Copper price falls to 3-month low, defies bullish forecasts

The price of copper in New York fell to its lowest level in more than three months on Thursday as fewer supply disruptions than expected and stockpiling in top consumer China translate to plentiful metal on offer.

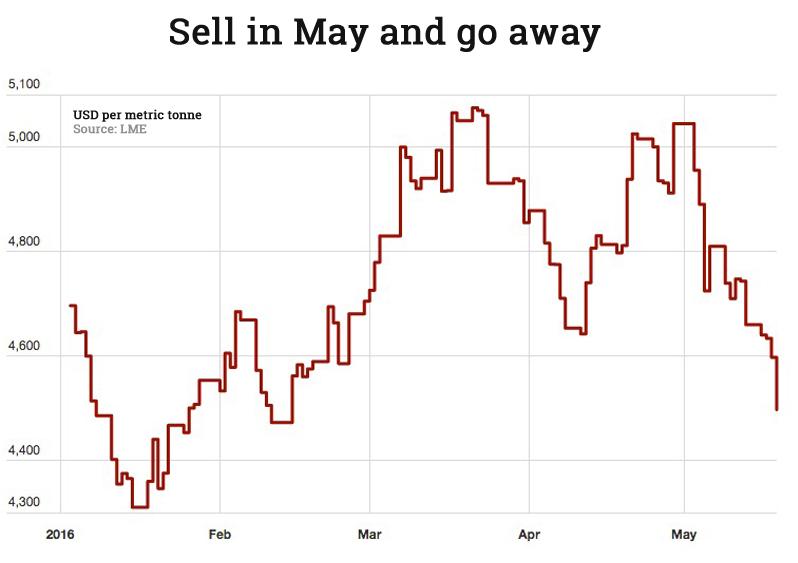

On the Comex market in New York July futures dipped to $2.0380 a pound (below $4,500 a tonne) in morning trade, down nearly 2% on the day and the lowest since February 12.

After a brutal couple of weeks of trading copper is down more than 10% in May, wiping out year-to-date gains entirely. Last year copper fell 26% in value.

A new research report by FocusEconomics compiling views on the copper market of global analysts and economists paints a much brighter picture than current trading would suggest.

Copper remains the least-preferred long position among base metalsAccording to the report which covers analysis by 22 investment banks and research houses including the likes of Deutsche Bank, JP Morgan, Macquarie, Oxford Economics and others, the copper price is set to rise steadily (albeit modestly) towards the end of the year and throughout 2017.

Analysts forecast that prices will average $4,972 per tonne ($2.25/pound) in the final quarter of 2016. They expect prices to increase further and average $5,373 per tonne ($2.44/pound) in Q4 of 2017. Of the 22 surveyed 15 kept forecasts for the rest of the year steady, 5 upped price targets and two lowered.

There is some divergence in the forecasts with Standard Chartered predicting copper at $6,000 ($2.72) by the end of the year. That compares to Barclays Capital which has a particularly dim view of the prospects for the red metal at $4,180 ($1.90) which is around the six-year low futures hit in January this year.

FocusEconomics points out that copper remains the least-preferred long position among base metals due to the well-supplied market, oil prices and risks to China's economic outlook.