British Columbia miners post record revenues in 2018

British Columbia's mining sector posted positive results for the second straight year in 2018 coming off a period of lower commodity prices and reduced activity, according to PwC Canada's latest BC Mine report.

In total, BC miners posted a record high gross revenue of C$12.3 billion, compared with C$11.7 billion in 2017. Capital expenditures also fell to C$1.2 billion from C$1.5 billion.

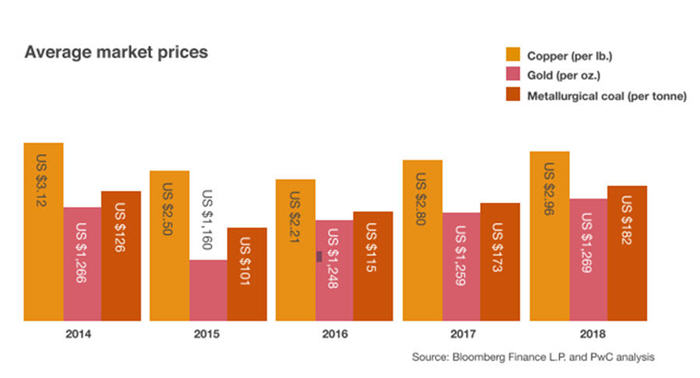

Key contributing factors were a recovery in the commodity market and increased mining activity within the province. On average, copper and metallurgical coal prices were 6% and 5% higher respectively in 2018 than the prior year, while gold price remained steady.

There were a handful of mergers and acquisitions involving BC miners in 2018, signalling a steady turnaround and renewed optimism in the industry. Notable transactions include Newmont Mining Corp.'s acquisition of a 50% interest in the Galore Creek Partnership from Novagold Resources Inc. (forming a partnership with Teck Resources) and Taseko Mines Ltd.'s purchase of Yellowhead Mining. Newmont also completed its acquisition of Vancouver-based Goldcorp earlier this year.

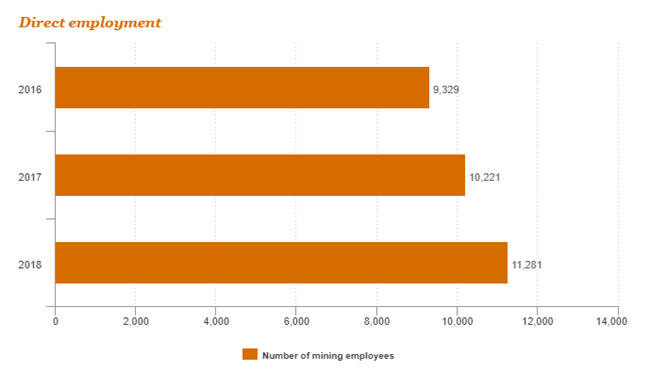

Confidence in mining projects was also reflected in the growing workforce in the sector. The number of mining employees grew by 10% in 2018 compared to 2017, partly a result of new projects coming online and expansions at existing projects (ie Teck's operations). The increased employment numbers helped to drive up total payments to the government to $953 million from $884 million a year earlier.

"There are great opportunities here in BC, and it's up to the industry, the government and all other stakeholders to bring certainty to the mining sector, which is a major contributor to the provincial coffers," said Mark Platt, Mining Partner, PwC Canada.