CHART: Stop panicking about Chinese growth

Fears of a hard landing in China have investors seeing red

Chinese leaders in October outlined the direction of the world's second largest economy over the next five years.

The country's 13th five-year plan running from 2016 - 2020 calls for "medium-high economic growth" and doubles-down on a long-stated commitment to "double 2010 GDP by 2020".

The 2020 GDP goal would require annual growth rates of 6.5% to go from a nominal $10 trillion last year to over $12 trillion in 2020. That's the equivalent of adding an economy the size of Switzerland's every year.

China's official GDP data released last week led to another round of selling on financial markets with headlines of the slowest growth since 1990 jolting already nervous investors. The headline figure? 6.9%

Some slowdown was both inevitable as the economy matured, and desirable as part of rebalancing away from over-investment towards consumptionJulian Jessop, commodity strategist and chief economist at Capital Economics, in a research note on Monday argues that the worry over Chinese growth is overdone and that the worst is already behind us.

Capital Economics' own measure of the Chinese economy which uses data such as electricity usage and rail freight traffic to gauge activity rather than Beijing's official figures puts the growth rate as low as 4.3%.

The London-based economist says "much of the recent gloomy commentary about the impact of slower growth in China on the rest of the world misses a number of other key points":

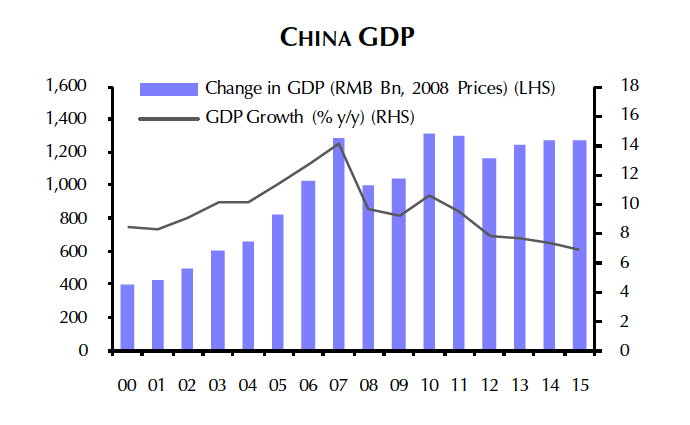

"First, it was never likely that China could maintain double-digit growth as incomes caught up with those in West. Some slowdown was both inevitable as the economy matured, and desirable as part of rebalancing away from over-investment towards consumption.

"Second, China's slowdown is nothing new. Growth peaked in 2007 and had been on a clear downward trend since 2011. Crucially, this has not prevented advanced economies from picking up, or global growth from stabilising.

"Third, the much larger size of China's economy means that even much slower rates of growth can deliver big increases in demand from year to year and maintain ahigh contribution to global growth."