Glencore posts worst half-yearly profit since listing in London

Shares in Glencore (LON: GLEN) were down 5.2% at noon in London after the miner and commodity trader reported a significant drop in underlying earnings and revealed it has taken a $400 million hit related to an accounting mismatch over coal derivatives.

Glencore posted a $369 million net loss in the period compared with a $676 million net loss in the same period last year.Despite a rebound in commodity prices and reduced costs in the six months to end-June, the Swiss company logged a $369 million net loss in the period compared with a $676 million net loss in the same period last year.

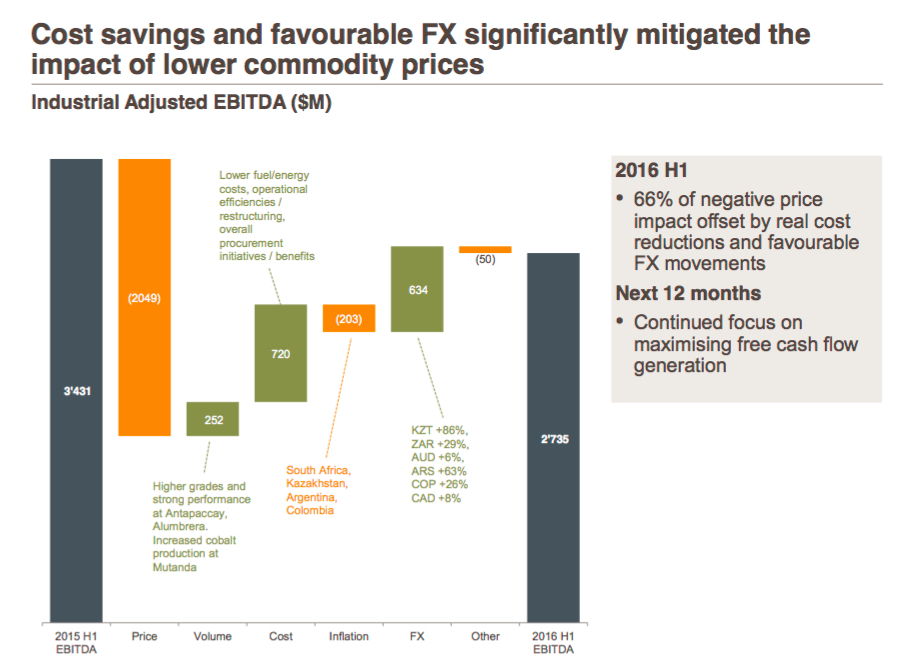

Glencore logged first-half adjusted EBITDA of $4 billion, 13% lower than a year ago, and the worst half-annual profit since listing in London in 2011.

But there also were good news, as the world's third-largest diversified miner by market value said it was "pretty likely" it would resume paying dividends before it reports results in March.

Glencore suspended dividend last year as part of an aggressive plan to cut a $30 billion debt load it had a year ago. It was one of the highest in the industry at the time, as prices for its key products copper and coal sank to multi-year lows.

Source: Glencore's CEO Ivan Glasenberg's presentation. August, 2016.

The firm also said it has stepped up its debt reduction plans and it is now targeting net debt of $16.5 to $17.5 billion by the end of the year, against $17bn to $18bn previously.

It has also successfully off-load assets, including the sale of almost 50% of its agriculture business for about $3.1 billion earlier this year. Overall, Glencore has sold $3.9bn of the $4n to $5bn asset disposals target, but it has yet to find buyers for its Australian coal train fleet, the Lomas Bayas copper mine in Chile, its Cobar mine in Australia's New South Wales, and a gold mine in Kazakhstan.

Glencore has sold $3.9bn of the $4bn-5bn asset disposals target set last year.Before postings half-year results, the company agreed to sell a stake in its Ernest Henry copper mine in Australia to Evolution Mining (ASX:EVN) for $670 million (A$880 million).

Glencore's trading division, or what the company calls marketing, logged Ebitda of $1.2bn in the first half of the year, a 14% increase from a year ago thanks to better performance in metals.

The company, which makes about a quarter of its earnings from commodities trading, maintained its full-year guidance for the unit of $2.4bn to $2.7bn.

With a a market value of about $34.5 billion, Glencore has become this year's third-best performer in the U.K.'s benchmark stock index.