Augustus Minerals Snapshot

Barry Dawes of Martin Place Securities and Kyle Williams of Morgan's Research take a look at Augustus Minerals Ltd.

Key Points

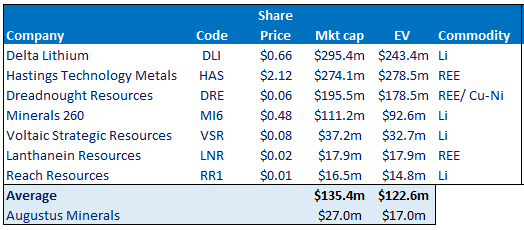

Augustus Minerals Ltd. (AUG:ASX) is listing at 11 am AEST tomorrow100% of Ti-Tree Shear Project in Gascoyne RegionSingle continuous 3600km2 regionally dominant portfolio of tenementsSought after tenements in Australia's pre-eminent critical elements provinceVery attractive underexplored tenements forRare EarthsLithiumCopperSurrounded by highly valued explorers and developersStrong shareholder wealth buildersAugustus is only 14% of the average of its peersSubstantial work done by AUG over the past few yearsWalk-up targets already identifiedMajor rerating expected on listingBUY more!Peer Group Valuations Ave AU$123m Enterprise Value vs. AUG AU$17m Enterprise Value.

Thanks to all MPS clients who participated in AU$0.10 seed and AU$0.20 IPO.

From Morgans: RESEARCH FLASH: Augustus Minerals Ltd | IPO Listing 25th May

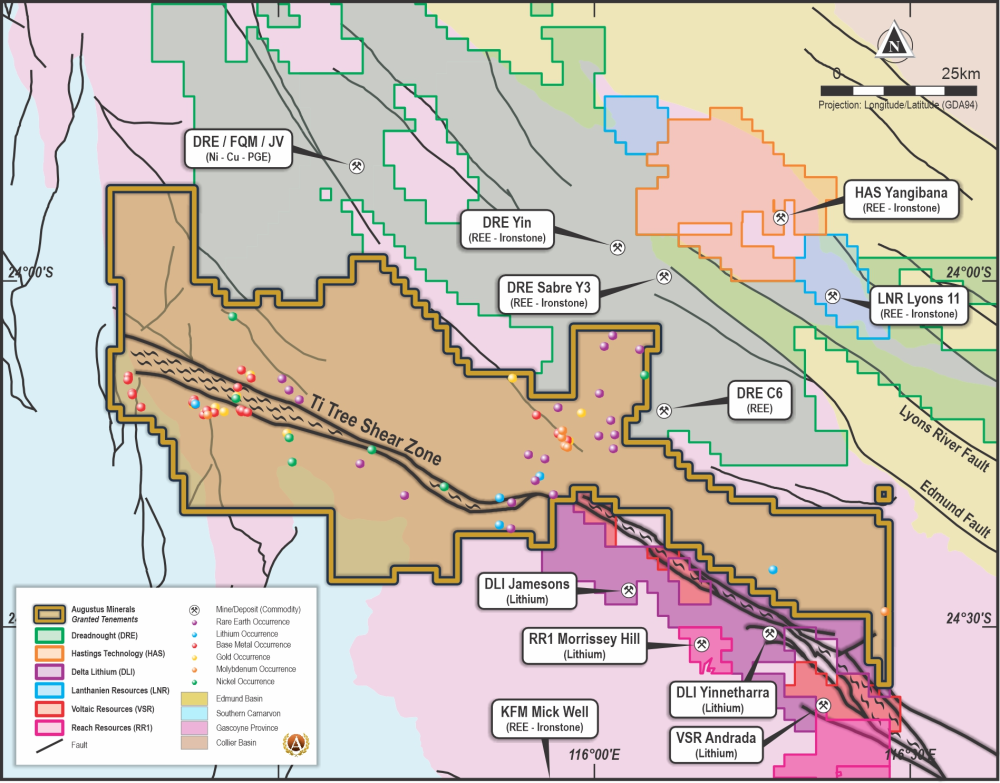

Augustus Minerals Limited is exploring for lithium, rare earths, and copper across a strategic tenement package in the emerging critical minerals hotspot of the Gascoyne Mineral Province in Western Australia. The project covers approximately 3,600km ? of granted and under-application tenements, and early exploration work has already defined multiple lithium and rare earth targets analogous to recent discoveries by neighboring explorers.

Gascoyne Region - Australia's Emerging Preeminent Critical Minerals Province

ASX explorers in the Gascoyne region have continued to report exceptional exploration results during the year as they aim to unlock value from lithium pegmatite and high-grade, high-value rare earth discoveries. At the same time, highly prospective base metal Ni-Cu-PGE targets have attracted First Quantum Minerals through their JV with Dreadnought Resources.

Delta Lithium (DLI:ASX) has been drilling their Yinnetharra Lithium Project since November 2022 and steadily delivered positive results as they defined multiple pegmatite bodies. Last week at the Resources Rising Stars Conference, Delta Lithium Chairman David Flanagan confirmed on-market buying from Mineral Resources (MIN:ASX) and Hancock Prospecting in Delta.

In recent weeks, Voltaic Resources (VSR:ASX) reported thick pegmatite intersections in drilling, while Reach Resources (RR1) reported positive rock chip results for lithium adjacent to Delta Lithium's Malinda lithium prospect.

Hastings Technology (Mkt cap AU$274m) is developing the Yangibana Rare Earths Project, with billionaire Andrew Forrest providing an AU$150m Convertible Note last year. Dreadnought Resources (DRE:ASX Mkt cap AU$196m) is exploring its Mangaroon REE Project.

Snapshot of Augustus

Augustus Minerals hold a dominant position in the Gascoyne, and their Ti-Tri Shear Project covers 3600km ? with several high-priority lithium, copper, and rare earth targets already defined and set for testing in the coming months. A tenement package of this scale, covering multiple untested targets and supported by strong geophysical signatures and geochemical anomalies, underpins the exploration potential at Ti Tree.

Key Takeaways

Large ~3,600km ? exploration package with >50 targets already defined.First mover in this region having pegged the major geological structure - Ti Tree Shear (85kms) critical minerals host, prior to the recent pegging rush.Acquired magnetics, radiometric, and digital elevation data.Rare Earth, Lithium & Copper targets analogous to neighbors.100% AUG ownership.Early work by AUG has defined multiple new targets analogous to recent adjacent discoveries.AUG will list at a market cap of Au$27.3m and EV of Au$17.3m. This is substantially below the peer group average of ~Au$140m mkt cap and ~Au$127m EV (refer to Table 1 below).

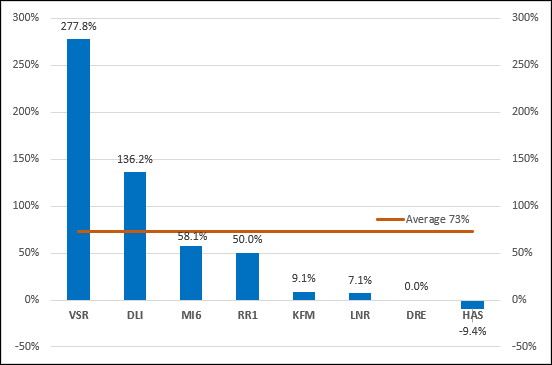

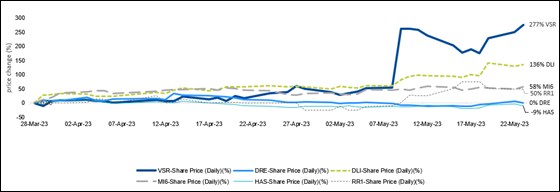

We also note the exceptional share price performance of this peer group which has increased an average of >70% over the past 60 days (refer figure 3 below).

Summary

Augustus has assembled a strategic tenement package, defined numerous targets at Ti Tree, and planned a high-impact exploration program this year.

With the Gascoyne region delivering significant rare earth and lithium discoveries over the past year, exploration and development companies have stepped up their focus on the emerging critical minerals province.

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interestingCobalt / Lithium / Manganese,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures please click here.

Morgan's Research Flash Disclosures

Analyst(s) own shares in the following stock(s) mentioned in this report: All.

Corporate disclosure: Morgans Corporate Limited is Lead Manager to the IPO and will receive fees in this regard. Morgans Corporate Ltd holds 2.7m options in Augustus Minerals Ltd at an exercise price of $0.30 on or before a date 3 years from listing.