Gold Fields Funding Internally On Heavy Growth Capex

The company maintained an ambitious level of capital expenditures in 2017.

Strong leverage metrics support capital.

The company delivers consistent production and reducing cost at South Deep mine project.

Investment Thesis

Headquartered in Johannesburg, South Africa, Gold Fields Ltd (NYSE:GFI) holds gold reserves in Ghana, Australia, South Africa and Peru. It is also engaged in other related activities such as smelting and surface copper mining. Its South African operation is South Deep.

The company believes that it can sustain the current gold production level for 8 to10 years and that it expects gold ore production to increase to 2.5 million ounces by 2021 as Gruyere, Damang and South Deep ramp up.

GFI also owns an economic interest in the Cerro Corona mine. The company holds interests in eight operating mines with an annual gold production of approximately 2.16 million ounces.

Through the financial analysis presented below, we can prove or disprove the hypothesis, that GFI is trying to maximize its operations and optimize its asset portfolio, through generation of ample internally generated funds to sustain its heavy capital expenditures:

Earnings

Revenues decreased by 16% y/y to $174 million in 2017. Such decline is attributed to lower sales volumes in gold and silver by 24% and 31% y/y, respectively. The reduction in sales volumes was due to lower production at Pe??asquito Polymetallic, the fifth largest silver mine in the world and the second largest in Mexico. It also resulted from lower ore grade and recovery.

In Cerro Negro mine, lower gold production was due to lower mill throughput resulting from stockpiled ore processed in the fourth quarter of 2015. The impact of the drop in sales volumes was offset by higher realized prices for gold and silver by 7% and 9%, respectively.

Source: Deutsche Bank

Annual costs for 2017 are expected to decrease due to the following:

Increased gold production Lower sustaining capital expenditures Continued portfolio optimizationThe company expects gold reserves to increase by 20% to 50 million ounces over the next five years. Additional gold reserves will be sourced from the conversion of existing resources at Century, Pe??asquito, Cerro Negro and Pueblo Viejo. Exploration at its portfolio of mining camps in the Americas will also lead to more gold reserves.

Royalty payments of $80 million in 2016 were slightly higher versus $76 million in 2015. A decrease in the taxation charge in 2016 to $192 million (from $247 million in 2015) further supported turnaround. Taking into account all of the above, the net income attributable to shareholders amounted to $163 million in 2016, compared to a net loss of $242 million in 2015.

Capital Expenditures

GFI embarked on an ambitious capital expenditure program in 2017. The company spends significantly on three of its mines: Damang, Gruyere and South Deep. It has an ongoing pre-feasibility study at Cerro Corona and has another project which is Salares Norte, where exploration is currently being done. On the other hand, capital spending was up 35% y/y last 2016.

Gold production in Ghana and Australia declined. However, it was more than offset by higher production from South Deep and Cerro Corona, both as a result of higher grades. Unit costs declined across the board year-on-year.

Capital expenditure is expected to increase largely as a result of the investment in growth projects - South Deep, Damang, Gruyere and the Salares Norte project in Chile. GFI illustrated that it will sustain capital expenditures of $869 million next year.

Capital Management

The company launched an accelerated stock offering of up to 5% of its issued share capital to raise Rand 2.5 billion. The company had in early a tender offer to buy treasury shares worth $200 million of its $1 billion outstanding shares, and 4.875% notes due October 2020. Of which, $147 million were tendered. This utilized the firm's existing available credit facilities. Proceeds were applied to the existing US dollar revolving credit facility.

The offering is considered small. It would lead to a dilution of up to 5% of existing shareholders, but not totally unexpected. GFI has $440 million of cash on its balance sheet, net debt of $1.4 billion and net debt/EBITDA of 1.27X as of end-2015. It could have used its cash to apply it to its revolving credit facility.

However, the company thought of raising equity when the shares are close to its two-year highs. This move is well executed on the back of the rally in gold prices. Reduction in total debt reduces interest expenses by $7 million. Although this amount is inconsiderable, it gives the company sufficient funds to make an acquisition if it intends to.

Cash Flows

GFI generated a net $294 million in cash flow from operating activities in 2016. Yield of free cash flow (FCF) as of 2017 is negative 9%. Improved cash generation was due to the South Deep and Australian mines aided by weaker Australian Dollar and South African Rand. South Deep recorded a $92 million swing in cash-flow. Net debt was reduced to $1,029 million from $1,155 million at the end of June 2016.

South Deep Mine

South Deep mine was cash positive in 2016. Production is expected to increase from 315,000 ounces in 2017 to 500,000 ounces in 2022. Growth capital expenditures shelled out over the next six years will be $170 million and AISC is expected to steadily decrease from $1,277 per ounce to $900 per ounce by 2022.

Capital expenditure rebasing plan requires an additional Rand 2.3 billion of growth capital expenditures. Mine assets target 500,000 ounces per annum by 2021 to 2022. However, Deutsche Bank expressed a cautious stance on the ability of the mine to fulfill the reduced ramp-up targets. Hence, analysts do not expect South Deep to repeat its positive free cash flow performance in 2016 in the near future.

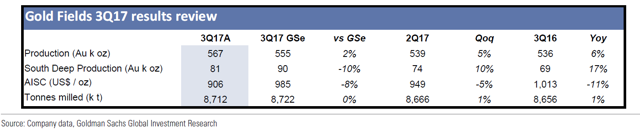

Source: Company data, Goldman Sachs Global Investment Research

Equity Valuation

GFI share performance in the third quarter this year recorded a minus 8.58%. For the whole year, performance was 23.48%. Similarly, share performance was up 4.5% over the last six months. Stock price was up 58.6% over the last year. Currently, 64.41% shares of GFI are owned by insiders. Shares of GFI were languished around its 52-week low of $2.60 in 2016. Price-to-Earnings ratio is projected at 10X and a 1.0X NAV in 2018.

Source: Deutsche Bank

Recommendation

The 2017 pickup in gold prices enabled GFI to improve its cash reserves, reduce its debt and strengthen its balance sheet. GFI maintained its policy of rewarding shareholders with generous dividends. However, internally generated funds bear the risk of erosion. This was due to multiple ongoing projects and significant increase in net debt on the back of increased capital expenditures.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.