Barrick Gold: What To Expect In 2018

Barrick Gold is one of the largest gold producers in the world with 1.243 Moz of gold produced in 3Q'17. The company forecasts gold production of ~5.4 Moz/2017.

Acacia Mining in Tanzania: A lingering subject of concern for Barrick that will remain in 2018.

ABX offers a good opportunity and seems undervalued as it enters 2018 while it is not totally "risk free." It is perhaps the right time to start a long-term accumulation.

Courtesy: Barrick Gold (ABX)

Investment thesis

Barrick Gold is one of the largest gold producers in the world with 1.243 Moz of gold produced in 3Q'17. The company forecasts a gold production of ~5.4 Moz midpoint and ~430 Mlbs of copper in 2017.

Barrick Gold runs as much as 11 mines producing mostly gold (including seven core mines in Americas producing an expected 70% of the total production 2017 at an AISC of $770-$800/ Oz ). The stock is part of my main core investment in gold since 2015.

The company stock price has suffered from a gold price slump and high debt level weighing heavily on its balance sheet reaching over $12.75 billion in 4Q'14, and despite an impressive comeback in July 2016 with a peak around $23 followed by an additional attempt in February 2017 at around $21, the stock price is still regarded as depressed from a midterm to long-term perspective.

However, ABX offers a good opportunity and seems undervalued as it enters 2018 while it is not exempt from risks (Acacia mining in Tanzania for example). It is perhaps the right time to start a long-term accumulation using this gold miner as a general hedge against an increasingly overheated market.

Owning gold as a hedge against inflation/US dollar is the traditional purpose of keeping a constant gold holding. It is true at least for the long term albeit debatable for the short and midterm. Thus, investing in the gold majors makes sense as long as the balance sheet is solid.

This serious long-term commitment added to constant free cash flow, which led me to revise my thinking toward ABX, from "not interested" to "long-term buy" in 2015, and we own since then a long-term position that we intend to increase on any weakness.

ABX was struggling with a high-level total debt but looks much healthier entering 2018.

ABX overused acquisitions as a failed growth strategy in the past to establish its leadership position in the resources/reserve base.

However, Barrick ran into a debt issue due to past fumbled acquisitions and uncontrolled capex. The company still has one of the highest debt/equity ratios among the major gold miners.

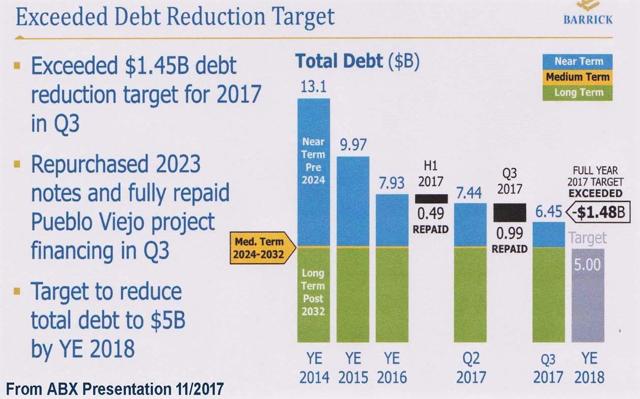

Barrick Gold management is certainly aware of the debt issue and was able to reduce long-term debt to $6.45 billion in October 2017 with a target of $5 billion in YE 2018.

The company is committed to reducing total debt to less than $5 billion in the midterm (2018). The reduction was driven mainly by selling the company's non-core assets to optimize its balance sheet. The result is that Barrick presents a strong near and medium-term liquidity of about $6 billion and about 75% of the debt has an average maturity of 18 years.

Free cash flow analysis

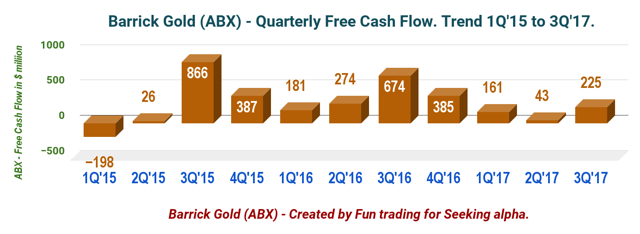

One important financial element that deserves some serious attention is the ability of the company to deliver sufficient free cash flow. On a yearly basis, FCF is now $814 million, which is sufficient to pay for the dividend payout of $140 million annually, which leaves a good security margin.

Source: ABX Presentation November 2017

Source: ABX Presentation November 2017

Free cash flow is an important hint that should be always evaluated carefully when looking at a long-term investment. Basically, FCF should be sufficient and of course positive if the business model can be regarded as solid to support a long-term investment.

ABX passes the test here, in my opinion.

Gold production analysis

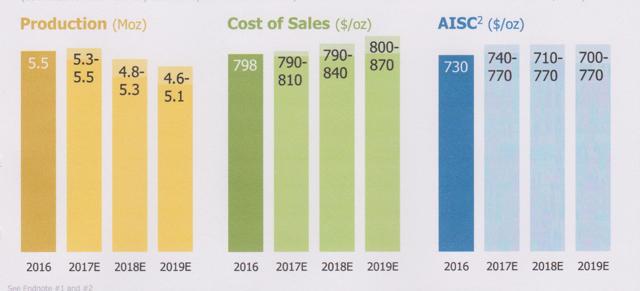

All-in sustainable cost AISC is one of the lowest in the industry and has been under $800/oz for over two years. One of the best AISC among its peers.

All-in sustainable cost AISC is one of the lowest in the industry and has been under $800/oz for over two years. One of the best AISC among its peers.

Based on the recent production forecast for 2017 with a midpoint of 5.4 Moz, production in the fourth quarter 2017 will be between 1.40 Moz to 1.44 Moz. Also Barrick gold is producing copper.

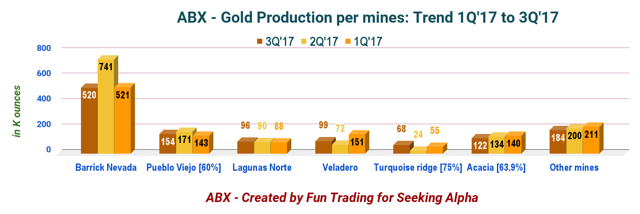

The production was impacted by lower planned ore grades, mainly at Pueblo Viejo, Hemlo, and Lagunas Norte. The company expects 3Q'17 production to be the lowest in 2017. We should see higher production in the fourth quarter which will be above 1.4 Moz.

The production was impacted by lower planned ore grades, mainly at Pueblo Viejo, Hemlo, and Lagunas Norte. The company expects 3Q'17 production to be the lowest in 2017. We should see higher production in the fourth quarter which will be above 1.4 Moz.

Gold production for 3Q'17 has been the main weakness that has driven the stock down lately. However, the company discussed in its last press release that its four projects:

Cortez Deep South underground expansion, underground mine at Goldrush, the third shaft at Turquoise Ridge, and Lagunas NorteAre scheduled to contribute more than 1 M Oz of annual gold production to the company starting in 2020. According to the third quarter press release:

Feasibility level projects at Cortez Deep South, Goldrush, Turquoise Ridge, and Lagunas Norte continue to advance on schedule and within budget. A prefeasibility study for Pascua-Lama remains underway.

Acacia Mining in Tanzania: A lingering subject of concern for Barrick that will remain in 2018

What may have triggered some sell-off is the proposed framework on October 20, with the Tanzanian government about Acacia's (OTCPK:ABGLF) mine.

The "framework agreement" that complies with newly enacted laws in Tanzania, one of which is to hand 16% in shares of locally operating firms to the government. The other key concession is best described as a kind of downpayment of $300m that Barrick recommends Acacia make to the government.

Barrick gold owns 63.9% of equity interest in Acacia Mining. Consequently, Credit Suisse downgraded the stock from "outperform" to "neutral," citing "weaker operational results" so far this year, with potential value loss in Acacia, as the reason for the downgrade.

Surprisingly, Barrick's $300 million goodwill gesture resembles more like an admission of guilt than anything else and many wonder how Acacia will be able to pay that exorbitant amount while having net cash resources of about $24 million?

The Tanzanian government claims alleged underpayment of taxes and duties by Acacia to the Tanzanian tax authority over a period of about 20 years.

On November 2, 2017, we learned from Reuters that Acacia Mining's top two executives have resigned in the midst of talks between its parent company and the Tanzanian government.

The dispute has wiped about $1.7 billion off Acacia's market value since the ban was introduced. The miner said in September it would shut all underground mining at its flagship Bulyahulu mine.

Final commentary and technical analysis

Barrick Gold is a typical example of what we should expect from a top-tier gold miner.

Fast-improving debt level Good production decreasing slightly until 2019 and strong growth pipeline. Solid balance sheet and generation of sufficient free cash flow A small but safe dividend with a yield of 0.83%. However, Barrick will have to deal with Acacia - which provided 122 K Oz of gold in 3Q'17 or 9.8% of the total production for the 3Q'17- and its negative effects in 2018. It is difficult to see how this problem will not impact negatively Barrick gold one way or another.

However, Barrick will have to deal with Acacia - which provided 122 K Oz of gold in 3Q'17 or 9.8% of the total production for the 3Q'17- and its negative effects in 2018. It is difficult to see how this problem will not impact negatively Barrick gold one way or another.

Technical analysis

Technically, ABX is forming a descending (falling) wedge pattern. The falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower.

Technically, ABX is forming a descending (falling) wedge pattern. The falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower.

The assumption here is that ABX could eventually experience a positive breakout after testing the resistance around $16.50-$17, which will probably lead to a high of $19.25 (first resistance - Sell signal) and eventually as high as $23 (Sell signal).

However, the stock may fluctuate widely depending on the price of gold, which may or may not rally in 2018.

Federal Reserve monetary policy is likely to be the overriding factor determining the direction of gold prices in 2018, with most analysts seemingly upbeat on the yellow metal on a view that policymakers may not hike interest rates as much as currently forecast and that other central banks will also tighten, meaning the U.S. dollar cannot gain traction.

They also cite potential for a correction in the stock market that translates into safe-haven demand for gold. Bears, meanwhile, say the U.S. economy will remain strong enough that Fed policymakers will in fact hike as much or possibly even more than they've hinted.

The risk of a downside is limited (25%) but still present and alive. The support line is around $13.50 (Buy signal) and I do not see any negative breakout occurring at this level unless gold turns really bearish and/or ABX experiences further production setbacks.

Important note: Do not forget to follow me on ABX and other gold stocks. Thank you for your support.

Disclosure: I am/we are long ABX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.