Gold's Completing Pullback

Barry Dawes, the executive chairman of Martin Place Securities, reviews current updates in the U.S. dollar, Euro, Yen, Australian dollar, bonds, and the U.S. stock market.

Key Points

Gold

Consolidating at important support

Completed 5 Waves down in C for Wave 2?

Breaks up through wedge

Despite the torpor of the markets US$ gold actually has just made an all-time high this month!

Gold still the all-time highs in many currencies

Central banks buying gold

Gold ETFs still in that torpor too

US$ - heading higher

Rally to 105Euro, Yen, and Swiss Francs, etc., still look awfulNth Am Gold stocks completing C Wave?

Backtesting sharply after earlier strong move

Good technical support

Completing a Wave 2

XAU still heading for 165

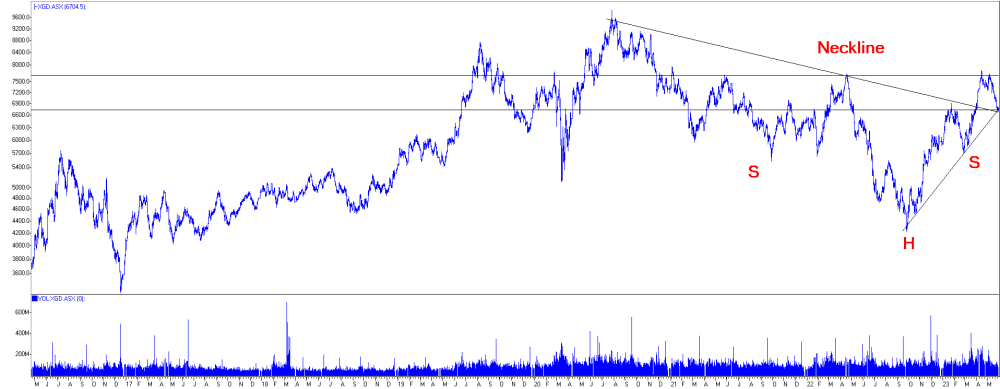

ASX Gold Stocks completing Wave 2 pullback

Major technical support here

August 2020 downtrend support

Oct 2022 uptrend test

Horizontal support around 6700

Bigger picture H&S reversal pattern set up

Neckline at ~7700

Much higher target levels generated

U.S. Bonds

Bond prices consolidating

Yields achieve 'island' reversals again?

U.S. equities

S&P 500 exceeds 4200

Looking to break sharply higher

Gold

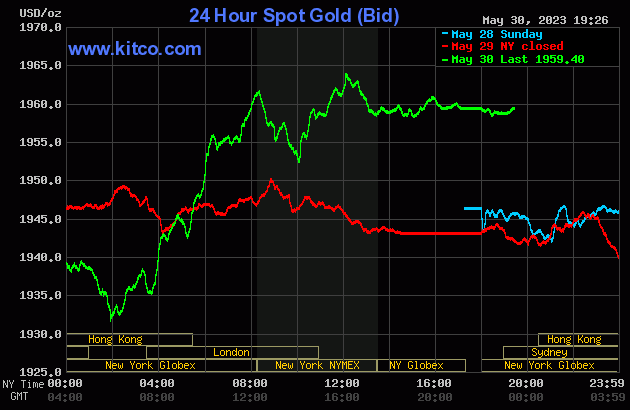

Another >US$30 intraday move. And a breakout from the last wedge after gold picked up the Oct 2022 uptrend.

Gold is still at or very near all-time highs in most other currencies.

But the market sentiment is eerily quite neutral because gold stocks were weaker, and the follow-through in silver was quite muted. But as has been pointed out, gold is technically ready for another sharp move higher.

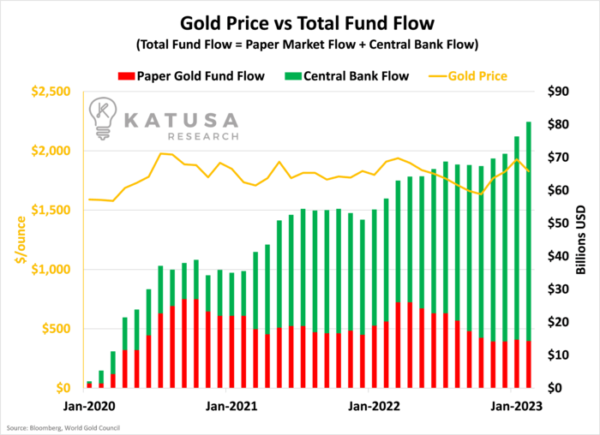

World Gold Council has published some excellent global data on central banks and gold ETFs.

Katusa Research has compiled some of the data into this graphic showing:

Central bank cumulative purchases since Jan 2020 have totaled ~US$65bn

ETFs have been net sellers over this time

Helps explain the lack of enthusiasm in the gold market despite record gold prices.

This was a very nice breakout from that wedge, as earlier suggested.

The evidence suggests that the high in US$ gold in May was actually a B Wave.

And followed by five Waves down in the C Wave to complete Wave 2 and return to the Oct 2022 uptrend.

And then we had this breakout.

Expect gold to backtest to around US$1,950 on this graphic, and then we should get moves to new highs.

Bounced off the uptrend quite nicely.

The U.S. dollar is still rallying with a near-term target of 105.

A pullback from 105 might be the trigger to push gold much higher.

The big four currencies, Euro, Yen, Sterling, and Swiss France, have all broken major, major long-term uptrends and seem to be heading much lower over the next few years.

Gold prices in these currencies are right now at all-time highs or very close, and they are confirming the long-term bear market in those currencies.

Gold stocks

Gold stocks continued lower today despite the move in gold bullion

It still seems they were completing their five-Wave C Wave for the low in Wave 2.

Gold stocks should soon start Wave 3

Zone of maximum acceleration

Next stop 165 on the XAU

5 Waves down here. Expect a strong bounce once the downtrend is broken.

XAU is now on Oct 2022 uptrend as well as at some longer-term horizontal support.

Gold ETF interest might be poor, but so is gold stock sentiment.

The Elliott Wave Count here is still very bullish.

And as ever, the only time markets are overly bearish is in a Wave 2, particularly when those awful C Wave declines occur.

XAU seems to be completing a mini Wave 2 within the green labeling, but Green Wave 3 should start very soon.

Long-term gives >100% upside in XAU.

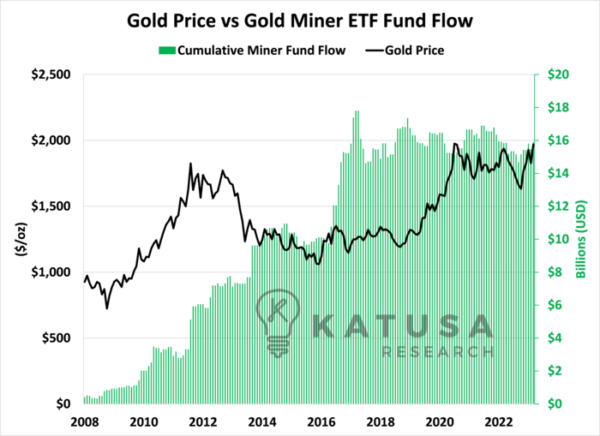

Katusa Research also published this figure which is the cumulative flows into Gold Miner ETFs.

This graphic is suggesting that no new funds have flowed into the sector since 2017 despite all-time highs in US$ gold prices. Again indicating it is just very early days in this gold bull market.

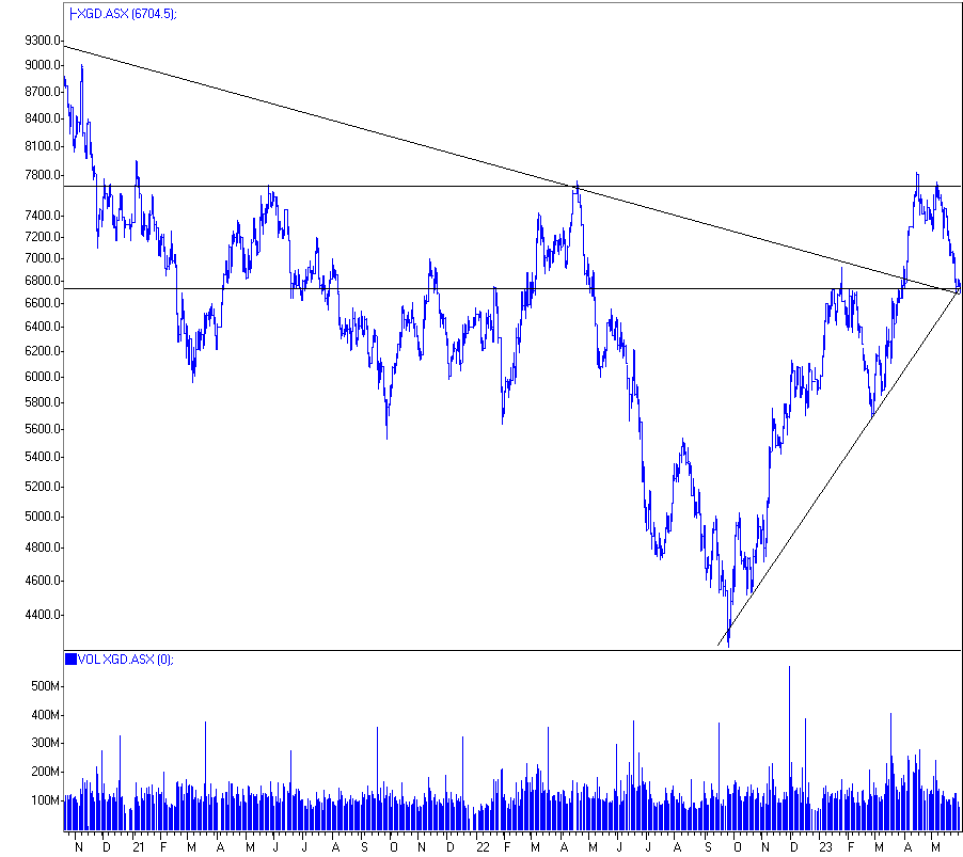

ASX Gold Index

Short-term strong technical support:

July 2020 downtrend

Sept 2022 uptrend

Horizontal support at around 6700

Need to keep repeating the big picture here:

7700 is important long-term resistance

Clear 'Neckline' for Head and Shoulders reversal.

Target is around 12,000 as intermediate after passing 9888 previous all-time high

Over 20,000 longer term

XGD has completed 5 Wave C Wave to complete Wave 2

The big picture supports a MASSIVE rise in the XGD.

US Bonds

The requirement to sell bonds by the U.S. Treasury is very large, so long-term supply looks gargantuan, but in the meantime . . . that big rally is still setting up.

Yields to fall:

Island reversals here againSigns of a strong move to comeIt should be lower!

US equities

Breakthrough 4200 achievedA strong rise comingShort covering driving

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.For additional disclosures, please click here.