Billionaire Sam Zell Buys Gold: Right Move, Wrong Reason

Investment guru Sam Zell is buying gold for the first time. Zell claims "Supply is shrinking."

Please consider Billionaire Sam Zell Buys Gold for First Time in Bet on Tight Supply.

Gold’s dimming supply prospects have caught the eye of one billionaire.

“For the first time in my life, I bought gold because it is a good hedge,” Sam Zell, the founder of Equity Group Investments, said in a Bloomberg TV interview. “Supply is shrinking and that is going to have a positive impact on the price.”

“The amount of capital being put into new gold mines is a most nonexistent,” Zell said. “All of the money is being used to buy up rivals.”

Misunderstanding Supply

Zell is correct about capital, about new mines, and about gold being a hedge.

Zell is wrong about supply. The supply of gold increases every month, albeit at a diminishing rate.

Since gold is not used up, the supply of gold is nearly every ounce ever mined, including gold in jewelry. The supply does not include gold buried and forgotten about or otherwise lost, gold in antiques, gold in historical treasures, etc.

At every price point, someone has to decide to hold on to their gold or sell it. Someone has to hold 100% of the supply, 100% of the time and that supply is constantly increasing.

Supply is not tight. Zell confuses supply with production as do most analysts.

But Zell is correct about gold being a hedge, perhaps not how he intends it. Gold is a hedge against central banks and runaway credit expansion.

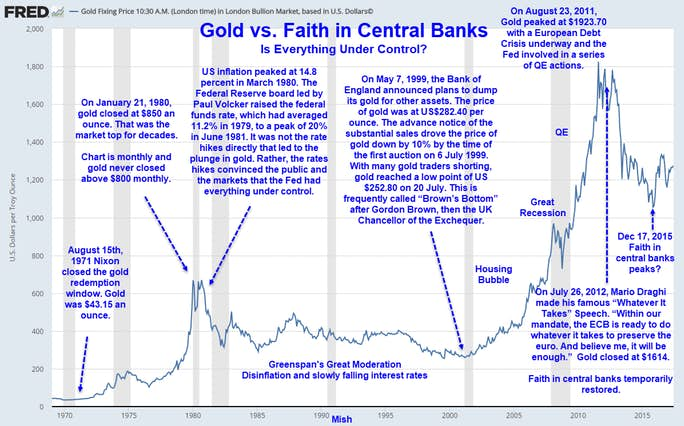

Gold a Measure of Faith in Central Banks

As I have pointed out, gold moves primarily in response to faith in central banks.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.