of demand from China's central bank demand and tariffs by the Indian government will continue to put a lid on demand for gold.

Rising budget deficit narrative has broken down with regards to gold prices in the last 5 years.

Potential rising real interest rates are not a good sign for gold.

Charts do point to a potential breakout.

The x factor here is the probability of a major catalyst resulting in the flight to gold.

Humans have a weird obsession with gold. Having no cash flows, earnings or growth, it is something that is impossible to value. Yet it is seen as a safe haven for many, and to others, an object of speculation. I definitely wouldn't recommend that anyone invest for the long term in gold, which has been moving sideways for almost 5 years and has no intrinsic value. To quote Warren Buffett:

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

However, one should look at gold as a potential hedge in your portfolio due to its negative beta, or to trade gold for a quick speculative profit. With gold having tight consolidations lately, seemingly approaching key resistance levels, and sudden spiking of fear levels among investors, it is time to take a closer look at whether gold is worth trading now.

The key element investors pay attention to for gold are the fundamental demand and supply dynamics, government debt levels, real interest rate levels and fear catalysts. With the breaking down of the correlation between demand and supply and gold price levels, declining purchases from China's central bank, continuation of high tariffs from India, real interest rates projected to rise, and most importantly, the lack of a clear catalyst, it seems like the time for a bull run in the gold market has not arrived as of today.

Demand and Supply

Examining the demand and supply dynamics of gold allows us to determine the price of gold in theory. If demand exceeds supply, there would be a shortage of gold, resulting in upward pressure on the price of gold. With China and India comprising approximately 40% of the world's total demand for gold, it is crucial to analyze these two overweight players in the gold market with regards to demand for gold.

China is the largest producer of gold in the world, so these imports take place to satisfy their domestic excess demand. Chinese demand is not only for jewelry, but actions from their central bank to diversify its excess foreign currency reserves. Low demand from China's central bank would potentially be a huge issue for the price of gold. China's central bank does not seem to be increasing gold stocks to the large levels held by Western central banks, its bullion hoard is still small, and ''as a share of total reserves, China's gold holdings are falling.'' However, demand for jewelry in China was especially strong, rising 7.4 percent at the end of 2017, to the point where jewelry demand is now the largest contributor to the total appetite for gold in China.

For India, it is not about the central bank buying; it is more of the public favoring ownership of gold. India is projected to overtake China as the most populous country in 2025, an expanding middle class could mean a large demand for gold. The Indian rupee has also fallen tremendously against the USD due to domestic inflation (Figure 1). The Indian government has to deal with a huge current account deficit as the imports are so large, lots of money leave the country. However, the Indian government controls this by introducing tariffs on gold, which weighs on the price of gold. From January 2012 to August 2013, the government of India raised gold import taxes from 2% to the present day 10%, which corresponded with a 22% fall in gold prices in the same period. In spite of anticipation from bullion traders that the government would announce a fall in tariffs this year in its 2018 budget, tariffs remained, which will continue to put a lid on demand, despite reforms for the agriculture and rural sector.

Figure 1

Source: INR / USD Currency Chart

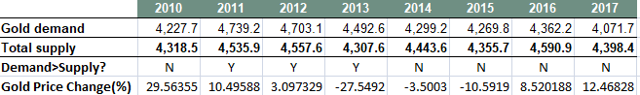

It is crucial to note how the dynamics of demand and supply do not play out for gold in reality, as seen in Figure 2, for the past 7 years, the laws of demand and supply and gold price only moved together in 2011, 2012, 2014 and 2016, which is 4 out of past 7 years. Thus, we should not base our decision to trade Gold solely on demand and supply dynamics.

Figure 2

Source: Created by the author using data from World Gold Council

Excessive government debt

Another reason why one may want to own gold is the fear that excessive government debt will cause erosion of value of paper money due to inflation. To quote Alan Greenspan:

Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.

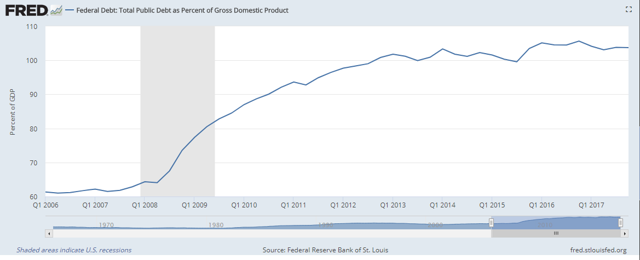

As seen in Figure 3, rising U.S. government debt has left many investors fearing that it is unsustainable and a ticking time bomb for the stock market.

Figure 3

Source: FRED

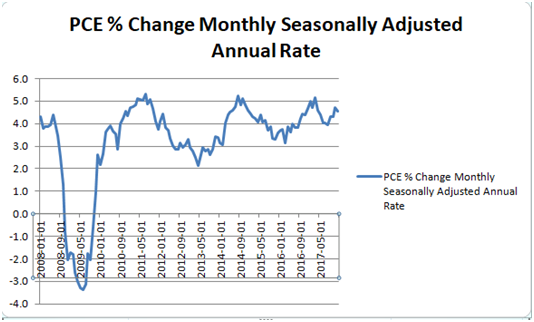

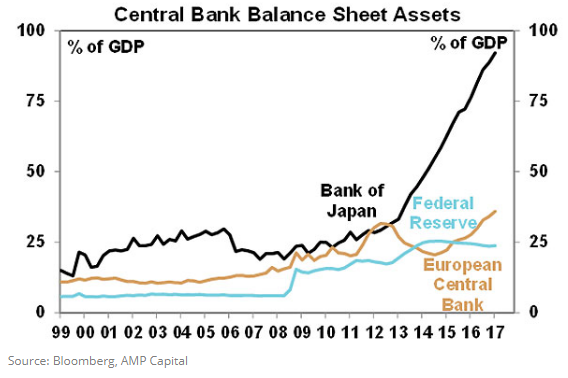

Similarly, there was fear that Quantitative Easing (QE) by central banks worldwide would result in inflation and erosion of fiat money (Figure 4).

Figure 4

However, it is important to note the breakdown of correlation between rising debt and QE and the price of gold from 2013 onward as gold stopped rallying, broke down and became stuck in sideways consolidation for the past 5 years (Figure 5). Furthermore, with the stagnation of inflation and the FED signaling the gradual reduction of assets on their balance sheet, the fear of government debt resulting in inflation and QE seems to have broken down with regards to translating these concerns in the price of gold.

Figure 5

Source: Gold Price Chart

Geopolitical impact

Another reason for possibly looking at gold now is the increase in fear (Figure 6) and current geopolitical worries. However, this is not a strong indicator to me as fear and geopolitical worries are subjective- there are many issues to worry about every year, from Russia's invasion of Crimea in 2014, the South China Sea Issue, refugee crisis in Europe, Trump's potential protectionist policies and impact on world trade, and the North Korea question - all these issues have been plaguing the world for quite some time, yet gold has trended sideways for 5 years, hence showing that geopolitical worries, while possibly driving large intra-day moves, are not good reasons for committing capital into gold.

Figure 6

Source: CNNMoney

Real interest rates

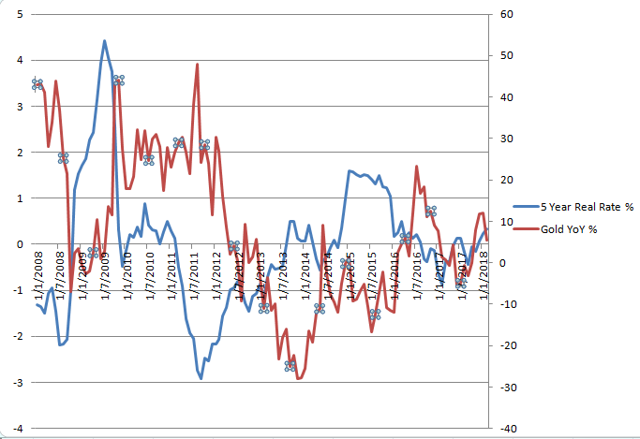

Gold also has an inverse relationship with real interest rates, when the inflation rate is greater than nominal interest rate, it is good for gold. Yet, this inverse relationship may not always hold such as from 2004 to 2006, where real interest rates rose in tandem with gold as Chinese demand became the main driver. With interest rates set to rise and inflation remaining stagnant for the time being, real interest rates have started to rise, which usually corresponds with a fall in gold prices (Figure 7). Hence, real interest rates, one of the key drivers for gold, lean towards a fall in gold prices. However, bearing in mind rising Chinese demand for jewelry, one may point to a similar situation like 2004 to 2006 where Chinese demand was so great that gold prices diverged from the inverse relationship with real interest rates and moved in tandem with it. Yet, one also has to bear in mind China's central banks reduction of gold demand, one which I believe will weigh down the overall Chinese demand for gold. Furthermore, I doubt Chinese demand for gold will surpass peak Chinese demand in 2013 as the Chinese yuan continues to appreciate against the dollar. Gold, which is priced in USD, would seem less attractive. With recent wage growth data continuing to remain stagnant, inflation is still muted (Figure 8). Concurrently, Fed is signaling at least 3 more rate hikes in 2018, which will push short-term interest rates up, as they closely mirror the overnight inter-bank borrowing rate set by the Fed. Thus, rising real interest rates will negatively impact gold prices.

Figure 7

Source: Created by author using data from FRED

Figure 8

Source: Created by author using data from FRED

While the correlation of real interest rates and gold prices did breakdown from 2009 to 2011, this was due to the massive catalyst of the Global Financial Crisis where maximum fear among investors led to a spike in gold demand. Unless a huge crisis occurs today, the relationship is likely to hold.

Technical analysis

Now for some technical analysis. The price of GLD seems to be forming a bullish wedge and price actions seems to become increasingly tight (Figure 9). This is definitely a bullish signal from the big picture, but to determine the probability of GLD breaking out of its bullish wedge, we have to look at the positions of speculators in the futures market.

Figure 9

Source: Created by author using data from Yahoo Finance

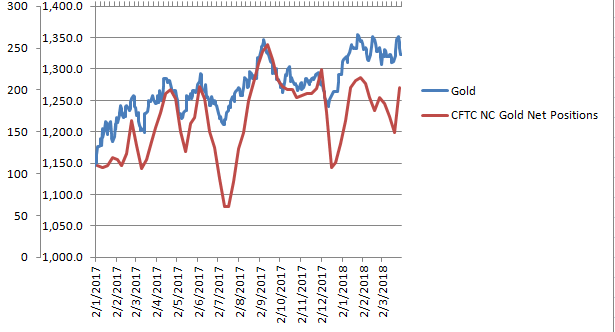

Figure 10 shows high correlation between CFTC non-commercial gold net positions and gold prices. With net positions in gold increasing, it seems reasonable to expect a short-term breakout in gold prices.

Figure 10

Source: Created by the author using data from World Gold Council and fxstreet

Conclusion

I wouldn't recommend allocating substantial amounts of capital to gold as I'm not convinced by the fundamental reasons supporting the price action, it seems to me that the current driver of gold is due to fears of geopolitical issues, most prominently, a trade war between the U.S. and China. Unless trade tensions escalate further, I'm simply not convinced of a strong catalyst in the present day, unlike the end of 2008, where the global financial crisis sparked off almost 4 years of strong rallying from gold. However, gold is a market where the state of key fundamental drivers are in constant flux and it is definitely worth monitoring if the facts that we have in hand change and adapt accordingly. If the fundamentals of the bull market are still going strong as I stated in my previous article, the lack of catalyst will continue to haunt gold, and we may continue to be in a long sideways consolidation, until the macro economic outlook changes. Furthermore, the wild card of cyrptocurrencies such as Bitcoin potentially acting as a store of value, though unlikely in the near term due to the large fluctuations in price in the past year, may pose as a threat in the near future as the millennial generation jumps aboard the narrative of Bitcoin as not only a global digital currency, but also as a store of value. While you may want to own gold if you are in a region where the currency keeps on depreciating against the dollar, as gold is priced in U.S. dollars, for the majority, gold is yet to glitter.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Jonah Ho and get email alerts