BHP searching for assets with lessons learned during downturn in mind

World's largest miner BHP (ASX, NYSE, LON, JSE:BHP) told investors on Wednesday that it has learned from its past mistakes and is now spending its money more wisely.

Explaining BHP's fresh strategy to seek growth while maintaining a healthy balance sheet, chief financial officer Peter Beaven said in a briefing the company has learned to assess both risks and returns, actively manage threats and think beyond simple hurdle rates for investment.

CFO Peter Beaven has outlined a detailed plan on how to not waste a whole lot of shareholders' money again.Capital allocation has been a bone of contention in the past few years between executives and investors, as the results of the big pro-cycle investments during the China-inspired post-crisis resources boom ended with heavily indebted miners when the boom came to an end.

BHP, for one, spent more than $40 billion in its onshore US oil and gas business before admitting defeat and selling its shale assets to BP Group for around $11 billion earlier this year.

"We know that over-investing destroys value but under-investing likewise can also destroy value, so we have to find a balance," Beaven said. "Over the past five years, we've worked hard to learn from our mistakes. We have made significant improvements. We have institutionalized our approach to capital allocation," he noted, adding that BHP has managed to reduce net debt by $15 billion while changing its dividend policy to a more appropriate payout ratio.

Jansen back on the table

While BHP said it would continue to acquire early stage assets such as SolGold's (LON, TSX:SOLG) highly prospective Cascabel copper deposit in Ecuador, the company will also have to make up its mind regarding two major spending decisions - the Olympic Dam and Jansen.

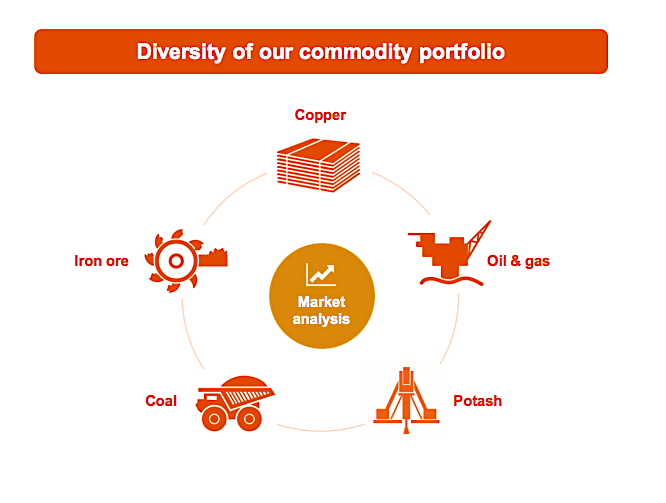

BHP aims at having a balanced portfolio of commodities and options, with the appropriate and optimum mix of risks and returns.(From: Capital allocation briefing. Nov. 21, 2018.)

The company needs to evaluate whether it should move forward with a $2.1 billion expansion of Olympic Dam copper, gold and uranium mine in South Australia, which would lift the operation's copper production to 330,000 tonnes by 2023.

The other option would be to finally move ahead with its Jansen potash mine in Canada, which could become the world's largest, producing 8 million tonnes of the fertilizer ingredient a year, or nearly 15% of the world's total.

Beaven said the Jansen mine was one of those "lower-risk, lower-returning projects" BHP considers to invest in.Construction has been advancing slowly for years, but BHP has held off on committing the capital needed for completion, because of soft fertilizer prices.

Beaven said Jansen was one of those "lower-risk, lower-returning projects." He said the mine was a big investment, but could be the sector's lowest-cost producer, with a multi-decade resource base and the potential/optionality for future capital-efficient expansions.

Its scale, however, could also have a material impact on the market - it could create a supply glut and affect prices - hence BHP is moving slowly and cautiously and may try to introduce a partner to reduce the risk, Beaven said.

The executive also said BHP plans to invest in high risk, high return projects like Trion, oil joint venture with Pemex, Mexico's state oil company. "We could lose all our investment on these, if, for instance, exploration fails. But we could create the tier one assets of the future," he said.