Emu NL confirms gold and silver potential at its Vidalita project in Chile

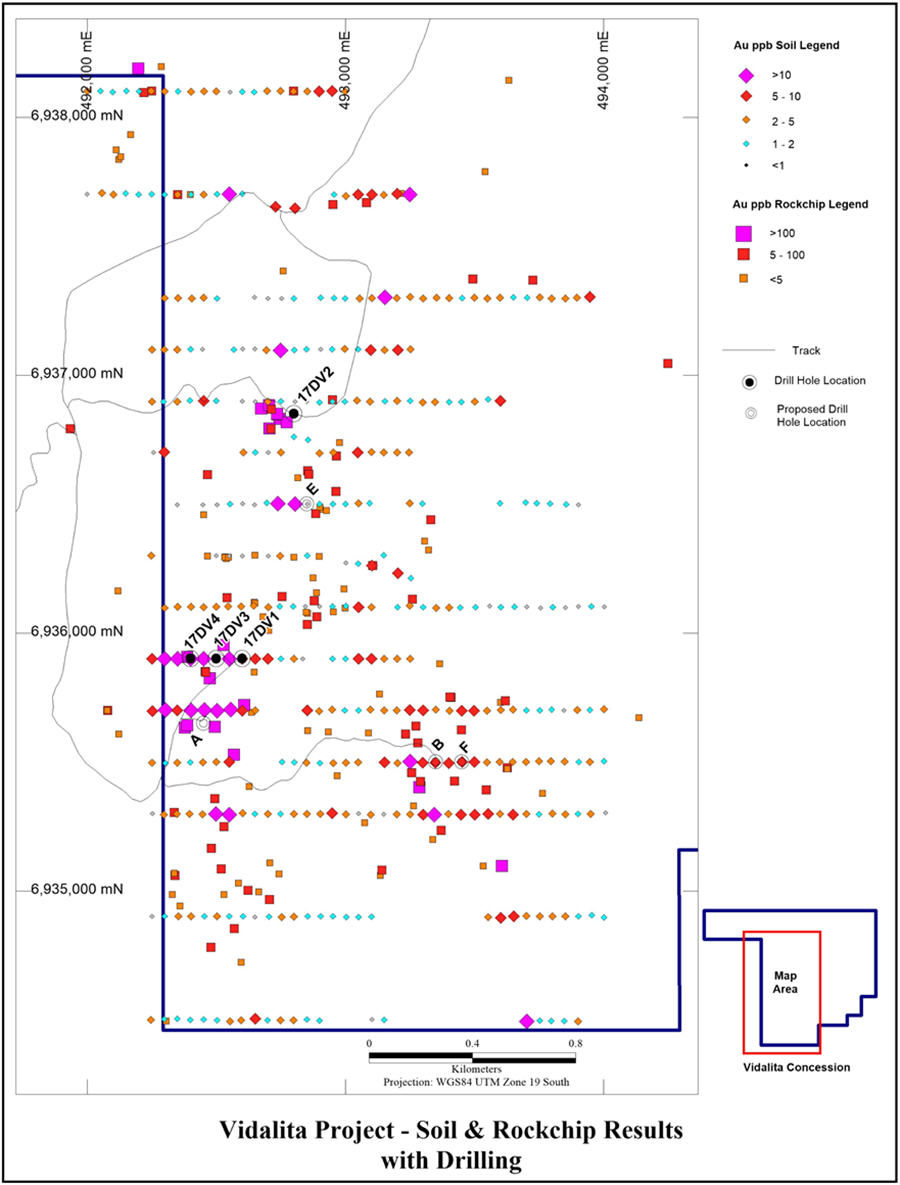

Australian explorer, Emu NL (ASX: EMU), provides the following update on its drilling program on the Company's Vidalita project in northern Chile. The objective of the program is, in addition to testing some of the targets generated from the December 2016 and January 2017 surface geochemical programs, to test below these surface indications of mineralisation for the inferred core of the mineralised system producing these surficial responses. Drill samples from diamond drill holes 17DV1 & 2 have been sent for assaying.

Diamond drill hole 17DV3, located at 6,935,900N, 492,500E (100m west of 17DV1), was commenced on 6th April. As at 10th April, the hole was at ~60m and drilling ahead. The geology is similar to hole 17DV1 as in the same argillic (clay) alteration and sulphides typical of high sulphidation epithermal Au/Ag ore deposits in the region.

A trench has been excavated between 17DV1 and 17DV3 to expose bedrock for mapping and sampling. Surface prospecting in the area around the trench has located numerous examples of banded chalcedonic silica and ferruginous/chalcedonic rocks containing sulphide minerals, secondary copper minerals and a mineral, based on previous work, probably alunite. Alunite is one of several alteration minerals characteristic of high sulphidation epithermal systems. Photos of some of these samples are included in this ASX release.

While in themselves, these samples are not directly providing evidence of significant mineralisation, the combination of these occurrences, the results of the surface rock and soil geochemistry, and the sulphide mineralisation and argillic alteration in 17DV1 and 17DV3 are substantial reasons to believe that Emu is drilling into the upper levels of a high sulphidation epithermal system.

The resistivity target that underlies the extensive surface geochemical target remains untested as 17DV2 (stopped at 193.35m) was best positioned to do this. Hole 17DV3 is drilled too far west to properly test the resistivity target. Interestingly, at ~170m downhole in drill hole 17DV2, just short of the resistivity target, the geology changed from argillically altered but fresh (unoxidised) breccia to a breccia flooded with iron oxides, the cause of which at this time is unknown. A follow-up hole to test the resistivity target is planned (probably for the next field season) to be collared further east of 17DV2 to go under an area of sinter at surface and then to intersect the resistivity target below 17DV2.

Alunite crystals

Banded chalcedony

Alunite pseudomorphs

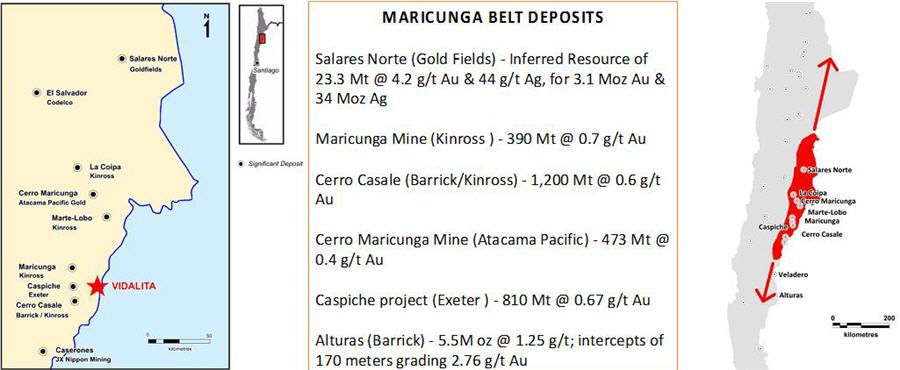

About the Chile gold projectsThe Vidalita and Jotahues gold projects are located in the highly mineralised Oligocene/Miocene Maricunga gold belt in northern Chile, approximately 200 km east from the city of Copiap?? in the Atacama Region of Chile. The two projects cover an area of approximately 2,800 hectares of mineral exploration concessions and host alteration and mineralization that appear geologically similar to other high sulphidation oxide gold deposits of the Maricunga gold belt. The projects are accessed using a network of roads that link Copiap?? with the Refugio project (Kinross), Cerro Casale project (Barrick/Kinross) and the Caspiche project (Exeter). Refugio is located 30 km to the northwest of Vidalita. Apart from the current programme, due enquiry having been made, the Company is unaware of the project having been drilled before.

Emu has an option agreement with Prospex SpA and BLC SpA, Chilean subsidiaries of Altius Minerals Corporation of Canada, to acquire 8 concessions at Vidalita and 3 concessions at Jotahues. This option maybe exercised any time up until November 2019 by granting Prospex and BLC a 1% NSR on production and allotting them up to 15 million Emu ordinary shares subject to certain vesting conditions (see ASX release 15th November 2016). Prospex SpA in turn has an option to acquire 6 of the 11 Vidalita concessions from local Chilean parties. Under the terms of that agreement, Prospex has the right to exercise that option by November 2019 by paying US$2 million and granting the Chilean parties a 1% NSR over those 6 concessions. Under the Emu option agreement, Emu has assumed the rights and obligations of Prospex in relation to those 6 concessions.

Competent person's statementThe details contained in this report that pertain to exploration results, mineral resources and mineral reserves are based upon information compiled by Mr. Greg Steemson, Managing Director of Emu NL. Mr. Steemson is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and has sufficient experience in the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr. Steemson consents to the inclusion in the report of the matters based upon his information in the form and context in which it appears.

Forward looking statementThis report contains forward looking statements concerning the projects owned by Emu NL. Statements concerning mining reserves, resources and exploration results may also be deemed to be forward looking statements in that they involve estimates based on specific assumptions. Forward-looking statements are not statements of historical fact and actual events and results may differ materially from those described in the forward looking statements as a result of a variety of risks, uncertainties and other factors. Forward looking statements are based on management's beliefs, opinions and estimates as of the dates the forward looking statements are made and no obligation is assumed to update forward looking statements if these beliefs, opinions and estimates should change or to reflect other future developments.

For more information on the Company see the website www.emunl.com.au