Bad News Is Still Good News For Gold

Inverse correlation between U.S. equities and gold remains intact.

As long as financial market is internally weak, gold should stay strong.

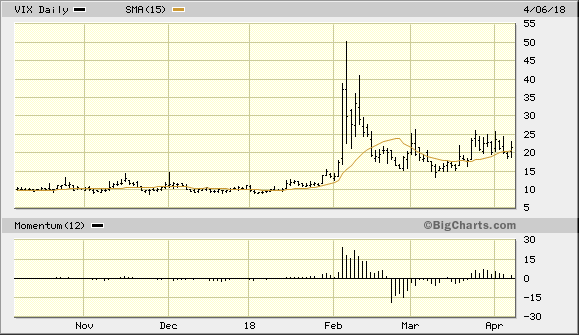

Volatility Index (VIX) is a worthwhile reflection of this relationship.

Gold prices rose on Friday and U.S. equities sold off on trade-related concerns. Meanwhile the dollar was lower while Treasury prices were higher as safe-haven buying was in evidence. Gold continues to benefit from economic uncertainty and broad equity market weakness which remain the two main drivers of its recent buoyancy. As we'll examine in this commentary, the technical odds are still in favor of gold feeding off these factors and strengthening in the near term.

Spot gold rose 0.5 percent at $1,332 on Friday while June gold futures settled 0.6 percent higher at $1,336. This allowed the gold price to finish a somewhat tumultuous week above its key immediate-term trend line and comfortably above its 3-month trading range floor.

One of the news-related factors which helped boost gold prices on Friday was the latest U.S. payrolls data. While the unemployment rate held steady at 4.1% for the sixth straight month there were signs that the pace of hiring slackened in March, according to the latest numbers from the Labor Department. Payrolls rose to 103,000 in March, which was well below the consensus forecast by economists. This represented the lowest level of job creation in six months, which prompted worries among traders that the Federal Reserve might be forced to slow the pace of its interest rate increases. This helped buoy the gold price, but the main catalyst for the metal's latest rise was the sell-off in stock prices.

As has been a lingering problem for Wall Street, the latest rhetoric from the Trump administration and Chinese officials over trade tariffs upset the equity market, causing the Dow Jones Industrial Average to plunge 572 points, or 2.34%. President Trump late last week threatened to impose an additional $100 billion in tariffs on Chinese imports while Beijing pledged a "fierce counter strike."

In Friday's report I emphasized that the next couple of trading sessions were likely "make-or-break" for gold as far as determining its near-term directional trend. I wrote that one confirmation of a positive outcome would be if the gold price closes Friday's (Apr. 6) session decisively above its 15-day moving average. An even better sign of technical strength would be if gold closes somewhere near or above its most recent price high which was made in late March. While the latter development hasn't happened yet, gold did at least manage to finish last week above its technically significant 15-day MA.

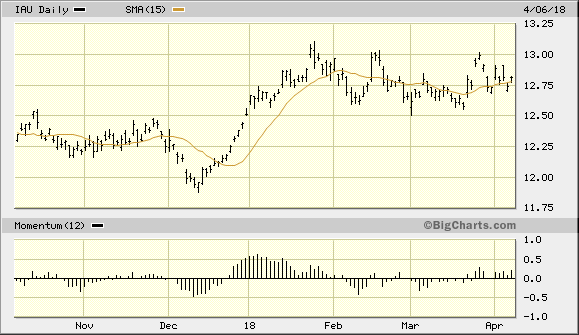

Shown here is my gold proxy, the iShares Gold Trust (IAU). As the graph clearly shows, IAU has stubbornly refused to break down decisively under its 15-day moving average since February, which can be interpreted as a sign that the bulls are still control of the immediate-term (1-4 week) trend. The gold bears haven't completely given up in their attempts at keeping the gold price from breaking out to new yearly highs, however, as can be seen by IAU's failure to rally decisively above the $13.00 level (roughly the 2- 1/2 month trading range ceiling). The coming week could well see a test of this important level, though, and the odds of this happening will dramatically increase if the U.S. stock market remains volatile as trade-related concerns are still a major worry on Wall Street.

Source: BigCharts

Basically the most important factor behind gold's immediate-term increase in safe-haven demand has been the inverse correlation between the gold price and equity prices. More specifically, whenever the incremental demand for equities drops - as evidenced by a significant increase in the number of NYSE-listed stocks making new 52-week lows - gold's near-term prospects tend to improve as safety-conscious investors are motivated to purchase gold as an insurance against additional financial market uncertainty.

The progression of the CBOE Volatility Index (VIX), which roughly measures the rise and fall of investor fear, illustrates the recent tendency for equity market volatility to remain elevated. As long as the widely followed VIX remains above its 15-day moving average (along with the gold ETF price), a positive outlook for the yellow metal outlook is reasonably assured.

Source: BigCharts

For the benefit of ETF traders, my favorite gold trading vehicle, the iShares Gold Trust (IAU), confirmed an immediate-term buy signal per the rules of the 15-day MA trading method two weeks ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts