Gold Mining Bull: Top News For May 2018

Barrick invests in Idaho gold project.

First Quantum nixes deal with Northern Dynasty.

Maverix lands a royalty deal and partnership with Newmont.

Here's a look at the top news in the gold mining sector for May 2018.

Here's a monthly recap of the top news in the gold mining sector, including acquisitions and takeover announcements, financial results and other relevant updates, to keep readers up-to-date on news in the sector. Here's my last update for April if you missed it.

Gold prices recently took a breather falling from $1,350 in April to $1,290 last week, but have since rebounded to $1,303/oz. Prices look ready to surge again with a bullish MACD crossover recently occurring, and the 50-day moving average for gold remains above its 200-day moving average, a bullish technical sign. The third quarter of the year is historically the best time to buy gold.

(Credit: StockCharts)

Also, as I pointed out recently, insider buying has been picking up a bit at various gold mining companies, another positive sign. I'd also like to point out that you can make money in this market even if gold prices trade sideways, as you can do quite well with developers and explorers.

Bottom line: This could be a good time to buy gold stocks.

The month was highlighted by several investments made by mid-tier and senior gold producers in junior gold companies (which is great news for juniors!) as well as several big developments in the royalty and streaming sector.

This article was released first to subscribers of "The Gold Bull Portfolio," my marketplace service offering. Subscribers get a look at my personal holdings which are made up of miners, juniors and exploration companies. The portfolio provides leverage to the price of gold, with the goal of outperforming benchmark indexes, such as the VanEck Gold Miners Index (NYSEARCA:GDX), the Junior Miners Index (NYSEARCA:GDXJ), and the price of gold (NYSEARCA:GLD). The portfolio has outperformed year-to-date, after gaining 41.50% in 2017 (compared to an 11% gain in the GDX).

Here's a look at the top news in the gold mining sector for May 2018.

1. Barrick Makes Strategic Investment in Midas Gold

Barrick Gold (ABX) has made quite a significant investment in a junior miner called Midas Gold. The company announced that it will purchase 46,551,731 common shares of Midas in a private placement at a price of C$1.06 per share.

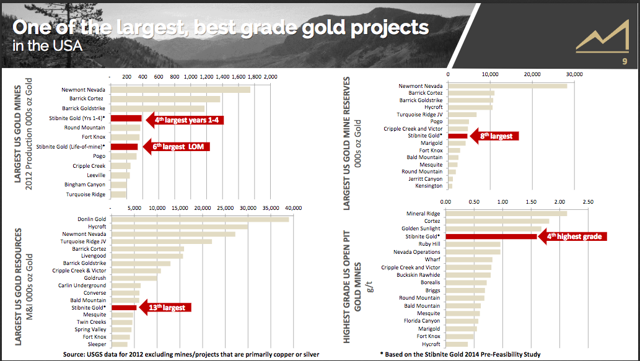

Following close of the deal, Barrick will own 19.9% of Midas Gold. The company is supporting Midas' efforts to permit and advance its Stibnite Gold Project in Idaho. Proceeds will also be used to help advance Stibnite to completion of a feasibility study.

According to its pre-feasibility study, Stibnite profiles as a long-life, low-cost gold mine, with average annual gold production of 337,000 ounces, although initial capital costs of $970 million are a bit high.

(Credit: Midas Gold presentation)

Presumably, Barrick may be interested in a takeover at some point in the future, when the project is in a more advanced stage. We will see what the results of the feasibility study look like, which will include mineral resource drilling and metallurgical testing, and updated geological models to maximize returns.

For now, the shares were bought for investment purposes. Barrick's forward guidance calls for a slight drop in gold production, so Stibnite could lessen the decline. It's an interesting development and I think investments in juniors from mid-tier and senior producers will only pick up from here as we've likely reached peak gold.

2. First Quantum Pulls the Plug on Deal With Northern Dynasty

First Quantum (OTCPK:FQVLF) has walked away from a framework agreement with Northern Dynasty, under which the company could have earned into a 50% interest.

The two companies were unable to reach a deal to advance the controversial gold project in Alaska. The project faces fierce opposition from locals; among the main concerns is contamination risk to the world's largest sockeye salmon fishery. It's unclear why First Quantum pulled out of the deal.

Northern Dynasty was listed as a top gold stock to avoid this year in a previous article, when shares traded at $1.07. Shares of the company plunged by more than 30% following the news and now trade under $.50. The company is "confident" it can find a new partner for Pebble.

3. Nevsun Rejects Takeover Offer by Euro Sun and Lundin

NSU data by YCharts

NSU data by YCharts

Nevsun Resources (NSU) has shunned a proposed takeover offer from Euro Sun and Lundin Mining. Consideration would be C$2.00 per Nevsun share in cash, plus shares of Euro Sun and Lundin representing a total of C$3.00 per Nevsun share when factoring in transaction costs and taxes, according to Nevsun.

The board of Nevsun feels that this offer does not provide adequate value, as it says Lundin has indicated that it values Timok alone at C$4.00 per share. Nevsun also raises concern over the structure of the deal, which would leave shareholders open to transaction costs and taxes of C$100 million.

Nevsun also blasted Euro Sun as a potential partner, saying the company has a small market capitalization, has had issues raising financing, and has no relationship with the government of Eritrea, where the Bisha mine is located. It's hard to argue with Nevsun on these points.

Watch out for another potential bid for Nevsun in the coming months. Whether it comes from Lundin or an outside miner is anyone's best guess.

4. IAMGOLD Surprises With Solid Q1

IAMGOLD (IAG) reported Q1 2018 earnings that came in stronger than expected. The mid-tier gold miner saw its production increase by 7% with all-in sustaining costs falling by $39/oz. This led to operating cash flow of $106 million (up 58%) and net earnings of $42.9 million, or $.09 per share.

The company ended the quarter with one of the best balance sheets in the gold sector, with $856.3 million in cash, cash equivalents and short-term investments compared to $392.5 million in long-term debt.

Read more about IAMGOLD's outstanding quarter.

5. Orca Gold Lands Investment from Resolute Mining

Resolute Mining (OTCPK:RMGGF) has invested $22 million to acquire a 15% stake in Orca Gold (OTCPK:CANWF). Resolute has agreed to subscribe for 32,364,960 common shares of Orca at a price of C$0.675 per Share for aggregate gross proceeds of approximately C$22,000,000.

The financing gives Orca Gold the cash to further advance its Block 14 project in Sudan, which is undergoing a feasibility study. Resolute also gains a nominee to serve on Orca's board, as long as it owns at least 15% of Orca.

This development was covered in more detail for subscribers.

6. Maverix Buys Royalty Portfolio From Newmont Mining

Maverix Metals (OTC:MACIF) is one step closer to being the next mid-tier royalty and streaming company. The company has acquired 54 royalties from Newmont Mining Corporation (NEM) for total consideration of 60 million shares (worth C$76.8 million currently) and $17 million in cash, plus 10 million warrants to buy shares at $1.64 for five years from the date of transaction close.

The deal includes immediate cash flow from royalties such as a 1% NSR on the Hope Bay mine, operated by TMAC Resources (OTC:TMMFF), a 2.5% GRR on the Hemlo gold mine, operated by Barrick, and a 1.5% NSR on the development stage McCoy-Cove property.

Maverix says the royalties will earn between C$6 million and C$8 million in 2019 ($4.62 million and $6.16 million), potentially growing to as much as C$20 million per year (using $1,300 gold prices and assuming key development projects come online, such as Relief Canyon and Hasbrouck).

Newmont becomes a 28% shareholder in Maverix, and will also provide Maverix with the opportunity to buy metal streams and royalties in the future, which could be a key advantage.

This deal looks like a big win for Maverix, and the market seems to agree with shares rising 13.79% following the announcement.

7. Triple Flag Pays $200 Million for Centerra's Royalty Portfolio and Stream on Kemess

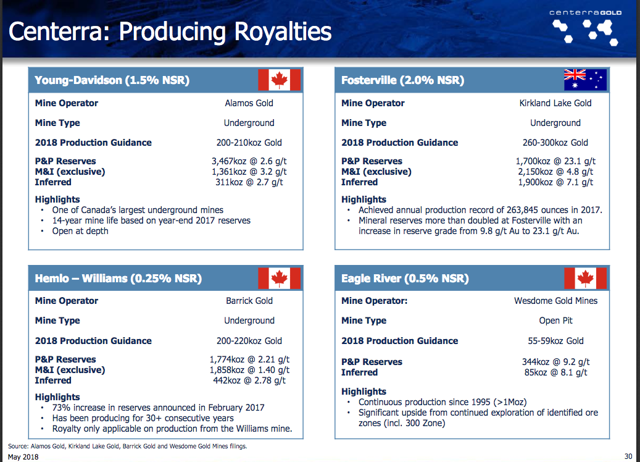

I've speculated that Centerra Gold (OTCPK:CAGDF) was likely to flip its recently acquired royalty portfolio from Aurico Metals (OTCPK:ARCTF), and it has happened. The company has entered into an agreement to sell its royalty portfolio, plus a silver stream on its Kemess project and a few other royalties, for total consideration of $200 million to Triple Flag Finance.

The first part of the deal consists of the sale of the Aurico Metals royalty portfolio, plus three new exploration royalties, for a total consideration of $155 million. The second part is for a silver stream equal to 100% of silver produced at Kemess for consideration of $45 million (for ongoing payments of 10% the market price of silver).

(Credit: Centerra Gold corporate presentation)

The royalty portfolio has a net asset value of $85 million and is expected to yield between $11.5 million and $12.7 million in revenue this year, according to Centerra's corporate presentation, but I think this NAV undervalues the upside of the 2% NSR Fosterville royalty.

The Fosterville mine is producing up to 300,000 ounces of gold this year based on Kirkland Lake's (NYSE:KL) guidance, but the plan is to increase production to 400,000+ ounces per year by 2020. Based on that production, the royalty would produce $10+ million ounces in revenue alone.

This deal looks expensive at first glance, but it could be a good deal in the long-term for Triple Flag, especially if Fosterville delivers.

8. Kirkland Lake Gold Reports Strong Earnings, Boosts Dividend

KL data by YCharts

Kirkland Lake Gold reported its first quarter 2018 financial results recently, and the company keeps cruising along. Production increased to 147,644 ounces, up from 130,425 ounces in Q1 2017, with all-in sustaining costs of $833/oz, versus $873/oz in Q1 2017. Net earnings were $.25 per share and EBITDA was a quarterly record $105.9 million. Free cash flow was $50.2 million, or slightly more than $200 million annualized.

As I pointed out in recent coverage, Kirkland Lake's stock has pretty decent medium- and short-term upside as the company advances its Macassa and Fosterville mines, with the goal of achieving 1 million ounces of gold production annually, up from just under 600,000 ounces in 2017.

It has been an unbelievable run for the gold miner and my #1 overall gold stock pick for 2017.

9. Kirkland Lake Ups Its Investment in Novo Resources

Kirkland Lake is also thinking about where its future growth may come from, as it recently made an additional C$20 million investment in shares of Australian explorer, Novo Resources (OTCQX:NSRPF). The deal was done at a price of C$5.00 per Novo share.

After closing of the deal, Kirkland Lake owns a 23.14% stake in Novo (partially diluted, assuming the exercise of warrants).

Novo is a highly speculative explorer, as it trades at a high valuation despite not having any defined resources. But the company has been pulling gold nuggets out of the ground during its bulk sampling program at its Karratha gold project in Western Australia. Keep an eye on future exploration activity from Novo, which could be sitting on a huge gold discovery.

10. Osisko Mining Releases First Resource at Windfall, Shares Plunge

OSK data by YCharts

The market was not impressed by Osisko Mining's (OTCPK:OBNNF) first resource at its Windfall deposit in Canada.

This mineral estimate comes from 1,453 drill holes (596,733 meters) in the resource area completed by previous operators on the project since 1997 and includes 812 new drill holes (413,692 meters) completed by Osisko over the past three years.

The company has defined a 2.88 million ounce resource at Windfall, however, the majority of its resource are classified as "inferred" which is the lowest-confidence resource category.

With a market cap just under $500 million, the market was perhaps expecting a larger and more well-defined resource out of Windfall. Insiders don't seem as concerned, as several have used the recent dip to purchase shares in the public market.

Watch out for the upcoming preliminary economic assessment, which is due out in early Q3 2018. This study will include Windfall and the 510,000 ounces Osborne-Bell deposit.

Gold miners: other top news this month

- Sandstorm Gold (SAND) has invested $3 million in a Burkina Faso explorer called Nexus Gold and now owns 17.3% of the company, plus a 1% NSR on Nexus' properties.

Sandstorm also landed a $2.1 million financing deal with explorer Aton Resources earlier this month, which included the purchase of a 1% NSR on Aton's Abu Marawat project in Egypt.

- Silvercorp (NYSE:SVM) reported strong financial results and recently increased its dividend by 25%. This was previously listed as a top silver stock to own for 2018.

- Roxgold (OTC:ROGFF) reported record gold production in Q1 2018, and announced an increase in its full-year guidance.

- Yamana Gold (AUY) announced first gold and silver production at the Cerro Moro mine, and has guided for 85,000 ounces of gold and 3.75 million ounces of silver production for this year.

- Endeavour Mining (OTCQX:EDVMF) has made significant high-grade gold discoveries at its Hounde mine in the Kari area.

This article was available first to subscribers of The Gold Bull Portfolio. Sign-up now and get a 10% discount on your subscription (for a limited time only).

Did I miss any top news this past month? Please let me know in the comment section.

Disclosure: I am/we are long VARIOUS STOCKS MENTIONED.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Follow Gold Mining Bull and get email alerts