Did $78 billion South African gold exports really go missing?

According to a new study by the UN's Conference on Trade and Development some commodity dependent developing countries "are losing as much as 67% of their exports worth billions of dollars to trade misinvoicing".

Trade misinvoicing - when export and import data between two countries do not align - is thought to be "one of the largest drivers of illicit financial flows from developing countries, so that the countries lose precious foreign exchange earnings, tax, and income that might otherwise be spent on development," according to the report.

UNCTAD's the study uses data from up to two decades covering exports of commodities such as cocoa, copper, gold, and oil from Chile, Cote d'Ivoire, Nigeria, South Africa, and Zambia.

Trade misinvoicing is thought to be one of the largest drivers of illicit financial flows from developing countries"This research provides new detail on the magnitude of this issue, made even worse by the fact that some developing countries depend on just a handful of commodities for their health and education budgets," UNCTAD's Secretary-General, Mukhisa Kituyi, said:

"Importing countries and companies, which want to protect their reputations, should get ahead of the transparency game and partner with us to further research these issues."

The analysis shows patterns of trade misinvoicing on exports to China, Germany, Hong Kong (China), India, Italy, Japan, the Netherlands, Spain, Switzerland, the UK, US including:

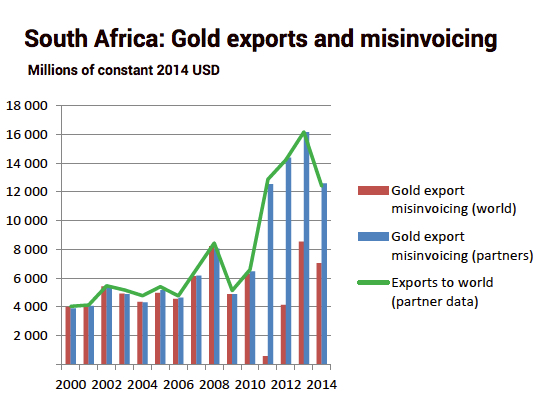

Between 2000 and 2014, underinvoicing of gold exports from South Africa amounted to $78.2 billion, or 67% of total gold exports. Trade with the leading partners exhibited the highest amounts: India ($40 billion), Germany ($18.4 billion), Italy ($15.5 billion), and the UK ($13.7 billion).Between 1996 and 2014, underinvoicing of oil exports from Nigeria to the United States was worth $69.8 billion, or 24.9% of all oil exports to the US.Between 1995 and 2014, Zambia recorded $28.9 billion of copper exports to Switzerland, more than half of all its copper exports, but these exports did not show up in Switzerland's books.Between 1990 and 2014, Chile recorded $16.0 billion of copper exports to the Netherlands, but these exports did not show up in the Netherlands' books.Between 2000 and 2014, underinvoicing of iron ore exports from South Africa to China was worth $3 billion.This is another explanation of the Chile/Netherlands puzzle too as Holland is a centre of LME warehousesAccording to the report gold exports from South Africa "is peculiar in that there is a perfect correlation between gold export underinvoicing and the volume of exports as reported by the country's trading partners:"

"This suggests that export underinvoicing is not due to underreporting of the true value of gold exports, but rather to pure smuggling of gold out of the country. In other words, virtually all gold exported by South Africa leaves the country unreported."

Source: UNCTAD computation using UN Comtrade data

The headline numbers may be startling, but there are explanations for the discrepancies that do not relate to nefarious trade practices or tax dodging.

The FT quotes Christine Clough, of the US-based group Global Financial Integrity, as saying the "suspicious results involving trading hubs such as Switzerland, particularly with regard to Zambian copper, were often because the commodities never went there":

"On paper most of the copper goes to Switzerland, but in reality the majority of it goes straight to buyers in other countries," she said.

Writing in Forbes, Tim Worstall also point to the fact that the numbers - particularly in Zambia - may be skewed by the fact that commodity traders like Glencore, based in Switzerland, would deliver Zambia copper from its mines directly into London Metal Exchange warehouses around the world:

"Some of it will end up in storage at least for a time. But the storage will be in bonded, LME approved, warehouses. And bonded here means that it doesn't turn up on the import statistics of a country. Because it hasn't, in the legal sense, entered a country. This is another explanation of the Chile/Netherlands puzzle too as Holland is a centre of LME warehouses."