Gold Miners Taking Severe Punishment: A Rebound Appears Very Likely

Gold miners have been punished severely throughout the correction process.

While gold has declined by only 4%, GDX fell by more than 16% from peak to trough.

However, gold's uptrend is well intact, prices are trending above $1,300, and gold miners have become much more productive and efficient in recent years.

Moreover, the fundamental backdrop for gold remains extremely favorable, and what's good for gold is also good for gold miners.

Gold miners have become unjustly oversold, and as gold resumes its uptrend gold miners are likely to follow.

Gold Miners: Taking Severe Punishment

Gold Miners/VanEck Vectors Gold Miners ETF (GDX) have taken a beating over the past few weeks. Three weeks ago, GDX traded up to $24.86, but as the gold rally stalled and the broader market selloff ensued the ETF cratered by more than 16% from peak to trough. However, as stocks reversed Friday, so did gold miners. GDX had a violent 4% reversal, bouncing off the significant support level of $20.70-$21.00, closing higher on the session after spending most of the day deep in the red. In addition, while gold miners have sold of drastically, gold is only down by 4% from its recent high of $1,365, and remains firmly above its significant support level of $1,300-$1,310.

Gold miners typically follow the price of gold, and since gold's uptrend is well intact it is likely that the GDX selloff is significantly overdone. Therefore, once gold regains its upward trajectory GDX should also regain its momentum and begin to move significantly higher throughout the year.

About GDX

GDX aims to imitate the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. The ETF has total net assets of roughly $8 billion, and has 51 holdings. Some of the fund's top holdings include Barrick Gold Corp. (ABX), Newmont Mining Corp. (NEM), Franco-Nevada Corp. (FNV), Newcrest Mining Ltd. (OTCPK:NCMGF), Goldcorp Inc. (GG), and other gold mining companies.

What's Good for Gold Also Good for GDX

The backdrop for gold is quite positive as the yellow metal has a lot of favorable factors going its way right now. Several key elements appear to be joining together to shape a constructive atmosphere for gold and the assets that surround it. Rising inflation, a falling dollar, dropping demand for bonds, ballooning trade and budget deficits are all bullish factors for gold. Moreover, these underlying constructive elements are likely to persist and should support gold prices for a prolonged period of time.

Inflation Picture

Just to provide some background information, the latest CPI came in at above 2%, and has been trending at an elevated pace above 2% for the better part of the last year. The PPI also has been elevated and is now trending above 2.5%, with final demand goods coming in at 3.5% and trending well above 3% throughout the last year. Even wage growth is on the rise with the most recent number coming in at 2.9%. Crude oil appears to be on its way to $70, likely $80 before mid-year, and possibly $100 before the year ends. And gold is no exception when it comes to price appreciation. Gold's price is approaching multi-year highs, and will very likely break out in the very near future due to higher inflationary pressures and other bullish elements.

The Dollar is Tumbling and is Likely to Fall More

The dollar has been in decline for over a year now, and it doesn't look like relief for the selloff is anywhere in sight. Gold is priced in dollars, and a weakening dollar is beneficial for gold. Market participants using international currencies get more bang for their buck when purchasing gold priced in dollars. Also, banks, institutions, countries, and other organizations hold reserves in dollars as well as in gold. The dollar is down by more than 10% over the last year, and is likely to decline further going forward. Thus, gold is a much more attractive store of value instrument than the dollar right now.

^DXY data by YCharts

^DXY data by YChartsAmerica's Impending Debt Crisis: Bullish for Gold

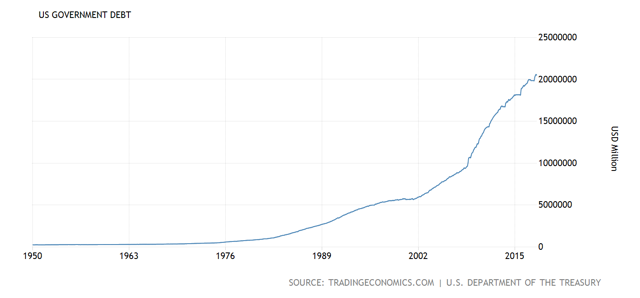

The United States has a huge debt and a massive spending problem. The government is addicted to spend trillions on all sorts of programs. The only problem is that the U.S. can't afford it all, not even close. So, the government puts all the excess debt on the seemingly limitless national credit card, also known as the national debt. The only thing is that it's not limitless, there will be consequences, and we are already starting to see some of this starting to play out now.

The national debt is now over $20.6 trillion, roughly 105% of GDP. This is a big problem because the debt needs to be serviced continuously, currently at around $500 billion for this year. Yes, this is $500 billion American taxpayers are paying in interest this year alone to service the national debt. The bigger problem is that massive debt servicing is a vicious cycle that continuously leads to higher debt and higher servicing payments.

For instance, by 2023 the national debt is likely to be $25 trillion, and depending on where the 10-year is by then 3%, 3.5%, or 4%, the servicing payments will be $750 B, $880 B, or a staggering $1 trillion. 4% is not the top by the way, it is possible that rates are significantly higher by then. So, essentially you can see how this will create serious issues for the dollar and the bond market down the road, which would in turn push investors toward gold.

For instance, by 2023 the national debt is likely to be $25 trillion, and depending on where the 10-year is by then 3%, 3.5%, or 4%, the servicing payments will be $750 B, $880 B, or a staggering $1 trillion. 4% is not the top by the way, it is possible that rates are significantly higher by then. So, essentially you can see how this will create serious issues for the dollar and the bond market down the road, which would in turn push investors toward gold.

Gold Miners Have Become Significantly More Productive

In addition to having an extremely favorable looking backdrop for gold most gold miners that comprise GDX have become far more efficient and productive in recent years. Thus, they should begin to bring in significantly higher profits with gold prices above $1,300, and probably going significantly higher. Most of the companies that comprise GDX have had ample time to adjust to some of the costly capex projects the companies took on during times of peak gold. Due to the successful integration of newly acquired assets, coupled with higher gold prices, most of these companies are now producing very healthy cash flows. In fact, through cost-cutting and other efficiency efforts, many gold miners have dramatically lowered their all-in sustaining costs (AISC).

For example, Barrick Gold's AISC was down to just $730 an ounce in 2016 and the company produced a notable $1.5 billion in free cash flow that year. Other major gold miners also have drastically reduced their AISC in recent years. With gold prices trending above $1,300 and likely to go significantly higher, it is probable that gold miners will become significantly more profitable going forward.

Technical Picture

We can see that GDX became grossly oversold in recent sessions. The RSI dropped to around 30, the CCI went below -200, the full stochastic fell below 10, and the price bounced off the key support level of $20.70 - $21. We also can see that this price action is consistent with the range bound trading that has ensued for over a year now. Roughly $21 to $25 has been the range and GDX is at the bottom end of this range, suggesting that a strong rebound is likely here. Moreover, this is the fifth time GDX has bounced off this level in the last year, indicating that this very solid support level is likely to hold and that with rising gold prices a breakout to a higher trading range in GDX is probable.

GDX 1-Year Chart

GDX 2-Year Chart

While GDX has been in a range we can clearly see that gold is in a well-defined uptrend. The price has had a very healthy 4% correction since hitting the most recent highs and now appears intent on proceeding higher. Gold will probably hit new multi-year highs soon, and GDX should rebound and follow gold higher, likely breaking out of its multi-year trading range in the process.

While GDX has been in a range we can clearly see that gold is in a well-defined uptrend. The price has had a very healthy 4% correction since hitting the most recent highs and now appears intent on proceeding higher. Gold will probably hit new multi-year highs soon, and GDX should rebound and follow gold higher, likely breaking out of its multi-year trading range in the process.

Gold 2-Year Chart

Bottom Line: Gold Should Proceed Higher and GDX Will Follow

Bottom Line: Gold Should Proceed Higher and GDX Will Follow

The fundamental atmosphere surrounding gold and gold miners is very favorable. Rates are still relatively low, there's a healthy dose of inflation in the economy, the dollar is weak, and the trade and budget deficits are burgeoning. All this equates to a very constructive goldilocks type environment for gold going forward. And what's good for gold is also good for gold miners as well. I expect gold to retest the prior highs in the upcoming weeks, eventually breaking out to $1,400 and beyond. It appears likely that we see gold $1,500 by the end of this year, and with gold prices rising throughout the year, GDX should follow and trade up to an approximate price range of $27.50 - $30 by the end of 2018.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please always conduct your own research and consider your investment decisions very carefully.

To receive real time updates, and get more information about this idea as well as other topics please visit the Albright Investment Group trading community. Join us and receive access to exclusive content, trade triggers, trading strategies, price action alerts, and price targets. Theses value adding features are available only to members of our trading community, and are not typically discussed in public articles.

Disclosure: I am/we are long GDX NEM.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.