Gold Is Holding Well, Newsletter Writer Says

Barry Dawes of Martin Place Securities shares his thoughts on the gold market as well as the price of various currencies, as he believes a currency crisis is imminent.

We all know gold has moved to new all-time highs and most commentary seems to relate back to the FED and interest rate policies. The theme seems to be that lower interest rates will encourage the US$ to fall and allow gold to rise.

The U.S. economy is expected to continue slowing so the stock market is overheated and everything is ready for the famous oft-called recession. Of course, the concern about ever-growing deficits and higher levels of bond issues should be really crunching the bond market because the funds will simply not be found.

But that is not what is happening.

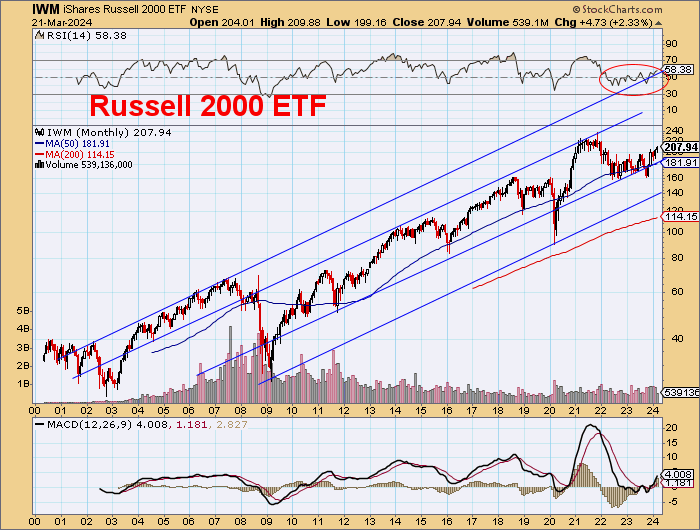

The stock market continues to surge ahead, and the commentary on its narrowing is simply not correct as the Russell 2000 moves higher. Market breadth is continually improving.

Small caps versus large caps is going through a transformational time, and great outperformance is coming here.

The US$ is also remaining strong. In fact, the weakness in the other major currencies is about to accelerate.

Gold is making new highs in US$, but it is soaring parabolically in these other currencies. The performances of gold in these currencies should put concerns about a false move by gold out of your mind. These should convince the market that major pullbacks are simply not going to occur.

So the loss of faith in fiat currencies is increasing and the interest in gold and tangible assets is increasing faster. The continual references here about gold stocks versus gold apply equally to small caps versus large caps and probably stocks generally versus bonds.

This is the move away from government control over the population. It is all part of the same thing. Small-cap resources have been among the worst performers, so this change should reverse all that and make them among the best-performing sectors.

Volatility is increasing again, which is good.

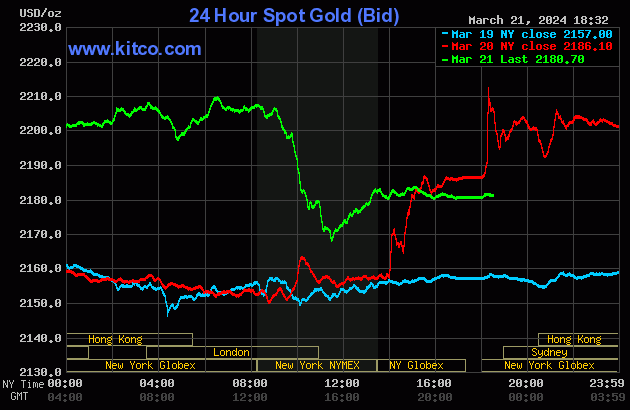

Gold technically looks very sound for another move higher.

A sharp intraday move is retraced, ready to move higher again.

Of course, market slapdowns might occur here. Who knows. But it won't matter.

The engine for the power is already here.

This will be a powerful move.

Gold in other currencies just continues to rise.

No resistance here.

Gold in Yuan is soaring.

And these other currencies. Harping on this ad infinitum but the reality is of sharply falling currencies and their collapsing bond markets.

Their bond yields are rising, while those in the U.S. seem to be falling. The Yen is about to have a very sharp fall from here.

The Euro is holding on by its fingernails now.

The Swiss Franc is collapsing. Note that these are technical movements that relate to the breaking of those 50-year uptrends.

The moves will be of major significance.

The British Pound is also just holding.

A real currency crisis is coming.

T Bonds

These yields are heading lower

A big battle is on, but the direction is lower.

Yields did not match the recent highs before turning down again.

US Stocks

Heading much higher.

Resistance just ahead at channel boundary, but it is seemingly not overbought.

Market breadth is increasing.

Here is that wedging and transformation mentioned earlier.

Interesting times.

Gold Stocks

Gold is holding, and these stocks are turning up. Looks like that bull hook did work here too.

Jump and then pull back. Ready to head higher.

We can see the smaller gold stocks ( these are, of course, mid caps) starting to outperform the large caps.

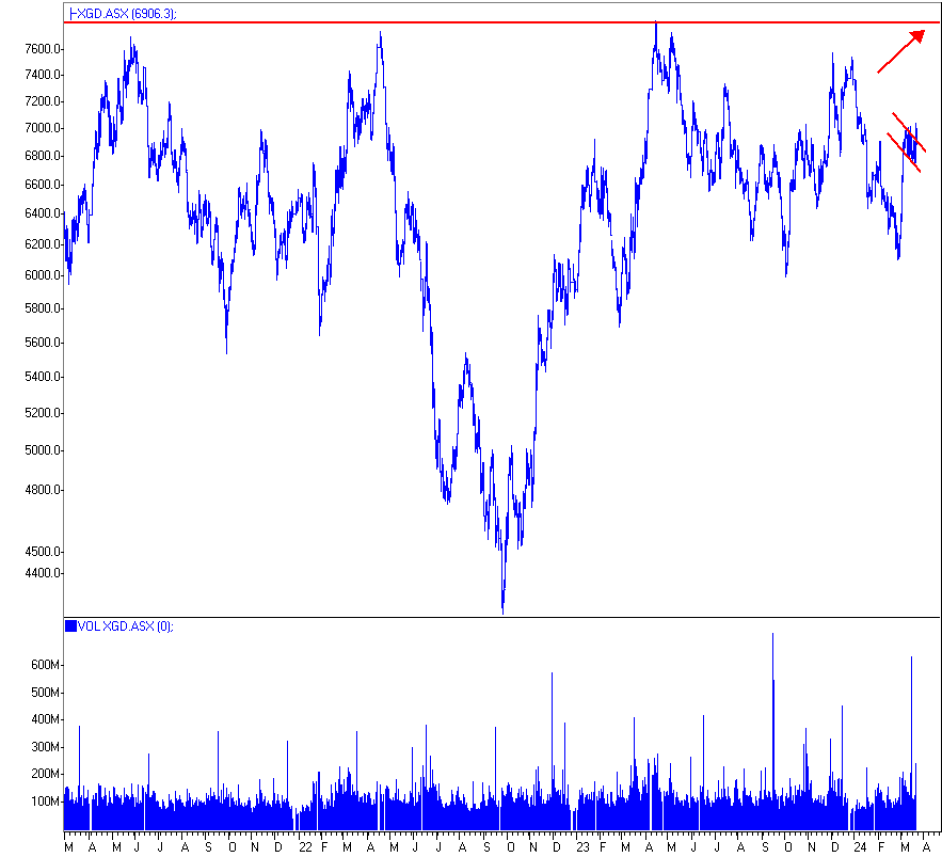

ASX Gold Stocks

AU$ gold over AU$3300.

The cashflows for these miners are now immense.

The index will explode soon.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.