Diamond Trading Robust in February

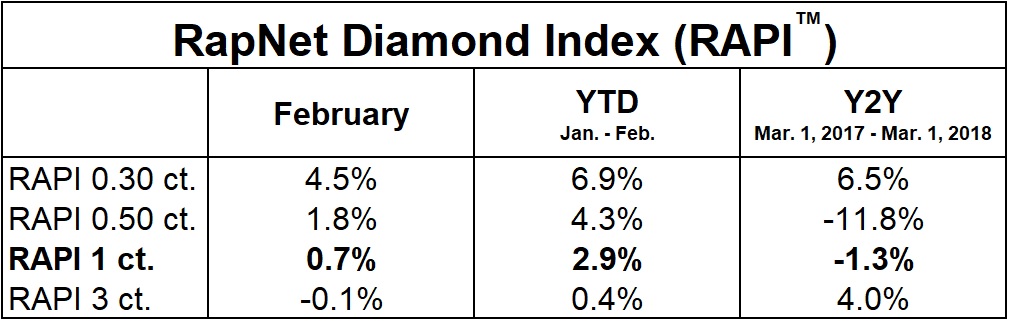

RAPAPORT PRESS RELEASE, March 7, 2018, New York... Diamond market sentiment was positive in February, with steady dealer trading, though allegations of a major bank fraud involving two Indian jewelry companies dampened the mood. Polished prices firmed, following a better-than-expected US holiday season and renewed optimism in China. Traders focused on the Hong Kong International Diamond, Gem & Pearl Show, which saw better deals before the event than during it. Buyers have adapted to higher price levels.The RapNet Diamond Index (RAPI?,,?) for 1-carat diamonds increased 0.7% in February. RAPI for 0.30-carat diamonds rose 4.5%, while RAPI for 0.50-carat advanced 1.8%. RAPI for 3-carat diamonds slid 0.1% during the month.  (C) Copyright 2018, Rapaport USA Inc.Dealers were encouraged by solid US and European orders, while Asian demand improved ahead of the Chinese New Year on February 16. Initial reports signaled positive retail sales during the lunar festival. However, trading was below expectations at the Hong Kong show, which attracted fewer Chinese buyers. Exhibitors felt the show was too close to the holiday, since many clients from mainland China were still on vacation. Dealer demand was robust, with shortages in select categories. Indian suppliers are concerned claims that Nirav Modi and Gitanjali Gems defrauded Punjab National Bank of an estimated $2 billion will impact domestic consumer demand and available credit. Indian banks are expected to tighten their compliance standards and require greater transparency from the trade. Manufacturing is stable, with strong rough buying during February. De Beers boxes were more expensive due to a change in assortments and a slight price increase, renewing pressure on manufacturers' profit margins. Demand shifted to 1- to 2-carat rough that would yield 0.30- to 1-carat polished, which sold well at the Hong Kong show.Polished trading is expected to stabilize in March as Chinese jewelers return to the market and restock following the holiday season. However, rough sales are projected to stay strong, and profit on new polished production is likely to be squeezed. Rapaport Media Contacts: media@diamonds.netUS: Sherri Hendricks +1-702-893-9400 International: Avital Engelberg +1-718-521-4976Mumbai: Prashant Bhojani +91-97694-66855About the Rapaport RapNet Diamond Index (RAPI?,,?): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. www.RapNet.com has daily listings of approximately 1.2 million diamonds valued at approximately $7.3 billion. Additional information is available at www.diamonds.net. About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet - the world's largest diamond trading network, with over 15,000 members in 94 countries and daily listings of approximately 1.2 million diamonds valued at approximately $7.6 billion; Rapaport Laboratory Services, providing GIA and Rapaport gemological services in India, Israel and Belgium; and Rapaport Trading and Auction Services, the world's largest recycler of diamonds, selling over 500,000 carats of diamonds a year. Additional information is available at www.diamonds.net.

(C) Copyright 2018, Rapaport USA Inc.Dealers were encouraged by solid US and European orders, while Asian demand improved ahead of the Chinese New Year on February 16. Initial reports signaled positive retail sales during the lunar festival. However, trading was below expectations at the Hong Kong show, which attracted fewer Chinese buyers. Exhibitors felt the show was too close to the holiday, since many clients from mainland China were still on vacation. Dealer demand was robust, with shortages in select categories. Indian suppliers are concerned claims that Nirav Modi and Gitanjali Gems defrauded Punjab National Bank of an estimated $2 billion will impact domestic consumer demand and available credit. Indian banks are expected to tighten their compliance standards and require greater transparency from the trade. Manufacturing is stable, with strong rough buying during February. De Beers boxes were more expensive due to a change in assortments and a slight price increase, renewing pressure on manufacturers' profit margins. Demand shifted to 1- to 2-carat rough that would yield 0.30- to 1-carat polished, which sold well at the Hong Kong show.Polished trading is expected to stabilize in March as Chinese jewelers return to the market and restock following the holiday season. However, rough sales are projected to stay strong, and profit on new polished production is likely to be squeezed. Rapaport Media Contacts: media@diamonds.netUS: Sherri Hendricks +1-702-893-9400 International: Avital Engelberg +1-718-521-4976Mumbai: Prashant Bhojani +91-97694-66855About the Rapaport RapNet Diamond Index (RAPI?,,?): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. www.RapNet.com has daily listings of approximately 1.2 million diamonds valued at approximately $7.3 billion. Additional information is available at www.diamonds.net. About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet - the world's largest diamond trading network, with over 15,000 members in 94 countries and daily listings of approximately 1.2 million diamonds valued at approximately $7.6 billion; Rapaport Laboratory Services, providing GIA and Rapaport gemological services in India, Israel and Belgium; and Rapaport Trading and Auction Services, the world's largest recycler of diamonds, selling over 500,000 carats of diamonds a year. Additional information is available at www.diamonds.net. Image: Lesley Cheung, courtesy HKTDC

Image: Lesley Cheung, courtesy HKTDC