Gold's Fear Component Comes To The Forefront

An increasingly panic-prone market is supporting gold.

Gold's relative strength factor has been increasing.

Most importantly, its fear component is bolstering the price.

Gold got a much-needed boost from the latest spike in bearish sentiment among equity investors. As the stock market plunged on Monday, the price of gold was one of the assets to actually benefit from the increase in fear. In today's commentary, we'll look at what appears to be a bullish scenario for gold in the growing number of safety concerns facing investors.

Gold prices rose more than 1 percent on Monday as China raised tariffs on U.S. products, escalating global trade tensions. China imposed extra tariffs of up to 25 percent on 128 U.S. products including frozen pork and wine in response to U.S. duties on imports of aluminum and steel. Aside from a notable show of relative strength Monday, spot gold also registered its third straight quarter of gains last week. Meanwhile, June gold futures rose $19.60, or 1.5 percent, to close Monday at $1,346.90 per ounce.

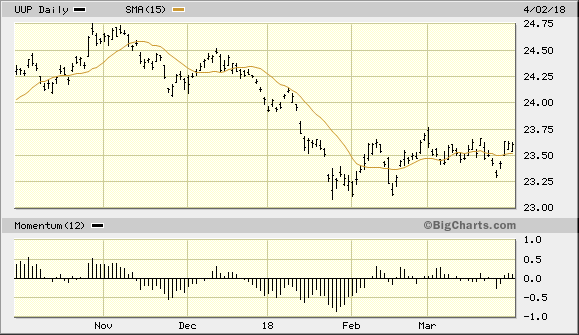

As emphasized in my recent commentaries, the most important factor for continued gold strength in the near term, aside from safety concerns, is sustained weakness in the U.S. dollar index. However, there is an exception to this necessity as we'll see. Shown here is my dollar proxy, the PowerShares DB US Dollar Bullish Fund (UUP).

Monday was one of those rare instances where gold rallied without a decline in the dollar index (which was unchanged). This sometimes happens in tumultuous times for the financial market due to investors' intensive desire to raise cash. At the same time, gold and other safe havens such as the Japanese Yen and U.S. Treasuries tend to rally.

Source: BigCharts

Another factor currently supporting gold is a significant net long position in gold. Gold speculators increased their net long position by 50,996 contracts to 172,834 contracts in the week to March 27, according to the latest Commodity Futures Trading Commission (CFTC) data. This further underscores the increased safety-related demand for the metal in the wake of global market volatility.

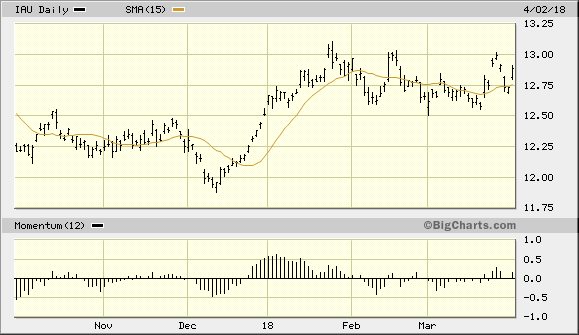

The iShares Gold Trust (IAU), my preferred gold trading vehicle, confirmed an immediate-term buy signal per the rules of the 15-day MA trading method several days ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average, as long as it's accompanied by a majority of five supporting factors. To reiterate, those factors include a strengthening silver price, strengthening crude oil price, weakening dollar, and rising gold relative strength vs. equities, along with a rise in the gold ETF price itself.

Currently, only three of the five aforementioned factors are in gold's immediate favor. A caveat is in order here, however. As with the dollar index exception mentioned above, when investors are in "panic" mode and extremely turbulent conditions prevail on the stock exchanges, the price of gold can sometimes rally well beyond what would be a normal percentage gain based on prevailing technical and fundamental conditions. This is due to the fear component underlying the gold price. As long as retail investors as a crowd are gripped with fear, the gold price can continue rising even with a weak technical backdrop.

Source: BigCharts

Although I don't normally consider the equity market a paramount concern to the gold price in the immediate term, I would reiterate my previous assertion that as long as the number of new 52-week lows on the NYSE stock exchange remain above 40 on a daily basis, investors should assume that internal selling pressure in the equity market remains high.

For the last several days, there have been significantly more than 40 stocks making new lows; moreover, the new high-new low differential remains decidedly negative on a daily basis. This continued situation of broad market weakness should lend itself to continued safe-haven demand for gold, as has been the case lately.

On a strategic note, I've purchased a conservative trading position in the iShares Gold Trust after it confirmed an immediate-term breakout signal per the rules of my technical trading discipline on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts