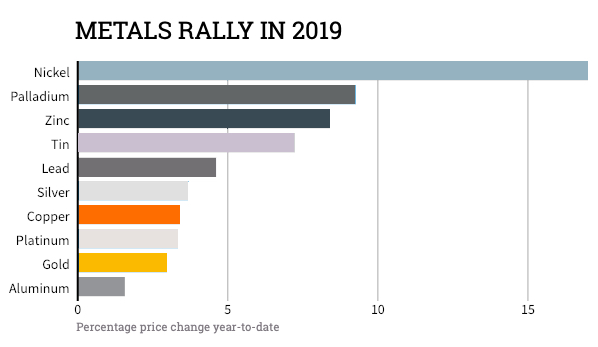

Copper price rally halted by Chinese factory surprise

January's copper price rally came to a screeching halt on Friday after a key gauge showed Chinese factory output shrinking at the fastest pace in almost three years.

Copper for delivery in March slumped 3% compared to Thursday's close to a low of $2.7535 per pound ($6,070 a tonne) on the Comex market in New York.

Source: Thomson Reuters Datastream. Graphic adapted from original by Vincent Flasseur and Matthew Weber

A January survey of Chinese private sector factory purchasing managers fell to 48.3 from 49.7 in December, the lowest reading since February 2016 and well below forecasts. A reading below 50 signals contractionary conditions.

The subindex for new orders was the weakest since September 2015, but the outlook for the rest of the year improved slightly, with factory bosses most optimistic since May last year.

The Caixin index focuses on small and medium-sized private sector companies while Beijing's official manufacturing PMI is skewed towards large state owned firms. That reading actually increased last month although it also remains stuck just below 50.

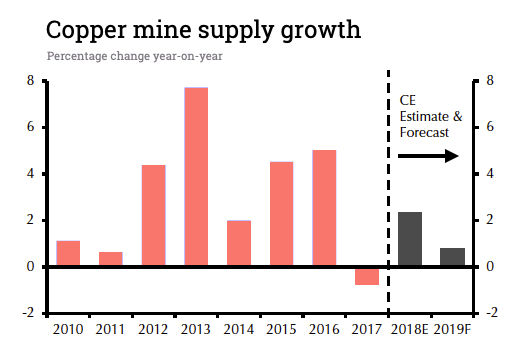

Source: Capital Economics

Given its widespread use in construction, transportation and power grid infrastructure, copper is considered a good barometer for economic activity and with China consuming nearly half the world's copper, the price of the red metal is closely correlated with domestic factory conditions.

At the start of 2019, copper fell to a near two-year low of $2.54 a pound over worries about slowing growth in China and fears of the impact of the trade dispute between China and the US.

Most analysts remain bullish on the longer term prospects for copper. Capital Economics, a London-based researcher, says that is partly due to slowing mine supply growth.

Capital Economics believes the metal will average $6,500 per tonne in the first quarter of 2020, after a gradual rise this year.