Anglo American narrows debt despite posting steep first-half loss

Shares in Anglo American (LON:AAL) were up Thursday after the miner announced its net debt had fallen and that an aggressive cost-cutting and asset sale strategy was on track.

The stock jumped almost 7% to 855.70 p, its highest level in more than a year, after the announcement and it was still trading about 5.25% up to 841.60 p at 3:47 pm GMT, outperforming the sector.

Anglo said that current volatility in the markets could make the second half of the year challenging.The miner, one of the hardest hit by the commodity rout from the top global mining companies, warned that current volatility in the markets could make the second half of the year challenging.

"I am not suggesting it is going to be easy from here - we have still got lots of challenges and probably tougher markets to navigate," CEO Mark Cutifani said. "There is still a long way for us to go."

However, he reaffirmed commitments to reinstate Anglo American's dividend by the end of 2017 after having suspended its final dividend payment last year.

Anglo posted a net loss of $813 million for the first half of 2016, compared with a $3 billion loss for the same period last year. The figure included a $1.2 billion impairment for some of its Australian coal assets, the company said.

Underlying earnings dropped 23% to $698m compared with the same period last year, just before the most commodities nose-dived.

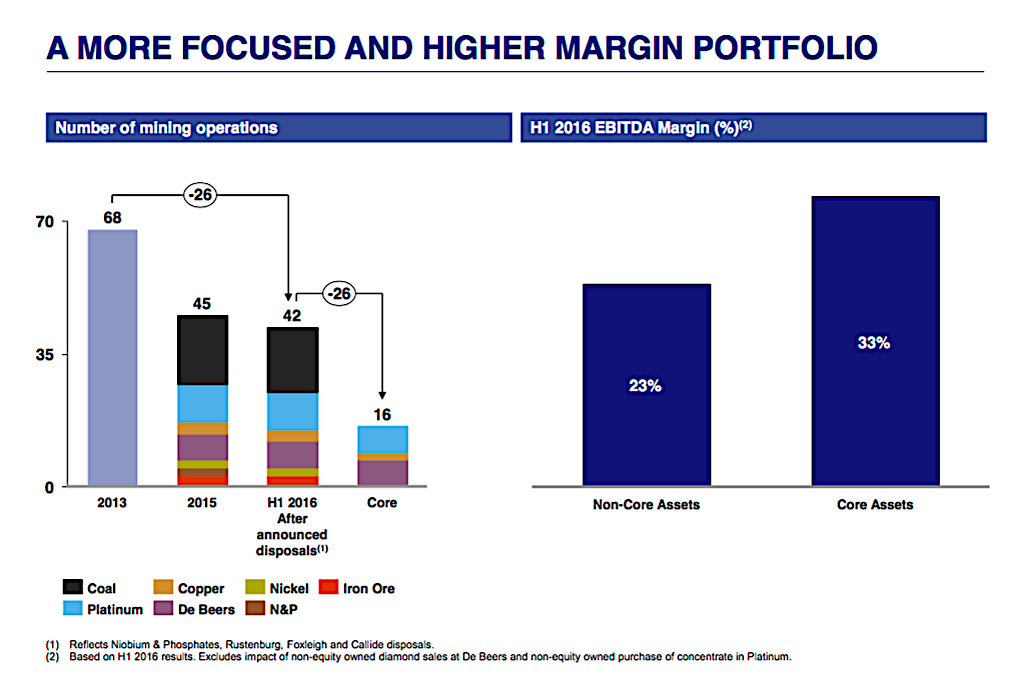

Source: Mark Cutifani's presentation.

But prices for some of the metals and minerals Anglo mines such as iron ore have been better than expected this year, which -combined with cost cutting measures- helped the firm to report $1.1 billion of free cash flow.

Diamonds were a key driver of first-half earnings, accounting for 42% of the total before interest and taxes.Diamonds were a key driver of first-half earnings, accounting for 42% of the total before interest and taxes. A 29% increase in volumes sold over the same period last year provided a boost to results at its De Beers unit as the diamond giant worked down excess inventory built up in 2015 amid a sharp decline in demand.

Despite the positive results, Cutifani was cautious about the diamond market conditions for the second half and said De Beers' results weren't likely to be as robust.

The company, which agreed in April to sell its niobium and phosphate operations for $1.5bn to China Molybdenum, did not announce any new asset sales. It did say it expected to complete that deal in the second half of the year and that it was working on selling coal mines in Australia.

Anglo expects to rise $3 billion to $4 billion in assets sales this year.

Watch Mark Cutifani speak about the way forward: