Copper price plummets as stocks pile up

The copper price was hammered down on Tuesday as a rise in warehouse stocks convinced traders that end-demand in China has not materially improved despite Beijing's economic stimulus.

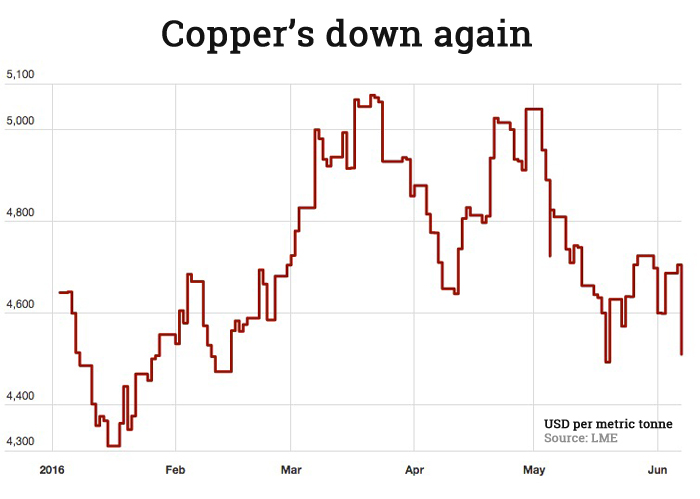

In late New York trade July copper, the most active contract, fell 3.4% exchanging hands for $2.0450 a pound ($4,508 a tonne), more than wiping out Friday's rebound and pushing the metal back into the red for 2016.

The latest leg down came as LME data showed more than 42,000 tonnes of copper arrived in warehouses - mostly Chinese smelter delivering into Singapore and Korea - just over the last two days."Chinese manufacturing is not picking up momentum, so demand is not picking up and there is no reason for copper prices to rise"Another indication that there is plenty of metal on offer was the collapse in spreads reports FastMarkets with cash buyers paying roughly the same as those wanting delivery in three months compared to a $25 discount last week.

On futures markets large-scale speculators like hedge funds have also taken a bearish position on the metal with net short positions - bets that the commodity can be bough at a cheaper price in the future - near record levels on the Comex market in New York.

Reuters reports traders expect weak demand fundamentals to limit price rises in 2016:

"Chinese manufacturing is not picking up momentum, so demand is not picking up and there is no reason for copper prices to rise," said Julius Baer analyst Carsten Menke.

The copper price has been under pressure recently after a reading of Chinese manufacturing activity showed that Beijing's economic stimulus program is beginning to run out of steam. Fears of devaluation in the renminbi compounded the pressure on the copper price as China is responsible for 46% of total global copper demand.

More than 750,000 tonnes of annualized supply was idled in 2015 by companies including Freeport McMoRan and Glencore in response to low prices, according to a report by consultants Wood Mackenzie, but producers are looking far more resilient in 2016 and curtailments this year are unlikely to exceed 150,000 tonnes.

In addition some major projects are ramping up this year including China Minmetals' Las Bambas mine and Freeport's Cerro Verde expansion project in Peru. There is also a robust pipeline of projects that could fill any supply gaps including First Quantum's Cobre Panama and the Goldcorp-Teck joint venture in Chile named NuevaUnion.