Copper, lead, zinc prices to stay on the boil

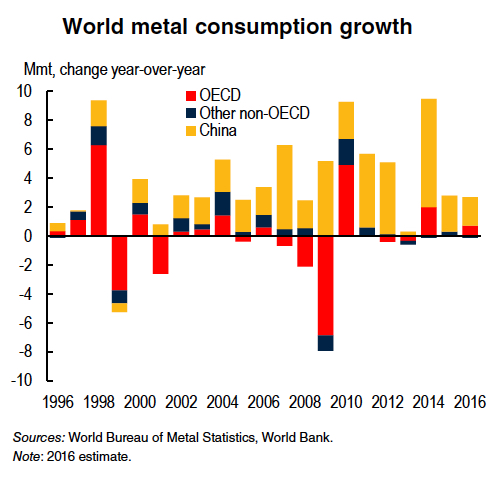

Industrial metals prices are projected to jump 16% this year due to strong demand, especially from China, and supply constraints, including mine disruptions in Chile, Indonesia and Peru, the World Bank says in its commodities markets outlook published on Wednesday.

Researchers at the institution believe zinc has the brightest prospects this year and will follow up 2016's 60% price gain with a 32% jump this year.

The Gamsberg zinc project in South Africa and Dugald River in Queensland are expected to add new production in 2018Lead, often a byproduct of zinc mines, will also build on last year's gains and is expected to add 18% in value due to mine supply constraints brought on by permanent closures due to resource exhaustion, as well as discretionary closures and downscaling in Canada, Peru and Australia top zinc miner and trader Glencore.

[Lead] demand remains strong for the battery and industrial sectors, including increasing demand for "stop/start" vehicles, which use batteries containing 25 percent more lead than conventional units. However, lead demand faces threats from a maturing electric bike sector in China and alternate battery technologies (e.g., lithium).

The authors of the report also warn however that zinc-lead fundamentals may change longer term as higher prices "prompt greater supply in China, and Glencore's idled capacity eventually restarts."

The Gamsberg zinc project in South Africa (240ktpa capacity) and Dugald River in Queensland (170ktpa) are expected to add new production in 2018, "while a slowing property market in China and threats of substitution may ease demand," according to the report.

The Gamsberg zinc project in South Africa (240ktpa capacity) and Dugald River in Queensland (170ktpa) are expected to add new production in 2018, "while a slowing property market in China and threats of substitution may ease demand," according to the report.

The outlook is also positive on the price of bellwether metal copper which is expected to increase by 18% boosted by disruptions. Strikes in Chile and Peru, and contractual disputes in Indonesia recently took more than 10% of global output offline.

Double-digit gains are also expected for aluminum, iron ore, and tin, but the outlook for nickel is murkier.

China is expected to offset the lost volumes from other countries, such as Guatemala and New CaledoniaNickel prices bucked the general positive trend during the first quarter falling 5% on expectations of renewed low-grade nickel exports from Indonesia due to the partial reversal of that country's ore export ban:

Thus far the [Indonesian] government has recommended exports of about one-third of the volume sought by the private sector. Meanwhile, in early February the Philippines announced closure of 23 of the country's 41 mines, and suspension of five others, on environmental grounds. The affected mines account for more than one third of the country's 2016 nickel production. Because companies can appeal the closures, the potential lost output is uncertain.

China, the main nickel importer, is expected to offset the lost volumes from other countries, such as Guatemala and New Caledonia, as well as sulfide concentrates from the Russian Federation and Zimbabwe.

The World Bank says upside risks to the price forecasts include stronger global demand, slower ramp-up of new capacity, tighter environmental constraints, and policy action that limits exports. Downside risks include slower demand from China and higher-than-expected production, including the restarting of idled capacity.