Black Tusk Gets to Work in BC

June 5, 2018 (Investorideas.com Newswire) Bob Moriarty of 321 Gold profiles a small-cap explorer with prospective land in British Columbia.

If you want to be a hero with the PermaBulls, all you have to do is predict an imminent and high price for gold, no matter how absurd. But PermaBulls either forgot or never knew that prices for everything go both up and down. And if you want to profit the most, you want to be buying on the way down because, who knows, maybe prices will go up one day.

We seem to be on track for the seasonal low due in June/July. It seems reasonable to me to believe that since gold shares are the lowest relative to gold in many years that we are due a tradable low soon followed by much higher share prices. The DSI for gold has hit 10 and 12 for silver; that suggests a valid low soon.

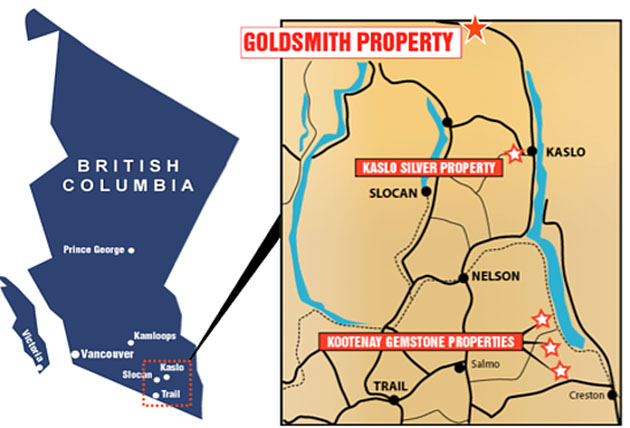

I have been tracking a young and very early stage gold exploration company named Black Tusk Resources (TUSK-C). The company only went public at a dime in November of 2017 so it's not loaded up with irate investors. Their only asset is the Goldsmith property in southeast BC about 65 km north of Kaslo.

Their option on the property calls for cash payments of $100,000 and the issuance of 400,000 shares. There is a 2% NSR on the project that can be bought down to 1% for $500,000.

Goldsmith has a history of prior production so it's not entirely greenfields. The area has power, water and good roads and is part of the Slocan Mining District with a mining history going back to 1891.

Black Tusk is at the put up or shut up stage with enough capital on hand to run a small aggressive exploration program this summer. Obviously they will need to raise more money and to do that they have to show results.

On May 16th they released a series of assays from grab samples taken on the property showing high-grade nuggety potential. Samples showed 29.89 g/t Au, 27.5 g/t Au, 13.34 g/t gold, 12.53 g/t, 9.61 g/t and 8.06 g/t gold so certainly the potential is there.

The company is busy doing the groundwork of sampling and data compilation as well as LIDAR for target definition for a trenching program later this summer. Look for steady news flow all this summer.

In this market having no history may well be a good thing. The company isn't carrying around any spare baggage. With a tiny 14 million shares outstanding and a market cap of $2.8 million it won't take much in the way of results to get this puppy moving.

At the very least the company is interesting. They are in a gold district, they did a very cheap deal on the project and have a tiny number of shares. I'd really like it to succeed but for sure the management team knows they have a gun held to their heads. Personally I think that's a great way to run a company.

Black Tusk is an advertiser and you should do your own due diligence. I do not own shares but would be a lot more interested with some compelling results.

Black Tusk ResourcesTUSK-C $0.195 (Jun 05, 2018) 14 million shares Black Tusk Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. Black Tusk Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.