Alrosa's Profit, Revenue Rise in 2018

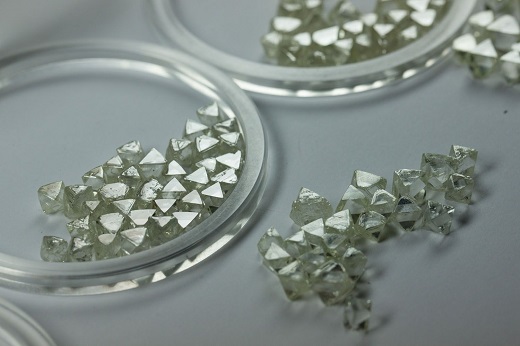

RAPAPORT... Sales of higher-quality stones and an increased average price drove a spike in Alrosa's profit and revenue in 2018.Profit increased 15% to RUB 90.4 billion ($1.39 billion),while revenue climbed 9% to RUB 299.7 billion ($4.62 billion), the miner saidlast week. The company's diamond sales jumped 12% to RUB 278 billion ($4.29billion), despite a 12% decrease in sales volume to 26.4 million carats. The declinein carats sold was offset by a 21% surge in the average price for gem-qualitydiamonds to $164 per carat. Alrosa derived its remaining revenue fromtransportation, gas and social infrastructure. Belgium remained the miner's biggest market, as sales increased 4% to RUB 130.39 billion ($2.01 billion). Domestic saleswent up 8% to RUB 53.34 billion ($823 million) and India sales grew 3% to RUB41.14 billion ($634.7 million). "In 2018, the company continued to consistently improve itsfinancial position," said Alrosa deputy CEO Alexey Philippovskiy. "The keyfinancial drivers included improved market environment (recovery in prices andstronger demand for diamond jewelry in major markets), and management effortsto boost efficiency." Production for the year fell 7% to 36.7 million carats, dueto the shutdown of the Mir pipe and the completion of open-pit mining at theUdachnaya pipe, the company said. In the fourth quarter, revenue inched up 1% to RUB 61.4 billion($947.4 million), as the average price rose 10% year on year to $153 per carat.Profit plunged 52% to RUB 7.9 billion ($121.9 million) as the figure in 2017 was higherdue to a payout from an insurance claim, Alrosa noted. "The trend of weaker demand for lower-priced stones thatemerged in the third quarter continued into the fourth quarter," the companyadded. Alrosa's diamond inventory decreased 6% year on year to 17 million carats as of December 31, as the miner sold more diamonds than it produced. The miner's rough-diamond resources increased to 1.1 billion carats at July 1, from 1.03 billion carats the company reported in January 2017. Reserves, defined as resources whose mining is economically viable, dropped 4% to 628 million carats. Image: Rough diamonds at the sorting center. (Alrosa)

RAPAPORT... Sales of higher-quality stones and an increased average price drove a spike in Alrosa's profit and revenue in 2018.Profit increased 15% to RUB 90.4 billion ($1.39 billion),while revenue climbed 9% to RUB 299.7 billion ($4.62 billion), the miner saidlast week. The company's diamond sales jumped 12% to RUB 278 billion ($4.29billion), despite a 12% decrease in sales volume to 26.4 million carats. The declinein carats sold was offset by a 21% surge in the average price for gem-qualitydiamonds to $164 per carat. Alrosa derived its remaining revenue fromtransportation, gas and social infrastructure. Belgium remained the miner's biggest market, as sales increased 4% to RUB 130.39 billion ($2.01 billion). Domestic saleswent up 8% to RUB 53.34 billion ($823 million) and India sales grew 3% to RUB41.14 billion ($634.7 million). "In 2018, the company continued to consistently improve itsfinancial position," said Alrosa deputy CEO Alexey Philippovskiy. "The keyfinancial drivers included improved market environment (recovery in prices andstronger demand for diamond jewelry in major markets), and management effortsto boost efficiency." Production for the year fell 7% to 36.7 million carats, dueto the shutdown of the Mir pipe and the completion of open-pit mining at theUdachnaya pipe, the company said. In the fourth quarter, revenue inched up 1% to RUB 61.4 billion($947.4 million), as the average price rose 10% year on year to $153 per carat.Profit plunged 52% to RUB 7.9 billion ($121.9 million) as the figure in 2017 was higherdue to a payout from an insurance claim, Alrosa noted. "The trend of weaker demand for lower-priced stones thatemerged in the third quarter continued into the fourth quarter," the companyadded. Alrosa's diamond inventory decreased 6% year on year to 17 million carats as of December 31, as the miner sold more diamonds than it produced. The miner's rough-diamond resources increased to 1.1 billion carats at July 1, from 1.03 billion carats the company reported in January 2017. Reserves, defined as resources whose mining is economically viable, dropped 4% to 628 million carats. Image: Rough diamonds at the sorting center. (Alrosa)