Condor Gold hopes to kick off construction at Nicaragua project this year

Nicaragua-focused Condor Gold (LON:CNR) (TSX:COG) expects to begin construction at its 100%-owned La India Project in the first half of the year, following the reception of final permits currently being processed by the country's government.

The company, which just this week started trading in the Toronto Stock Exchange, knows that acquiring the pending licences would not only represent a significant milestone, but it would also materially de-risk its promising project.

In an interview with MINING.com, chief executive Mark Child acknowledged delays in the permitting process because of the need to resettle locals to build the mine.

By exploiting just 0.3% of Nicaragua's land area, the country has double gold production and increase silver output by up to seven times in the last 11 years.A pro-mining government and the fact that Condor has been actively engaged with the community and authorities, however, makes Child quite positive about La India's prospects.

"The Government sees mining as a key industry and means to reduce poverty and enhance economic growth," Child told MINING.com.

He added the country is very under-explored from a geological perspective, but he qualifies its current mining law as "fair" and "reasonable," with a 3% royalty and 30% corporate tax.

"The initial barrier to entry," he said, "is that it can take 10 months to apply for an exploration and exploitation permit."

The company initially staked concessions in Nicaragua, Central America's largest country, in 2006. Since then, mining has significantly taken off in the country thanks to the arrival of foreign companies with the money and knowledge to tap into its reserves.

According to an independent study published last year, by exploiting just 0.3% of Nicaragua's land area, the mining sector has been able to double gold production and increase silver output by up to seven times in the last 11 years.

Today, Child said, gold is the nation's third largest export.

Aware of the country's potential, the company has invested $45 million there to date, completed over 70,000 meters of drilling on its flagship La India asset, and produced two PEAs and a PFS.

In addition to permitting a base case, Condor Gold's strategy is to prove a major gold district of 4 to 5 million ounces of gold.

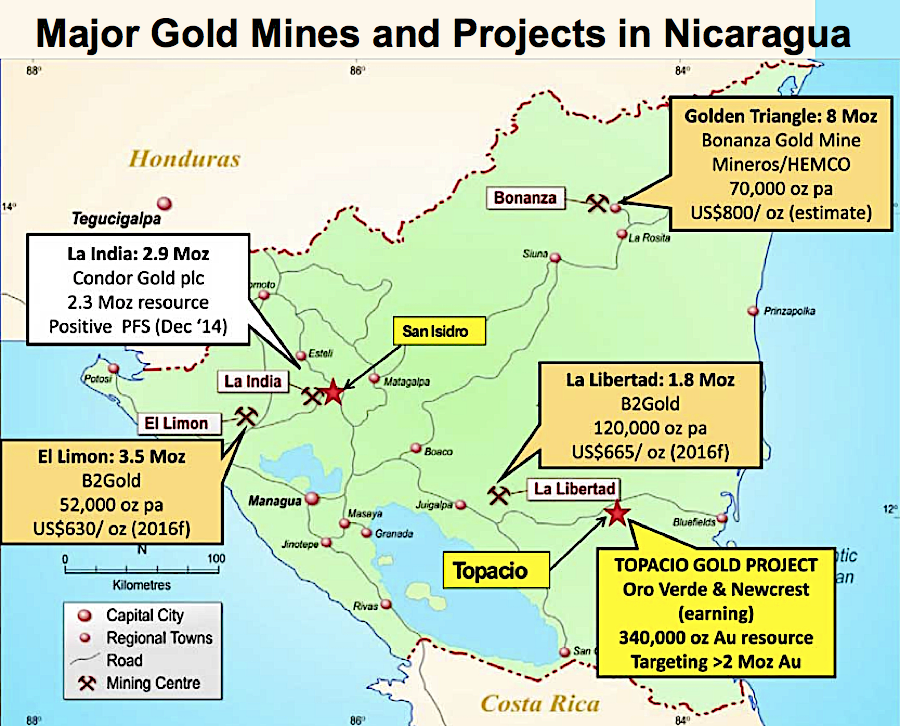

Other companies currently present in Nicaragua are Canada's B2Gold and Australia's Oro Verde. (Map courtesy of Oro Verde.)

According to a 2014 prefeasibility study, La India holds an open pit constrained probable gold reserve of 6.9-million tonnes, grading 3 g/t gold for 675,000 ounces of the precious metal, producing 80,000 ounces annually for seven years.

The project contains a mineral resource in the indicated category of 9.6-million tonnes grading 3.5 g/t gold for 1.08-million ounces of the metal and an inferred resource of 8.5-million tonnes grading 4.5 g/t for 1.23-million ounces of gold.

The firm also has three other concessions, where exploration is actively taking place. In November, the team struck it lucky as it discovered another vein on the 313 km ? concession package, covering 98% of the historic La India Gold Mining District.

Nicaragua's gold production is supplemented by small scale artisanal mining of placer and alluvial placer gold, particularly in the regions that form what is known as the "mining triangle": Siuna, Rosita and Bonanza, where small-scale gold extraction has been the dominant trade since 1880.

Referring to its recent debut in the TSX, Child said the added exposure to the Canadian market should further strengthen the company's board, boosting its marketing budget, which, with enough interest from the investment community, could lead to an equity rerating.

"According to RBC Capital markets, Condor Gold's valuation is a quarter of the valuation of its TSX listed peer group at US$18 per resource ounce gold in the ground and a price to book ratio of approximately 0.20 times," he said. "A major re-rating is overdue," he concluded.