CHART: Trump $500 billion will do very little for global mining

During his campaign Donald Trump promised to push through a $500 billion spending program to build bridges, roads, railways, schools and hospitals early next year and the president elect has aspirations of $1 trillion in infrastructure build-out in the US over the next decade.

The surge in industrial metals prices and steelmaking raw materials following the surprise victory of Trump has definitely cooled - copper for example is down 10% from its intra-day high a week ago. Other base metals had been rising strongly long before the vote and the recent frenzy for met coal and iron ore also seems to be on the wane.

While a notable boost to the domestic market, this translates to less than 1% of additional global steel and copper demand growth over the next four yearsA new report by BMI Research, a Fitch company, says even if a Trump administration is able to keep much of its promises of fiscal stimulus (not that likely - a Republican-led Congress blocked a similarly-sized plan by Barack Obama at the height of the financial crisis), the impact on global mining markets will be minimal.

BMI gives several reasons for its highly skeptical view of the infrastructure plan and its potential to lead to a metals demand surge including a likely 'America First' metals procurement policy under the program and a global supply response to any increase in demand in the US thanks to weakening local currencies.

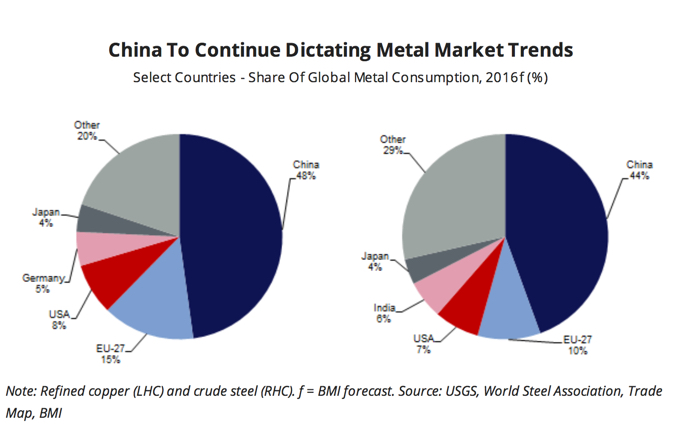

But the number one reason is one of simple math. The US is just not a big enough metals consumer to move global markets and prices:

Under a best-case scenario for Trump's infrastructure plan, we would expect to see average US steel and copper demand growth of 4.4% and 4.6%, respectively over 2017-2020, reflecting an additional 4.0% and 3.0% annually to our core scenario forecasts.

While a notable boost to the domestic market, this translates to less than 1.0% of additional global steel and copper demand growth over the next four years. For both metals, this amount would not substantially tighten the global market balance, and, as such, provide negligible upward pressure to prices.

We estimate that the US accounted for only 8.1% and 7.1% of global refined copper and crude steel demand in 2016. These figures are dwarfed by China's copper and steel market shares of 47.8% and 44.5%, respectively.