Can John Paulson Save The Gold Mining Stocks?

Hedge fund group aims to boost gold mining stock performance.

A mining sector turnaround will need a lot more than activism, however.

Despite near-term weakness, intermediate-term potential exists for XAU.

Natural resource investors were excited to learn recently that an effort is underway to boost the profile of the underperforming gold mining industry. If successful, this campaign could result in higher share prices for major mining companies and may even the gold price a lift. But how likely are the combined efforts of several major stakeholders to succeed in turning things around for the industry? And even if successful, how long will this effort take before making a definite impact on gold mining companies? As I'll argue here, investors shouldn't hold their breath in expectation of any significant results in the foreseeable future.

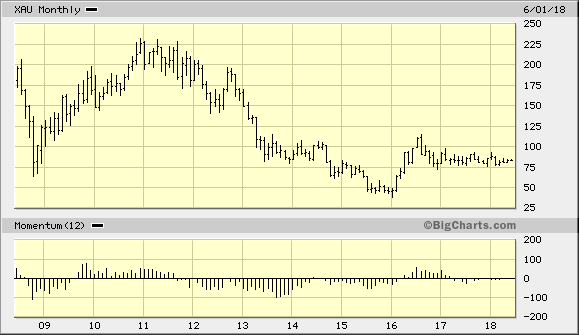

Long-term gold mining stock investors are understandably disappointed with the lack of returns since 2011 when the average gold mining and exploration company saw its share price peak. The PHLX Gold/Silver Index (XAU) registered a long-term high price at just above the 225.00 level (below) and has traded well under that level ever since. The XAU's value as of the first week of June was closer to the 83.00 level.

Source: BigCharts

Meanwhile the Canadian gold mining index has lost 40 percent of its value in the past decade, compared with a 9 percent gain in the benchmark TSX index and a 95 percent rise in the S&P 500. The gold price has increased 46 percent in the same period. Thus it's easy to see why investors in the precious metals mining industry are upset.

When faced with this level of relative under-performance, most investors would have long since thrown in the towel on the mining stocks and moved on to greener pastures. Not so the activist investors who run major hedge funds. This class of investor is just stubborn enough - and well capitalized enough - to do something about what they see as bad management practices among the miners.

A June 1 Reuters report revealed that hedge fund manager John Paulson of & Co. is leading a group of investors in an attempt at boosting returns from the beleaguered gold mining industry. According to Reuters:

The Shareholders Gold Council (NASDAQ:SGC), expected to be launched as early as June, will have more than a dozen investors, including Delbrook Capital, Livermore Partners and Tocqueville Asset Management, one of the people said."

BlackRock Inc. and Van Eck Associates, two of the biggest investors in the mining sector, are also reportedly in discussions to join the group of hedge funds and institutional investors, according to Reuters. The SGC is expected to raise investor awareness of the gold mining industry by publishing research reports. The group also aims to increase accountability among gold mining companies and encouraging them to "make changes in capital allocation, compensation and corporate government," according to the Reuters report.

Efforts at boosting share price performance among mining companies isn't new and has been tried before with mixed success. For instance, back in 2016 a U.S. investment firm called Raging River Capital, formed by mining industry veterans, turned their attention to Canadian copper miner Taseko Mines (TGB). Judging by the stock price performance of Taseko in the months following the firm's activism, the effort was at least somewhat successful. To turn around the entire industry, however, through activism is an entirely different proposition and will likely require an extraordinary outlay of both time and capital in order to succeed. If indeed success is to be seen in turning around the gold mining stocks as a group, it will likely be measured in years - not months, as is sometimes possible with individual companies.

The primary determinant for a turnaround in the major gold stocks as reflected in the PHLX Gold/Silver Index (XAU) shown above is major improvement in the physical gold price. This is after all the basis of the gold miners and without a rising bullion price it's extremely unlikely that any amount of concerted activity among hedge funds will succeed. A rising gold price, in other words, will go a long way in curing the under-performance of the companies that mine the metal.

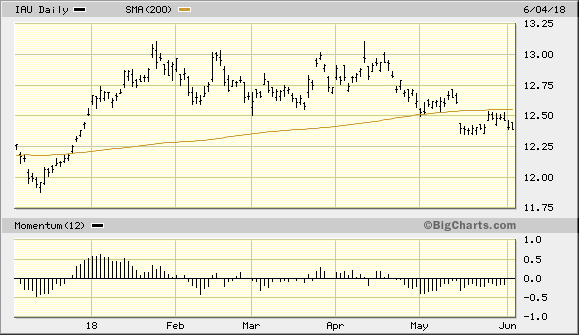

The gold price remains under pressure right now thanks to the combined influence of a stronger U.S. dollar and competition from the strengthening equity market. Shown below is a graph of the iShares Gold Trust (IAU), my favorite gold trading vehicle. As is true for the gold price, IAU is struggling not to fall decisively further below its benchmark 200-day moving average. This is the trend line which most institutional investors monitor to evaluate the basic strength of the intermediate-term gold price trend. As long as IAU is under its 200-day MA, gold mining stocks will remain under pressure as well.

Source: BigCharts

Turning our attention to the near-term technical picture, the internal condition for the most actively traded gold mining stocks could definitely use some improvement. It's clear that the latest Shareholders Gold Council (SGC) news did nothing to boost the mining stocks, so it's up to the gold stock bulls to take control of the short-term trend in order to stanch the recent bleeding evident in the XAU index. Shown below is the 6-week rate of change (momentum) of the 50 most actively traded mining stocks, which is based on the combined new highs and lows of those stocks, is currently in decline. This indicator needs to reverse its downward slope to let us know that the buyers have regained control of the short-term XAU trend.

Source: WSJ

There is some light at the end of the tunnel, however. The following graph shows the 24-week (120-day) momentum of the cumulative new highs and lows among the actively traded gold stocks. Although the indicator remains in negative territory, it's rapid improvement of late suggests that perhaps later this month the gold stocks - along with the price of gold - will attempt a turnaround. With as much intermediate-term momentum reflected in this indicator (below), it would indeed be surprising if the XAU didn't attempt another breakout attempt above its 200-day moving average fairly soon.

Source: WSJ

For now, though, gold investors should remain in cash until there is improvement in the actual gold price. I also recommend that investors avoid the temptation to catch the proverbial "falling dagger" by anticipating a bottom since the gold price can always go lower before hitting a completely sold out technical condition.

As discussed in previous reports, we need to see a simple 1-day close below the 15-day moving average in the U.S. dollar index (DXY), as well as evidence of a bottom in IAU as mentioned above. For now, no new trading positions in the gold ETF (NYSEARCA:IAU) are recommended.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts