Curb your copper price enthusiasm - report

A year ago credit ratings agency Moody's warned that the downturn in raw materials was like no other and that defaults among mining and metals companies could reach levels last seen during the height of the financial crisis.

As a result, Moody's embarked on a sector-wide review of the 87 global mining majors that it covers, eventually downgrading 36 companies, including marquee names like Rio Tinto, BHP Billiton, Freeport-McMoRan and Chile's state-owned Codelco. The likes of Anglo American and Vale also lost their investment grade rating for the first time.

By August conditions had improved to such and extent that the New York-based firm upgraded its outlook for the industry to stable from negative.

"We anticipate political issues and speculation will continue to drive shorter-term market activity and high volatility"Yesterday Moody's issued a new report on the global base metal sector, noting that "a couple of weeks into 2017, we have witnessed a starkly different picture, with higher metal prices and, for the most part, stronger company balance sheets, better liquidity, and better debt-maturity profiles."

But Carol Cowan, a Moody's Senior Vice President and the author of the report added a warning that "the run-up in base metal prices, particularly after the US Presidential election, may be getting ahead of fundamentals":

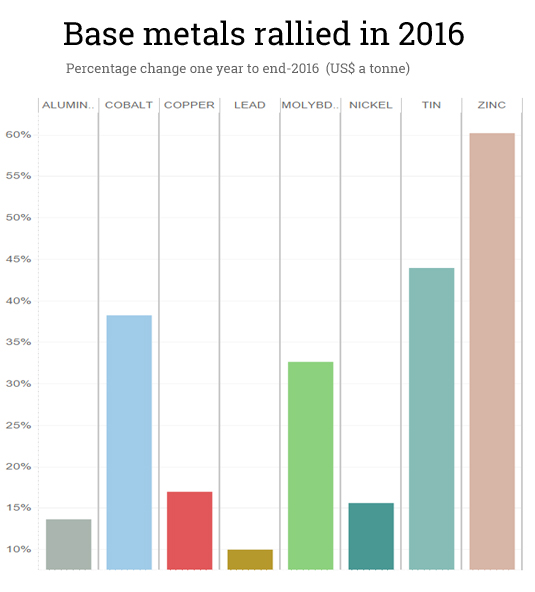

"[Base metal prices] will fall back over the course of the year. With the exception of zinc, the higher prices do not stem from meaningful improvement in supply/demand fundamentals.

"Nonetheless, we anticipate political issues and speculation will continue to drive shorter-term market activity and high volatility."

Source: London Metal Exchange

The major driver of the rally in base metals and positive investor sentiment towards mining came on the back of improving data from China that largely reflects stimulus spending by the Beijing government last year and expectations that the new US administration will increase infrastructure spending according to the report:

"We do not believe this level of optimism is justified but rather reflects trading activities and increased demand expectations that may not materialize.

On a fundamental basis, with the exception of zinc, there has not been material improvement in supply/demand fundamentals in the base metals complex."

Moody's expects prices, including for zinc, to fall back over the course of the year. However, despite expectations for more pronounced volatility, "some level of improvement in base metal prices is expected to hold."

Moody's recently revised upwards expectations for Chinese GDP expansion to 6.6% and 6.3% in 2016 and 2017 respectively from 6.3% and 6.1% before, but the authors need to see further improvement in global economic conditions before it would change its outlook for base metals to positive:

"On a fundamental basis, with the exception of zinc, there has not been material improvement in supply/demand fundamentals""Moody's global GDP growth forecast would need to be higher than 4% and purchasing managers' indices for the US, Europe and China would need to exceed 55 for at least three consecutive months. But while its Global Macro Outlook for 2017-18 predicts G20 economic growth of about 3% and the three major PMI indexes are all above the breakeven growth point of 50, none has yet reached the 55 mark."

Moody's has adjusted upwards the price sensitivities by which it measures mining companies' operating performance over the medium term and the agency now sees copper trading in a range of $2.15 - $2.40 a pound ($4,740-$5,291 a tonne) through 2018, up slightly from previous bands. Moody's does not rate to the spot price which for copper on Thursday was well above its range at $2.60 a pound.

Moody's view of the nickel price has improved more than bellwether copper and the firm now sees the steelmaking raw material priced at between $4.75 and $5.00 a pound ($10,472-$11,025 a tonne) this year and next. Aluminum should move between $0.70 and $0.80 ($1,540-$1,764) and zinc at $0.90-$1.10 ($1,985-$2,425).